File - mrs. la ferney

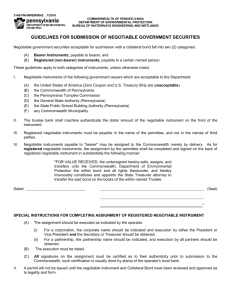

advertisement

1. Bill Of Exchange Must Contain An Order It must in imperative terms direct the drawee to "pay to A" the sum specified. There must be no qualifying statements. A request to pay, or an authority to collect money due, is not an order, though it is often hard to tell from the language used just what is meant. An order implies in its terms a right to command and a duty to obey. Words of politeness, however, will not deprive an order of imperative quality. "Please pay X" is a common phrase, but is held to be an order. The following was held to be a bill of exchange: "Mr. Nelson will oblige Mr. Webb by paying J. Ruff, or order, twenty guineas on his account." The order must be unconditional on its face. If a bill was to be payable only if some specified event should happen it would be of little value in business, since the event might never happen. Even if the event should afterwards take place the instrument would not then become a bill. Suppose A has two accounts with the firm of B and draws a draft on B in the following words: "Please pay C, or order, $500 and charge account No. 1." Is this a negotiable instrument? It has been held to be. There is an unqualified order to B to pay C, or order, the $500 and the words "charge account No. 1" are only an indication to B of the account to which the bill is to be charged after it is paid. The fact that the consideration may be stated does not make the instrument conditional. Suppose the above bill had read: "Please pay C, or order, $500, account five typewriters." This is still an unconditional order to pay C, or order, and the statement of the consideration does not affect it. A Bill Of Exchange "Must Be Payable On Demand Or At A Fixed Or Determinable Future Time." There must be certainty as to the time when a bill will be due, or no one would take it from anybody else. An instrument is payable on demand (1) where it is expressed to be payable on demand, or at sight, or on presentation; or (2) where no time of payment is stated. An instrument is payable at a fixed time if it says, for example, "30 days after date." An instrument is payable at a determinable time when the date can be fixed with reference to the happening of an event certain to happen. Death is sure to come, though the time of its coming is uncertain, so an order to pay thirty days after death would be binding. Suppose an order said "pay to X $500 when he becomes twenty-one years of age." This would not be negotiable, since X might never become twenty-one. The Amount To Be Paid Must Be Certain If the bill reads "$500 and accrued taxes," then it would not be negotiable, for the amount payable at maturity is uncertain. But stipulations for interest at a given rate, or for the payment of costs of collection and attorney's fees, if not paid at maturity, do not affect the negotiability of a bill. The order to pay must be to pay money. The money must be that of the country where the order is payable. For instance, a note payable in Canada but made in Illinois must be payable in Canadian money. By business customs the following terms mean money: "currency" and "current funds," so a bill containing an order to pay $500 in "currency" or "current funds" will be negotiable. A particular kind of legal tender may be designated, such as gold eagles or pennies. There must not be an order to pay money and (or) something else. An order "pay X $500 and give him my horse Black Star," or "pay X $500 or give him my horse Black Star" will not be negotiable - the payee or anybody to whom the bill is indorsed must be certain of getting money alone if he wishes it. But if X was to have the choice of taking the money or the horse it would be all right. In other words, if the maker of a note has the election of paying money or giving something else, the note is not negotiable. If the holder has the option of requiring something to be done in lieu of the payment of money, the note is negotiable, because the holder can always demand money. Read more: http://chestofbooks.com/finance/banking/Elementary-Banking-AIB/A-Bill-OfExchange-Must-Contain-An-Order.html#.VGPM8WdOVaQ#ixzz3ItIrz2Xu Sample promissory note for loans to family, friends By Tony Mecia If you're lending to a relative or friend, you'll want to craft a written agreement. This sample promissory note (also available in Microsoft Word, PDF and plain text downloadable files) spells out how and when you are to be paid, and what happens if the borrower doesn't repay the loan. Scroll to the bottom for a blank repayment schedule that you can fill in. Having a note won't guarantee you'll be repaid, but it does help clear up ambiguities and serves as evidence if you ever decide to take the borrower to court. PROMISSORY NOTE $________(AMOUNT) __________________(DATE) FOR VALUE RECEIVED, the undersigned, (the "Maker"), hereby promises to pay to the order of ____________________ (LENDER NAME) ("Payee"), the principal sum of $ ____________ pursuant to the terms and conditions set forth herein. PAYMENT OF PRINCIPAL. The principal amount of this Promissory Note (the "Note") and any accrued but unpaid interest shall be due and payable in ____________ (NUMBER OF PAYMENTS) (CIRCLE ONE: equal monthly installments / equal quarterly installments / payments as described below) beginning ___________________ (DATE OF FIRST PAYMENT). All payments under this Note shall be applied first to accrued but unpaid interest, and next to outstanding principal. If not sooner paid, the entire remaining indebtedness (including accrued interest) shall be due and payable on _________________ (DATE OF FINAL PAYMENT). INTEREST. This Note shall bear interest, compounded annually, at _________ (ANNUAL INTEREST RATE) percent. PREPAYMENT. The Maker shall have the right at any time and from time to time to prepay this Note in whole or in part without premium or penalty. REMEDIES. No delay or omission on part of the holder of this Note in exercising any right hereunder shall operate as a waiver of any such right or of any other right of such holder, nor shall any delay, omission or waiver on any one occasion be deemed a bar to or waiver of the same or any other right on any future occasion. The rights and remedies of the Payee shall be cumulative and may be pursued singly, successively, or together, in the sole discretion of the Payee. Read more: http://www.creditcards.com/credit-card-news/sample-promissory_note-friends-family-loans1293.php#ixzz3ItJwlzQ4 Follow us: @CreditCardsCom on Twitter | CreditCards.com on Facebook Compare credit cards here - CreditCards.com Parts of a cheque based on a UK example 1. 2. 3. 4. 5. 6. drawee, the financial institution where the cheque can be presented for payment payee date of issue amount of currency drawer, the person or entity making the cheque signature of drawer The four main items on a cheque are Drawer, the person or entity who makes the cheque Payee, the recipient of the money Drawee, the bank or other financial institution where the cheque can be presented for payment Amount, the currency amount bearer instrument is a document that indicates that the owner of the document has title to property, such as shares or bonds. Bearer instruments differ from normal registered instruments, in that no records are kept of who owns the underlying property, or of the transactions involving transfer of ownership. Whoever physically holds the bearer bond papers is assumed to be the owner of the property. This is useful for investors and corporate officers who wish to retain anonymity, but ownership is extremely difficult to recover in event of loss or theft. In general, the legal situs of the property is where the instrument is located. Bearer instruments can be used in certain jurisdictions to avoid transfer taxes, although taxes may be charged when bearer instruments are issued. Under the Uniform Commercial Code, a negotiable instrument (such as a check or promissory note) that is payable to the order of "bearer" or "cash" may be enforced (i.e. redeemed for payment) by the party in possession. The payee (i.e. the person named in the "pay to" line) may also convert an instrument into a bearer instrument by endorsing (signing) the back. This is the letter of the law; in practice many merchants and financial institutions will not pay a check presented for payment by anyone other than the named payee. In earlier times many forms of government issued currency were actually bearer instruments giving the bearer property title to precious metals INVESTOPEDIA EXPLAINS 'Commercial Paper' Commercial paper is not usually backed by any form of collateral, so only firms with high-quality debt ratings will easily find buyers without having to offer a substantial discount (higher cost) for the debt issue. A major benefit of commercial paper is that it does not need to be registered with the Securities and Exchange Commission (SEC) as long as it matures before nine months (270 days), making it a very cost-effective means of financing. The proceeds from this type of financing can only be used on current assets (inventories) and are not allowed to be used on fixed assets, such as a new plant, without SEC involvement.