Total Best Customers

advertisement

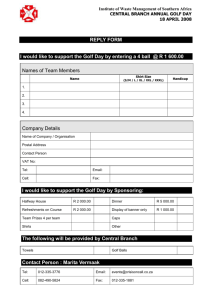

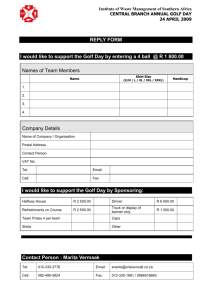

Jon Last Vice President, Corporate Marketing & Research Golf Digest Companies Page 2 Objectives – Looking To Our Best Customers • For detailed understanding of their attitudes, motivations & perceptions and implications for growing the game • Encompassing, but not limited to: – Why they play? …Benefits and Motivations – How much they plan to play in the future – Their potential as missionaries/influencers for future generations – The role that golf plays in the context of their social and professional lives – Perspectives on golf’s future Methodology • The largest and most comprehensive study ever done on Golf’s Best Customers – Core Golfers; those who have played 8-24 rounds a year – Avid Golfers; those who have played 25+ rounds a year • 2 Phases: – 48 hours of one-on-one depth interviews in six U.S. markets (n=96) – Quantitative online surveys (n=13,290) • Large sample size allows for further market segmentation (regionally, avid vs. core; men vs. women; etc – with statistical stability and projectability) Today’s Areas of Focus • Introduction to the Game • Drivers of Satisfaction and Enjoyment • Key Attitudes about the Game • Inhibitors to More Play • Drivers of Increased Play: Concepts • Drivers of Increased Play: Tactics • The Future – Golf in the Year 2150 • Implications and Take-a-ways Introduction to the Game Introduction to the Game Driven as Much by Friends & Business Associates as by Family Q. How were you first introduced to Golf? Parents/Spouse/Other Family (Net) 40% Total Best Customers Friend/Work Colleague (Net) 34% Introduction to the Game Where Did You First Play Golf? Total Best Customers % Core Golfers % Avid Golfers % At a public course 59 57 60 At a par 3 or short course 14 16 13 At a private club 12 At a range 9 12 6 At school 2 2 2 23% 9 28% 14 19% Introduction to the Game In-School Programs Are Embraced As Opportunities to Grow Participation • School programs are 2 of the top 6 initiatives tested in terms of their effectiveness for bringing new people into the game! Mean Scores (1-7 Scale) Reasonably Priced Introductory Lessons at Driving Ranges 6.17 Junior HS and HS Golf In PE Programs 6.06 5.84 Free Golf Days At the Course Adding Women’s Golf Programs by Women and for Women 5.76 Bundle New Equipment Purchases with Lessons Elementary School Golf In PE Programs 5.62 5.55 Total Best Customers Introduction to the Game If Today’s Best Customers Are Indicative of the Future, We Need to Hook Them Younger! Q. When did you first learn to play? 45-54 6% 55-64 1% 65+ 1% 35-44 10% Under 18 44% 25-34 17% Total Best Customers 18-24 21% Drivers of Satisfaction and Enjoyment Drivers of Satisfaction and Enjoyment Drivers of Enjoyment – Conditions, People & Performance Mean Score (1-7 Scale) Total Best Customers Well maintained greens & bunkers 6.34 Well maintained fairways & tees 6.28 The people you play with 6.24 Playing well on the course 5.84 Availability of practice facilities 5.68 Beautiful surroundings and scenery 5.74 Scoring well 5.65 Challenging course 5.65 Fast pace of play 5.39 Knowledgeable marshals and starters 5.38 Drivers of Satisfaction and Enjoyment Overall Enjoyment Is Less about Course Challenge & More about Conditioning Forced Choice: Do you generally prefer to play a course that is… Very challenging, not top condition 12% Total Best Customers 88% Not as challenging but in very good condition Drivers of Satisfaction and Enjoyment Overall Enjoyment Is Less about Course Challenge & More about Conditioning • Golfers were twice as likely to want “better course conditioning” over “better architecture and layout” as an incentive for them to pay 25% more for greens fees! 74% 39% Total Best Customers Better Course Conditioning Better Architecture/Course Layout Drivers of Satisfaction and Enjoyment It’s More about Camaraderie and the People you Play With Q. Which is more important in driving overall enjoyment derived from a round of golf? Total Best Customers % Core Golfers % Avid Golfers % The people you play with vs. How well you play 57 43 61 39 54 46 The people you play with vs. The condition of the golf course 56 44 61 39 52 48 The people you play with vs. The pace of play 63 37 68 32 58 42 • Those with established and reliable peer groups are playing more than those who don’t have a “consistent” game. This was especially evident among young adults in their early stages of family formation and career growth. Key Best Customer Attitudes About the Game Key Best Customer Attitudes About the Game What Golfers are Thinking Today! Agreement Ratings on 27 Statements Mean Scores (1-7 Scale) Total Best Customers Core Golfers Avid Golfers 1. There are no guarantees in golf 6.23 6.17 6.29 2. More young players like Tiger Woods and Michele Wie have been instrumental in growing the game 6.14 6.10 6.18 3. Golfers today are more athletic than they were 20 years ago 5.61 5.50 5.70 4. Golf is an intimidating game for beginners 5.55 5.46 5.63 Key Best Customer Attitudes About the Game Golf Is More about Leisure than Competition • For all but the best, golf was perceived as a leisure activity which has ramifications on what golf’s major competitors are for time and dollars Total Best Customers % For me, golf is more about the competition Core Golfers % Avid Golfers % 35 27 42 65 73 58 Or For me, golf is basically a leisure activity Key Best Customer Attitudes About the Game …And It’s More about Preference for Course Variety I would rather play the same course on a regular basis 19% Total Best Customers 81% I would rather play a variety of courses Key Best Customer Attitudes About the Game Golf’s Best Customers Aren't Necessarily Willing to be Ambassadors • Less than 20% of golfers surveyed would be willing to commit to a program that required them to introduce at least one new person a year to the game of golf • Less than 25% of Best Customers are “willing to contribute $25 a year toward development programs that would insure the future of the game” • More than 45% of Best Customers agree (25% strongly) that they are “concerned that with all of the new players coming into the game, golf courses are going to be too crowded” Inhibitors to More Play Inhibitors to More Play Bad Behavior, Course Condition & Skill Level Q. What inhibits your enjoyment of the game of golf? Mean Scores (1-7 Scale) Total Best Customers Behavior of players on the course 4.81 Course conditions 4.79 Cost 4.64 Time required to play 3.95 Tee time availability 3.89 My skills/performance 3.72 Elitist perception 3.21 Inhibitors to More Play Cost & Time – The Two “Crutches” Q. What inhibits your enjoyment of the game of golf? Mean Scores (1-7 Scale) Total Best Customers Behavior of players on the course 4.81 Course conditions 4.79 Cost 4.64 Time required to play 3.95 Tee time availability 3.89 My skills/performance 3.72 Inhibitors to More Play A Further Look At Costs Total Best Customers Core Golfers Avid Golfers So cheap that its quality would be questionable? $20 $20 $21 Such A bargain that you would definitely purchase it? $31 $30 $33 Starting to get expensive, but still worth considering? $55 $52 $57 So expensive that you would not consider it? $93 $88 $98 Inhibitors to More Play Going Beyond the Crutches They Say Crutch #1 Crutch #2 “Golf is too expensive” “I don’t have enough time to play golf” They Mean “I’m not getting value out of my experience” Issues Customer service; Pace of play; Conditions “I spend on lessons & equipment but I don’t get better” “My on-course experience doesn’t justify the time investment” Too crowded; bad service; lack of improvement Inhibitors to More Play Going Beyond the Typical Crutches Why Not More Golf..? There are No Guarantees in Golf #1 of 27 Attitudinal Statements Drivers of Increased Play: Concepts Drivers of Increased Play: Concepts Success Breeds Interest and Increased Play Why are you playing MORE Golf in last two years? Total Best Customers #2 – My game has improved 50% Why do you expect to be playing MORE Golf in the next 3 years? Total Best Customers #1 – My game has improved 46% • 53% of Golf’s Best Customers agreed with the statement: “I would play more golf than I’m currently playing, if I got better at it!” Drivers of Increased Play: Concepts Access To Playing Partners Can Also Increase Play Why are you playing more often than you did in the past two years? Total Best Customers #3 – I have more golf partners to play with 41% #4 – My family is more involved with golf 19% Drivers of Increased Play: Concepts …Enhanced Service Would Also Improve the Golf Experience Q. What would enhance your overall golf experience? Mean Scores (1-7 Scale) Total Best Customers Improved pace of play 5.98 Courteous and upbeat staff 5.92 Marshals who do their job 5.14 Drivers of Increased Play: Concepts Growing the Game is More about Adding New Golfers Q. What do you think is more important to insure golf’s future? Getting Existing Golfers To Play More • Those favoring new golfers spoke to: 26% Bringing In New Golfers 74% Total Best Customers – Junior golf programs – Continuous focus on minorities and women Drivers of Increased Play: Concepts Growing the Game is More about Adding New Golfers Q. What do you think is more important to insure golf’s future? Getting Existing Golfers To Play More 26% Bringing In New Golfers 74% Total Best Customers • However, a significant number of respondents took on a more protectionist approach Drivers of Increased Play: Tactics Drivers of Increased Play: Tactics Q. How Effective Would The Following Be In Getting Golfers To Play More Frequently? Top 5 Out of 9 Tested Mean Scores (1-7 Scale) Reduced Fees During Off-Peak Hours 6.18 Discounted Golf Packages 6.03 5.31 Less Expensive Golf Instruction Joining An Organized Golf League Family Golf Programs 4.81 4.64 Total Best Customers Drivers of Increased Play: Tactics Moving Golf Leagues to the 40% Mark Total Best Customers % Core Golfers % Avid Golfers % 35 26 44 Golf leagues not through work 26 16 36 Golf leagues through work 12 11 13 Current Participation Any Leagues (Net) Drivers of Increased Play: Tactics Golf Leagues – A Huge Opportunity • Regionally test market new corporate golf leagues for workers • Organize Sponsorship of National Golf League Championships – the Corporate Challenge Model • Locally sponsored after school leagues in suburban middle class/affluent neighborhoods – like little league • Local business golf leagues during off season like bowling, with banquets and trophies at the end of the season. Drivers of Increased Play: Tactics Innovative Memberships Programs: The Health Club Model “Market golf like your local gym club.” Martin S - Los Angeles Drivers of Increased Play: Tactics The Health Club Model: What Would It Take? Number of rounds you would prepay for in a month for unlimited golf Total Best Customers Core Golfers Avid Golfers Average Number of Rounds: 5.29 4.94 5.67 Median Number of Rounds: 5 5 5 Extremely interested Drivers of Increased Play: Tactics Another Popular Option: Consumer Loyalty Programs with REAL, Attainable Rewards Extremely interested Total Best Customers Rounds to play to get one free Average Number of Rounds: 4.14 Median Number of Rounds: 5 Discount you would require for next round Average Percentage Off: 30% Median Percentage Off: 25% Drivers of Increased Play: Tactics Putting the Guarantee in Golf • Satisfaction guarantees on: – Lessons – On-Course experience • Supervised practice, not just instruction: – Practice where pros/better players take notice and give tips – On the range and on the putting green – Practice logs and formalized training programs – Certificates of progress to measure against improving scores – Golf practice/socials regularly scheduled Drivers of Increased Play: Tactics Increasing the Value Quotient! • New stronger emphasis on marshalling for pace of play – develop certification program • Improve and market condition of golf course, rather than challenge or slope index • Promote heightened respect of game by new focus on obeying rules, replacing divots, ball marks and appreciation of tradition. • Tiered pricing for effective yield management Drivers of Increased Play: Tactics What Do We Have To Do To Tip the Scales? • Develop more opportunities to play – Promote leagues at work and at the course – Increase golf course exposure at ranges and in schools – Get children playing younger – More tailored promotions and frequency loyalty programs Drivers of Increased Play: Tactics Promoting the Golf Family Q. What other family members play golf? Total Golfers Core Golfers Avid Golfers 51% 41% 44% 55% 48% 38% Spouse or Significant Other Child/Children The Future – Golf in the Year 2150 The Future: Golf in the Year 2150 Optimism in General – But Lots of Caveats Too! Mean Scores (1-7 scale) Best Customers 1. Golf will be bigger than ever as media and grass roots programs are successful in bringing new players in 4.84 2. Courses will become more challenging with tighter fairways, tougher greens and bigger carries to ward off the “power game effect” of technology 4.77 3. A greater percentage of the population will be playing golf 4.65 4. Golf will become more expensive due to the increasing cost of real estate 4.61 Implications Implications The Attrition Battle: Tipping The Scale of Critical Success Factors Play More If Benefits > Detractors Play Less If Detractors > Benefits Implications The Headlines • Optimal price point for Daily Fee greens fees is $40 - $50 • Leisure is more important than competition • Course conditioning is more important than challenge • Time issue is more about priorities and family; more rounds will eliminate the guilt factor • There’s a group out there who is resisting • Youth – if you get them when they’re under 12, they might leave…but they’ll come back later Implications So, What Will the Game Look Like? • There are more affordable public facilities – $50 and less • There are lots of leagues – for families, at work and through other social organizations • More “well-conditioned” courses – less emphasis on penal design • More school programs • More monitored practice sessions • More recognition & rewards for Best Customers