Study Unit 2 - CMAPrepCourse

advertisement

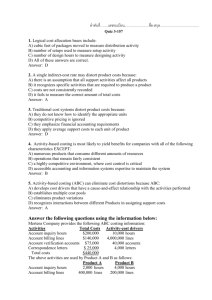

Study Unit 2 ABC – Activity-Based Costing LCC – Life-Cycle Costing Activity-based costing Traditional costing system: OH is simply dumped into a single cost pool Under ABC, indirect costs are attached to activities and then rationally allocated ABC may be used by manufacturing service or retailing Traditional Costing System Peanut-butter costing = product-cost crosssubsidization inaccurate allocation of indirect costs over products or service units DL + DM are traced to products/services A single pool of indirect costs is allocated based on a single rate (overhead) How much resources did I use to product X? Steps in ABC process 1) 2) 3) Activity Analysis: understand the different steps and process from DM to Finished Goods Assign Resource Costs to Activities: first-stage allocation. Identify resource costs: a separate Accounting System may be necessary to track resource costs separately from the GL. Then we need to define resource drivers to allocate it. Allocate Activity Cost Pools to Cost Objects: allocating the activity cost pools to final cost objects = second-stage allocation What are my activity drivers? Cost Drivers Cause-&-effect relationship Cost object may be a job, product, process, activity, service or anything else for which a cost measure is desired Process value analysis: Organization flow Value-adding Vs. Non Value-adding Product costing / continuous improvement ABC used to obtain full-absorption cost (US GAAP) ABC Advantages/Disadvantages Product costing is improved, better decision making Process value analysis (non-value adding activities can be removed) More cost assignment of OH Better cost control and more efficient operations Maintain a separate Accounting System to capture resource costs Design and implement drivers and cost pools ABC-derived costs of products or services may not conform with GAAP Cost of implementing an ABC system Organizational Benefits Significant variance in volume, diversity of activities, complexity of operations, relatively high OH costs… ABC difficult for service organizations: high facility-level costs hard to assign to service DL as a base for allocating OH No benefit for a single product and average regular volume of activity Real benefits for high level of FC + wide variety of products and level of production Life-cycle costing Estimate revenues & expenses Over the entire sales life cycle Upstream costs (R&D, Design) Manufacturing Downstream costs (Mktg & Distribution, Customer Service) Great value for Pricing Decision Potential Benefits Relationships among costs incurred at different value-chain stages Incurring costs vs. locking in costs (SUNK) Focus on cost control Vs. cost reduction After-purchase costs (operating, support, repair, disposal…) Life-cycle and whole-life cycle target costing Value engineering: minimize cost without reducing customer satisfaction Internal & External Reporting For external financial statement purposes, costs during the upstream phase must be expensed in the period incurred IFRS For allows development costs to be capitalized internal purposes, the costs (R&D) must be capitalized in a life-cycle costing Organizations must develop an accounting system consistent with GAAP Advantage Better measure for evaluating the performance of Product Managers Life-cycle costing combines all costs and revenues for all periods to provide a better view of a product’s overall performance