Document

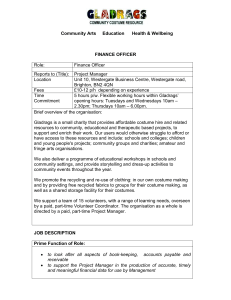

advertisement

Financial Operating Procedures Introduction It is a requirement of any organisation to recognise the extent of resource at its disposal and ensure that the procedures that are introduced are appropriate to the organisation. They will recognise the checks and balances that exist, are appropriate to the resource available and take account of the effect of incorrect accounting or fraud on the organisation, i.e. they will not be onerous. A Postal receipts 1. Wherever practical, the incoming post will be opened in the presence of two people who are independent of finance office staff The value of incoming cash and cheques shall be checked and noted against the accompanying documentation The value and nature of postal receipts shall be listed in a postal record book and then passed to the finance office together with accompanying documentation Discrepancies between documentation and the accompanying cash and/or cheques shall be noted on the documentation and drawn to the attention of finance staff or Insurance Manager, as appropriate The finance staff are responsible for ensuring a receipt is issued, where feasible, for all incoming cash. Administrative office staff are responsible for ensuring that all donations are acknowledged in a thank-you letter which must state the amount received Unopened mail retained in the administration office, or on other sites, should always be attended or locked 2. 3. 4. 5. 6. 7. B Public donations (collection income) The person appointed to oversee the public donation activity has the responsibility of ensuring: 1. 2. 3. 4. 5. 6. Collections conform to legal requirements Collection boxes are numbered and a record is made of their allocation and of their return (the collection box record) Collection boxes are to be sealed, spare seals being kept in a secure place, and inspected prior to their release Collection boxes will be returned to finance staff, opened in the presence of two staff, monies counted and recorded on the collection box record and banked within the Weekly Cash and Banking Significant sums received from collections should be banked immediately A record must be made of the location of all static collection boxes and they should be regularly examined and counted in a manner similar to the above requirements Policy title Policy version number Document1 1.0 Policy approved date Policy author 01/03/2005 Rosemary Andrews Page(s) 1 of 12 C Fundraising events The person appointed to oversee the fundraising event has the responsibility of ensuring: 1. 2. 3. 4. 5. 6. 7. 8. D Records are maintained for each fundraising event and any collections conform to legal requirements Collection boxes for fundraising events should be administered as set out in paragraph B Appropriate administration and financial controls are established and comparable controls are maintained as for public donations Income from external fundraising events should be recorded by the person responsible for the event and passed to the finance office for checking, verification and banking Records of income and expenses of the fundraising event should be retained and filed with the Weekly Cash & Banking records Where raffle tickets, admission tickets or something similar are involved: a. Tickets must be pre-numbered b. A record maintained of all tickets issued – their numbers and recipient - and the monies and tickets returned recorded c. Monies received should be passed to the finance office for checking, verification and banking in the Weekly Cash and Banking d. Finance office records should reconciled to the administrators records as appropriate Similar records to the above should be maintained in relation to sponsored events Professional fundraisers should be engaged only in accordance with the provisions of the Charities Acts and with the approval of the Board of Management. Records should be maintained to identify funds generated though the activities professional fundraisers Donations All donations will be recognised by one of the following methods: 1. 2. 3. 4. 5. Where a cheque or cash donation is received it will be recorded and acknowledge as set out in paragraph A Where an outreach worker receives cash or cheques, they will make a record of the donation, give receipt if required, and pass the monies and record to finance staff for verification and banking. If appropriate, a letter of thanks will be raised by Administration Where a cheque or cash donation is received at a location other than Arkwright House, the staff member receiving the donation will make a record of the donor and the amount, giving a receipt if required, and pass the monies and record to finance staff for verification and banking. If appropriate, a letter of thanks will be raised by Administration Donations received as part of an Ageing Well activity should be recorded on the Activity Sheet and a receipt issued, if required, by the staff member responsible for the activity The Finance Manager is responsible for ensuring that any restrictions applicable to the spending of donations is recorded and actioned Policy title Policy version number Document1 1.0 Policy approved date Policy author 01/03/2005 Rosemary Andrews Page(s) 2 of 12 E Gift Aid The Finance Manager is responsible for ensuring that: 1. 2. 3. Records are kept of all gift aid declarations Routine checks are established to ensure due amounts are received Routine checks are established to ensure that the tax due is received F Shop income The Shop Manager is responsible for ensuring that: 1. 2. 3. 4. 5. 6. 7. G Individual transactions are rung into the till and appropriately analysed to distinguish between donated goods and various categories of new goods for resale A summary of each days takings is entered onto the Weekly Takings Record and reconciled against the daily till total - discrepancies being noted on the Weekly Takings Record Shop takings are banked daily to minimise the amount of cash to be held on the premises and the days banking on Weekly Takings Record initialed by the person performing the banking The Weekly Takings Record is signed by the Shop Manager at the end of the week and passed to the finance office for verification with the bank statement Petty Cash Float reimbursements from takings are noted appropriately on the Weekly Takings Record Till float totals are regularly checked Till floats are removed from the till at the end of the day’s trading and stored overnight in a locked location. Service income Service Income is defined as income from the service activities such as foot care and day care. Foot Care income Each foot care worker is responsible for: 1. 2. 3. Ensuring numbered receipts are given for foot-care charges Ensuring receipt numbers and amounts are recorded on the Foot- care Charges Record Passing records and monies, as far as possible on a daily basis, to the finance office for verification and banking. Withy Trees Day Care spot contracts The Day Care Manager is responsible for: 1. 2. 3. Ensuring appropriate attendance records are kept for spot contract day care places Preparing a summary on a four weekly basis the spot contract details to be invoiced Passing the Spot Contract Schedule to the finance office, no later than one week after the end of the four week period, for invoicing Policy title Policy version number Document1 1.0 Policy approved date Policy author 01/03/2005 Rosemary Andrews Page(s) 3 of 12 Withy Trees Day Care daily lunch fees The Day Care Manager is responsible for: 1 2 3 4 5 Ensuring appropriate daily lunch fees are received from clients on a daily basis Recording attendance at the centre and performing a daily reconciliation numbers with fees received Recording the total of daily lunch fees on the Daily Fees Schedule Passing the Daily Fees Schedule and monies received, in a secure manner, to the finance office on a weekly basis for verification and banking Keeping cash on the premises in a secure locked location Supported shopping service income The Supported Shopping Coordinators are responsible for: 1 2 3 Ensuring payment is collected from the client for all shopping purchased whether via the company credit card or paid from the coordinator's float Giving a receipt, if requested, to the client for monies received Passing the shopping voucher and monies to the Finance office vas soon as possible Other service income Similar controls to the above should be applied for other service income sources. Advice should be sought from finance staff for the appropriate controls required for new service income sources. Finance office staff will verify service income received with the accompanying documentation and record it on the Weekly Cash & Banking schedule and bank it with the other income as detailed in section K. H Activity centre income Income and expenditure for Ageing Well activities is to be recorded and checked by the appropriate Ageing Well Officer who is responsible for: 1 2 3 4 5 Ensuring a record of attendees and visitors is made and reconciled to the cash received Ensuring a petty cash or other receipt evidences any expenditure, e.g. tutor fee or minibus fuel. Fees paid to third parties should be signed for on a petty cash voucher Income and expenditure is analysed and recorded on the appropriate Activity Sheet which is to be signed by the person responsible for running the activity and by the relevant the Ageing Well Officer Passing the Activity Sheet and net monies received, in a secure manner, to the finance office, as far as possible on a daily basis, for verification and banking Ensuring that cash is not held in unsecured locations but in locked an appropriate place or, preferably, placed in the deposit safe in the finance office Policy title Policy version number Document1 1.0 Policy approved date Policy author 01/03/2005 Rosemary Andrews Page(s) 4 of 12 I Service agreement, contract and grant income Service Agreement Income and Contract Income are defined as income from the community service activities such as Community Links, Home Support or Day Care. Grant Income is defined as income won from bids for grant aid or grant assisted activities. Normally such income will require to be invoiced to the appropriate agency although occasionally the agency may undertake to pay directly without being invoiced. Common internal control mechanisms applicable to both invoiced and non- invoiced income are: 1 2 3 4 The Community Services Manager, Deputy Chief Executive or other appropriate person is responsible for informing the Finance Manager of the details of the service and the income expected. A copy of the relevant service level agreement or grant application or confirmation should be passed to the finance office as soon as possible. Finance office staff will confirm with the agencies, if necessary, the details of payment arrangements and will monitor the income levels and uplifts in income under the agreement. Finance office staff will liaise with the relevant Project Officer to ensure appropriate records are maintained and any required reporting submissions are made in the manner required by the agency. Income received will be controlled though deferred income accounts and released into revenue on appropriate timed basis. For service agreement or grant income requiring invoicing: 1 2 Finance office staff will raise invoices on a quarterly or annual basis in advance, unless otherwise dictated by the agreement. Outstanding invoices will be checked on a monthly basis by the Finance Manager and actioned as appropriate to ensure collection. For service agreement or grant income not requiring invoicing: 1 2 Finance office staff will monitor postal receipts and bank statements/remittance advices for the relevant income and advise the Community Services Manager, Deputy Chief Executive or other appropriate person if no receipt is received within a month of the agreement commencing or if monies received or notified are not recognised to an agreement, contract or grant. Finance staff will send an acknowledgement of the Service Agreement, Contract or Grant income as soon as possible after receipt if one is required. Policy title Policy version number Document1 1.0 Policy approved date Policy author 01/03/2005 Rosemary Andrews Page(s) 5 of 12 J Centre hire income Centre income is defined as income from the letting of premise to third parties or internal users and may include the supply of catering or other facilities. This includes hire of the Lostock Hall Friendship Club and the Conference Centre at Arkwright House. 1 2 3 4 5 Centre managers will record all bookings in an appropriate bookings record and complete booking confirmations for all lettings, both external and internal At the end of each month a schedule of bookings, agreed hire rates and charges for other services, such as catering, is to be sent to the finance office Finance office staff will raise invoices in accordance with the booking information supplied and will monitor the payment of the debt by the customer Invoices will be filed in the finance office together with the booking sheet Invoices for service costs, such as catering, will be authorised by the relevant centre manager who is responsible for ensuring that the correct charge has been received K Petty Cash 1 2 Petty Cash floats at all locations will be maintained on an imprest system External locations shall have the levels of their petty cash float agreed by the Finance Manager and they will be subject to periodic unannounced spot checks. Cash to replenish petty cash floats will be drawn in the following manner: a. Shops may replenish their petty cash float from shop takings. The value of cash used for such purposes will be entered on the Weekly Takings Record and the petty cash vouchers summarised, total agreed and verified by the Shop Manager and passed as soon as possible to the finance office. Finance staff will cross check the vouchers with the Weekly Takings Record and enter a nominal journal to account for the expenses b. Other centres will replenish their petty cash by sending their vouchers to the finance office for reimbursement from the finance office float. Centre Managers will summarise and sign to verify the total of vouchers being reclaimed. Finance office will check the vouchers with the total claimed and pass the cash reimbursement to the centre in a secure manner All petty cash payments must have appropriate supporting evidence and be authorised by the relevant staff member or senior manager Vouchers for reimbursement of volunteer expenses (other than for mileage) should be signed by the volunteer and authorised by the appropriate staff member Mileage claims by volunteers should be made on the appropriate claim for, signed and authorised Finance staff may refuse to pay expenses they deem to be inadequately evidenced or authorised A listing of all authorised signatories in respect of petty cash and purchase invoice costs and nominal cheque payments will be maintained by the Finance Manager and agreed by the Chief Executive Petty cash expenses are not appropriate for lager value purchase or contractual commitments – these should be controlled through the purchase ordering system 3 4 5 6 7 8 9 Policy title Policy version number Document1 1.0 Policy approved date Policy author 01/03/2005 Rosemary Andrews Page(s) 6 of 12 The finance office staff will record cash receipts and payments in the following manner: 1 Cash and cheque receipts will be recorded and analysed on a Weekly Banking Schedule in a format approved by the finance manager. Such receipts will typically be from the following sources: a. b. c. d. e. f. 2 3 4 5 6 Donations from outside organisations and individuals Insurance commission cheques Lottery commission cheques Ageing Well activities net income Withy Trees Day Care daily lunch fees Foot care charges income Cash or cheque receipts for sales ledger invoices will be banked separately from nominal receipts Cash income recorded as above may be used to reimburse the finance office petty cash float. The vouchers reimbursed being entered on the Weekly Banking Schedule. Finance office staff will agree the net total of the Weekly Banking Schedule with the net cash and cheques to be banked and will bank this net amount at least once a week. The Weekly Banking Schedule will be filed together with the receipts and vouchers in the Cash & Banking files. A nominal journal posting will be raised to enter the weekly bankings into the accounts and matched to the bank statement entry. Petty Cash balances shall be subject to the following controls: 1 2 3 4 5 All petty cash balances shall be kept in secure lockable locations and not left unattended or on open display. Cash handlings should be as discreet as possible and cash and cheque receipts and balances immediately transferred to the safe or other lockable location. The finance office petty cash float and net banking (prior to banking) are to be kept in the finance office safe. Each petty cash imprest balance is to be checked and verified at least once each week by staff at the location and discrepancies notified to the Finance Manager. Finance office staff will make periodic unannounced checks on petty cash balances at other locations. L Banking and custody 1 The Board of Management must approve all banking arrangements and the finance office shall maintain proper lists of authorised signatories. Finance staff will ensure that all incoming receipts are banked weekly or sooner if significant sums are received. Sales Ledger receipts must be banked separately from the Petty Cash banking. All cheque receipts should be restrictively crossed Banking must be carried out by finance staff who should be accompanied if cash amounts exceed £500. Rooms containing cash or cheques are to be locked if left unattended. Personal monies are not to be kept with charity cash balances. 2 3 4 5 6 Policy title Policy version number Document1 1.0 Policy approved date Policy author 01/03/2005 Rosemary Andrews Page(s) 7 of 12 7 8 9 10 11 Banking must be made using bank paying in books and receipts or stamps obtained for deposited sums. A record is to be maintained by the Finance Manager of safe key holders. Electronic banking passwords and codes should be recorded in a secure location and not released or declared to non-finance staff without authorisation of the Chief Executive. Bank accounts are to be reconciled monthly and checked by the Finance Manager The Finance Manager is responsible for monitoring the bank balances and ensuring sufficient balances are maintained to meet payment requirements and surplus funds transferred to deposit accounts. M Cheque payments 1 Cheque payments will only be made against authorised invoices or expenditure claims A listing of all authorised signatories in respect of petty cash and purchase invoice costs and nominal cheque payments will be maintained by the Finance Manager and agreed by the Chief Executive Finance staff will be responsible for preparing cheque payments from a review of purchase accounts and nominal payment requirements. Chequebooks will be kept in the safe or lockable drawer or cabinet when not in use Chequebooks will be ordered by the Finance Manager Two authorised signatories, neither of whom may be finance office staff, must sign all cheques Normally the Chief Executive and the Deputy Chief Executive should sign cheques, or failing one of them, a Trustee who is an approved authorised signatory Cheque signatories must ensure that the cheque amount equals the invoice(s) total and/or the nominal ledger requisition and that the cheque is made payable to the correct payee All requested payments will be supported by invoices and a purchase payment summary or authorised nominal ledger payments requisition slip Cheque payments must be recorded by finance staff on a monthly cheque listing which must be evidenced when posted to the ledgers 2 3 4 5 6 7 8 9 10 N Sales ledger and credit control Sales Ledger 1. Sales Invoices require an authorising back up and must only be raised from appropriate authorised documentation, such as: a. b. c. 2. Sales advices for activities at outreach areas – normally from the Ageing Well manager, which will informs the finance office of centre hire details for invoicing Spot Contract schedules from the Withy Trees Day Centre for invoicing to Lancashire County Council Social Services. These usually require a four-weekly activity sheet (prepared by the Day Care Manager) to support the invoices Advice of Service Level or Contract Agreements or Grant claims from Community Services or others Finance office staff will raise sales invoices as soon as the relevant advice is received from other departments on pre-prepared stationery Policy title Policy version number Document1 1.0 Policy approved date Policy author 01/03/2005 Rosemary Andrews Page(s) 8 of 12 3. 4. Invoices will be filed, together with the backing paperwork, in numerical order in the finance office in separate files for paid and outstanding invoices. Sales Ledger age analysis and monthly summary prints of invoicing and allocated receipts will be printed and retained in the finance office. Credit control 1 2 3 The objective of credit control is to ensure that monies due to the organisation from sales invoices and grants are received at the time they are due The Finance Manager is responsible for reviewing the aged debtors list on a regular basis and for ensuring that appropriate action is taken in respect of overdue debts – these are set out in a Finance Office Note on Credit Control Procedures Any invoices, which remain unpaid after the normal series of enquiries and actions, should be notified to the Chief Executive or Deputy Chief Executive. O Purchasing and purchase ledger 1 All goods and services, other than petty cash items and utility costs and other similar contractual commitments, must have to have a correctly authorised purchase order showing details of the item(s) ordered, quantities and prices Purchase orders must be raised on official pre-numbered order stationery and signed by the relevant departmental manager or other authorised person procuring the goods or services A listing of all authorised signatories in respect of petty cash and purchase invoice costs and nominal cheque payments will be maintained by the Finance Manager and agreed by the Chief Executive Blank order packs are to be securely kept in the finance office and, when issued to managers, recorded and signed for by the receiving manager The three part order set should be distributed as follows: the green office copy will be filed by the department, in numerical order, to provide a reference of orders placed; the pink copy will be passed to the finance office for matching to delivery note and invoice; and the original white copy will be dispatched to the supplier The originator of the purchase order should retain relevant quotation paperwork Purchase orders for should be placed after acquiring quotations as follows: 2 3 4 5 6 7 a. b. c. d. 8 9 10 11 Value up to £250 – 1 quotation Value from £251 to £1000 – 2 quotations Value over £1000 – 3 quotations Any value in respect of an ongoing contractual relationship will require only that the cost is in line with that in the contract or current catalogue agreed price list Purchase orders for all capital items and non-urgent repairs over £250 are to be authorised by the Chief Executive or the Deputy Chief Executive Purchase orders for other items may be authorised by the appropriate authority (see 3 above), up to a value of £1000 provided their purchase is in line with an agreed budget Any purchase order over £1000 must be countersigned by the Chief Executive or Deputy Chief Executive Goods received should be checked on delivery for quantity and condition by the requisitioner, or if this is not possible, the delivery note should be signed to indicate that goods have not been checked Policy title Policy version number Document1 1.0 Policy approved date Policy author 01/03/2005 Rosemary Andrews Page(s) 9 of 12 12 13 14 15 16 17 18 19 Delivery notes should be passed to the finance office as soon as possible for matching to order and invoice Finance staff are responsible for matching purchase invoices with delivery notes and purchase orders and for checking the calculation of the total cost. Invoices so matched will need no further authorisation Invoices which have no delivery note and/or purchase order (e.g. utility bills) must be authorised by the appropriate Departmental Manager to certify receipt and agreement of price and quantity Finance staff will refer invoices requiring further authorisation to the Chief Executive Invoices will be posted to the purchase ledger immediately upon receipt but held in abeyance until they have been properly authorised. Finance staff will enter on the posting slip an account code and a cost centre to allocate the cost to its correct account and initial the posting slip on completion of posting Invoices will be filed together with their matched delivery note and order in the finance office- initially in an outstanding payments file and, when paid, in a paid cheques file in cheque number order Finance staff will review outstanding purchase orders on a regular basis to check for missing liabilities or cancelled orders Finance staff will review outstanding purchase ledger accounts on a regular basis to ensure payments are made within agreed terms and prepare cheque payments as appropriate P Direct debit and standing order payments 1 All direct debit and standing order authorities must be authorised by the Chief Executive and signed in accordance with the rules for cheque payments (see M) The Finance Manager is responsible for matching vouchers for direct debits (e.g. for Mobile Contracts, Telephone Call Costs or Company Credit Cards) to the bank statements Vouchers for direct debit costs must be authorised by the appropriate person as defined in the listing of authorised signatories and the filed in the finance office 2 3 Q Shop Stocks The Shop Manager is responsible for ensuring: 1 2 3 4 5 6 All donated stock is reviewed, priced for sale or consigned to waste New stock for resale, e.g. wool and jewellery, is checked on receipt and the delivery note signed and passed to the finance office New goods for resale are analysed appropriately in the till when sold and the total daily sales recorded on the Weekly Takings Record Donated stock is reviewed regularly to prevent stock build up, and if required, is consigned to the waste bin or transferred to other shops Weekly Takings Records are completed with the requisite data and sent to finance office at the end of each week Finance staff will record each shops ‘new goods for resale’ stock position from purchase invoices and sales records and stock will be checked at least once a year and always at the end of the financial year Policy title Policy version number Document1 1.0 Policy approved date Policy author 01/03/2005 Rosemary Andrews Page(s) 10 of 12 R Salaries and related payments 1 Personnel records are the responsibility of the Chief Executive who will inform the Finance Manager of any changes in staff payment terms Details of new staff members will be advised to the Finance Manager on the appropriate New Employee documentation giving all relevant details for payroll purposes The preparation of monthly salaries is the responsibility of the Finance Manager, with the running of the payroll outsourced to a payroll bureau Staff travel expenses will be paid through the monthly payroll via a staff expense claim form authorised by the appropriate Departmental Manager. Absence will be notified to the Finance Manager by Administration on copies of selfcertification or doctors sick notes. The Finance Manager will cross check sickness when preparing the monthly payroll with the attendance records maintained in Administration All changes or additions affecting payroll, including changes in salary levels, will be advised to the Finance manager by the personnel function on signed notifications Staff Travel Expense claims must be submitted on the appropriate form, signed by the claimant and authorised by the relevant Departmental Manager and passed to the Finance Manager for processing within one week of the month end The Finance Manager will prepare a list of payroll changes and travel expense claims for the Payroll Bureau and will sign the listing, retaining a copy in the payroll records The Finance Manager will ensure all processing and data are submitted to the Payroll Bureau in sufficient time for processing to employees bank accounts on the due date The monthly payroll will be countersigned by the Chief Executive, and cross referenced to the bank statement, the entry to be initialed by the Chief Executive Salaries and travel expenses for the prior month will be paid into the employee’s nominated bank account on the 20th of each calendar month or the previous week day if falling at a weekend The Finance Manager is responsible for maintaining records of deductions from salaries and ensuring that all PAYE/NI, Pension and other deductions are paid over by their due date 2 3 4 5 6 7 8 9 10 11 12 S Fixed assets 1. It is the responsibility of the Finance Manager to maintain a fixed asset register complete with sufficient data to allow a physical audit to take place either as an internal or as part of the annual statutory audit Items costing less than £250 will not normally be treated as capital costs unless forming part of a greater whole The Finance Manager must be informed, e.g. by passing to finance of a delivery note, of the acquisition of capital items The Finance Manager is responsible for ensuring all fixed assets are properly insured Assets to be disposed should be authorised prior to disposal by the Chief Executive and the Finance Manager informed of disposal details, including selling price, if applicable Assets will be depreciated in line with the organisation’s depreciation policy and depreciation costs will be accounted for on a monthly basis 2 3 4 5 6 Policy title Policy version number Document1 1.0 Policy approved date Policy author 01/03/2005 Rosemary Andrews Page(s) 11 of 12 T Investments and reserves The Finance Manager is responsible for: 1 2 3 4 The keeping of full records of all investments in a secure place Statements on investment performance a submitted to the Chief Executive Maintaining controls to ensure that all investment returns are received Maintain records of Designated Reserves and record expenditure against such reserves U Financial & Management Reporting 1 Regular monthly management accounting information shall be produced by the Finance Manager in a format agreed by the Chief Executive and distributed to members of the Senior Management Team The management information produced will include those reports specified a requirements for consideration by the Board of Management The Finance Manager is responsible for the preparation of monthly summary reports from the computerised accounting system and for their retention for audit. All balance sheet control accounts are to be reconciled monthly and copies of current reconciliations retained The Finance Manager is responsible for the preparation of the organisations annual statutory accounts and for ensuring the availability for audit of all appropriate books and records 2 3 4 5 V Other matters 1 Irregularities – Any irregularities observed by any member of the finance staff should be reported to the Finance Manager or the Chief Executive or the Chairman of Trustees Delegation- The Finance Manager will delegate tasks to finance staff as appropriate, but remains responsible for the adherence of those staff to these procedures Training – The Finance Manager is responsible for the identification of training needs of finance staff and for ensuring action is taken to complete training identified Records – All financial records should be retained for a minimum of 7 years or longer if dictated by other regulation. Records should be kept in a secure place Personal Transactions – No member of staff or volunteer is permitted to pass a personal transaction through the accounts of the organisation and any personal expense claims to be reimbursed from the organisation’s funds must be authorised by the appropriate independent authoriser 1 2 3 4 Policy title Policy version number Document1 1.0 Policy approved date Policy author 01/03/2005 Rosemary Andrews Page(s) 12 of 12