ACC 2010 Intermediate Accounting

advertisement

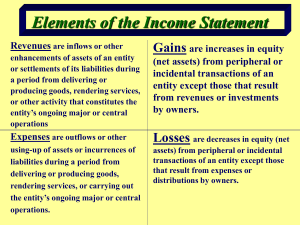

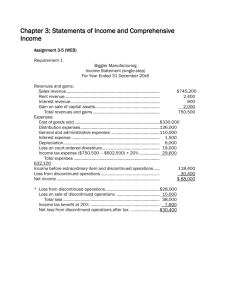

FA2 Module 2. Income statement and statement of financial position presentation I. II. Statements of income and comprehensive income Statements of financial position and changes in equity Remember the attendance sheet! I. Statements of income and comprehensive income 1. 2. 3. 4. 5. 6. Theoretical considerations Income statement presentation Asset disposals Discontinued operations Intraperiod tax allocation Comprehensive income 1. Theoretical considerations The income statement is the most important financial statement, and net income the most important figure: • EPS widely predicted and published; earnings surprises rewarded (or punished) • Income statement information helps to confirm past predictions (feedback value) • I/S information helps predict future cash flows and risk associated with them Nature of income Economic income: Income is change in wealth – events approach, i. e., watch for events that change wealth (e. g., changes in fair value of asset) Accounting income: Traditionally based on transactions approach, i. e., income is recognized only as result of transactions (e. g., item sold for amount different than its historical cost) More recently, accounting income moving closer to economic income Nature of income (cont’d) Comprehensive income • all changes to owners’ equity not the result of transactions with owners in their capacity as owners (e. g., dividends, share capital) • Two categories of comprehensive income – Periodic profit/loss (net income) – Other comprehensive income (OCI) – changes in balance sheet values that are not yet recognized in net income (profit or loss) Nature of income (cont’d) Items not included in net income • all changes to owners’ equity that result from transactions with owners in their capacity as owners (e. g., dividends, share capital) • OCI (other comprehensive income) • cumulative adjustments to retained earnings that result from changes in accounting policies and corrections of errors Nature of income (cont’d) Presentation of comprehensive income 1.Single statement that combines income statement and OCI Revenue $ Expense $ Net income $ OCI $ Comprehensive income $ Nature of income (cont’d) Presentation of comprehensive income 2.Income statement plus statement of comprehensive income Revenue $ Expense $ Net income $ Net income OCI Comprehensive income $ $ $ 2. Income statement presentation Required components (IFRS) • Revenues • Finance costs (interest expense) • Share of earnings from associated cos. • Profit or loss on discontinued operations, net of tax • Net income • Earnings per share Lots of additional note disclosure 2. Income statement presentation Alternative formats 1. Classification by nature of expense Classification on the basis of inputs – what the money was spent on (e. g., salaries, amortization) 2. Classification by function Output-based classification – what money was used for (cost of goods sold, operating expenses, selling and administrative expenses) Example: Nature vs. Function Chen Inc. Expense Depreciation Salaries Other Cost of goods sold Selling Administrative Total Total $500 $120 $100 $40 260 60 110 30 200 $180 $210 $70 $960 Revenue for the year was $1,400. Prepare an income statement for Chen for the year, classifying expenses by (a) nature and (b) function. (a) Chen Inc. Income statement: Expenses classified by nature Chen Inc., Income Statement for the year ended December 31 Revenue $1,400 Cost of Goods Sold 500 Depreciation expense 180 Salaries expense 210 Other expenses 70 Net income $440 (b) Chen Inc. Income statement: Expenses classified by function Chen Inc., Income Statement for the year ended December 31 Revenue $1,400 Cost of Goods Sold 500 Selling expense 260 Administrative expense 200 Net income $440 2. Income statement formats 1. Single-step income statement Revenue $ Expenses $ Net income $ Simple presentation, allows (forces) users to decide what importance to attach to each item. Disadvantages: GAAP requires separate presentation of items like discontinued operations 2. Income statement formats 2. Multiple-step income statement Often includes: • Separation of results related to normal vs. unusual activities • Expenses grouped by functional category: cost of goods sold, selling expenses, administrative expenses • Separate presentation of other, nonoperating items: interest, gains, losses 2. Income statement formats 2. Multiple-step income statement Advantages: • Arguably more informative in that operating and non-operating items are separated • Better matching of expenses with related revenues Example: A3-6 3. Asset disposals and restructuring Asset disposal means disposal of a (usually non-current) asset by abandonment or sale. Abandoned asset: No longer used in company operations but there are no plans to sell. Amortization stops, asset is written down to lower of net realizable value (fair value less costs to sell) and carrying value. Asset remains classified as non-current. Planned disposal of assets by sale Individual assets Current assets: Written down to lower of NRV and carrying value and left as current asset Non-current assets: Once removed from use, amortization ceases. Asset written down to lower of NRV and carrying value. If right conditions are met, asset is classified as heldfor-sale and reclassified as current asset. Conditions for held-for-sale classification 1. Asset available for immediate sale in present condition 2. Asset sale is highly probable – – – – Price asked for asset is reasonable Active program to find buyer has started Management committed to selling asset Unlikely that offer to sell will be withdrawn or terms significantly changed – Sale expected to take place within one year of reclassification as held-for-sale Recording non-current asset as held-for-sale 1. Asset is remeasured at lower of NRV and current carrying value; any loss determined as result of remeasurement is recognized 2. Asset is reclassified as held-for-sale if all of the criteria are met Amortization ceases. Accumulated depreciation is eliminated. Recording non-current asset as held-for-sale Example: A3-14 (c): Panych ceased to use a company-owned cargo plane on September 30. The plane cost $7,000,000 and now has a carrying value of $2,400,000. The company plans to find a buyer as quickly as possible, and has engaged a dealer to look for a buyer. The agent expects to find a buyer within the following six to eight months. The asking price is $2,000,000. The dealer will take a 3% commission on the sale. Prepare journal entries and show how the assets will be reported on balance sheet. 4. Discontinued operations A discontinued operation is an operating segment that contains a “cash generating unit” (group of assets that generates cash flows that are independent of cash flows from other assets or groups of assets) and has either been sold or is held-for-sale (same criteria as for assets). The segment is separable from the rest of the organization. Under IFRS, discontinued operations are only major organizational segments. Components of net income 1. Current operating performance concept Net income should contain only regular, recurring revenues and expenses. Unusual items should be presented on statement of retained earnings. 2. All-inclusive concept All gains and losses should be included in net income. What is “relevant” income? 1. Net income 2. Income from continuing operations 3. EBITDA (earnings before interest, tax, depreciation and amortization) 4. Pro forma earnings (includes EBITDA) 5. Core earnings (Standard & Poors) Bell Canada 2010 earnings release Earnings figure Net earnings for common Net earnings before investments, restructuring and other Operating income EBITDA* Free cash flow* Total ($ billion) $2.165 $2.159 $3.292 $7.188 $1.374 Why calculate a second earnings figure? “Because the numbers reached by applying GAAP are woefully inadequate when it comes to giving investors a good sense of a company’s prospects. Many institutional investors, most Wall Street analysts, and even many accountants say GAAP is irrelevant . . . The problem is that GAAP includes a lot of noncash charges and one-time expenses.” - Business Week, November 26, 2001 Components of net income IFRS approach: A modified all-inclusive concept Unusual items are included in income, but discontinued operations are presented separately on the income statement in order to highlight income from continuing operations. This enhances the predictive power of the I/S. Items that affect shareholders’ equity – where do they go? Income statement: revenues, expenses, most gains and losses Statement of changes in equity: effects of changes in accounting policy, error corrections, effects of some capital transactions Other comprehensive income: unrealized gains and losses on held-for-sale assets, translation of statements of some foreign subsidiaries, some hedging instruments Discontinued operations and the financial statements Income statement • Net profit or loss from operating discontinued operation until date of disposal or year-end if disposal not complete by year end, net of income tax • Writedowns of asset carrying values to net realizable value, plus all realized gains and losses on disposal not previously recognized, net of income tax Discontinued operations and the financial statements Statement of financial position • Assets are reclassified as held-for-sale and reported as single current asset • Liabilities associated with segment are reclassified as single current liability Discontinued operations example On September 1, Hatchet Ltd. closed and decided to sell off its unprofitable Service Division. The division has non-current capital assets with a carrying value of $300 (cost = $500, accumulated depreciation = $200) and a fair value of $250. Selling costs are expected to be $10. Its current assets have a carrying value and fair value of $100. Hatchet’s tax rate is 40%. Prepare the journal entry required on Sept. 1. 5. Intraperiod tax allocation Income tax expense depends on all other income statement items. Inc. tax exp = Tax rate (R) X Inc before tax = (R X Revenue) – (R X Expenses) + . . . Guiding principle The income tax effect of major income statement items (continuing operations, discontinued operations) should be related to the specific item on the income statement. Example: Viger Ltd. Viger Ltd Income statement for the year ending Dec. 31, 2010 Revenue $400 Operating expenses 150 Loss on operation of discontinued op. 40 Gain on sale of investment 60 Income before tax 270 Income tax expense (40%) 108 Net income $162 Prepare an income statement that is consistent with IFRS. 6. Comprehensive income In 2006, Canadian firms had to start reporting comprehensive income, composed of (1) net income and (2) other comprehensive income (OCI). OCI includes unrealized gains and losses on certain types of transactions – available-forsale assets, translation of financial statements of a certain type of foreign subsidiaries, and cash flow hedges related to anticipated transactions. Other comprehensive income on the balance sheet OCI recognized each year accumulates in the “Cumulative other comprehensive income” account (a shareholders’ equity account) on the balance sheet. When the gains and losses included in OCI are realized, they are transferred from Cumulative OCI to Income statement gain and loss accounts. Example: A3-9 II. Statements of Financial Position (SFP) and Changes in Equity 1. 2. 3. 4. 5. Uses and limitations of the SFP SFP classifications SFP formats Statement of Changes in Equity Disclosure notes Remember the attendance sheet! 1. Uses and limitations Uses of SFP information • Compute rates of return (income vs. assets and owners’ equity) • Evaluate firm capital structure (debt vs. equity financing) • Assess liquidity (ability to meet obligations coming due) and financial flexibility (ability to alter cash flows to meet unexpected needs or take advantage of unexpected opportunities) 1. Uses and limitations (continued) SFP limitations • Historical cost basis of valuing many assets and liabilities • Use of estimates and accounting choices • SFP omits many items that are of financial value to the firm but cannot be measured reliably (e. g., human resources, internally generated goodwill) • Numbers are consolidated 2. SFP classifications Overriding principle: Provide sufficiently detailed information to permit users to assess future cash flows (amounts, timing and uncertainty) and the liquidity, financial flexibility, profitability and risk of the entity. Balance sheet items are sorted according to: • Type or expected function (assets) • Implications for financial flexibility • Liquidity characteristics 2. SFP classifications Assets are resources controlled by an enterprise as a result of past transactions or events from which future benefits may be obtained. • Current assets (cash, accounts receivable, inventories, prepaid expenses) • Investments (current and non-current) • Capital assets (PP&E plus intangibles) • Other assets (e. g., deferred charges) 2. SFP classifications While not required under IFRS, most Canadian companies distinguish between current and non-current assets and liabilities. Current assets are cash and other assets that are expected to be converted into cash, sold or consumed within one year or one operating cycle, whichever is longer. The operating cycle is the conversion of cash into inventory (through purchase and/or production), then into accounts receivable (through sale) and, finally, back into cash. Current assets (order of liquidity) Item Valuation Cash Market value Temporary investments Accounts receivable Market value Inventory Lower of cost and net realizable value Cost Prepaid expenses Realizable value 2. SFP classifications Liabilities are obligations of an enterprise arising from past transactions or events, the settlement of which may result in the transfer of assets, provision of services, or other yielding of economic benefits in the future. • Obligations related to operations (accounts payable, future income taxes) • Unearned revenue • Obligation from financing (loans, bonds) • Contingencies 2. SFP classifications Current liabilities are obligations that are reasonably expected to be settled through the use of current assets or the creation of other current liabilities (usually, liabilities due within one year) • Accounts payables • Accrued liabilities (e. g., wages payable) • Unearned revenue • Current portion of long-term liabilities Example: A4-11 4. Statement of changes in equity (SCE) Discloses the components of equity and the changes in each of those components during the reporting period. Typical components are: • Share capital • Additional paid-in capital/contributed surplus • Equity components of hybrid instruments • Retained earnings • Cumulative other comprehensive income • Non-controlling interest SCE Example The balances in Richmond Inc.’s shareholders equity accounts on December 31, 20x8 were as follows: Common shares Retained earnings Total $500 $250 $750 During 20x9, Richmond changed accounting methods to provide more relevant information to shareholders. The cumulative effect was to increase retained earnings by $60 as of Dec. 31, 20x8. Richmond issued common shares during 20x9 for $120. 20x9 net income was $35 and cash dividends of $40 were declared. 5. Disclosure notes 1. 2. 3. 4. 5. Compliance statement (GAAP used) Accounting policies New accounting standards not yet in effect Additional detail required by standards Major underlying assumptions and estimates 5. Additional disclosures 1. Contingencies: material events that have an uncertain outcome 2. Guarantees 3. Segment reporting 4. Related party transactions 5. Economic dependence 6. Unrecognized contractual commitments 7. Financial risk management objectives and policies 8. Subsequent events Subsequent events The or subsequent events period is the period between the date of the statement of financial position and the date of publication of the annual report. Subsequent events occur in time to have an impact on the previous year’s annual report, if necessary. Types of subsequent events 1. Adjusting events provide additional information about conditions existing at the balance sheet date, information that affects estimates used in preparing the financial statements. An adjustment is required. This is generally information that would have been in the financial statements were it available. Types of subsequent events 2. Non-adjusting events provide information about conditions that did not exist and do not require adjustment to the financial statements. This information will affect next year’s financial statements and should be disclosed. Examples include: • Fire or flood • Decline in value of investments • Issues of share capital or long-term debt Non-adjusting events that do not require disclosure • • • • • These are typically nonaccounting events or events that are generally communicated to users through other means. Examples include: Legislation Product changes Management changes Strikes Unionization Subsequent events exercise For each of the following subsequent events, should company (a) adjust financial statements; (b) disclose in note; (c) neither adjust nor disclose? 1. Settlement of tax case for amount in excess of amount estimated at year end 2. Introduction of new product line 3. Loss of assembly plant due to fire 4. Sale of significant portion of company assets 5. Retirement of company president 6. Prolonged employee strike 7. Loss of significant customer Subsequent events exercise Should company (a) adjust financial statements; (b) disclose in note; (c) neither adjust nor disclose? 8. Issuance of significant number of common shares 9. Material loss on year-end receivable because of a customer’s bankruptcy 10. Hiring of a new president 11. Settlement of a prior year’s litigation against the company 12. Merger with another company of comparable size