TUM: Strategic Management of Innovation

advertisement

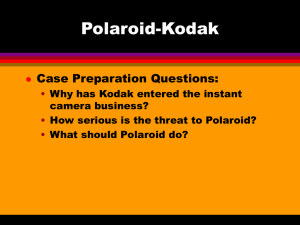

TUM: Strategic Management of Innovation Day 2: 9.00-16.00 Day 1 • Strategy as Internal and External perspective – Innovation as (creation of) knowledge platform fits better the Internal, Learning Perpsetive – Path dependency, Asset Legacy • Review of Watch Industry, GM and Seafax to highlight the dilemma of old vs new Strategy and Innovation • Part I, Day 2 – Kodak, Polaroid – Industry, Sector Evolution and Inertia • Part II, Day 2 – Core Rigidities and Competencies – Firm Inertia • Gunfire at Sea • Part III, Day 2 – Ab und Aufbauen or Reinventing the Firm’s strategy Inertia as a Industry-wide Innovation Challenge • • • • Market, Industry Value Chain Ecology …what is firm competitive arena performance/cost Technological Substitution Digital 35MM time From 35MM to Digital Cameras 35MM with FILM Digital with FLASH CARD Paradigm • 35MM • Digital Key Players, Value Chain • Players: – Kodak, Canon, Minolta, Fuji, Agfa-Gevaert, Sony, Zeiss Ikon, Polaroid (bankrupt in 2002), Casio • Value Chain: – (1) Housing, (2)Shutter mechanism, (3) Optics, (4) Flash and Power source, (5) Development, (6) Printing, (7) Wholesale and (8) Retail Evolution in this “ecology” • • • • !: 80-85….2: 86-90….3: 91-95….. 4: 96-03 Photography Group Adjacent Groups (Computer HW and SW) Development Infrastructure Evolution of Photography 80-85 35MM Cameras And Early DI (Sony MAVICA No Substitution Paradigm and its Trajectory Very “Obvious” 86-90 PC Revolution Internet and Email limited to Universities Photo CD with CD Player 1. Complementary technologies And 2. Firms with NE Strategies, hugging Aging Paradigms 91-95 ‘Counter’ Innovations 96-2003 Polaroid Bankrupt APS Price-adjusted Quality full Match Convergence In Full Swing Digital sales Exceeds Conventional Sales Paradigm • 35MM : – Complements are development, paper – 50Mn plus pixels – Limited duplication, transmission – Analog – Hard, Real – Key Players Kodak, Agfa, Fuji, also Canon – Companion Paradigms: Film and film reels, Movie Production, Projection • Digital: – Complements are PC, WWW, Email – Number of pixels growing – Duplication – Digital – Soft, Virtual – Key Players Canon, Sony, Minolta, and perhaps Kodak – Companion Paradigms: Editing, Visual arts, Movie Production Key photography elements of product/service/delivery Relative Value Digital Price Resolution Features Immediate Image Viewing Sharing Photographic Process – Digital vs. Film Paradigm Traditional Film Image Lifecycle Slide Album Camera Slides Image Taken Developing Film Consumer Re-purchase Cycle Prints Negatives Photo Album Frequent re-purchases Digital Image Lifecycle Ink . Memory Cards Digital Camera Specialty Batteries Printed on Home Printer Image Taken Image Transfer Software and Hardware Viewed on PC Photo Paper Printer Consumer Repurchase Cycle Professionally Printed On-line Stored on Home PC or CD-ROM Infrequent re-purchase CD-ROM Infrequent repurchase Imaging / Photography Value Chain Imaging Equipment • Canon • Nikon • Kodak • Olympus • Minolta • Polaroid Imaging Equipment • Sony • H-P Imaging Media Imaging Transfer • Kodak film • Fuji film • Agfa film • Kodak Chemicals Imaging Media Imaging Transfer • SanDisk • Sony • Intel • Toshiba • Microsoft Software • Adobe Software • Kodak Software • Dell Software • H-P Printers / Ink • Epson Printers / Ink • Lexmark Printers / Ink Imaging Storage • Kodak Paper • Fuji Paper Imaging Storage • Ofoto online • H-P paper • CVS.com • AH.com • CD-ROMs Imaging Display • Various Album Manufacturers Imaging Display • PC Manufacturers • Mobile Phones • Palm Pilots / PDAs Cameras • Old versus New Paradigm – “Razor Blade” – Polaroid Dead and Kodak out of the Dow (DJIA) – Movie Theaters and Hollywood next? – Film, Paper and Album replaced by Digital – …..and WWW and Email – What is Next ? Kodak Options – – – Majority of Kodak’s revenues come from sales of films not 35MM cameras, and digital cameras do not use any film. How difficult for Kodak to give up its cash cow product. The economics of traditional photography are much more attractive for 35MM producers than those of digital. A constraint on Kodak? Finally, given that Kodak supports a vast organization on the basis of film sales, and that digital won’t yield profits for some time to come, how will this 35MM competency will be supported in lieu of film sales. Patents, Strategic Alliances, Joint Ventures….. Links Among Companies in Photo Subgroup (Alliances) 40 30 PhotoCentrality 20 Centrality (mean) 10 0 1980 1985 1990 1995 2000 Kodak’s Response to Digital Disruption • Approached digital photography as a threat to its core business – Saw cannibalization of existing film-based business – Focused on current consumer behavior vs. emergent technologies (Paradigm Hugging) – Focused on traditional film competitors (e.g. Fuji) Kodak’s Response to Digital Disruption Before December 2001: –Kodak’s organization was organized by end-user market –The work of digital champions had to be divided among the various segments rather than as a unified strategy – Besides having the difficulty of charging one group with the responsibility to develop Kodak’s digital strategy, simple funding for R&D efforts would be divided among the existing segments –Given this structure, digital imaging was a threat to the established paradigm and its “owners” Kodak’s Prospects • Kodak is not the leader it once was; its core competencies in paper and film have become core rigidities • The photography market is likely to be much more fragmented • As we will see on June 13, we need a dedicated integrated business unit for new paradigm to overcome core rigidities From Industry Inertia to Firm Inertia • How do firms become trapped in their learning curve • Core competencies and core rigidities So far… lessons: 1. Death of “Dominant Design” – Firm versus its environment – Innovations – Inertia and Paradigm Huggers 2. Unlocking the Firm or Industry from “Old” Paradigm Photography Industry Strategy and Innovation • Part I, Day 2 – Kodak, Polaroid – Industry, Sector Evolution and Inertia • Part II, Day 2 – Core Rigidities and Competencies – Firm Inertia • Gunfire at Sea • Part III, Day 2 – Ab und Aufbauen or Reinventing the Firm’s strategy Overcoming Inertia • Gunfire at sea: firm-specific obstacles for shedding the old S curve • Steps towards a new paradigm Established firms and Innovation • Firms are locked into a dominant design • Its departments, career paths, customer base and suppliers share in the dominant design that has become the standard • Dilemma of being entrapped by tangible and intangible, mindsets and values, whose platform you need to move on. Core Competencies • Knowledge – human capital – social capital – technical systems • Managerial systems – knowledge creation and recycling • Culture (norms and values) Core Rigidities (as distinct from core competencies) • Competency Traps – NE Strategy – Disruptive Technology • Forgetting Difficulties – Old skills get in the way (Cobol vs C++) – Learning Mandarin while you speak already Cantonese • Competencies to create New Competencies – Dynamic capabilities Strategy and Innovation • Part I, Day 2 – Kodak, Polaroid – Industry, Sector Evolution and Inertia • Part II, Day 2 – Core Rigidities and Competencies – Firm Inertia • Gunfire at Sea • Part III, Day 2 – Ab und Aufbauen or Reinventing the Firm’s strategy U.S Navy and Continuous Firing Gunfire at Sea • What is meant by “They are holding the horses”? Why gunnery as case study? • What is that gunnery innovation? • What was Sims’ motivation? How did this motivation differ from Scott’s • Why did the Navy resist Sims’ efforts? Identify some core rigidities. • What remedies? What is here the Innovation • Old Paradigm – Close proximity – Poor hit rate – Risk of black eye • New Paradigm – Telescope mounted on sleeve such that it could move – Gear ratio – 3000% Improvement Gunfire at Sea:take-away • Innovation not due to R&D but creative use of existing technology • Continuous aim gunfire due to a chance event and a driven person who was maverick, prepared to break rules • Tyranny of past success entraps the organization (core rigidities) • Resistance to change is “society”-wide • Role of leadership in unlocking system Strategy and Innovation • Part I, Day 2 – Kodak, Polaroid – Industry, Sector Evolution and Inertia • Part II, Day 2 – Core Rigidities and Competencies – Firm Inertia • Gunfire at Sea • Part III, Day 2 – Ab und Aufbauen or Reinventing the Firm’s strategy Basic “Templates of Organization Design • Templates, Structure, Governance, Form • Functional and Divisional Two Templates President President Sales Manufacturing Function R&D Project 1 Project 2 Business Project 3 Organization Structure • Functional (F-form) is attractive: – ease of supervision – maximum specialization in occupational skills • But, has drawbacks: – conflict prone – free ridership – performance responsibility difficult to define – do not produce general manager • Divisional (M-form) is attractive: – simplifies coordination – creates client responsiveness – accountability of performance – do-ers decide • But has also drawbacks: – duplication of effort – creates superficial skills – competition between business units Note Newer Types such as Matrix, Corrupted Divisional and Network Functional CEO Sales Service Finance Divisional CEO NewCars UsedCars Service “Corrupted” Divisional CEO Matrix CEO Service Sales NewCars Service Finance NewCars UsedCars Trucks UsedCars Trucks Network or Spaghetti CEO Network “Theory”: two schools of thought • Cohesion: – dyad – communication with the primary group and its “closest confidants”, attraction – social proximity due to physical proximity inducing similarity – Sherif, Schachter, Festinger: reduction of ambiguity; Lazarsfeld :voting • Structural Equivalence: – social system – competition and relative deprivation within a statusset with the “nearest rival” compare a “menage a trois,” the “laughing third” – physical proximity providing alters for whose evaluation affection etc. ego competes – similarity due to effort to eliminate relative deprivation – Burt: adoption to avoid embarrassment, to acquire legitimacy: Table 1: Examples of social capital among organizations Mediated by Individuals (Simplex) Interlocking directorates (Pennings, 1980) Guest engineers (Dyer, 1996) Social register (Useem and Karabel, 1986) Revolving door syndrome (Pennings, Lee and Witteloostuyn, 1998) Alumni (McKinsey) Double agent Gatekeeper (Tushman, 1978) Emissary Mediated by Systems(“Multiplex) Business groups (Acevedo, et al, 1990) Chaebol (Kim, 1997) Keiretzus (Gerlach, 1987) Investment bank syndicates (Chung, Singh, and Lee, 1995) Joint ventures R&D partnerships Guanxi-si-sen (Tsui, 1997) Electronic clearing house (Pennings and Harianto, 1992) Three Forms of Capital an MGI Post-script • Financial Capital ($$$$) • Human Capital (skills, training, experience, looks) • Social Capital (networks, channels, alliances) – all three contribute to performance and innovation A Communications Network 3 1 2 4 5 7 6 9 8 11 10 Why Worry about Networks? • Access to know-how, contacts, resources • Unique combinations of network benefits yield opportunity • Network ideas operate within and across organizations • Expand size of radar screen and make you detect technological discontinuities, emergent markets, new designs. Internal Circulation of Knowledge • • • • Job Rotation Boundary-Spanning Roles Information Technology(email, intranet) Social Networks External Circulation of Knowledge • Strategic alliances • Equity JVs, licensing, minority participation, R&D partnerships, etc. • Consortia You Network A’ Strategic Network Expansion You You Network B’ Network C’ The Social Structure of Competition Redundant contact A Non-redundant contact D YOU C Structural Holes Structural Holes Filled by “You” B Spider and its Net Osama Bin Laden and his network? Network of Countries linked by Footballers Movements Complete Network Smallness due to Hub: in this vast network we sense our own little world • • • • WWW The Internet Airline networks Mobile phone networks • Sexual-contact networks • Food web Smallness due to shortcut • Social networks – E.g.) A flight attendant for Air Canada played a key role in spreading AIDS among homosexuals who were locally isolated in several regions. • Neural networks Random shortcuts • Often, social contact is not constrained by physical distance. – E.g.) Spam mail, Viral marketing, Internet chat room, & Internet auction The Watts Strogatz Model No shortcuts Lots of Shortcuts Communication Technologies and Shortcuts No or few shortcuts Instant messaging Lots of shortcuts E-mail Chat room Cumulative distributions of market share difference by Entry Time Cumulative frequency 250 Entry time = 0 200 Entry time =10 150 Entry time = 20 Entry time = 30 100 Entry time = 40 50 Entry time = 50 Tippy market 0 -1.5 -1 -0.5 0 0.5 Market share difference 1 1.5 Strategic Implications for Innovation and Change • Networks with few or no shortcuts – An entrant with large resources can attempt to win the market by offering an incompatible paradigm – Change agents in a firm can seek to break away the firm form legacy Some other key concepts • Networking – Structural Holes – Network surrounding some individual, an entrepreneur like Bill Gates, Ellison, Karl Rove – Tipping Point Why Worry about Networks? • Access to know-how, contacts, resources, serendipity • Network ideas operate within and across organizations – BA&H – mcc • Expand size of radar screen Internal Circulation of Knowledge • • • • Job Rotation Boundary-Spanning Roles Information Technology(email, intranet) Social Networks External Circulation of Knowledge • Strategic alliances • Equity JVs, licensing, minority participation, R&D partnerships, etc. • Consortia Connecters make Links • What endows a a person, a firm with Social Capital? • How do we measure Social Capital? Networking • Person, Firm or Market • Tipping Point in market (craze, fad, herd, bandwagon) due to: – Connector> schmoozer, bundler – Maven> reservoir or pool of know how to be linked – Salesperson> motivator Joint ventures are beneficial, but some are more beneficial! Chemical Patents (chemical firms only) Firms with non-redundant joint ventures Firms with redundant joint ventures Networking, based on joint ventures Groups • What is the New Structure of Oticon? – Firm drop the Matrix Structure and Adopts a Spaghetti Structure – Do you like what you see? – Why would that “noodle structure” fail? Internal Newtorks • Oticon and Foss Functional CEO Sales Service Finance Divisional CEO NewCars UsedCars Service “Corrupted” Divisional CEO Matrix CEO Service Sales NewCars Service Finance NewCars UsedCars Trucks UsedCars Trucks Network or “Spaghetti” CEO Firm A Firm B 3 Management 4 6 R&D 5 6 1 Creativity Marketing 5 Production 5 2 Innovations Other departments 3 Management 3 4 6 Management R&D 5 6 1 Creativity 4 6 Marketing 5 Production 5 2 Innovations Other departments R&D 5 6 1 Creativity Marketing 5 Production 5 2 Innovations Other departments 3 Management 4 6 R&D 5 1 6 Creativity Marketing 5 Production 5 2 Innovations Other departments Internal or External Hybrid Oticon • Manufacturer of hearing aids • Paradigm shift from behind-the-ear to inthe-ear (innovation with a 1 cm travel) • Oticon’s miniaturization competencies were becoming obsolete, locked in a trap. Discussion Questions READ: Oticon • Oticon Strategy involves a 1 cm journey (moving from Out to In-the- Ear hearing aids) by crafting the spaghetti design: what is that new organization? • Do you like what Kollind, the CEO accomplished? • Would the spaghetti design work for EPCD? • Why do you think did Oticon abandon the spaghetti structure in 1998 and move back to a matrix design? Spaghetti Structure at Oticon (1) • What idea behind this structure? • Where would this structure work well? • Where would this structure not work well? – Firms with strong cost control needs – Large Firms – Firms whose employees do not share strategic vision Oticon (2): Spaghetti as Structure JV with Firm B Subcontractors Project Teams with Cross Functional Backgrounds Oticon Story • Spaghetti structure has “structural ambiguity” – Knowledge-centers connected by links in nonhierarchical way – Jobs fit the persons – Free market forces – New building, no walls – Paperweight (only two layers), flat project organization – Multi-job (multi projects and skills) with knowledge transfer – Delegation of “rights” to make decisions Oticon Story • Balance chaos of skill mixing and coherence of projects: – Project organization – New ICT system (“hypertext”) – Physical walls, fixed workplace eliminated – Corporate values of responsibility and freedom • Produced effects – Old ideas returned, new ideas emerged Other Elements of Oticon’s (6) New Design • Tasks – Anything goes • Informal Arrangements – Culture (creed, wheeled furniture), chaos – Networks, job banks – P&P Oversight, PA • People – Computer illiterates – Paradigm huggers and loose canons Oticon (7) : Organizational Change and Results * * Dk is approximately €.11 Demant Hldgs (Oticon Owner) Oticon Story(Post Mortem2): contrasting ways to produce innovation and profits • Market versus Hierarchy (or Firm) • Capitalism vs Socialism • Transaction versus Coordination Costs • Haggling, (bargaining) versus Shirking and Free Ridership • Hierarchy: dilemma of delegation: too much or too little empowerment Oticon Story (PostMortem3) • Co-location of knowledge with decision and income “rights” • Transparency • Major AGENCY problem: – Decision rights (begin, ratify implement or track projects) and “P&P” (Project and Product”) Committee – Get all the elements to fit at same time – Return to Matrix structure in 1998 Oticon Story (PostMortem4) • Failure of Spaghetti structure: – Mis-Allocation of competencies – Get rid of promotion ladders – Get rid of special skills – Coordination problems – Knowledge hoarding – Politicking • Impossibility of selective intervention by boss Functional CEO Divisional CEO “Corrupted” Divisional CEO Matrix CEO S 1986 Oticon 1998 Network or “Spaghetti” CEO Oticon Story(final 1) • Co-location of knowledge with decision and income “rights” • Transparency • Major AGENCY problem: – Decision rights (begin, ratify implement or track projects) and “P&P” (Project and Product”) Committee – Get all the elements to fit at same time – Challenge of hierarchy dilemma – Return to Matrix structure in 1998 Oticon Story(final 2) • Failure of Spaghetti structure: – Allocation of competencies – Get rid of promotion ladders – Get rid of special skills – Coordination problems – Knowledge hoarding – Politicking • Impossibility of selective intervention by boss Selective Intervention and Internal Hybrids: Interpreting and Learning from the Rise and Decline of the Oticon Spaghetti Organization Nicolai J. Foss External Hybrids & Internal Hybrids • Market exchanges infused with elements of hierarchical control • Relative Benefits: – Fewer incentive problems • Hierarchical forms infused with elements of market control • Relative Benefits: – Fewer layoffs needed The Oticon Spaghetti Organization • Internal Hybrid introduced to allow radical changes • Only 2 layers left in hierarchy – Managerial team – Projects • Decision rights widely allocated (or so it seems!) – Any individual can start a project and work on as many projects as he/she wants (at least 3!) The Oticon Spaghetti Organization (cont’d) • New high powered incentives introduced (Stock ownership plan) • Lead to increase in innovatiness new products introduced product development time 50% reduced • Still, the S.O was abandoned after a few years. Why??? Where did the designers of the S.O. fail? • Oticon only recognized the benefits of this internal hybrid! Costs of Markets Costs of Hierarchy Total Costs Market Hierarchy Spaghetti O. Matrix O. JV Potential problems with the S.O. • Allocating competence • Elimination of tournaments • Sacrificing specialization advantages • Coordination • Knowledge sharing • Leadership => All of these may have contributed to the failure, but not likely to be the main cause Real Problem • Selective intervention: – Managerial meddling with delegated rights – Managers can overrule « selectively » the decision to start a project => loss of motivation – Present in all hierarchies but especially in very flat organizations How could this have been avoided? – Credible commitment to non-interference (by being rationally ignorant or making it harmful to themselves to intervene) Discussion points (cont’d) • Wasn’t a spin-off a viable option? • Was the success caused by the implementation of the S.O. or by the « shake-up » it caused? • Was the S.O. a failure? • Why wasn’t the design adapted instead of abandoned? • Can this ever work? • Is selective intervention the real reason for failure? What about the other problems mentioned? Discussion points (cont’d) • Couldn’t selective intervention be avoided by putting a different system in place to initiate or ratificate a project? • What alternatives were there to get out of the competence trap the organization was in? Wrap Up • Firms want to introduce “market” like conditions within the firm (e.g., incentive compensation, and project autonomy) to stir up the innovation pot • Firms often reach out to other firms to combine their assets with those of others for innovation(e.g. joint venture, outsourcing) yet maintain managerial oversight Oticon Postscript and Move into Day 3 • Spaghetti Structure failed • Matrix was re-instated • Other possible hybrids? – Internal :Matrix, or Parallel Structures – External JV – Ambidexterity: the paradox of overcoming inertia and joining the new thing TUM Strategic Management of Innovation: Day 3 • Ambidexterity • Three Examples of Internal Structure, Strategy and Innovation: – Ely Lilly: Matrix – 3M: Intrapreneurs as strategy makers – Hermes Systems: Create New Departments • Do you like Hermes Entrepreneurial Subsidiaries: – Before the buy-out – After the buy-out • Booz Allen – How to dismantle old structure, cretae new networks, to implement innovations • Prepare in Groups for Day 4 Second Day • • Industry and Firm Inertia: Kodak, US Navy Organization Design and Innovation: Ambidexterity, Foresight and Hindsight, Oticon