Datalex 2011 Results, press release – 30 March 2012

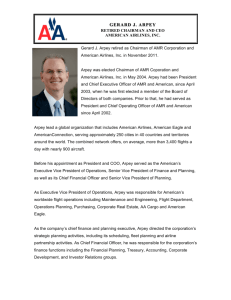

advertisement

Datalex plc announces results for the year ended 31 December 2011 Dublin, Ireland 30 March, 2012 We are pleased to report on our performance for the year ended 31 December 2011, a year in which we have built on the progress made in 2010, by delivering 42% EBITDA growth, before exceptional items, to $4.3m (2010: $3.1m) and growth in cash reserves to $12.5m (2010: $11.1m). 2011 Highlights Some of the key highlights from 2011 include: 42% EBITDA growth, before exceptional items. Increase in total cash reserves of $1.4m (2010 increase: $0.6m) TDP goes live at Air China, and with global airline IT provider SITA. A number of significant new contract wins, including new contracts with Delta Airlines and United Airlines, the world’s two largest carriers, and Westjet, Canada’s number two carrier. Winner of World Travel Awards for the third consecutive year, including the award for ‘The World’s Leading Travel Merchandising Solution Provider’. Conclusion of the Flight Centre litigation. Financial Performance A summary of our 2011 financial performance is set out below: Year ended 31 December 2011 2010 Change $M $M % Total Revenue 28.0 26.8 +4% Transaction revenue included in total revenue 13.2 13.0 +2% Total cost of sales, selling & marketing costs and administrative expenses 29.1 28.5 +2% Total cost of sales, selling & marketing costs and administrative expenses before impact of product development 27.7 26.6 +4% Loss before tax – before exceptional items (1.4) (2.1) -33% EBITDA before exceptional items 4.3 3.1 +42% Cash and cash equivalents 12.5 11.1 +13% Exceptional Items 2.5 0 n/a Net Loss after exceptional items 3.9 2.1 n/a EBITDA after exceptional items 1.8 3.1 n/a 2011 Review Our expectations for 2011 were that we would deliver significant growth in our EBITDA and cash reserves whilst continuing to expand our customer base. The results for the year are in line with these expectations. Total revenue in 2011 was US$28.0m (2010: US$26.8m), and transaction revenue 1 in the period was US$13.2m (2010: US$13.0m). 2012 will see a significant increase in transaction revenue as we see the full year impact of revenue from customers who went live during 2011, together with revenue from new customer wins in 2011 that will go live during 2012. Our total operating costs before product development and deferred project costs were $27.7m (2010: US$26.6m). With the projected increases in transaction revenue and customer numbers in 2012, it is anticipated that our operating leverage will improve in 2012, as our product strategy delivers bottom line benefits. Our loss for the year of $3.9m (2010: $2.1m) is after exceptional items of $2.5m. This is made up of two elements; $2.1m as a result of the partial write off of receivables and some unrecovered expenditure relating to the conclusion of the Flight Centre litigation, and a $0.4m provision against our receivable from Spanair, which ceased trading on 27 January 2012 last. Our EBITDA before exceptional items was $4.3m, a 42% increase on the previous year, and we have grown our total cash reserves in 2011 to US$12.5m (2010: $11.1m). 2011 Business Development In 2011 we brought a number of important new customers live on our platform: Air China, which ranks among the world’s largest carriers, went live in July. Global airline IT services provider SITA went live in April to enable merchandising pricing and shopping for its customer airlines across the globe. Air Malta went live in September. We also secured eight new contracts in 2011, including: Delta Airlines, the world’s largest carrier, which selected TDP to deliver their merchandising strategy across all channels, serving over 160m passengers. A new contract with United Airlines, who will use TDP for their Mileage Plus loyalty system, the largest loyalty and redemption platform in the world. We have also reached a further agreement with global airline IT services provider SITA, which will see them use TDP as the full ecommerce solution for their airline customers. The full list of our new contracts signed in 2011 is as follows: Name Country Delta Airlines USA United Airlines USA SITA USA Westjet Airlines Canada Garuda Indonesia Malaysian Airlines Malaysia TCH Germany Air Pacific Fiji 2 Outlook for 2012 The economic challenges of the last number of years have required airlines to fundamentally redefine and simplify their businesses. Airlines are recognising that their business is not simply transport but retail, and their customers are travellers, not passengers. Airlines continue to develop merchandizing and retail strategies to maximize the revenue opportunity. It is this retail challenge that our product – more than any other - is designed to enable. The growing list of market-leading airlines recognising that TDP delivers unrivalled retail capabilities is a testament to our product and our people. While challenges still remain, as evidenced by the cessation of operations by Spanair in January 2012, our new business pipeline remains strong and we are confident that our business will continue on a solid growth trajectory and deliver further significant growth in EBITDA, cash generation and Enterprise Value through 2012. Our 2011 Datalex Annual Report is included in the attached PDF and is also available at; http://www.datalex.com/wp-content/uploads/2012/03/Datalex Annual Report 2011.pdf For more information, contact: Analyst/Investor Enquiries: Press Enquiries: David Kennedy Ornagh Hoban Chief Financial Officer VP of Marketing and Strategy +353 1 806 3500 +353 1 806 3574 david.kennedy@datalex.com ornagh.hoban@datalex.com About Datalex Datalex is a leading provider of travel distribution software and solutions which enable global travel industry suppliers and distributors deliver increased content and choice to their customers across multiple sales channels, while enabling significant reductions in distribution costs. Datalex’s customers represent the elite of the travel industry and include Air China, United Airlines, Delta Airlines, Frontier Airlines, Aer Lingus, STA Travel, South African Airways, and Copa Airlines. Founded in 1985, the company is headquartered in Dublin, Ireland, and maintains offices across Europe, the USA and AsiaPacific. Datalex is a publicly held company traded on the Irish Stock Exchange (symbol: DLE). For more information, please visit the company’s web site at www.datalex.com This press release contains certain forward-looking statements. Actual results may differ materially from those projected or implied in such forward-looking statements. Such forward-looking information involves risks and uncertainties that could significantly affect expected results. 3