office of the accountant-general capacity building for local government

advertisement

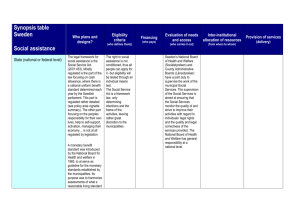

OFFICE OF THE ACCOUNTANT-GENERAL CAPACITY BUILDING FOR LOCAL GOVERNMENT Presenter: TV Pillay | Chief Director , National Treasury 1 | 17 August 2010 Capacity Building: Government and role players University – Curriculum design versus the LG workplace needs, is it still relevant? LGSETA – Can they structure MOU’s with Departments to assist in mobilising the required resources for skills training? PALAMA – Can they play a role in fast tracking skills training in the LG arena? DBSA – Can they assist with their development mandate? National Treasury – FM - Regulate, Coordinate, Review, Guide, Support and monitor? DCoG – Their role in Governance and Oversight training? SALGA – Support for Councillor development programmes? Consultants - Are they delivering on their contracts? 22 LG CAPACITY BUILDING UNDERTAKEN BY THE NATIONAL TREASURY National Treasury is responsible for training, supporting and monitoring the reforms framework under LG finance; Municipal Finance Management Internship Programme; Budget and Treasury Office (BTO) survey; Minimum Competency Regulations, Gazette 29967 of 15 June 2007; Awareness raising on MFMA reforms; Building capacity of the Provincial Treasury (PT) MFMA, and Provincial Accountant-General units to assist municipalities; Siyenza Manje programme - allocation of financial expertise; CFO forums; NT/PT MFMA coordinators quarterly meetings; Financial Management Grant (FMG) allocations - published in DORA. 33 MUNICIPAL FINANCE MANAGEMENT INTERNSHIP PROGRAMME (MFMIP) This graduate internship programme was introduced in 2004 to build in-house capacity of Budget & Treasury Offices (BTO) within Municipalities; A 2-year structured programme affording training opportunities to previously unemployed graduates with Accounting, Economics, Finance of Auditing qualifications; MFMIP focuses on all areas of support, e.g. mentoring, training and work rotation and is financed from municipality budgeted funds and supplemented by the FMG; There are 1181 interns in the 283 municipalities as at 31 July 2010; the target is 1500 by March 2011. (30 to 40 percent of the allocation is in support of the interns training and stipends); We encourage municipalities to retain or, if unable, to refer interns to neighbouring municipalities for permanent appointments after the training period; This is a flagship effort worth replicating in other sectors, e.g. water and sanitation, public works, etc. 44 MUNICIPAL FINANCE MANAGEMENT INTERNSHIP PROGRAMME (MFMIP) AS AT 31 JULY 2010 Province Number of municipalities Captured on Intern Database Eastern Cape 45 159 Free State 25 144 Gauteng 14 50 KwaZulu-Natal 61 271 Limpopo 30 161 Mpumalanga 21 79 North West 25 73 Northern Cape 32 121 Western Cape 30 123 283 1181 Total 55 BUDGET AND TREASURY OFFICE (BTO) SURVEY NT/PT undertook BTO survey in all municipalities; The purpose of the survey was to evaluate the establishment of the unit in accordance with the MFMA; Understand financial management capacity constraints and requirements per Municipality; Upon analysis, we recommended support areas and measures for improvement; The following key areas, amongst other, were surveyed: o Delegations within the key positions; o Qualifications of officials; o Experience of officials; o Number of officials within the BTO; o Financial performance information from the key responsibility areas; A limited sample of 30 senior officials were surveyed in the 17 large municipalities due to the large number of officials within a given BTO unit; Report used to provide feedback to municipalities on gaps, recommendations and follow up in progress. 66 Findings of the BTO survey Delegations of financial management responsibilities is still very weak in most municipalities, thus creating unnecessary bottlenecks; Key skills shortages in Financial Accounting, Auditing , Risk Management and SCM among others, is common within most municipalities; Financial performance information emerging from the responsibility areas still reflects a weak internal control structures; The metropolitan municipalities have the largest concentration of personnel with degrees or diplomas; The 17 large municipalities exhibit poor revenue management reflected in huge amounts outstanding from consumers; The use of consultants in the preparation of annual financial statements appears to be widespread across municipalities; There is a generally limited experience and financial management qualification base in most municipalities. 77 Findings of the BTO survey Continued The next high level analysis of the data is presented using the following municipal classifications: The 6 Metropolitan Municipalities are classified as Category A municipalities comprising of a large urban complex with population size exceeding one million and accounting for 56 percent of all municipal expenditure; The 21 B1 local municipalities are classified as having large budgets and consisting of major secondary cities; The 29 B2 local municipalities have a large town as their centre; The 111 B3 local municipalities have small towns, with relatively small population and a significant proportion of urban population but with no large town as a core; The 70 B4 municipalities are mainly rural with communal tenure and with at most, two small towns in their area; There are 46 C district municipalities of which 25 of those are not water service authorities and provide limited functions, whilst the other 21 are water service authorities. 88 ACADEMIC QUALIFICATIONS WITHIN THE BTO’S Municipal Category A - Metros Proportion of Disclaimers or Adverse Audit Opinions (2008/2009) Number of municipalities Total number of staff responses Total number of staff with no Diplomas or Degrees Total number of staff with Diplomas and Degrees 6 NIL 191 21 170 B1 – Secondary Cities 21 33% 1790 1140 650 B2 – Local Municipalities 29 34% 1249 821 428 B3 – Local Municipalities 111 44% 2370 1653 717 B4 - Local Municipalities 70 68% 1016 413 603 C – Districts 46 20% 950 439 511 7566 4487 3079 Total 283 99 MINIMUM COMPETENCY REGULATIONS, GAZETTE 29967 OF 15 JUNE 2007 The minimum competency levels were introduced to support a sustained, uniform and consistent implementation of the MFMA reforms; The regulations affect the following positions at a municipality: o Accounting officer; o CFO and CEOs for municipal entities; o Senior Managers; o Heads of SCM and other middle management officials; The competency levels cover the required minimum: o Work-related experience; o Higher education requirements; o Performance management competencies as prescribed through the CoGTA performance regulations; o Financial and SCM competency levels. The above is consistent with the work undertaken in the competency evaluation of other divisions within municipalities by DCoG. 1010 MINIMUM COMPETENCY REGULATIONS … CONTINUED The Regulations were issued with the supporting implementation guidelines for the affected positions; Deriving out of the regulations was the need to develop an appropriate training programme, Municipal Finance Management Programme (MFMP) in conjunction and registered with LGSETA to facilitate ease of compliance progressively; All training material and assessment instruments have been designed to ensure consistent and uniform interpretation of the reforms; Up to 40 regionally based training providers. PALAMA and DBSA’s Vulindlela Academy received training status to deliver against the prescribed programme and received free training material; Further training on basic accounting skills are presented by SAICA’s (AAT) Accounting Association Technician programme; 600 learners have completed the AAT programme to date. The following training opportunities are currently running or planned for rollout: 300 learners for WC; 250 for FS; 212 for EC; 100 for NC and 138 for NW; 200 for MP; 366 of KZN; and 195 for LP A high level summary of participation on the MFMP supporting the implementation of the above Regulations follows. 1111 MUNICIPAL FINANCE MANAGEMENT PROGRAMME Learning Programmes SAQA Unit Standard IDs (NQF level 5) and NQF level 6 Strategic management; Budgeting implementation and Performance management 116358; 116342; (116345); 116364; 116363; 116341 Municipal accounting and Risk management Registered 09/10 Registered 10/11 Total Learners 2265 1221 3486 (119350); (119348); 116346; 116362; 116339; 116357; 116351 879 498 1377 Governance and Legislation 116348; 116343; 116344;116361; (119334) 788 565 1353 Cost and capital planning 116347; 116340; (119331); (119341) 22 14 36 Municipal IT support and Project management (119351); (119352); (119343); 116360 303 255 558 SCM and PPP 116353; 119353 652 375 4909 2928 Total Learners 1027 1212 7837 INFORMAL TRAINING Informal training – basic FM reforms, awareness raising, and technical questions answered, examples provided to delegates which emphasize MFMA reforms, such as: o Budgeting o SCM o GRAP standards o Reporting o Auditing o Oversight o Etc. Reforms are developed with support from provincial treasury units, local government departments and municipal officials; The following slide presents a high level summary of 2 areas of informal training support provided. 1313 INFORMAL TRAINING CONTINUED… Province Eastern Cape Municipal Budget and Reporting Regulations 2009/2010 Generally Recognised Accounting Practice (GRAP) statements 2009/2010 Total 180 128 308 97 137 234 Gauteng 206 77 283 Kwa-Zulu Natal 422 197 619 Limpopo 143 113 256 Mpumalanga 26 139 165 North West 99 72 171 Northern Cape 74 115 189 Western Cape 126 102 228 1 373 1080 2453 Free State Total 1414 BUILDING CAPACITY OF THE PROVINCIAL TREASURY (PT) MFMA UNITS The Budget Council and the Technical Committee on Finance have approved support for all Provincial Treasury MFMA units to build capacity; This action will assist in ensuring that municipalities receive continuous, efficient support and monitoring in all areas of MFMA reforms; Regular PT visits are undertaken by National Treasury, especially to provinces that experience challenges in implementing the MFMA; Future plans also include the placement of experts in the 9 provinces to assist all municipalities in making Financial Management improvements. 1515 CFO AND PT MFMA COORDINATORS FORUMS NT makes presentation on key issues covering FM in the CFO forums countrywide; The quarterly MFMA provincial treasury coordinators meetings also serve as a platform of review and update on the progress of MFMA implementation and reforms relating to: o Compliance; o Support; o Monitoring; o Development of guides and circulars; o Feedback on training; o Coordinating joint efforts of provinces. 1616 FINANCIAL MANAGEMENT GRANT (FMG) CONDITIONS Appointment of a minimum of five (5) interns; Appointment of a qualified CFO; Establishment of Supply Chain Management and Internal Audit units; Ongoing review, revision and submission of MFMA Implementation plans to NT; Improvement of the financial and reporting systems; implementation of the MFMA reforms; Acquisition of financial management system that can produce multi-year budgets, inyear reports, SDBIP, annual reports and automation of financial management practices; Compliance with the MFMA Competency levels; Preparation and submission of annual financial statements for audits and implement changes required to address findings; Preparation of a financial recovery plan and implementation where applicable. 1717 FMG OUTCOMES STATEMENTS Improved capacity in financial management of municipalities; Progressive improvement in the quality of reporting for municipalities; Appropriately skilled financial management officers appointed in municipalities consistent with competency regulations; Municipalities have processes and producers in place to provide quality reports and are publishing financial information on a regular basis; Continuous improvement in audit outcomes; Improved revenue, expenditure, asset and liability management; Improved overall compliance with implementing the MFMA. 1818 2 FMG OUTPUTS AS STATED IN DORA Improved and sustained skills development including the appointment of at least five interns supporting the implementation of financial management reforms in municipalities focusing on the gaps identified in MFMA Implementation plans; Upgrading of IT systems to deliver reports required for financial management improvement and improve quality of data; Preparation and implementation of multi-year budgets meeting uniform norms and standards; Assist in the implementation of supply chain reforms, producing quality and timely financial statements; Assist in the preparation and implementation of financial recovery plans; Progressive improvements in audit outcomes; Improvements to internal and external reporting on budgets, finance, Service Delivery and Budget Implementation Plan (SDBIP), in-year and annual reports; Implementation of the MFMA. 1919 1 FMG ALLOCATIONS PUBLISHED IN DORA PROVINCE 2009/2010 Actual Expenditure 30 June 2010 for 2009/10 allocations Amount Percentage 2010/2011 2011/2012 Eastern Cape R 54 250 000 R 44 688 000 82.37% R 62 800 000 R 66 300 000 Free State R 26 500 000 R 23 839 000 89.96% R 33 939 000 R 33 750 000 Gauteng R 14 750 000 R 12 750 000 86.44% R 19 250 000 R 19 000 000 Kwa Zulu Natal R 67 490 000 R 56 349 000 83.49% R 78 900 000 R 86 141 000 Limpopo R 31 500 000 R 27 693 000 87.91% R 37 750 000 R 38 750 000 Mpumalanga R 22 750 000 R 18 947 000 83.28% R 27 000 000 R 26 250 000 Northern Cape R 30 000 000 R 26 833 000 80.97% R 41 200 000 R 45 200 000 North West R 22 750 000 R 18 240 000 89.44% R 27 500 000 R 31 500 000 Western Cape R 30 000 000 R 27 237 000 90.79% R 36 250 000 R 37 750 000 R 299 990 000 R 256 756 000 86.00% R 364 589 000 R 384 641 000 TOTAL 2020 FMG 2010/11 ALLOC. WITHHELD (1) MUNICIPALITIES 2009/10 Actual Expenditure 30 June 2010 Amount Ukhahlamba (EC) Mkhondo (MP) Nkangala (MP) 2010/11 Reasons for Withholding % R750 000 R382 000 50.93 R 1 000 000 Slow Expenditure: Awaiting cash flow projection (CFO contacted and promised information) R1 000 000 R368 000 36.80 R1 000 000 Slow Expenditure: Awaiting cash flow projection (Prov. Treasury visited munic.) R750 000 R58 000 7.73 R1 000 000 Slow Expenditure: Awaiting cash flow projection (CFO working on the matter) 2121 FMG 2010/11 ALLOC. WITHHELD (2) Actual Expenditure as at 30 June 2010 MUNICIPALITIES 2009/10 Amount 2010/11 % Reasons for Withholding Bushbuckridge (MP) R750 000 R71 000 9.47 R1 000 000 Slow Expenditure: Awaiting cash flow projection ((Prov. Treasury visited munic.) Dikgatlong (NC) R750 000 R388 000 51.73 R1 200 000 Outstanding Reports: Still awaiting response from Muni (CFO suspended, acting persons) Molopo (NW) R1 000 000 R662 000 66.20 R1 250 000 Slow Expenditure: Awaiting cash flow projection ((Prov. Treasury visited munic.) uMdoni (KZN) R1 500 000 R1 148 000 76.53 R1 200 000 Slow Expenditure: Awaiting cash flow projection (CFO requested information) 2222 FMG 2010/11 ALLOCATIONS Transfer of FMG allocations to 242 municipalities undertaken in July 2010: comply with DORA requirements; targeted spending levels were at 80% or higher; Per payment schedule. Transfers to 34 municipalities, who responded late to missing information will be made before 30 August 2010; Remaining 7 non-complying municipalities receive constant correspondence, telephone calls, emails, requesting missing information or cash-flow projects, and commitments; Monitoring of progress, regular follow-ups, etc very time consuming. 2323 Conclusion National Treasury will continues to support municipalities in building the required capacity through: o o o o o o o o The expansion of the Internship programme, bringing onboard new graduates, assisting in the placement of current interns etc; Liaising with LG stakeholders (SAICA, Universities, SETAs, DCoG etc) to strengthen the capacity of all role players within the sector; Support the efforts of other departments in the discharge of the responsibilities under LG sector, as it relates to FM; Strengthen, support and monitor the reform agenda required as per the MFMA; Monitoring the competency of official through the issued regulations; Training of officials on preparation of AFS; Provincial Accountant General forums; Cluster approach in engagements with munic by introducing multi-disciplinary teams. 2424 Conclusion CONTINUED… o o o o o o o o Develop and finalise the FMCMM specific for municipalities over the medium term; Development of a delegations framework for municipalities; Revenue enhancement project; Improvements in content, quality and frequency of reporting to municipal councils and closer monitoring of resolutions taken by municipalities; Direct visits and writing to municipalities on key issues requiring attention; Recommendations to legislatures to implement and adopt joint sittings to evaluate municipal progress; Strengthening the municipal committee structure; Separation of political from administrative appointments. 2525