minimax regret analysis

advertisement

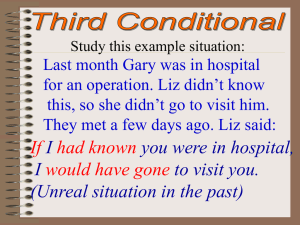

PLANNING UNDER UNCERTAINTY REGRET THEORY MINIMAX REGRET ANALYSIS Motivating Example Traditional way Maximize Average…select A Optimistic decision maker s1 High s2 Medium s3 Low Average A 19 14 -3 10 B 16 7 4 9 C 20 8 -4 8 D 10 6 5 7 Max 20(C) 14(A) 5(D) 10(A) MaxiMax … select C 20 Pessimistic decision maker C $ Million MaxiMin … select D A 15 10 5 B D 0 1 -5 s 1 2 s2 3 s3 MINIMAX REGRET ANALYSIS Regret s Pr ofit from Pr ofit from Best Alternative s Chosen Alternative s If chosen decision is the best Zero regret Nothing is better than the best No negetive Regret MINIMAX REGRET ANALYSIS Motivating Example Calculate regret: find maximum regret A … regret = 8 @ low market C … regret = 9 @ low market s1 High s2 Medium s3 Low Maximum Regret A 1 0 8 8 B 4 7 1 7 C 0 6 9 9 D 10 8 0 10 D … regret = 10 @ high market 10 8 In general, gives conservative decision but not pessimistic. $ Million B … regret = 7 @ medium market MINIMAX B D B 6 C 4 2 A 0 s11 s22 s33 MINIMAX REGRET ANALYSIS Two-Stage Stochastic Programming Using Regret Theory Two-Stage Model Optimal Profit Here & Now (HN) Uncertainty Free Optimal Profit Wait & See (WS) MINIMAX REGRET ANALYSIS Two-Stage Stochastic Programming Using Regret Theory Minimize MR x MaxWSs - HN s x sS|x where: WS s Max qsT ys c T x x, ys subject to: Ax b , x 0 ys 0 Ts x Wy s hs HN s ( x) Max qsT ys c T x ys | x subject to: Ax b , x 0 ys 0 Ts x Wy s hs s s s1 High s2 Medium s3 Low Average A 19 14 -3 10 B 16 7 4 9 C 20 8 -4 8 D 10 6 5 7 Max 20(C) 14(A) 5(D) 10(A) MINIMAX REGRET ANALYSIS Two-Stage Stochastic Programming Using Regret Theory Minimize MR x MaxWSs - HN s x sS|x where: WS s Max qsT ys c T x s1 High s2 Medium s3 Low Average A 19 14 -3 10 ys 0 B 16 7 4 9 Ts x Wy s hs C 20 8 -4 8 D 10 6 5 7 Max 20(C) 14(A) 5(D) 10(A) x, ys subject to: Ax b , x 0 HN s ( x) Max ys | x qsT ys c x subject to: Ax b , x 0 ys 0 Ts x Wy s hs T s s MINIMAX REGRET ANALYSIS Two-Stage Stochastic Programming Using Regret Theory Minimize MR x MaxWSs - HN s x sS|x where: WS s Max qsT ys c T x x, ys subject to: Ax b , x 0 ys 0 Ts x Wy s hs HN s ( x) Max qsT ys c T x ys | x subject to: Ax b , x 0 ys 0 Ts x Wy s hs s s s1 High s2 Medium s3 Low Maximum Regret A 1 0 8 8 B 4 7 1 7 C 0 6 9 9 D 10 8 0 10 MINIMAX REGRET ANALYSIS Two-Stage Stochastic Programming Using Regret Theory s1 d1 19.01 d2 11.15 d3 12.75 d4 5.41 d5 15.09 Max 19.01 s2 10.38 14.47 7.81 9.91 7.40 14.47 s3 10.57 8.87 16.02 12.63 8.81 16.02 NPV s4 15.48 20.54 22.25 32.02 12.48 32.02 s5 10.66 10.58 9.16 8.08 15.05 15.05 ENPV 13.22 13.12 13.60 13.61 11.77 13.61 Max Min 19.01 10.38 20.54 8.87 22.25 7.81 32.02 5.41 15.09 7.40 32.02 10.38 s1 d1 d2 d3 d4 d5 0.00 7.86 6.26 13.60 3.92 s2 4.09 0.00 6.66 4.56 7.07 Regret s3 s4 s5 5.45 16.54 4.39 7.15 11.48 4.47 0.00 9.77 5.89 3.39 0.00 6.97 7.21 19.54 0.00 Min 35 25 15 5 s1 s2 d1 s3 d2 d3 s4 d4 s5 d5 Max 16.54 11.48 9.77 13.60 19.54 9.77 MINIMAX REGRET ANALYSIS Limitations on Regret Theory It is not necessary that equal differences in profit would always correspond to equal amounts of regret: A small advantage in one scenario may lead to the loss of larger advantages in other scenarios. May select different preferences if one of the alternatives was excluded or a new alternative is added. $1000 - $1050 = 50 $100 - $150 = 50 s1 s2 s3 Max. Regret A 100 0 5 100 B 99 95 40 99 C 0 100 200 200 D 150 85 150 0 CONCLUSION Suggested improvements to minimax-regret criterion: Minimizing the average regret instead of minimizing the maximum. Minimizing the upper regret average instead of the maximum only. Measure relative regret instead of absolute regret: s1 s2 s3 Max. Regret Avrg. Regret Upper Regret A 100 0 5 100 35 52.5 B 99 95 40 99 78 97 C 0 100 200 200 100 150 85 78.3 117.5 D 150 0 150 150 100 1050 1000 33 % 4.8% versus 150 1050 instead of: 1050-1000 = 50 versus 150-100 = 50