12-2

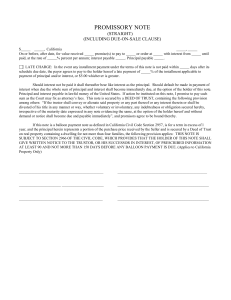

advertisement

Case 12-2 Mair v. Bank of Nova Scotia 徐月婷 常琳 张阳 王彤绯 胡武 李静 邓晓彬 0101163005 0101163017 0101163019 0101163023 0101163027 0101163030 0101163037 2013.12.23 • Background Information • Case Background Information 1. Promissory Note (本票) A written, dated, and signed two-party instrument containing an unconditional promise by a maker to pay a definite sum of money to payee on demand of specified future date. Background Information 2. Bills of Exchange, Draft(汇票) An unconditional order in writing, addressed by one person to another, signed by the person giving it, requiring the person to whom it is addressed to pay on demand, or at a fixed or determinable future time, a sum certain in money to or to the order of a specified person, or to bearer. 2 basic kinds Time bill Bill of exchange that is payable at a definite future time. Sight bill Bill of exchange that is payable at the time it is presented or at stated time after presentment. Background Information 3. Check/Cheque (支票) A bill of exchange drawn on a banker payable on demand. Differences among check, bills of exchange, promissory note (1) Unlike other bills of exchange, checks are always payable on demand. (2) The only difference between a promissory note and a bill of exchange is that the maker of a note promises to personally pay the payee rather than ordering a third party to do so. (3) Bills of exchange must be signed by the drawer, and promissory notes by their maker. Background Information 4. Endorsement (背书) The act of a payee, drawee, accommodation party, or holder of a negotiable instrument in signing the back of the instrument, with or without qualifying words, to transfer rights in the instrument to another. Background Information 5. Holder (持票人) & Holder in due course (正当持票人) Holder A person who has physical possession of a bill or note that was drawn, issued, or endorsed to him or her, or to his or her order, or to the bearer, or in blank 在结算中指持有票据(汇票、支票或本票)并有权要求按票据给定 的金额得到相应货币支付的任何人。一般来说,持票人可以是 票面上所记载的受款人、经前手特别背书后而取得票据权益的 受背书人、不记名汇票的持有人和经前手空白背书而取得票据 的受让人。 Background Information 5. Holder (持票人) & Holder in due course (正当持票人) Holder in due course Under common law (but not civil law), a person who acquires a bill or note for value, in good faith, and without notice that it is defective, overdue, or that any person has a claim to or defense against it 英美票据法对某一类持票人特定的名称。善意地花了对价(对价: 指当事人一方在获得某种利益时,必须给付对方相应的代价), 取得一张表面完整、合格的未到期票据的持票人。 票据的派生当事人具有以下特征:(1)所得票据表面完全正常; (2)没有过期;(3)没有发现该汇票曾被退票;(4)不知道前手的权 利有任何缺陷;(5)善意地取得汇票,支付了对价,从而对票据 拥有完全的权利。 Case—Facts An appeal from a decision dated June 18, 1980, in which judgment was given for the respondent bank in respect of a claim by the appellant alleging negligence and breach of duty in the sum of $6,000 and interest, together with costs. Parties Appellant: An architect Appellee: Bank of Nova Scotia Case—Facts 1974 The appellant engaged Barbara Hill to assist him in work. 1.16 A $6,000 check was dated and made payable to “Barbara Hill”. 1.23 The check was altered by the addition of the words “Associates” as payee, endorsed “Barbara Hill” and deposited at the branch of the respondent bank at Worthing, Christchurch, Barbados to the credit of “Barbara Hill Associates”. 1.29 The check was returned to the Antigua branch of the Bank of Nova Scotia and in due course the canceled check was forwarded to the appellant. 5.07 The appellant drew the bank’s attention to the alteration and demanded reimbursement. The bank refused to reimburse. Case—Issues Can the alteration be identified as a material alteration? Was the bank a holder in due course or not? Did the drawer have suffered any actual damages due to the alteration? Case—Law & Explanation Can the alteration be identified as a material alteration? YES. Section 64 of the Bills of Exchange Act(BEA) : In particular the following alterations are material, namely, any alteration of the date, the sum payable, the time of payment, the place of payment, and, where a bill has been accepted generally, the addition of a place of payment without the acceptor’s assent. 下列规定即为重要修改,如改日期、付款金额、付款时限及地点, 又如该票为普通承兑,未得承兑人同意而加上付款地点。 Case—Law & Explanation Was the bank a holder in due course or not? No, the bank is a holder. Section 64 of the Bills of Exchange Act(BEA) : Where a bill or acceptance is materially altered without the assent of all parties liable on the bill, the bill is avoided except as against a party who has himself made, authorized, or assented to the alteration, and subsequent endorses. Provided that, where a bill has been materially altered, but the alteration is not apparent and the bill is in the hands of a holder in due course, such holder may avail himself of the bill as if it had not been altered, and may enforce payment of it according to its original tenor. 汇票或承兑,未经各当事人之同意而经重要修改,除对其本人或曾经 授权或同意涂改之当事人及继后之背书人外,不能认为有效。但如涂 改并不显明,合法持有人得视为未经涂改,而要求按照该票原文支付。 Case—Law & Explanation Did the drawer have suffered any actual damages due to the alteration? No. The damage suffered was the debiting of the appellant’s account with a payment to someone other than the payee stated by the appellant, and there was no evidence to show the drawer had suffered any actual damages. Thank you