GST and Local Government

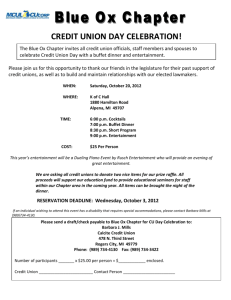

advertisement

Welcome FBT 2006 20 years on TAX-EXEMPT BODIES Recent developments Dual cabs – update of exempt vehicles – full list Apportioning entertainment between employees and non-employees – clarification Car benefits – effect of contribution by employee to purchase price Retention of electronic records – what satisfies the ATO? Meal Entertainment Fringe Benefit: 50/50 split method - reimbursement of employer’s expenditure by a third party Laptops - expense payment made earlier in the FBT year 2 Recent Developments Remote area housing - non-arm’s length arrangements Remote area housing and water – how much is taxable? Employee contributions -can excess contributions be used in a later FBT year? New interest and penalties to be applied Employees in foreign service now subject to FBT ATO’s view on what constitutes a LAFHA – update 3 Recent Developments Personal credit card payments – exempt or not? When to use 365 days or 366 days in formulae – surprising ATO change Extended application of relocation concessions ANAO audit report on the administration of FBT Cancellation fees – FBT treatment The provision of food and drink in dining facilities – when exempt Employer contributions to social clubs and benefits provided by social clubs to members 4 Recent Developments Payments on dwelling after employee terminates employment Work related counselling – what can you provide as exempt benefit? Charitable institutions and charitable funds – FBT differences Laptop and loans – one benefit or two? Long service awards – exemption increased Exemption for work-related tools – more laptop accessories included 5 Recent Developments Remote area housing – more employers entitled to provide exemption FBT rebate eligibility - Commonwealth, State and Territory institutions – latest Entertainment – employees attending a function as a an employment duty Relocation exemption – does it include transporting a car? Employee discounts from third parties – sometimes taxable, sometimes not 6 WHAT IS A FRINGE BENEFIT A ‘payment’ to an employee, but in a different form to salary or wages. Employer, associate, third party Employee, associate in respect of employment. right, privilege, service or facility. former or future employee. by another person on behalf of the employer. to another person on behalf of the employee 7 Steps in calculating FBT liability Step 1Work out the individual fringe benefits amount for type 1 benefits for each employee Step 2 Sum of all the individual fringe benefits amounts worked out in step one. Step 3 Identify the type 1excluded fringe benefits Step 4Add the totals from step 2 and step 3. This is known as the type 1 aggregate fringe benefits amount Step 5 Work out the individual fringe benefits amount for each employee not included above Step 6 Sum the individual fringe benefits amounts from 5 Step 7Add up the taxable value of those excluded fringe benefits not in 3 above Step 8 Add up the totals from step 6 and step 7. This is known as the type 2 aggregate fringe benefits amount Step 9 Gross up the type 1 aggregate fringe benefits and the type 2 aggregate fringe benefits and add them together. Step 10 Calculate the amount of tax payable as a percentage of the fringe benefits taxable amount 8 Rebatable employers Certain non-government, non-profit organisations that are eligible for a rebate of 48 per cent of the amount of FBT that would otherwise be payable. 0.48 x (gross tax - aggregate non-rebatable amount) x rebatable days in year / total days in year 9 Compliance issues Rate of tax 48.5%. Registration As soon as you begin providing fringe benefits.. Annual return 21 May Fringe benefits tax assessments Payment of FBT Instalments if previous year’s FBT liability exceeded $3 000. Record-keeping requirements 10 Reportable fringe benefits Grossed-up taxable value on payment summary benefits total taxable value exceeding $1 000. 'Reportable Fringe Benefits Amount RFBAs used in income tests for the following: superannuation surcharge termination payments surcharge Medicare levy surcharge deduction for non-employer sponsored superannuation contributions tax offset for personal superannuation contributions tax offset for contributions to spouse’s superannuation HECS repayments child-support obligations entitlement to Family Tax Benefits, Child Care Benefit and Youth Allowance administered by Centrelink and the Family Assistance Office. 11 Car fringe benefits 12 Definition motor cars, station wagons, panel vans and utilities all other goods-carrying vehicles with a designed carrying capacity of less than one tonne, and all other passenger-carrying vehicles with a designed carrying capacity of fewer than nine occupants. 13 Requirements for car benefit Car held by an employer Made available for the private use of an employee Taken to be made available for private use by an employee on any day that: it is actually used for private purposes by the employee, or the car is not at the employer's premises, and the employee is allowed to use it for private purposes. Garaged at an employee's home is available for the private use Private use of a motor vehicle that is not a car may give rise to a residual fringe benefit. 14 Home to work travel Generally private Exceptions : where the home constitutes a place of employment and travel is between two places of employment or business; where the taxpayer's employment can be construed as having commenced before or at the time of leaving home where the taxpayer transports bulky equipment necessary for employment; where the taxpayer's employment is inherently of an itinerant nature; and where the taxpayer is required to break his or her normal journey to perform employment duties 15 Itinerant Travel inherently itinerant; fundamental part of the employee's work; impractical to perform the duties without the use of a car; employee performs duties at more than one place of employment; the nature of the job makes travel in the performance of duties essential; and travelling in the performance of the employment duties from the time of leaving home. 16 Statutory formula method Taxable value = (A x B x C/D) -E A = the base value of the car B = the statutory percentage C= the number of days in the FBT year when the car was used or available for private use of employees D= the number of days in the FBT year E = the employee contribution 17 Annualised kilometres AxC/B A = the number of kilometres travelled in the period during the year when the car was owned or leased by the employer B = the number of days in that period C= the number of days in the FBT year 18 Operating cost method Taxable value = (A × B) - C A = the total operating costs B = the percentage of private use C= the employee contribution 19 Operating costs Actual costs and some deemed costs GST inclusive as appropriate. Deemed depreciation Apportioned Year acquired - cost of the car Subsequent year - depreciated value Depreciation cost limit Car purchased before 1 July 2002:22.5% Car purchased on or after 1 July 2002:18.75% Deemed interest Actual operating costs repairs maintenance fuel registration and insurance), and leasing costs. 20 Percentage of private use Difference between 100 and the percentage of business use. Keeping of log book records and odometer records 21 Exempt car fringe benefits taxi, panel van, utility, other commercial vehicle private use of such a vehicle is limited to: travel between home and work travel which is incidental to travel in the course of duties of employment, and non-work-related use that is minor, infrequent and irregular 22 Emergency vehicles ambulance, police or firefighting service exterior markings fitted with a flashing warning light and horn, bell or alarm 23 Record keeping Log book year Not a logbook year Replacement cars 24 Entertainment Introduction Entertainment Meal entertainment Categories of benefits Tax exempt body entertainment FB Income tax deductibility GST credits 25 Entertainment Introduction Exemptions Reduction in taxable value 50/50 split method 12 week register method Entertainment leasing facility expense Taxation ruling TR 97/17 26 Entertainment Categories of Benefits Property FB Expense payment FB Residual FB Meal entertainment FB Tax exempt body entertainment FB Board FB Airline transport FB 27 Entertainment Meaning Entertainment by way of Food Drink Recreation Accommodation and travel iro above Recreation includes Amusement Sport Similar leisure time pursuits 28 Entertainment Meaning Entertainment (32 -10 ITAA 97) The provision of property Entertainment at time of provision? Direct connection with entertainment? Example Bottled spirits, TV sets etc. Example Glasses of champagne, hot meals, holiday accommodation etc. 29 Entertainment Meal entertainment Distinction between “entertainment” and “meal entertainment” important Can elect to be a distinct category ~ ~ ~ 50/50 method of valuation 12 week register method of valuation If no election actual value of benefit Meal entertainment is excluded benefit 30 Entertainment Meal entertainment Definition of “meal entertainment” Entertainment bwo food or drink Accommodation or travel iro above Payment or reimbursement Irrespective of: ~ ~ ~ ~ Business discussions/ transactions Working overtime or performance of duties Promotion or advertising At or connection with seminar 31 Entertainment Meal entertainment Provision of food or drink not always entertainment must ‘entertain’ - two interpretations If not element of entertainment Category of benefit? No denial of income tax deduction Not tax exempt body entertainment FB Reportable FB? Ordinary meaning of ‘entertainment’ Agreeable occupation of mind Affording diversion or amusement Hospitable provision for wants of guest Narrow category of cases food or drink is not entertainment 32 Entertainment Meal entertainment When does provision of food and drink not entertain? TR 97/17 Distinction between entertainment and refreshment or sustenance - 4 x W test Why ~ What ~ Example 4 - Light lunches, morning teas or full meal? When ~ Example 3 - Social reasons or daily work reasons? Example 5 - During work, overtime, business travel or after hours? Where ~ Example 6 - At the office / usual place of work or elsewhere? 33 Entertainment Tax exempt body entertainment FB (TEBEFB) TEBEFB Provider incurs non deductible exempt entertainment expenditure Non-deductible entertainment expenditure not incurred for assessable income As result of Div 32 of ITAA TEBEFB or other benefit 34 Entertainment Tax exempt body entertainment FB (TEBEFB) Implications of TEBFBE No exempt property benefits (s 41) Limitation on minor exempt benefit (s 58P) Taxable value – extent of expenditure No reduction in value under otherwise deductible rule – (property FB, expense payment FB, residual FB, loan FB, airline transport FB) Still have choice of 50/50 or 12 week register for any meal entertainment 35 Entertainment Tax exempt body entertainment FB (TEBEFB) Income tax deductibility s 8 ITAA general deduction s 32 - 5 ITAA no deduction for entertainment Exceptions to s32 - 5 other than s 32 -20 Relevant income tax exceptions Food & drink to employees @ in-house dining facility ( no party, reception or like) ~ In-house dining facility On employer property Mainly for food & drink to employees Not open to public 36 Entertainment Tax exempt body entertainment FB (TEBEFB) Relevant income tax exceptions ctd. Food or drink to non-employees @ in-house dining facility ( no party, reception or like) Food or drink to employees working in dining facility (no party etc.) ~ Dining facility Canteen, dining room or like Café, restaurant or like On employer property 37 Entertainment Tax exempt body entertainment FB (TEBEFB) Relevant income tax exceptions ctd. Food or drink to employee under industrial instrument iro overtime ~ Industrial instrument Recreation facility mainly for employee ~ ~ Not for accommodation Not for dining or drinking unless Award or industrial agreement under Australian law Vending machine Assessable allowance to employee 38 Entertainment Tax exempt body entertainment FB (TEBEFB) Relevant income tax exceptions ctd. Food, drink, accommodation reasonably incidental to 4 hour or longer seminar, unless ~ Business meeting, other than ~ ~ Training General policy and management issues Main purpose to promote the business Main purpose to provide entertainment 4 hour seminar ~ ~ ~ Conference, convention, lecture, speech Q & A, training, education Ignore lunch and refreshment time, even if seminar continues through lunch 39 Entertainment Tax exempt body entertainment FB (TEBEFB) Relevant income tax exceptions ctd. Entertainment business Entertainment part of advertising business to general public Food or drink for overtime under industrial instrument Free entertainment to public who are sick, disabled, poor or otherwise disadvantaged 40 Entertainment Tax exempt body entertainment FB (TEBEFB) Exempt property benefit To current employee iro employment Consumed on working day At business premises of employer Would include provision of any food and drink other than for TEBEFB (eg food to employee at in-house dining facility which is tax deductible) 41 Entertainment Tax exempt body entertainment FB (TEBEFB) Exempt minor benefit (not TEBEFB) Less than $100 taxable value before gross-up Unreasonable to treat as fringe benefit ~ ~ ~ Infrequency and irregularity Taxable value of other minor benefits Difficulty in determining taxable value Stationary for private use, Christmas gifts (MT 2042) , could include food and drinks to non employees or entertainment other than food (ie not covered by property exemption) 42 Entertainment Tax exempt body entertainment FB (TEBEFB) Exempt minor benefit (TABEFB) Provision of entertainment to employee or ass ~ Incidental to provision of ent. to outsiders; and ~ Not a meal to employee or ass To recognise special achievement of employee Otherwise deductible rule does not apply Why? 43 Entertainment Tax exempt body entertainment FB (TEBEFB) Example Food and drinks to employees, spouses and others at social function Example Hot lunch to employees at canteen on premises Same to spouses 44 Entertainment Tax exempt body entertainment FB (TEBEFB) Example Employee reimbursed for meal and wine on business trip Also reimbursed for meal of spouse Example Employee sent to day seminar at which hot food and wine is provided The seminar is only 2 hours long 2 hour seminar and only snacks provided 45 Entertainment Meal entertainment election Can elect to treat provision of all meal entertainment … under 50/50 or 12 week register methods Applies to all meal entertainment Provided by employee ~ ~ Not associate Not by third party under arrangement Must be entertainment To exclusion of other categories No exemptions or reduction in taxable value 46 Entertainment 50/50 Taxable value = 50% of all meal entertainment expense Provided to employees Associates Others Example 11 Planning hint Does more than 50% of meal ent relate to staff? Does more than 50% of meal ent relate to others? 47 Entertainment 50/50 Entertainment facility leasing expense Leasing or hiring costs of ~ ~ ~ ~ Corporate boxes Boats Planes Other facilities for purpose of providing entertainment Not attributable to food and drink Not attributable to advertising that is deductible Can elect to use 50/50 valuation Example 12 48 Entertainment 12 week register Must elect the 12 week register method Must retain a valid register Taxable value Total meal entertainment expenditure x register percentage Register percentage ~ Total value meal entertainment FBs in 12 weeks Total value of meal entertainment in 12 weeks 49 Entertainment 12 week register Requirements of a valid register Kept for 12 weeks Valid for year 12 weeks end plus another 4 Register starts 1 year ends next, valid for next plus 4 If meal entertainment expense in year > 20% of first year, valid only for that year Two registers in 1 year, first invalid 12 week period must be representative of first FBT year 50 Entertainment 12 week register Information required in register Date meal provided If recipient is employee or associate Cost of meal entertainment Kind of meal provided Where meal provided If provided on employer’s premises, whether at in-house dining facility 51 Entertainment GST credits To extent for a creditable purpose No creditable acquisition if no income tax deduction for entertainment expenditure Credit to extent entertainment deductible Actual method 50/50 12 week register TEBEFB = not deductible for income tax other than 32-20, but may still be creditable as result of 32-20 52 Entertainment Comparison of valuations ~ ~ ~ Actual 50/50 12 week register 53 Other Categories Introduction Property Expense payment Residual Debt waiver Loan Car parking Board Remote housing Living away from home allowance 54 Other Categories Property Property provided for free or at discount Paid for my employer Property Tangible – goods including gas, electricity, animals and fish Intangible – includes real property, chose in action, but not contract of insurance or licence or lease over real property or tangible TV depends on In-house property FB External property FB 55 Other Categories Property Property provided for free or at discount Paid for my employer Property Tangible – goods including gas, electricity, animals and fish Intangible – includes real property, chose in action, but not ~ ~ contract of insurance licence or lease over real property or tangible TV depends on In-house property FB External property FB 56 Other Categories Property In-house property FB Only tangible property Provided by employer or ass ~ Provided by 3rd party ~ ~ Identical or similar to that ordinarily sold Acquired from employer or associate Identical or similar to that ordinarily sold y employer and 3rd party provider External property FB Any property FB that is not an in-house prop FB 57 Other Categories Property Taxable Value - In-house property FB Goods manufactured for retail sale ~ Goods manufactured for wholesale sale ~ 75% market value Goods purchased for sale in business ~ Lowest arm’s length selling price Goods manufactured, similar but not identical to those sold ( for example seconds) ~ 75% lowest price to public Arm’s length purchase price All other ~ 75% of market value 58 Other Categories Property Taxable Value – external property FB Provider is employer or ass and prop purchased at arm’s length ~ Provider not employer or associate but incurred the expense under arm’s length transaction ~ Cost price Amount of expenditure All other ~ Amount employee could reasonably be expected to pay 59 Other Categories Property Reduction in Taxable Value Amount of the employee’s contribution Amount that would be otherwise deductible ~ ~ ~ ~ ~ Had the employee purchased Only for one off deductions, not depreciable Can agree that contribution relates to non-deductible portion so as to reduce TV to nil Require employee declaration as to what is otherwise deductible Does not apply to associates In-house FB reduced by $500 Exempt property benefits Provided to employee for consumption at work on a working day Minor benefit 60 Other Categories Expense payment Discharge recipients obligation to 3rd party Reimburse recipients expenditure In-house expense payment FB Relates to good or services employer or associate sells to public External expense payment FB Everything other than in-house 61 Other Categories Expense payment Taxable value In-house ~ External ~ As per in-house property FB Amount of expenditure Exemptions “no-private use” declaration, only work expenses In respect of accommodation ~ ~ ~ Recipient living away from home Not travelling for work Recipient declaration 62 Other Categories Expense payment Exemptions continued ‘cents per kilometre’ motor vehicle ~ ~ ~ Not for holiday Not for relocation, employment interview, work medical etc Not to former employee Minor benefit Reduction in taxable value Recipient contribution To expense were otherwise deductible ~ ~ ~ Only if recipient is employee Once only deduction An employee declaration required $500 for in-house 63 Other Categories Residual Catch-all, not falling in other benefit categories Usually services In-house Provider is employer or associate Similar to that provided to public External Anything not in-house 64 Other Categories Residual Taxable value In-house ~ Identical benefits ~ No identical to public 75% of lowest arm’s length price to public 75% of lowest price employee expected to pay in arm’s length transaction External ~ Purchased by provider ~ Cost price Any other case Amount employee reasonably expected to pay in arm’s length transaction 65 Other Categories Residual Taxable value continued Motor vehicle other than car ~ ~ Calculated under operating cost or Cents/kilometre Reduction in taxable value Recipient contribution Otherwise deductible ~ ~ ~ Only employee One-off deduction Employee declaration $500 for in-house 66 Other Categories Debt waiver Employer forgives or waives an employees ~ Not if written of as genuine bad debt Taxable value ~ Amount of debt waived Include interest accrued No reduction in taxable value available 67 Other Categories Loan Employer makes loan to employee ~ ~ ~ Provided in respect of each year that an obligation to repay exists Benefit also arises if amount owed and payment not enforced Repayments not require before 6 months Accrued interest = separate loan Taxable value ~ Difference between actual interest and ‘notional amount of interest’ accrued at statutory rate Current statutory rate = 6.55% 68 Other Categories Loan Exempt loan ~ ~ On same terms and conditions as ordinary customer Advance for sole purpose of expenses in course of employment duties ~ Not exceed reasonable expense Employee to vouch for expense Expense incurred within 6 months of advance Advance to employee for rental bond or utilities Repaid in 12 months Employee in receipt of one of following: Expense payment iro accommodation Housing benefit Residual benefit iro accommodation 69 Other Categories Loan Reduction in taxable value ~ Otherwise deductible rule Recipient an employee Once-only deduction Interest rate less than statutory rate Employee declaration necessary 70 Other Categories Car parking Provided by employer for use of employee or ass. ~ ~ Car parked at premises owned, leased or controlled by provider Within 1 km radius = commercial parking station ~ ~ ~ ~ ~ Charging fee for all day parking In excess of car parking threshold (currently $5.96) Parked > 4 hrs between 7.00am and 7.00pm Car provided by employer or leased, owned or controlled by employee Provided iro employment Parked at or near primary place of employment Travel between work and home once a day 71 Other Categories Car parking Taxable value – 3 methods ~ ~ ~ Commercial parking station method Market value method Average cost method Commercial parking station method ~ ~ ~ ~ Lowest fee charged By commercial parking station Within 1 km radius Reduced by employees payment towards cost 72 Other Categories Car parking Commercial parking station method ctd. ~ Employer to keep records of actual number of benefits provided Number spaces available Number business days in year Method of valuation chosen Daily value of spaces Number of employees parked on premises each day Market value method ~ ~ ~ Valuation of space by valuer Reduced by employee payment Same record requirements as above 73 Other Categories Car parking Average cost method ~ ~ ~ Average of lowest fee for first and last day of FBT year Reduced by recipient payment Same record keeping requirements as above Number of benefits provided – 3 methods ~ ~ ~ Actual 12 week register Statutory formula 74 Other Categories Car parking 12 week register ~ ~ Parking FBs valued for 12 weeks Yearly value calculated $A x 52/12 x B/365 A = total TV over 12 weeks (any of 3 methods) B = number of days in period from first day provided to employee covered by election and ends on last day FBT year benefit proved to same employee 75 Other Categories Car parking Statutory formula ~ ~ ~ Assumes 228 FBs arise from each space in FBT year Reduced proportionately if number employees is less than number of car parks Value ~ $A x B/365 x 228 A and B = same as above Must make election Specify if covers all employees or Class of employees or Specific employees 76 Other Categories Car parking Exempt benefits ~ ~ ~ ~ ~ Not meet requirements for car parking FB Expense payments that are not car parking expense payment FBs Disabled employees Parking provided by various exempt employers Small business 77 Other Categories Car parking expense payment Reimbursement of parking expenses ~ ~ ~ Parking > 7 hours Between 7.00am and 7.pm No requirement regarding Availability of car parking Lowest fee charged 78 Other Categories Board Provision of meal to employee or ass. where also entitled to provision of accommodation and: ~ entitlement to 2 meals a day ~ ~ ~ ~ Under industrial award or Under employment arrangement ordinarily provided Supplied by employer Cooked or prepared on employers premises or worksite or place adjacent Meal supplied on employees premises Example meals in dining facility on remote construction site, oil rig or ship 79 Other Categories Board Taxable value ~ ~ $2 per meal per person $1 per meal if person under 12 Reduction ~ ~ Reduced by any recipient payment To extent otherwise deductible 80 Other Categories Remote housing Housing ~ Employee provided with accommodation ~ House, flat, hotel, motel, caravan, ship, etc Usual place of residence of employee Taxable value ~ ~ ~ Market value Reduced by recipient rent Employee of hotel etc. 75% market rental Reduced by recipient rent 81 Other Categories Remote housing Exempt ~ ~ Remote housing benefit Remote 40km from town with population 14,000 -130,000 100km from town with population > 130,000 Reduction in TV of related benefits ~ 50% reduction in TV of residential fuel to recipient of: ~ Exempt remote area housing benefit Remote area housing loan FB Remote area housing rent FB Remote housing loan Loan FB iro housing loan provided iro usual place of res Instead of remote housing would be exempt benefit 82 Other Categories Remote housing Reduction in TV of related benefits, ctd. ~ Remote area housing rent ~ Expense payment arises from rent iro usual residence Instead of remote housing would be exempt benefit 50% reduction in TV remote area housing assistance If provided as housing benefit would be exempt Housing assistance that is not housing benefit Reimbursement /payment of rent Making housing loan Reimbursement/payment interest on housing loan Provision of land or house and land Reimburse/payment cost of acquiring land/house Payment to employee iro granting to employer purchase option or payment iro purchase option 83 Other Categories Living away from home allowance Allowance paid to employee by employer for ~ ~ ~ ~ Additional expenses incurred Disadvantages suffered Because required to live away from home To perform employment duties Distinction between travel and living away from home Separately identified allowance in addition 84 Other Categories Living away from home allowance Taxable value ~ Allowance reduced by Reasonable cost of accommodation Reasonable compensation for increased food expense, equal to difference between Sum of $42 per adult in household and $21 for every child under 12; and Lesser of food component of allowance or maximum reasonable amount notified by commissioner 85 The End 86