Managerial Economics & Business

Strategy

Chapter 14

A Manager’s Guide

to Government in the

Marketplace

McGraw-Hill/Irwin

Copyright © 2010 by the McGraw-Hill Companies, Inc. All rights reserved.

Government Regulations

Government regulations affect most

decisions that consumers and firms make.

Legitimate reasons for government

intervention:

Market Power

Externalities

Public Goods

Asymmetric Information

14-2

Government Regulations

Government Policy and International Markets

– Quotas

– Tariffs

14-3

Market Power

Firm produces a level of output less than is

socially efficient and charges a price higher

than marginal cost.

Net gain to society if more output were

produced.

Government can intervene to increase

social welfare.

14-4

Market Power

Market power is the ability

of a firm to set P > MC.

Firms with market power

produce socially inefficient

output levels.

– Too little output

– Price exceeds MC

– Deadweight loss

P

Deadweight

Loss

MC

PM

PC

MC

• Dollar value of society’s

welfare loss

D

QM

QC

MR

Q

14-5

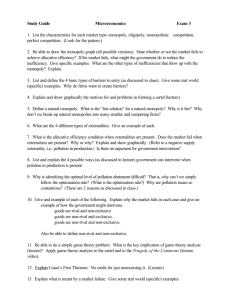

Antitrust Policies

Administered by the DOJ and FTC

Goals:

– To eliminate deadweight loss of monopoly and

promote social welfare.

– Make it illegal for managers to pursue strategies

that foster monopoly power.

14-6

Sherman Act (1890)

Sections 1 and 2 prohibits price-fixing,

market sharing and other collusive

practices designed to “monopolize, or

attempt to monopolize” a market.

14-7

United States v. Standard Oil of New Jersey

(1911)

Charged with attempting to fix prices of

petroleum products. Methods used to enhance

market power:

– Physical threats to shippers and other

producers.

– Setting up artificial companies.

– Espionage and bribing tactics.

– Engaging in restraint of trade.

– Attempting to monopolize the oil industry.

14-8

United States v. Standard Oil of New Jersey

(1911)

Result 1: Standard Oil dissolved into 33

subsidiaries.

Result 2: New Supreme Court Ruling the rule of

reason.

– Stipulates that not all trade restraints are

illegal, only those that are unreasonable are

prohibited.

Based on the Sherman Act and the rule of

reason, how do firms know a priori whether a

particular pricing strategy is illegal?

Clayton Act (1911) and Robinson-Patman (1936)

14-9

Clayton Act (1914)

Makes hidden kickbacks (brokerage fees)

and hidden rebates illegal.

Section 3 Prohibits exclusive dealing and

tying arrangements where the effect may

be to “substantially lessen competition.”

14-10

Cellar-Kefauver Act (1950)

Amends Section 7 of Clayton Act.

Strengthens merger and acquisition policies.

Horizontal Merger Guidelines

– Market Concentration

• Herfindahl-Hirschman Index: HHI = 10,000 S wi2

• Industries in which the HHI exceed 1800 are

generally deemed “highly concentrated”.

• The DOJ or FTC may, in this case, attempt to

block a merger if it would increase the HHI by

more than 100.

14-11

DOJ Flexibility

Mergers are often allowed even when HHI

is large provided there is likelihood of entry

of domestic or foreign firms, increased

efficiency, or a firm has financial problems.

14-12

Regulating Monopolies

When large economies of scale exist it

may be that one firm can more efficiently

service the market.

Government can sanction the monopoly

but will regulate prices to reduce

deadweight loss.

14-13

Regulating Monopolies:

Marginal-Cost Pricing

P

MC

PM

PC

Effective Demand

MR

QM

QC

Q

14-14

Problem 1 with Marginal-Cost

Pricing: Possibility of ATC > PC

P

MC

PM

ATC

PC

ATC

MR

QM

QC

Q

14-15

Price Regulation

If regulated price is set at too low a level

then the social cost of regulation is greater

then the social cost of allowing the firm to

price as a monopoly.

Next graph indicates this scenario.

14-16

Problem 2 with Marginal-Cost

Pricing: Requires Knowledge of

MC

P

Deadweight loss

after regulation

MC

PM

Deadweight loss

prior to regulation

PReg

Effective Demand

MR

QReg QM

Q*

Q

Shortage

14-17

Externalities

A negative externality is a cost borne by

people who neither produce nor consume

the good.

Example: Pollution

– Caused by the absence of well-defined

property rights.

Government regulations may induce the

socially efficient level of output by forcing

firms to internalize pollution costs

– The Clean Air Act of 1970.

14-18

Methods for Dealing with Negative

Externalities

Command and Control methods

Market based alternatives

– Pigouvian Tax

– Pollution Permit System (cap and trade)

– Coase

14-19

Socially Efficient Equilibrium:

Internal and External Costs

P

Socially efficient equilibrium

MC external + internal

PSE

MC internal

PC

MC external

Competitive

equilibrium

D

QSE QC

Q

14-20

Public Goods

A good that is non-rival and non-exclusionary

(excludable) in consumption.

– Non-rival: A good which when consumed by one

person does not preclude other people from also

consuming the good.

• Example: Radio signals, national defense

– Non-exclusionary (excludable): No one is

excluded from consuming the good once it is

provided.

• Clean air

• National defense

• Street lights

14-21

Public Goods

“Free Rider” Problem

– Individuals have little incentive to buy a public

good because of their non-rival & nonexclusionary nature.

– The market has no incentive to provide public

goods because of potential free riders.

– Government provides the public good from tax

monies collected from everyone.

14-22

Public Goods

Benefit-cost analysis is used to determine

whether and how much of a public good to

provide.

Costs are straightforward

Determining benefits poses a problem

14-23

Incomplete Information

Participants in a market that have

incomplete information about prices,

quality, technology, or risks may be

inefficient.

The Government serves as a provider of

information to combat the inefficiencies

caused by incomplete and/or asymmetric

information.

14-24

Government Policies Designed to Mitigate

Incomplete Information

OSHA – full info to workers

SEC – insider trading; 2009 crisis

Certification – minimum standards;

certified charities; schools

14-25

Government Policies Designed to Mitigate

Incomplete Information

Truth in lending –creating more symmetric

information between borrowers and

lenders

Truth in advertising – treble damages

under the Lanham and Clayton Acts

Contract enforcement – deterring

opportunistic behavior.

14-26

Rent Seeking

Government policies will generally benefit

some parties at the expense of others.

Lobbyists spend large sums of money in an

attempt to affect these policies.

This process is known as rent-seeking –

selfishly motivated efforts to influence

another party’s decision.

14-27

An Example:

Seeking Monopoly Rights

Firm’s monetary incentive to

P

lobby for monopoly rights: A

Consumers’ monetary incentive

to lobby against monopoly:

A+B.

PM

Firm’s incentive is smaller than

consumers’ incentives.

C

But, consumers’ incentives are P

spread among many different

individuals.

As a result, firms often succeed

in their lobbying efforts.

Consumer

Surplus

A = Monopoly Profits

B = Deadweight Loss

A

B

MC

D

MR

QM

QC

Q

14-28

Quotas and Tariffs

Quota

– Limit on the number of units of a product that a foreign

competitor can bring into the country.

• Reduces competition, thus resulting in higher prices, lower

consumer surplus, and higher profits for domestic firms.

Tariffs

– Lump sum tariff: a fixed fee paid by foreign firms to enter

the domestic market.

– Excise tariff: a per unit fee on each imported product.

• Causes a shift in the MC curve by the amount of the tariff

which in turn decreases the supply of all foreign firms.

14-29

Analysis of a Tariff on Cotton Shirts

P

free trade

CS = A + B + C

+D+E+F

PS = G

Total surplus = A + B

+C+D+E+F+G

tariff

CS = A + B

PS = C + G

Revenue = E

Total surplus = A + B

+C+E+G

Cotton

shirts

deadweight

loss = D + F

S

A

B

$30

$20

C

D

E

F

G

25

40

70 80

D

Q

14-30

Figure 7 The Effects of an Import Quota

Price

of Steel

Domestic

supply

Equilibrium

without trade

Domestic

supply

+

Import supply

Quota

Isolandian

price with

quota

Equilibrium

with quota

Price

World

without =

price

quota

0

Imports

with quota

Q

S

Q

S

Domestic

demand

Q

Imports

without quota

D

Q

D

World

price

Quantity

of Steel

14-31

Copyright © 2004 South-Western

Conclusion

Market power, externalities, public goods,

and incomplete information create a

potential role for government in the

marketplace.

Government’s presence creates rentseeking incentives, which may undermine

its ability to improve matters.

14-32