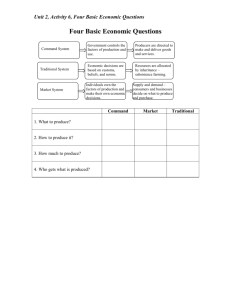

A Partial Equilibrium Model

advertisement

FORMS OF REGIONAL INTEGRATION Preferential tariff agreement Free trade area Customs union Single market Common market Monetary union Economic union Political union 1 ECONOMICS OF CUSTOMS UNION Jacob Viner’s theory 2 SIMPLE MODEL OF A CUSTOMS UNION Customs Union A group of countries among which trade takes place freely without being restricted by the barriers of tariffs (customs duties) or quotas (quantitative restrictions) on trade, and which adopts a common external tariff - all member countries impose the same tariffs on countries outside the customs union 3 SIMPLE MODEL OF A CUSTOMS UNION Elimination of tariffs on imports rofm member countries Adoption of a common external tariff on imports from the rest of the world Apportionment of customs revenue according to an agreed formula 4 SIMPLE MODEL OF A CUSTOMS UNION Assumptions: Pure competition in commodity and factor markets Factor mobility within countries but not between them No transportation costs Tariffs are the only form of trade restrictions Prices reflect the opportunity costs of production Trade is balanced Resources are fully employed 5 SIMPLE MODEL OF A CUSTOMS UNION Until the beginning of the 1950s it was commonly held that the customs unions and free trade areas were steps promoting free international trade, only after pioneering work of Jacob Viner was published in 1950 it was realised that customs unions might as well be seen as a step towards protectionism Jacob Viner (1892-1970) was Canadian economist, professor at Chicago University and Princeton University. Viner was an international trade theorist. His book The Customs Union Issue introduced the distinction between the trade-creating and the trade-diverting effects of customs unions. 6 SIMPLE MODEL OF A CUSTOMS UNION Any economic theory of regional product market integration has to address the question of economic justification of particular integration forms (the question whether an arrangement would be superior to the status quo and to participation in world-wide trade liberalisation) The contribution of Jacob Viner was an introduction of welfare consideration into the theory of international trade in general and particularly into the theory of customs unions. 7 Trade creation and trade diversion Ground-stones of Viner's theory of customs unions are concepts of trade diversion and trade creation effects of different arrangements of regional integration. Original Viners’ definition of these concepts was formulated in terms of trade flows: trade diversion switch in trade from less expensive to more expensive producers trade creation switch in trade from more expensive to less expensive producers 8 Trade creation and trade diversion We shall use a modified definition in terms of welfare changes: trade creation - welfare change due to the replacement of higher cost domestic production and/or higher cost imports by lower-cost imports trade diversion - welfare change due to the replacement of imports from a low cost source by imports from a higher cost source 9 Trade creation and trade diversion In terms of world allocation of resources: trade creation is beneficial to welfare, while trade diversion worsens allocation, a customs union is economically justified if it leads to a trade creation, while a customs union generating a trade diversion leads towards a deeper protectionism and decrease of efficiency. 10 A Partial Equilibrium Model Two countries: H (home country) P (potential partner country) W (world market) 11 A Partial Equilibrium Model SH(p): domestic supply function DH(p): domestic demand function for this commodity in the country H The supply by the partner country and the world market supply of the commodity is assumed to be perfectly elastic, hence the country H cannot influence the price 12 A Partial Equilibrium Model World price: pW The price in the partner country: pP The closed equilibrium price in the home country: pH Let pw < p P < pw + t < p H Then the country H will cover part of its domestic demand by import from the world market 13 A Partial Equilibrium Model Fig.1, Country H in a general tariff protection regime 14 A Partial Equilibrium Model Assume that country H is considering a possibility of customs union with the country P After the customs union is created, the trade inside the union will be tariff free, for the price pCU = pP less than the pW + t. The tariff t for the trade with rest of world is maintained. The effective supply for country H in the union will be SCU, while domestic supply will decrease to sCU and domestic demand will increase to dCU. Import will expand from dt - st to dCU - sCU. Facing this possibility, is it beneficial for country H to enter the customs union with country P? 15 p consumers' surplus in TP EH p H p +t W Sd(p) Et tariff revenues in TP Sw(pw+t) (a) p W producers' surplus in TP s t q H Dd(p) d t q Fig. 2, Welfare effect of tariff protection 16 p consumers' surplus in CU Sh(p) EH pH Et p +t W (a) p (b) CU (c) (d) no tariff revenues in CU ECU (e) p Sw(pw+t) Scu(pcu) W producers' surplus in CU sCU st qH dt dCU Fig. 3, Welfare effect of customs union for country H q 17 A Partial Equilibrium Model Before the union was created, the country H was importing from the world market for lower price than in the customs union with country P. But we can observe at the same time a reduction of the more expensive domestic production in favour of cheaper imports from partner's country and increase of domestic supply. 18 A Partial Equilibrium Model p consumers' surplus in CU Sh(p) EH pH Et p +t W (a) p (b) CU (c) (d) no tariff revenues in CU ECU (e) p Sw(pw+t) Scu(pcu) W producers' surplus in CU sCU st qH dt dCU q 19 A Partial Equilibrium Model The total welfare effect for the home country from creating the customs union with country P can be expressed as follows: (1) The decrease of the equilibrium price from pW + t to pCU = pP leads to an increase of consumers' surplus by the amount equal to regions denoted as (a), (b), (c) and (d) in the Fig. 3. (2) At the same time producers' surplus is decreasing by an amount equal to the area (a). (3) The government is losing tariff revenues equal to the regions (c) and (e). 20 A Partial Equilibrium Model Considering gains and losses we can see that areas (a) and (c) do not represent a gain, because they are compensated by losses (in producers' surplus and government tariff revenues), but only an internal redistribution of welfare between producers and consumers. Hence, the positive welfare effects of the customs union for the home country consists of areas (b) and (d). The trade creation effect was defined by Johnson as a sum of these two areas, reg (b) + reg (d). Negative welfare effect is given by the region (e), the loss of tariff revenues, used before for welfare redistribution. By Johnson this represents a trade diversion effect. 21 A Partial Equilibrium Model Defining trade diversion as a negative welfare effect and trade creation as a positive welfare effect, the net welfare effect given as w = reg(b) + reg(d) - reg(e) indicates, whether the trade creation or the trade diversion prevails in a particular case of the customs union. We can make no general statement about the positive or negative effects of customs unions. An empirical investigation of each particular case is necessary. 22 EXAMPLE One commodity market in country H with domestic demand and supply functions: S H (p) = - 50 + 50p D H (p) = 370 - 20p A potential partner country: P World price: pW = 4 Non-discriminative ad valorem tariff: t = 1 Price in partner country: pP = 4.5 23 EXAMPLE From - 50 + 50p = 370 - 20p we get closed equilibrium price * p = 420 =6 70 and closed equilibrium quantity q* = S H ( p* ) = D H ( p* ) = 250 24 EXAMPLE Case 1: Welfare of closed equilibrium Price of zero demand 370 - 20p = 0 p = 18.5 Price of zero supply - 50 + 50p = 0 p = 1 25 EXAMPLE Consumers’ surplus 1 CS = (18.5 - 6) 250 = 1562.5 2 Producers’ surplus 1 PS = (6 - 1) 250 = 625 2 Total welfare in closed equilibrium TW CE = CS + PS = 1562.5 + 625 = 2187.5 26 EXAMPLE Case 2: Tariff Protection Tariff protected market price pt = p w + t = 4 + 1= 5 Domestic demand D H ( p t ) = 370 - 20 * 5 = 270 Domestic supply S H ( pt ) = - 50 + 50 * 5 = 200 Imports D H ( p t ) - S H ( p t ) = 270 - 200 = 70 27 EXAMPLE Consumers’ surplus 1 CS = (18.5 - 5) 270 = 1822.5 2 Producers’ surplus 1 PS = (5 - 1) 200 = 400 2 Government tariff revenue TR = 70 * 1 = 70 28 EXAMPLE Total welfare under tariff protection: TW TP = CS + PS + TR = 1822.5 + 400 + 70 = 2292.5 Compared to closed equilibrium consumers are gaining, producers are losing, total welfare effect is positive. 29 EXAMPLE Case 3: Customs Union of H with P Customs Union market price p CU = p P = 4.5 Domestic demand D H ( p CU ) = 370 - 20 * 4.5 = 280 Domestic supply S H ( p CU ) = - 50 + 50 * 4.5 = 175 Imports D H ( p CU ) - S H ( p CU ) = 280 - 175 = 105 30 EXAMPLE Consumers’ surplus 1 CS = (18.5 - 4.5) 280 = 1960 2 Producers’ surplus 1 PS = (4.5 - 1) 175 = 306.25 2 Total welfare TW CU = CS + PS = 1960 + 306.25 = 2266.25 31 EXAMPLE Welfare effect of CU compared to tariff protection: WE CU = TW CU - TW TC = 2266.25 - 2292.5 = - 26.25 Conclusion: By Viner’s model of customs union, in this particular case tariff protection is for country H economically more beneficial than customs union. 32 Likelihood of gains and losses from customs union The larger is the economic area of the CU and the more numerous are the countries of which it is composed, the greater will be the scope for TC. It is likely that TC will be greater than TD if countries joining together in a CU are similar in the range of products they produce before the formation of the union. This is because TC occurs through the replacement of domestic production by more efficient production within the union. If future members produce essentially different goods, there will be little scope for such replacement and, hence, little trade creation. 33 Likelihood of gains and losses from customs union TC is more likely in the long-run, through dynamic gains. TC is more likely, the greater are the initial tariff rates among future partners. TC is more likely, the higher is the elasticity of demand for imports on which duties are removed. The gains from integration are likely to be greater, the greater is the ratio of intra-trade (trade with future partners) to total trade. 34