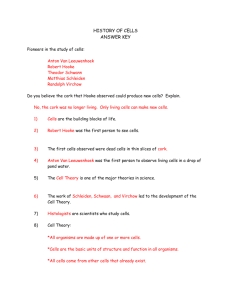

LecturePPTSample

advertisement

1- 1 Financial Management 1 Lecture 1: Introduction Anton Miglo Fall 2015 Financial Management, Anton Miglo © 1- 2 Organizational comments Blackboard: course outline, grades, announcements, PPT slides Assignments Business cases: Golden State Canning Investment game: Stock Track Excel practice and exercises Class participation Financial Management, Anton Miglo © 1- 3 Mini-case that will be used in this class You have been searching for a business with growth possibilities that you can own by yourself or with some partners, possibly members of your family. Recently, an old school classmate called to tell you that the family of a friend of hers was planning to sell a small canning and preserving business in northern California. The property consists of two small plants equipped for the canning of fruits and vegetables, located in a rural town near farms and orchards that supply the produce to be canned. The business, currently known as The Golden State Canning Company, Inc., has been managed by Richard Cota and owned by Mr. Cota and his wife. At age 58, Mr. Cota plans to retire and none of his children or their spouses wants to run the business. Though you have no experience with food processing, your friend suggests that you have a look at Golden State. She believes there are expansion possibilities, particularly in new product development and marketing. See Introduction Video from the website Financial Management, Anton Miglo © 1- 4 Investment game Financial Management, Anton Miglo © 1- 5 Some topics covered in the course Introduction Financial Markets and Introduction to Stock Track Game Introduction to Financial Analysis and Financial Ratios Investment Decisions Basics of Risk Portfolios and Diversification Cash Management and Working Capital Management Introduction to Cost of Capital and Capital Structure Introduction to Real Estate Investment and Finance International Aspects of Financial Management Financial Management, Anton Miglo © 1- 6 Lecture 1: Topics Covered Finance and other branches of business Money and finance Types of business organization Financial decisions and organizational chart Financial information versus accounting reports Introduction to Excel Additional readings: coursepack intro, video intro Financial Management, Anton Miglo © 1- 7 Finance and other branches of business Finance and Marketing Finance and Human Resources Management Finance and General Business Now a little more challenging…. Finance and Accounting Financial Management, Anton Miglo © 1- 8 Checkpoint For each of the following activities determine their type (accounting, finance or general management): Preparing budgets for future investment projects Preparing financial statements Making decisions about firm’s strategy Financial Management, Anton Miglo © 1- 9 Money and Finance Financial Management, Anton Miglo © 1- 10 Forms of Business Organization Sole proprietorship Ease of formation/ termination Owners liability Easy Unlimited Separate legal entity Degree of control Taxes Transfer of ownership Partnership Relatively Easy Usually unlimited No Complete Opportunities to raise capital Strong Financial Management, Anton Miglo Requires agreement of the partners Limited Complex Limited Yes Based on personal Income taxes Limited Corporation Separation of control and ownership Corporate Income Tax & tax on dividends Unlimited Large © 1- 11 Checkpoint Which form of business organization can be recommended for: A) An accounting firm with several senior specialists and a small group of support staff B) A house cleaning company with Mrs. Jones taking phone calls from customers on her pager and providing the most services and hiring friends for occasional help C) An aluminum company with sales of 250 million and 50,000 employees Financial Management, Anton Miglo © 1- 12 Organization Chart Board of Directors CEO GM Marketing Treasurer: raising capital banking relationship CFO GM Production Controller: Prepares financial statements and budgets, Internal accounting, taxes Financial Management, Anton Miglo © 1- 13 Financial Decisions Financing decisions (do not confuse with financial decisions): Capital structure choice Debt/equity ratio Long-term debt/short-term debt Capital budgeting (investment) decisions Projects’ choice To buy or to lease Assets’ choice Financial Management, Anton Miglo © 1- 14 Change in Google The shuffle also looked to have the markings of Ruth Porat, who joined Google as its chief financial officer in March from Morgan Stanley. In Google's recent quarterly conference call, Porat repeatedly emphasized keeping expenses under control. Porat will serve as the CFO of both Alphabet and Google. Page will serve as the CEO of the newly created holding company and Sundar Pichai, a long-time Google executive who most recently served as the company's senior vice president of products, will head Google. The company's current directors will become directors of Alphabet. Google co-founder Brin will become president of Alphabet, and Eric Schmidt will be executive chairman. Analysts said the move, which was mainly about transparency and accountability, could be followed by more structural changes in the future. "This may be step one of several steps," said Morningstar analyst Rick Summer. Financial Management, Anton Miglo © 1- 15 Checkpoint Are the following capital budgeting decisions or financing decisions? A) Sun Life issues new shares. B) RIM purchases a license to own and operate an NHL team. C) Encana decides to construct a pipeline to transport natural gas through the Rocky Mountains. Financial Management, Anton Miglo © 1- 16 The Balance Sheet (Accounting View) ASSETS LIAB&EQUITY Book Values!!!! Cash 5.2 Receivable s 70.5 Inventory 13.2 Short-term Investments 0 Fixed Assets 374.9 Intangible Assets 0 Total Assets 463.8 Financial Management, Anton Miglo Bank loans Ac. Payable Other accrued expenses = Long Term Bank Debt Capital Additional capital Retained earnings Liab&Shareholders’ Equity 50.7 17.4 5.2 70.0 320.5 0 0 463.8 © 1- 17 The Financial View of the Firm ASSETS LIAB&EQUITY Market Values!!!! Assets in place Growth Assets Total Assets Financial Management, Anton Miglo 463.8 0 463.8 Debt 143.3 Equity 320.5 Liab&Shareholders’ Equity 463.8 = © 1- 18 Checkpoint For shareholders the following information is usually more important: A) Market values of firm’s assets/liabilities B) Book values of firm’s assets/liabilities Financial Management, Anton Miglo © 1- 19 Income Statement Sales 842.0 Cost of Googs sold 735.5 EBITDA 106.5 Depreciation & Amortization 39.1 EBIT 67.4 Net interest expense 8.7 Income Before Taxes 58.7 Income Taxes 21.1 Net Income After Taxes 37.6 Cash Dividends 37.6 Retained earnings 0.00 Financial Management, Anton Miglo © 1- 20 Checkpoint Income statement is more like: A) A snapshot (a picture of firm’s assets and liabilities on a given date) B) A video (a history of firm’s earnings and expenses for a period of time) Financial Management, Anton Miglo © 1- 21 Financial Management: Current Issues Sales drop Revenues loss Dividend cuts?! Financial Management, Anton Miglo © 1- 22 Excel practice Introduction Creating simple formulas Financial Management, Anton Miglo © 1- 23 Try to put important variables in one place and use formulas instead of numbers 1 A Interest rate 2 Investment B C D E 10.50% 1000 3 4 5 Earnings Financial Management, Anton Miglo 105 C1*C2 © 1- 24 Avoid using blank columns to accommodate cell “spillovers” Financial Management, Anton Miglo © 1- 25 Do not forget to name your spreadsheets You can name sheets by clicking on the sheet tab. Financial Management, Anton Miglo © 1- 26 Simple formulas 1 A Interest rate 2 Investment B C D E 10.50% 1000 3 4 5 Earnings Financial Management, Anton Miglo 105 C1*C2 ©