Foundations of Strategy Chapter 3: Resources and Capabilities

advertisement

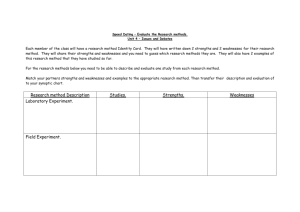

Foundations of Strategy Chapter 3: Resources and Capabilities Team 2: Mike Mullin Elizabeth Allen Joshua Zamarron Michael Johnson James Stariha Outline • • • • • • • Role of resources and capabilities in strategy formulation Identify the organization's resources Identify the organization’s capabilities Appraise resources and capabilities Put resources and capability analysis to work Develop resources and capabilities Approaches to capability development Hyundai Motor Company 2009: Hyundai/Kia overtook Ford 4th Largest car manufacturer by sales Doubled Net Profit and Increased sales by 11% from previous year Great example of capability development over a short period of time. Acquiring Key Capabilities Rapid International Expansion Develop Overseas Operations Recruiting talented individuals for market research and customer service Production plants in India, USA, Europe, and China Customized product offerings to different countries. 10-year/100,000 mile warranties Effects? Quality Awards Ranked above average in the well-recognized, annual quality study carried by J.D. Power and Associates Role of resources and capabilities in strategy formulation Shift to relationship b/t strategy and internal environment. (resources and capabilities of firm) Two main reasons for shift: Industry environments become more unstable Competitive advantage rather than industry attractiveness is the primary source of superior profitability Basing Strategy on Resources and Capabilities External Environment may be in a state of flux Resources and Capabilities may be much more stable to define firm’s identity. Ex: Honda Motor Company Not defined as either Motorcycle or Motor Vehicle Company. Expertise in developing/manufacturing engines Continued… “The greater the rate of change in a firm’s external environment, the more likely it is that internal resources and capabilities rather than external market focus will provide a secure foundation for long-term strategy.” Resources vs. Capabilities Resources- are the productive assets owned by the firm Capabilities- what the firm can do Remember: Individual resources do not confer competitive advantage alone, they must work together to create organizations capability. Tangible Resources Financial- cash securities, borrowing capacity Physical- plant equipment, land Both identified and valued in Financial Statements Primary goal is not to value company assets, but to understand potential for creating competitive advantage Intangible Resources More valuable than tangible resources Brand Names Technology Relationships Intellectual Property IBM (World’s biggest patent portfolio) Human Resources Expertise and Effort by employees Recruiting and Assessing potential employees Competency Modeling Identify skills, content knowledge, attitudes and values associated with superior performers within a particular job category, then assessing each employee against that profile Identifying the Organization’s Capabilities Organizational Capability – a firm’s capacity to deploy resources for a desired end result To perform a task, a team of resources must work together. i.e. a brain surgeon with a radiologist, anesthetist, nurses, etc. Distinctive Competence – those things that an organization does particularly well relative to its competitors Core Competences Make a disproportionate contribution to ultimate customer value, or to the efficiency with which that value is delivered; and Provide a basis for entering new markets. Ex) Product management over competence management (Prahalad and Hamel) RCA vs. Sony Case Insight 3.1 ~ Hyundai Motor Company Resources classified by type Tangible Resources 3 car production bases in Korea, 7 overseas manufacturing plants, & plans for additional plants in Russia (both established and emerging markets) Intangible Resources Brand name: now considered one of the top 100 most valuable brands Human Resources Recruits experienced senior staff, but cuts cost by producing overseas in less developed areas of its target regions to keep labor costs down Classifying Capabilities Functional Analysis – identifies organizational capabilities in relation to each of the principal functional areas of the firm Value Chain Analysis – separates the activities of the firm into a sequential chain Functional Analysis Functional Analysis Cont. Case Insight 3.2 ~ Hyundai’s Capabilities by function Corporate Functions International Management Financial Management Management Information A threshold capability Research & Development Product & Process improvements • Operations – Planning & Scheduling • Product Design – Global product development • Marketing – Threshold competence • Sales & Distributions – Packaging and customer service Value Chain Analysis Case Insight 3.3 ~ Porter’s value chain & the car industry Capability as Process & Routine Organizational Capability Requires efforts of various individuals to be integrated with one another and with capital equipment, technology and other resources. Organizational Process Coordinated actions undertaken by teams of people engaged in a series of productive tasks. The sequence of actions through which a specific task is performed is an organizational process. Routinisation An essential step in translating directions and operating practices into capabilities – only by becoming routine do processes become efficient and reliable. These organizational routines are viewed by evolutionary economists as fundamental building blocks of what firms are & what they do Hierarchy of Capabilities Capabilities are the outcome of processes and routines Likely to be broadly defined, but can be broken down into more specialized capabilities This creates a hierarchy of capabilities where more general, broadly defined capabilities are formed from the integration of more specialized capabilities Appraising Resources and Capabilities The profit earning potential of a resource or capability - The extent of the competitive advantage established Sustainability of the competitive advantage Appropriating the returns to competitive advantage Profit-Earning Potential Establishing Competitive Advantage Scarcity – Resources and capabilities within a given industry Relevance – A resource or capability must be relevant to the key success factors in the market Sustaining Competitive Advantage Durability – Some resources are more durable than others and therefore are a more secure basis for competitive advantage Transferability – Acquiring resources and capabilities form other companies Replicability – If a firm cannot buy a resource or capability, it must build it Appropriability Property Rights – Capabilities are depended heavily on employees skills and efforts Relative Bargaining Power – Division of returns between firms and individual members Embeddedness – How deeply rooted are the employees skills and knowledge tied to the company Putting Resource and Capability analysis to work How do we put these analysis into practice in the business world Broken down into 3-step approach 1. 2. 3. Identify the key resources and capabilities Appraising resources and capabilities Developing strategy implications Step 1: Identify the key resources and capabilities Construct a list of firms resources and capabilities (begin from inside or outside) From an external focus begin with key success factors What factors determine why some firms are more successful than others and on what resources and capabilities are these success factors based on Step 1: Hyundai’s example Start with key success factors in the world car industry (external) Low-cost production, attractively designed new models with latest technology, and the financial strength to weather the cyclicality and heavy investment requirements of the industry What resources and capabilities does this imply Manufacturing capabilities, new product development, effective supply chain management, global distribution, brand strength, scale efficient plants with up-to-date capital equipment, a strong balance sheet and so on… To organize and categorize these it is helpful to switch to the inside of Hyundai using either a functional approach(3.2) or the value chain approach (3.3) Step 2: Appraising resources and capabilities Need to be appraised against two key criteria 1. 2. Their importance, what is most important in conferring sustainable competitive advantage (Relative Importance) Where are our strengths and weaknesses as compared to our competitors (Relative Strength) Hyundai example Resources Importanc Hyundai’s Relative e Strength Comments Finance 6 6 Net profits are up despite general downturn in the car industry; rating about equal to industry average Technology 7 4 Not a leader in automotive technology Plant and Equipment 8 9 Invested heavily Location 4 5 Key low-cost growth markets but labor is rising Distribution 8 7 Experimented with new dealership arrangement, early stage very successful Assessing Importance Temptation is to concentrate on customer choice criteria However, we must remember that our ultimate goal is not to attract customers, but to make superior profit through establishing a sustainable competitive advantage Need to look beyond customer choice to the underlying strategic characteristics of resources and capabilities (2 criteria) What is needed to just play, vs. needed to win Step 2: Hyundai example assessing importance Many resources and capabilities are essential to compete in business, but are not scarce TQM and technologically advanced assembly plants have become widely diffused While IT and design capability are outsourced Needed to play While others like brand strength, global distribution network, fast-cycle new product development, and global logistics cannot be easily acquired or internally developed and are critical to establishing and sustaining advantage Needed to win Assessing Relative Strengths Objectively appraising comparative strengths and weaknesses is difficult Frequently fall victim to past glories, hopes for future, and own wishful thinking Business success often sows the seeds of its own destruction (U.S. steel giants) To identify and appraise capabilities must look inside and outside the company Internal: discussion can provide insights and evidence and build consensus regarding organization resource and capability profile Evidence of history can reveal instances where firm performed well and those where it performed poorly, do any patterns appear? Assessing Relative Strengths Benchmarking: a powerful tool for quantitative assessment of performance relative to that of competitors (external) Process of identifying, understanding and adapting outstanding practices from organizations anywhere to help improve our firms performance Offers a systematic framework and methodology for identifying particular functions and processes Assessing Relative Strengths Ultimately, appraising is not about data, its about insight and understanding Every organization has some activity where it excels FedEx: Guarantees next-day delivery BMW: World class engineering McDonalds: supply millions of hamburgers all over the world with remarkable uniformity All these companies are highly successful Were able to recognize what they can do well and have based their strategies on their strengths For poor-performing companies the problem is not necessarily the absence of distinctive capabilities, but the failure to recognize what they are and to deploy them effectively Bringing Together Importance and Relative Strength Combining the two criteria- importance and relative strength- allows us to highlight a firms key strengths and key weaknesses in a single display Dividing this display into four quadrants labeling each section appropriately Appraising resources and capabilities R e 10 l a t i v e 5 S t r e n g t 1 h 1 Superfluous Strengths Key Strengths Zone of irrelevance Key weaknesses 5 Strategic Importance 10 Hyundai Step 3: Developing Strategy Implications Key focus is on the two right hand quadrants How do we exploit are key strengths effectively? What do we do about our key weaknesses in terms of both upgrading them and reducing our vulnerability to them? what about our “inconsequential” strengths? Are they really superfluous, or are there ways in which we can deploy them to greater effect? Exploiting Key Strengths Key task is to formulate our strategy to ensure that these resources are deployed to the greatest effect Use key strengths and differentiate yourself from competitors To the extent that different companies within an industry have different capability profiles, this naturally implies differentiation of strategies within the industry Toyotas outstanding manufacturing capabilities vs. VW’s engineering excellence Managing Key Weaknesses What does a company do about its key weaknesses? Converting weaknesses into strengths is ultimate goal, but is likely a long-term task for most companies In short to medium term a company is likely to be stuck with the same resources and capabilities as before Most decisive and often most successful solution to weaknesses in key functions is to outsource Clever strategy formulation however may be able to negate the impact of a key weakness Hyundai case: company decided to offer a 10-year warranty on its cars to negate the negative perception of quality What About Superfluous Strengths A strength that does not appear to be an important source of competitive advantage Lower the level of investment in these activities and reinvest them in a key strength Possible to develop innovative strategies that turn apparently superfluous strengths into potential key strengths Capcom: started out manufacturing and distributing arcade game machines, soon realized it was their subsidiary skill in developing the game rather than the machines that offered the greatest potential Developing Resources and Capabilities Capabilities are not simply an outcome of resources upon which they are based. The Firms that demonstrate the most outstanding capabilities are not those with the greatest resource pools. Examples: 1) Honda vs. GM 2) Pixar vs. Walt Disney 3) Cisco vs. Alcatel-Lucent Path Dependency • Organizational capability is path dependent- A company’s capabilities today are the result of its history. We can trace the origins of a distinctive capability to circumstances during the founding or early development of the entity. Wal-Mart Inc supply chain logistics: Result of the need to create their own distributino system because of unreliable delivery in Arkansas and Oklahoma. Is it possible to develop new capabilities for future competition? Answer:Yes Two factors that contribute to efficiency and effectiveness: 1. Coordination is perfected through repetition 2. An understanding of culture and common values. Organizational capabilities rigid or dynamic? Core capabilities are rigid, meaning they inhibit firms’ ability to access and develop new capabilities. This is challenged in two directions: 1. Flexibility in organizational routines: even basic operations display variation and ability to adapt 2. Dynamic capability: “higher level” process through which firms modify their operating routines(HOWEVER, these are very uncommon which further implies rigidities) Approaches to capability development Acquiring capabilities through mergers, acquisitions, and alliances Acquiring a company with the already desired capability can speed up the process of capability development Major risks involved with these acquisitions: 1. Acquisitions are expensive 2. Acquiring company must find way to integrate the acquiree’s capabilities with its own. Our Company: Amgen On January 26, 2012 Amgen released a statement about their most recent a successful acquisition, Micromet, for 1.16 Billion dollars. Micromet is a biotechnology company that’s main capability is oncology development This is an example of a merger or acquisition that already contains a desired capability to speed up the process of development. Strategic alliances Risks of mergers and acquisitions leads to desire of strategic alliances: cooperative relationships between firms that involve the sharing of resources and pursuit of common goals. Key issue: Gain access to the capabilities of the partner firm or acquire capabilities through one partner learning from another Strategic alliances managing is itself a critical organizational capability making them more costly and timely then they appear. Our Company: Amgen Amgen focuses on building strategic alliances, or “partnerships”, with developers and wholesalers of human therapeutics by offering their financial backing and commitment in return for the partner’s resources and aid in development in their biotechnology goals. As stated in their mission statement, proper cooperation with their partners is one of their highest business priorities. Approaches to Capability development Internal development(focus and sequencing): Capability development needs to be systematic and a step by step process of design and implementation through several stages and in order. The organization must limit the number and scope of the capabilities that it is attempting to create at any point of time Focusing on developing and supplying the products that utilize the desired capabilities is often a useful strategy Capabilities development in relation to the Hyundai example 1967-1997 systematically developed capabilities in a series of compressed phases Recruited designers and engineers with car company experience to aid in implementation Since 2000, has developed quality control, market research, brand, and international management capabilities in similar fashion In conclusion Key issue for the internal environment is “what a firm can do” Our interest is the potential for resources and capabilities to establish sustainable competitive advantage The emphasis of our chapter was to identify, assess, and develop a firm’s existing resources and capabilities as well as consider how they can be developed for the future ANY QUESTIONS?