To:

advertisement

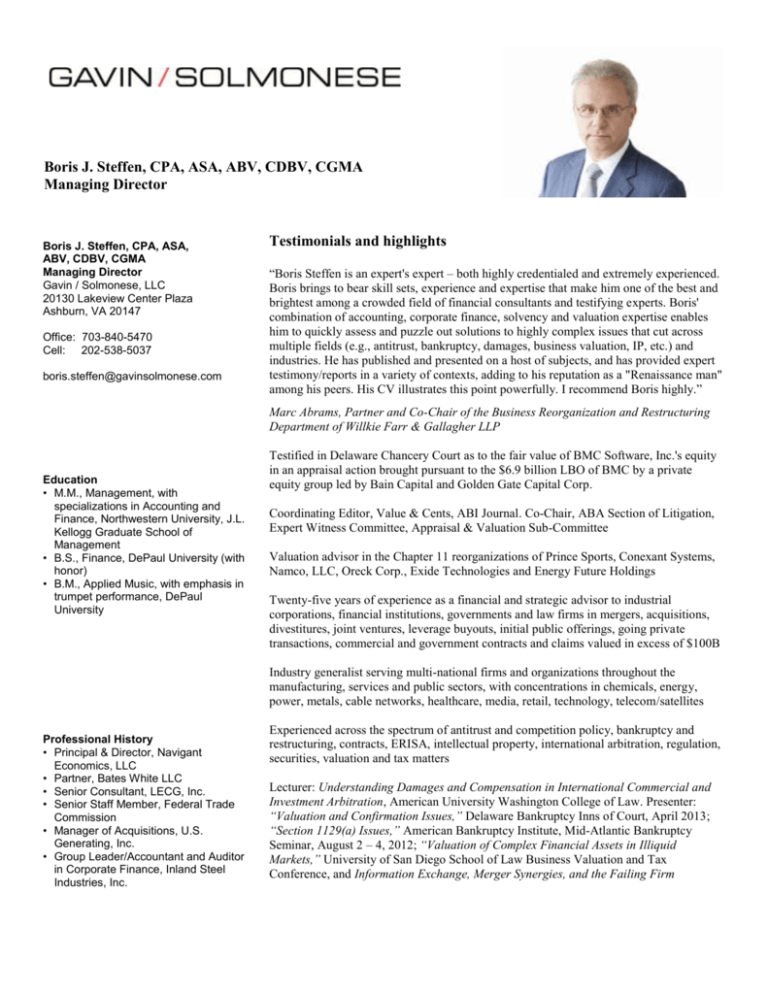

Boris J. Steffen, CPA, ASA, ABV, CDBV, CGMA Managing Director Boris J. Steffen, CPA, ASA, ABV, CDBV, CGMA Managing Director Gavin / Solmonese, LLC 20130 Lakeview Center Plaza Ashburn, VA 20147 Office: 703-840-5470 Cell: 202-538-5037 boris.steffen@gavinsolmonese.com Testimonials and highlights “Boris Steffen is an expert's expert – both highly credentialed and extremely experienced. Boris brings to bear skill sets, experience and expertise that make him one of the best and brightest among a crowded field of financial consultants and testifying experts. Boris' combination of accounting, corporate finance, solvency and valuation expertise enables him to quickly assess and puzzle out solutions to highly complex issues that cut across multiple fields (e.g., antitrust, bankruptcy, damages, business valuation, IP, etc.) and industries. He has published and presented on a host of subjects, and has provided expert testimony/reports in a variety of contexts, adding to his reputation as a "Renaissance man" among his peers. His CV illustrates this point powerfully. I recommend Boris highly.” Marc Abrams, Partner and Co-Chair of the Business Reorganization and Restructuring Department of Willkie Farr & Gallagher LLP Education • M.M., Management, with specializations in Accounting and Finance, Northwestern University, J.L. Kellogg Graduate School of Management • B.S., Finance, DePaul University (with honor) • B.M., Applied Music, with emphasis in trumpet performance, DePaul University Testified in Delaware Chancery Court as to the fair value of BMC Software, Inc.'s equity in an appraisal action brought pursuant to the $6.9 billion LBO of BMC by a private equity group led by Bain Capital and Golden Gate Capital Corp. Coordinating Editor, Value & Cents, ABI Journal. Co-Chair, ABA Section of Litigation, Expert Witness Committee, Appraisal & Valuation Sub-Committee Valuation advisor in the Chapter 11 reorganizations of Prince Sports, Conexant Systems, Namco, LLC, Oreck Corp., Exide Technologies and Energy Future Holdings Twenty-five years of experience as a financial and strategic advisor to industrial corporations, financial institutions, governments and law firms in mergers, acquisitions, divestitures, joint ventures, leverage buyouts, initial public offerings, going private transactions, commercial and government contracts and claims valued in excess of $100B Industry generalist serving multi-national firms and organizations throughout the manufacturing, services and public sectors, with concentrations in chemicals, energy, power, metals, cable networks, healthcare, media, retail, technology, telecom/satellites Professional History • Principal & Director, Navigant Economics, LLC • Partner, Bates White LLC • Senior Consultant, LECG, Inc. • Senior Staff Member, Federal Trade Commission • Manager of Acquisitions, U.S. Generating, Inc. • Group Leader/Accountant and Auditor in Corporate Finance, Inland Steel Industries, Inc. Experienced across the spectrum of antitrust and competition policy, bankruptcy and restructuring, contracts, ERISA, intellectual property, international arbitration, regulation, securities, valuation and tax matters Lecturer: Understanding Damages and Compensation in International Commercial and Investment Arbitration, American University Washington College of Law. Presenter: “Valuation and Confirmation Issues,” Delaware Bankruptcy Inns of Court, April 2013; “Section 1129(a) Issues,” American Bankruptcy Institute, Mid-Atlantic Bankruptcy Seminar, August 2 – 4, 2012; “Valuation of Complex Financial Assets in Illiquid Markets,” University of San Diego School of Law Business Valuation and Tax Conference, and Information Exchange, Merger Synergies, and the Failing Firm Boris J. Steffen, CPA, ASA, ABV, CDBV, CGMA Defense,” IncreMental Advantage’s Mergers & Acquisitions Due Diligence Conference Authored articles published globally by Financier Worldwide on “Accounting for Fair Value in the Subprime Market Meltdown,”“The Role of Valuation in Corporate Restructuring,” and “Valuation and Solvency Analysis in Failing Firm Claims.” Summary of experience Boris Steffen is an expert in accounting, corporate finance, valuation and solvency with multi-industry, multicompany experience assisting clients in managing a wide range of operating, financing, and investing transactions, claims and litigation. Matters in which he has consulted or testified include antitrust and competition policy, bankruptcy, restructuring and insolvency, contracts, corporate governance, ERISA, family law, going private transactions, intellectual property, international trade and arbitration, mergers and acquisitions, valuation, pricing, costs and profitability, securities and taxes. Boris has advised in negotiated as well as hostile transactions and claims valued in excess of $100 billion. Sectors in which he has consulted include the aerospace, aggregates, asbestos, automotive, batteries, beef processing, biotechnology, business services, cable network, chemical, consumer product, construction, defense, document management, electronic imaging, financial services & banking, food & beverage, healthcare, HVAC, independent power, information technology, insurance, internet, newspaper, magazine, pharmaceutical, oil & gas, paper and industrial packaging, printing, pumps & controls, plumbing, real estate, retail, semiconductor, software, steel, telecom, tobacco, electric utility and water industries. Boris testified as to the fair value of BMC Software, Inc.'s equity in an appraisal case before the Delaware Court of Chancery, merger efficiencies in the Sirius XM Satellite Radio merger litigation and proposed merger of Exelon Corp. and PSEG, and industry structure, merger efficiencies, pricing & profitability in FTC v. Staples/Office Depot. Boris also advised on damages in the Enron bankruptcy, Vitamins & AMD/Intel antitrust cases, and Vulcan Materials/Martin Marietta Materials hostile takeover battle; on fair value in the Xerox/ACS & Grifols/Talecris mergers and Chapter 11 cases of Prince Sports, Conexant Systems, Namco, Oreck, Exide Technologies and Energy Future Holdings; and on solvency in the Namco Capital, Frank Parsons and Circuit City fraudulent transfer and preference claims. Boris has held positions in finance, public policy, corporate development and consulting with Inland Steel Industries, the FTC, Bureau of Competition, PG&E National Energy Group, Bates White and LECG. He holds a Master of Management degree with specializations in accounting and finance from the Kellogg School of Management of Northwestern University, and a Bachelor of Science degree in Finance and Bachelor of Music degree in Applied Music from DePaul University. He is an Accredited Senior Appraiser, Certified Public Accountant, Accredited in Business Valuation, Certified Distressed Business Valuation Analyst, Chartered Global Management Accountant and member of the AICPA, ABA, ABI, Insol International, AIRA, ASA and American Finance Association. Page 2 of 21 Boris J. Steffen, CPA, ASA, ABV, CDBV, CGMA Selected experience Expert testimony • Expert and Rebuttal Reports in Merion Capital LP and Merion Capital II LP v. BMC Software, Inc., in the Court of Chancery of the State of Delaware, November 26, 2014 and December 24, 2014. Deposition testimony November 27, 2015 and November 29, 2015. Trial testimony March 18, 2015 and March 19, 2015. • Expert Rebuttal Report in Carl Blessing on behalf of Himself and All Others Similarly Situated v. Sirius XM Radio Inc., in the United States District Court for the Southern District of New York, No. 1:09-cv-10035HB ECF CASE, January 4, 2011; deposition testimony, March 4, 2011. • Declaration In Re Pharmaceutical Industry Average Wholesale Price Litigation, Civil Action No. 01-12257PBS, in the United States District Court, District of Massachusetts, September 21, 2009 • Expert report and deposition testimony in American Towers, Inc. v. Jackson & Campbell, P.C. et al. The Superior Court for the District of Columbia, Civil Action No. 0003277, April 27, 2009 and June 17, 2009 • Expert report and deposition testimony In re: Dynamic Random Access Memory (DRAM) Antitrust Litigation. United States District Court for the Northern District of California. Case numbers 06-cv-1665, 07-cv-1200, 07-cv-1207, 07-cv-1212, 07-cv-1381. May 2, 2008 and May 23, 2008 • Expert report In re: Estate of Clarence A. Warden, Deceased, in the Court of Common Pleas of Delaware County Orphans’ Court Division, October 1, 2007 • Expert report in The Related Companies, L.P. v. Government of District Columbia. The Superior Court of the District of Columbia, Civil Action No. 04-8680, February 16, 2007 • Direct and rebuttal testimony in Izmit SU A.S. v. The Metropolitan Municipality of Kocaeli, Reference No. SCH-4967, before The International Arbitral Center of the Austrian Federal Economic Chamber, November 17, 2006 and February 2, 2007 • Pre-filed expert testimony in Tariff filing of Green Mountain Power Corporation requesting an 11.95% increase in its rates, effective May 29, 2006, and Petition of Green Mountain Power Corporation for approval of an alternative-regulation plan, before the Public Service Board of the State of Vermont, Docket Nos. 7175 and 7176, August 4, 2006 • Direct, surrebuttal, and cross examination testimony In The Matter Of The Joint Petition Of Public Service Electric And Gas Company And Exelon Corporation For Approval Of A Change In Control Of Public Service Electric And Gas Company, And Related Authorizations, before the Board of Public Utilities of the State of New Jersey, November 28, 2005; December, 27 2005; January 12, 2006 Page 3 of 21 Boris J. Steffen, CPA, ASA, ABV, CDBV, CGMA • Pre-filed expert rebuttal testimony In the Matter of the Revision to Current Depreciation Rates Filed by Chugach Electric Association, Inc., before the Regulatory Commission of Alaska, Docket No. U-04-102, May 11, 2005; oral testimony October 31 and November 1, 2005 • Expert report and deposition testimony in Klein-Becker, LLC, Basic Research, LLC, v. William Stanley, Bodyworx.com, Inc., Guy Cordaro, No. A-03-CV-00871-SS in the United States District Court for the District of Texas Austin Division, July 1, 2004, and July 27, 2004. • Expert report and deposition testimony in District of Columbia v. CVS Corporation, et al., Civil Action No. 03-00443172 in the Superior Court of the District of Columbia Civil Division, Calendar No. 10, May 3, 2004 and May 24, 2004. • Declaration in BABI International Corp. v. PepsiCo, Inc. and Stokely-Van Camp, Inc., 02 Civ. 2850 (CM) (MDF) in the United States District Court Southern District of New York, September 3, 2003. • Expert report in United States of America v. Edward A. Kiley, Crim, No. L-01-0372 in the United States District Court for the District of Maryland, February 14, 2003. • Expert reports and deposition testimony in Acacia Mutual Life Insurance Company, and others v. BAA PLC, and others, Case No. C-2002-79742 in the Circuit Court for Anne Arundel County, MD, December 23, 2002; March 3, 2003 and March 12, 2003. • Expert Reports in FCE Benefit Administrators, Inc. v. George Washington University, et al., Civ. No. 00cv0682 (ESH) in the United States District Court For the District of Columbia, November 13, 2000 and March 1, 2002. • Declarations and deposition testimony in Federal Trade Commission v. Staples, Inc. and Office Depot, Inc., Civ. No. 97-701(TFH) in the United States District Court For the District of Columbia, May 9, 1997. Selected Litigation Consulting • Acacia Mutual Life Insurance Company, and others, v. BAA PLC, and others • American Towers, Inc. v. Jackson & Campbell, P.C. et al • Certain Crude Petroleum Products from Iraq, Mexico, Saudi Arabia, and Venezuela • Chiron Corp. v. Smith Kline Beecham • Coleman (Parent) Holdings, Inc. v. Morgan Stanley & Co., Inc. • Conwood Company, L.P. v. UST, Inc. Page 4 of 21 Boris J. Steffen, CPA, ASA, ABV, CDBV, CGMA • Enron Corp and Enron North America Corp v Citigroup Inc., et al. • Fore River Development, LLC Docket No. ER06-822-000 • FTC v. Abbott Laboratories • FTC v. R.R. Donnelley • Hewlett-Packard Company v. Nu-Kote International, Inc • FTC v. Intel Corporation • FTC v. Toys “R” Us, Inc. • Imo Industries, Inc., v. Transamerica Corp., et al. • In re: Dynamic Random Access Memory (DRAM) Antitrust Litigation • In re: Estate of Clarence A. Warden, Deceased • In re: Intel Corporation Microprocessor Antitrust Litigation; Advanced Micro Devices, Inc. and AMD International Sales & Services, LTD. v. Intel Corporation and Intel Kabushiki Kaisha; Phil Paul v. Intel Corporation • In re: Namco Capital Group, Inc., Case No. 2:08-bk-32333-BR, in the U.S. Bankruptcy Court, Central District of California, Los Angeles Division • In Re Pharmaceutical Industry Average Wholesale Price Litigation • Klein-Becker, LLC, Basic Research, LLC, v. William Stanley, Bodyworx.com, Inc., Guy Cordaro • Linerboard Antitrust Litigation • Litton Systems, Inc. v. Honeywell, Inc. • McDonnell Douglas Corporation and General Dynamics Corporation v. The United States • Sun Microsystems, Inc., et al. v. Hynix Semiconductor Inc., et al. • Surety Federal Savings and Loan Association, FSA and Federal Deposit Insurance Corporation v. United States of America • United States v. Edward A. Kiley Page 5 of 21 Boris J. Steffen, CPA, ASA, ABV, CDBV, CGMA • Vitamins Antitrust Litigation • Wheeling-Pittsburgh Steel Corporation v. Mitsui & Co., et al Bankruptcy and restructuring • Prepared guideline publicly traded company, guideline transaction and stock and debt valuation analyses of a Chapter 11 debtor engaged in the production, distribution and recycling of lead-acid batteries to evaluate whether certain secured creditors primed in a DIP financing were adequately protected. • Consulted in the defense of the CRO of a financial services company accused of breach of fiduciary duty, gross negligence and aiding and abetting breach of fiduciary duty. Researched the role of a CRO in managing the affairs of a Chapter 11 debtor, the common law duties of non-director corporate officers, the diverging interests of shareholders and creditors in the zone of insolvency and the potential shift of fiduciary duties. Evaluated the conduct of the CRO as compared to the required duties of loyalty, care and to inform the Board. Used findings to rebut plaintiffs’ liability theories and damages claims. • Retained to testify as an expert in defense of the Directors of a start-up medical billing services company that allegedly breached their fiduciary duties to the firm and its creditors. Restated the firm’s balance sheets, income statements and cash flow statements to conform with GAAP financial reporting practices to facilitate discounted cash flow, comparable company and comparable transaction analyses. Performed balance sheet and cash flow tests to analyze the solvency of the company, and changes therein, at six points in time from inception through bankruptcy and dissolution. Analyzed whether the prospects for the company to continue operating given its financial challenges were reasonable. • Financial advisor to the Liquidation Trustee in an action to recover damages from the financial collapse of a multi-billion dollar bank holding company. Evaluated the merits of breach of contract, professional negligence and aiding and abetting breaches of fiduciary duty liability theories based on purported misrepresentations of the value of the bank’s MBS and loan portfolio, compliance by the bank with mandated capital requirements and the adequacy of the bank’s financial controls. Considered fraudulent transfer recovery claims attributable to the up-streaming of dividends, transfer of real estate, incurrence of debt and foregone tax refunds. • Rebutted solvency analyses underlying a lawsuit brought by a Chapter 11 Trustee to avoid allegedly fraudulent transfers from a real estate private equity firm with approximately $600 million in liabilities to a group of banks that had provided financing prior to its involuntary bankruptcy and the conviction of its founder for wire fraud in a Ponzi scheme. Demonstrated that the valuation standard, premise, methodology, data, assumptions and solvency measurement of the plaintiff were not reliable or relevant as applied. • Financial advisor to the unsecured creditors committee in proceedings involving the Chapter 11 reorganization plan of Prince Sports Inc. Identified and analyzed market data pertaining to the terms and conditions of licenses involving comparable assets, products and geographic markets. Estimated a risk- Page 6 of 21 Boris J. Steffen, CPA, ASA, ABV, CDBV, CGMA adjusted discount rate to determine the present and future value of expected royalty payments exceeding $100 million. Prepared valuations of the licenses used to negotiate an increased recovery to the unsecured creditors of from zero to nearly 50 percent. • Refuted a claim of inadequate capital alleged in an attempt to pierce the corporate veil in an alter ego dispute in the pharmaceutical industry, demonstrating lack of comparability and consistency between the subject company and proposed industry benchmarks based on operating results, financial position and related accounting data and information • Developed, structured, and directed damages analyses and valuations of the loss of enterprise value, and of the lost growth opportunities, suffered by a privately held manufacturing subsidiary of a publicly-traded, multi-billion dollar international conglomerate, as a consequence of insurance company failure to provide insurance payments for asbestos liability indemnification and defense costs. • On behalf of the unsecured creditors committee of a multi-billion dollar, multi-national debtor operating under Chapter 11, directed forensic analyses of debtor accounting records to restate reported revenues, debt, and cash flows in accordance with the economic substance of disputed transactions, to support an action to recover damages attributable to defendants’ aiding and abetting a breach of fiduciary duty by debtor insiders. • Advised a hedge fund group that had acquired a portfolio of power plants in an out-of-court restructuring at a price in excess of book value, and sought to have the related acquisition adjustment included in rate base in a proceeding before FERC, in evaluating whether the excess represented money prudently invested in assets used and useful in rendering public service based on assessment of original cost, asset impairment, going concern value, arms-length bargaining, and public interest criteria. • Oversaw the preparation of solvency analyses to refute a fraudulent conveyance suit. Provided expert testimony in deposition focused on whether the subject firm was solvent, adequately capitalized, and able to repay its debts as they matured based on balance sheet, adequate capital, and cash flow tests. • Prepared solvency analyses to counter claims associated with asbestos liabilities in the European run-off market. Analyses focused on industry and insurer financial position, operating results, current and prospective liabilities, sources of funding, payout trends, and invocation of proportionate cover. • Testifying expert in value impairment counterclaim to charge of fraudulent conveyance. Estimated pre- and post-damage enterprise values based on comparable company and discounted cash flow valuation methodologies. Expert report filed in the Circuit Court for Anne Arundel County. • Assessed the viability of an initial public offering of stock intended to facilitate an asset divestiture ordered by the FTC. Evaluated management qualifications, firm strategy, industry competitive dynamics, historic and pro-forma operating results, financial position and cash flows, and use of proceeds. Prepared discounted cash flow and comparable company analyses to validate new issue price. Page 7 of 21 Boris J. Steffen, CPA, ASA, ABV, CDBV, CGMA • Managed the development and administration of the business plan for a $1.5 billion asset business group. Participated in restructuring of operations to reduce annual operating costs by $200 million. Planned and controlled the execution of, and accounting for, the annual physical inventory, the monthly close of the general ledger, and the conversion of the general ledger system software to a new McCormack & Dodge platform. • Prepared comparable company analyses focusing on operating results, financial position, and Z-scores to refute claims of financial failure and irreparable harm due to unfair competition from imported steel and crude oil. Intellectual property • Valued the assets of Prince Sports for purposes of negotiating the purchase price in a Section 363 sale of its assets. Used the relief from royalty method to value the firm’s trademark licenses, considering what would be a reasonable royalty rate, expenses required to maintain the licenses, and the tax benefit attributable to the amortization of the licenses over their useful life based on firm projections. Used the adjusted net asset method to calculate the fair value of the assets as equal to the sum of the fair values of the trademark licenses, receivables, inventories and property, plant and equipment. • Valued the tangible and intangible assets of Oreck Corporation for purposes of negotiating the purchase price in a Section 363 sale of its assets. Used the relief from royalty method to value the tradenames, trademarks and patents, considering what would be a reasonable royalty rate, expenses required to maintain the IP, and the tax benefit attributable to the amortization of the IP over their useful life based on firm projections. Used the adjusted net asset method to calculate the fair value of the assets as equal to the sum of the fair values of the tradenames, trademarks, patents, personal and real property. • Valued intellectual property rights to technology used in the production of diesel engines and trucks acquired by a Big 3 automotive manufacturer. Defined valuation objective, standard, and premise. Evaluated functional, technical, economic, and legal characteristics of subject IPRs. Analyzed industry, firm-specific, macro-economic, and transactional data. Prepared income, market, and cost approach valuations based on relief from royalty, reproduction cost, and avoided cost methodologies. Specified value conclusion for financial reporting purposes. • Refuted relief from royalty, profit split, and discounted cash flow valuation methodologies used to provide below-market valuations in the purchase of consumer product trademarks acquired in transatlantic merger. Determined reasonable royalty rates, valued goodwill, reallocated purchase price, estimated capitalization rate, weighted-average cost of capital, and internal rate of return. Results led to penalties of nearly $3 million in a finding of H-S-R Act violations. • Directed the preparation of intellectual property analyses in support of government investigations, private litigation and/or valuations of franchises, trademarks, patents, and goodwill in the aerospace, printing, Page 8 of 21 Boris J. Steffen, CPA, ASA, ABV, CDBV, CGMA consumer products, imaging system, ethical pharmaceuticals, microprocessor, and specialty chemicals industries. • Developed analyses of franchiser liquidity, solvency, and working capital requirements used successfully in negotiations to reduce FTC demands for consumer redress of $9 million by 60 percent for violation of the FTC Act and FTC Franchise Rule in the sale of printing and sign-making franchises. • Oversaw cross-border discovery efforts to determine the value of investment in research and development in the production of ethical pharmaceuticals for purposes of defending against claims of patent infringement brought before the International Trade Commission. Drafted interrogatories, information, and data requests. Researched international accounting standards, exchange rates, and cost of capital. Conducted interviews of European and U.S. based division management. Reconciled accounting standard differences to compile and value pro-forma research and development cost time series using discounted cash flow. • Directed the preparation of accounting and financial analyses used in antitrust damages counterclaims to charges of patent infringement in the aerospace and imaging system industries, and allegations of harm to competition and innovation in the microprocessor market. Drafted interrogatories, data requests, and subpoenas. Assisted with the taking of depositions. Evaluated labor costs, material costs, overhead costs (including overhead rates), cost pools, and allocation bases. Critiqued and revised plaintiff cost of capital estimates and discounting conventions. Assessed industry concentration based on HHI indices, adjusted for exchange rate, and transfer pricing effects. Corporate finance, valuation, and securities • Testified as an expert in Delaware Chancery Court as to the fair value of BMC Software, Inc.’s equity in an appraisal action brought pursuant to the $6.9 billion leverage buyout of BMC led by Bain Capital and Golden Gate Capital. • Consulting expert and designated testifying expert for issuer of ARS on damages suffered as a result of actions taken by its underwriter when the market for ARS became illiquid. Conducted research to identify factors affecting the demand, supply and liquidity of the ARS market, as well as the marketing, distribution, pricing and valuation of ARS, including issuer and underwriter rights, obligations and responsibilities, investor suitability, required information disclosures, ARS terms and order types, auction mechanisms and financial valuation and reporting requirements. Considered damages claims attributable to actions involving underwriting, broker-dealer, remarketing and cost of carry fees; interest rate caps, remarketing and ARS value. • To assess whether retiree benefit reductions were due to financial hardship or business necessity in an ERISA claim, and the effects of anti-competitive conduct in an antitrust damages action, analyzed firm and price sustainability demonstrating the relationships between analyst target stock prices, prices observed in the stock market, rates of return required by creditors and investors, firm intrinsic value, and actual and but for revenues. Page 9 of 21 Boris J. Steffen, CPA, ASA, ABV, CDBV, CGMA • In anticipation of a lawsuit challenging the fairness of consideration and process of a going-private transaction in Delaware Chancery Court, assessed the relevance and reliability of a business valuation prepared by an investment banking firm, proffered as an expert report. Advised defendant management and counsel on issues, challenges, opportunities and strategies within the context of governing statutes and case law. • Consulting expert in multi-billion dollar merger-related minority shareholder appraisal rights cases in the document management and biotech sectors alleging breach of fiduciary duty for approving a merger in which the consideration purportedly was inadequate. Provided research, analysis and advice regarding valuation standards, approaches, methods, value drivers and accounting issues consistent with Delaware Chancery Court case law, prevailing economic conditions, industry trends and the businesses and operations of the acquirer and target. • For purposes of estimating damages to which a trust was entitled as a result of actions taken by its trustees, estimated the fair market value, and changes therein, of a privately held, multi-national diversified conglomerate over a period of nearly twenty years, taking into account as appropriate discounts for lack of marketability, discounts for lack of control, and premiums for control. Assessed the potential for the trustees to have divested and monetized the trust’s interest in the firm on each valuation date in the M&A and IPO markets, in both taxable and tax-deferred structures, and calculated what the proceeds would have been worth had they been invested in a manner consistent with sound trust administration. • Delivered a Fairness Opinion to the Board of a firm divesting certain brands and businesses to a Fortune 500 corporation having an 18 percent interest in its publicly traded shares. Analyzed transaction documents and schedules, historical and projected financial and operating data, projected synergies, publicly available information, and accountant reports. Conducted due diligence interviews of senior management to evaluate the past and current operations, financial condition, and prospects of the buyer and seller. Prepared discounted cash flow, comparable company, and comparable transaction valuations. • Conducted event studies of transaction announcements to isolate and control for the influence of industry and market factors on the price of a publicly traded stock, and assess the probability that the observed change in the price of the stock was due to the transaction announcement, thus facilitating an objective quantification of the change in stock price associated with the disclosure. • Validated the efficient market hypothesis with respect to the market for a publicly traded stock by examining the subject stock’s weekly trading volume, the number of analysts following and reporting on the stock, the number of market makers for the stock, whether the related firm was eligible to file SEC Form S3, and whether empirical facts demonstrated a cause and effect relationship between unexpected events or news and an immediate change in the price of the stock. • Participated in the development of national and regional acquisition strategies, including the specification and implementation of competitive analysis and acquisition screening programs used to identify and value targets. Page 10 of 21 Boris J. Steffen, CPA, ASA, ABV, CDBV, CGMA • Prepared analyses and projections of power generation, energy and capacity revenue, capacity, operating and maintenance costs, fuel costs, heat rates, and EBITDA to evaluate the strategic fit and potential value of asset acquisitions and power contracts. • Assessed the effect on earnings, cash flow, and stock price of allocating acquisition costs to land, intangibles and property, plant, and equipment. Estimated the bid advantage to an acquirer in a tax-free versus taxable transaction. Monitored and interpreted regulatory factors affecting future acquisition targets and industry restructuring. • Testifying expert on behalf of defendant in aerospace industry tender offer related insider-trading litigation. Critiqued Government allegation of gains from insider trading and stock options. Determined rightful option gains based on Black-Scholes, comparable company, and comparable transaction valuations. Expert report filed in the United States District Court for the District of Maryland. • Estimated the value of employee stock options that were the subject of a dispute in a negotiation to settle a wrongful termination lawsuit. Reviewed and verified option grants, trading records, and account statements. Analyzed the terms and conditions of the options, including grant and expiration dates, number of underlying shares, related exercise prices, and style of exercise. Identified appropriate stock price, expiration date, volatility, and risk-free interest rate valuation parameters. Estimated the potential value of the options using the Black-Scholes option pricing model and unadjusted stock prices. • Prepared consolidated and subsidiary pro-forma financial statements and discounted cash flow valuations to assess defendant ability to pay restitution and measure impairment of firm value due to anti-competitive conduct in the petroleum retail marketing industry. • Directed the valuation of a start-up specialty chemical producer acquired in a cross-border transaction. Evaluated offering memorandum, assessed market potential, modeled pro-forma financial statements, estimated cost of capital, and determined enterprise value based on discounted cash flow, comparable company, and comparable transaction methodologies. Valuation was successful in refuting claims of belowmarket bid and value impairment due to industry cartel behavior. Mergers, acquisitions, and divestitures • Prepared accounting, economic, and financial studies, and provided expert analyses and testimony, focusing on the identification, verification, quantification, and realization of merger synergies; both direct and indirect cost savings and revenue enhancements focusing on sources of synergy, costs-to-achieve, timing, underlying assumptions, allocations, and operating constraints including scale, mix and proximity; work done on behalf of merger parties in the supermarket, computer superstore, petroleum refining, marketing and transportation, automotive component and media industries, as well as on behalf of federal and state government agencies in investigations and/or litigation of mergers in the aerospace, beef processing, chemical, cable network, consumer products, defense, financial services, information technology, media, oil exploration, printing, pharmaceutical distribution, retail, restaurants, soft drinks, and utility industries. Page 11 of 21 Boris J. Steffen, CPA, ASA, ABV, CDBV, CGMA • Provided expert testimony in support of restraint of trade and monopolization claims in litigation to block the acquisition of a retail enterprise. Determined transaction objective, structure, valuation and returns through evaluation of asset purchase and sale agreements, financing, valuation, and allocation of purchase price among tangible and intangible assets, including goodwill and non-compete covenants. • In FTC v. Staples, Inc. and Office Depot, Inc. authored, presented, and defended in cross-examination testimony trial exhibits and declarations pertaining to market share, industry concentration, merger synergies, gross margins, and product pricing. Case remains the state-of-the art in merger antitrust enforcement. • Advised the Federal Trade Commission in antitrust investigations, litigation, and negotiations involving M&As, JVs, LBOs, and IPOs with an aggregate value in excess of $67 billion in the aerospace, chemical, consumer products, defense, financial services, information technology, media, oil, printing, pharmaceutical distribution, retail, restaurants, soft drinks, and cable television industries. • Directed the analyses of operating results, financial position, cash flow, merger synergies, and failing firm claims to obtain FTC approval of M&As and JVs valued at $11.185 billion in the supermarket, computer superstore, petroleum refining, marketing and transportation, and automotive component industries. • Prepared comparable company, comparable transaction, break-up, leveraged buyout, and discounted cash flow valuations to value shareholder economic and voting interests, control premiums, and customer/vendor contracts. Used results to define and negotiate terms leading to Consent Decree between FTC and Time Warner pursuant to Time Warner’s merger with Turner Broadcasting. • Provided valuation, tax law, cash flow, and IRR analyses relied on by the Federal Trade Commission in determining HSR Act violations, negotiating related Consent Orders, and assessing and realizing penalties of more than $7 million. • Assessed the antitrust implications of document submissions, specified discovery, and cross-examination questions, conducted hearings, prepared expert exhibits, assisted with litigation strategy, drafted sections of trial briefs, and wrote proposed and reply findings of fact adopted by the Court in FTC v R.R. Donnelley. Antitrust, contracts, and damages • In a dispute between a health insurer and a health care provider regarding rates being paid to a nonparticipating provider, assessed the relevance and reliability of financial information regarding profits and losses realized by the provider within the context of an antitrust counterclaim by the health insurer that the provider had made anticompetitive acquisitions and was charging monopoly rates. • Provided expert testimony in defense of a professional services firm accused of negligence and of a breach of its contractual and fiduciary duties, allegedly causing its client to suffer damages comprised of lost profits, attorney’s fees and out-of-pocket costs associated with the development and construction of a telecommunications tower. Analyzed plaintiff’s damages period, modeling of expectations and reliance Page 12 of 21 Boris J. Steffen, CPA, ASA, ABV, CDBV, CGMA damages, implied theory of causation, projections of future lost revenues and avoidable costs, prejudgment interest calculations, discounting conventions, mitigation efforts, treatment of taxes and definition of out-ofpocket costs to assess the relevance, reliability and reasonableness of the damages claim. • Provided expert testimony in an international cross-border dispute between a governmental authority and the sponsors of the world's largest privately financed water supply project regarding certain terms and conditions governing the rights, responsibilities, and remedies available to the parties under the contract. Assessed whether the contract terms and conditions were verifiable, reasonable, and probable, and therefore known and measurable as required by the just and reasonable standard, based on analysis of supporting testimony, documentation, facts, and methodologies. • Provided expert testimony in support of the damages claim of a newly established Internet retailer attributable to an alleged price-fixing conspiracy arising out of a resale price management program. Examined competitors, customers, substitute products, suppliers and the possibility of new entry to support the product market definition, focusing on facts related to public and industry recognition, product characteristics and usage, targeted customers, pricing and price sensitivity, and marketing, sales, and distribution. Estimated expected but-for lost revenues, incremental costs, and lost profit damages. • Retained to serve as a testifying expert in opposition to a breach-of-contract claim alleging lost profits filed by a newly established importer and distributor of sport drinks. Considered product and geographic market entry barriers, competition and economic conditions, in addition to management expertise, past performance, demand build strategies, and projections. Analyzed liability theories, conduct allegations and mitigation efforts. Conducted forensic review of damages model back-up data and information. Declaration filed in the United States District Court for the Southern District of New York. • Testifying expert in support of multi-million dollar claim of lost profits involving unfair competition and breach of contract in healthcare benefit industry. Directed discovery, analyses of contract terms, business models, product profitability, accounting policies, operating results, and industry comparables. Expert reports filed in the United States District Court for the District of Columbia. • Managed the analysis of corporate financial position and debt capacity, focusing on industry and firmspecific capital structure, solvency, liquidity, and profitability. Drafted data, information, and document requests. Evaluated debt and equity financing agreement terms and covenants. Oversaw preparation of proforma financial models and sensitivity analyses. Deliverables aided in reversal of multi-billion dollar judgment in largest government breach of contract case in U.S. history. • Directed the analyses of antitrust damages attributable to anticompetitive conduct and market foreclosure by an automotive manufacturer and distributor. Modeled the effects of the actions of the plaintiff and defendant, their competitors, and other market participants and influences on plaintiff profits, and reconstructed the effects of the actions of the plaintiff and defendant, their competitors, and other market influences, but for defendant’s unlawful conduct. Determined damages by comparing profits that would have been realized but for defendant’s unlawful conduct with that actually earned, with lost profits defined Page 13 of 21 Boris J. Steffen, CPA, ASA, ABV, CDBV, CGMA as lost revenues minus costs avoided by selling at a lower volume, and measured using the discounted cash flow method. • Financial advisor in litigation and settlement discussions pertaining to defendant’s ability to pay compensatory and punitive damages in civil rights class action suit brought against a business services firm for employment discrimination. • Developed financial models of electric utility fossil/nuclear generation capacity and fuel, operating and maintenance, and station costs to estimate supply function and develop price caps to mitigate market power in privatization of state-owned hydroelectric generating assets. • Supervised the development of product profitability studies to model a “typical” vertically integrated manufacturer in the specialty chemical industry. Analyzed aggregate and per unit, variable and fixed, labor, raw material, and overhead costs. Normalized productivity and cost allocation rates. Eliminated intercompany profits. Evaluated relationship between raw material costs, exchange rates, arbitrage, and hedging strategies. Model was highly successful in damages case settlement negotiations and rebuttal. • Formulated analyses, rebuttal arguments, and negotiating strategies that successfully reduced FTC demands for consumer redress of $9 million by 60 percent in FTC Act and Franchise Rule violations in the sale of printing and sign-making franchises. Financial and managerial accounting and ratemaking • Evaluated cost of service adjustments filed in support of an electric utility’s requested rate increase. Assessed whether the adjustments were known and reasonable based on academic, industry, and regulatory criteria. Evaluated supporting facts, documentation, calculations, and methodologies through forensic examination and replication of work papers and estimates. • Examined electric plant depreciation studies prepared for purposes of regulatory review and ratemaking. Assessed supporting third party studies and continuing property record accounting data for plant additions, retirements, adjustments, and transfers used to develop survivor characteristics. Evaluated alternate statistical methods of service life estimation, and alternate accounting methods, procedures, and techniques used to estimate depreciation accruals. Tested the relevance and reliability of estimated average service lives, salvage value, removal costs, and depreciation accrual rates. Audited accounting treatment for consistency with GAAP for changes in estimates, accounting principles, and errors • Conducted forensic accounting studies of multi-national companies to recreate and or back-out 1) variable manufacturing and operating costs to facilitate the estimation of but-for prices in price fixing damages litigation, and (2) transactions for purposes of developing but-for statements of firm financial position and operating results for use in evaluating firm profitability, operating efficiency, liquidity, and solvency. • Completed economic, operational, quality, and internal control reviews of equipment, transportation, energy, purchasing, information technology, and distribution functions and departments. Developed policies Page 14 of 21 Boris J. Steffen, CPA, ASA, ABV, CDBV, CGMA and procedures to reduce the cost of quality, increase efficiency, and achieve aggregate savings estimated at $80 MM in utilities, staffing, shrinkage, freight, demurrage, invoice processing, spares, and Black Lung excise taxes. • Planned, organized, and directed audits of physical inventories. Conducted interim and year-end financial audits of Accounts Receivable, Cash, Fixed Asset, and Inventory Accounts. Prepared fiscal year comparative income, balance sheet, and cash flow statements and analyses of corporate and subsidiary return on investment, sales, and equity for presentation to the Board of Directors by the CFO. Professional experience Prior to joining Gavin / Solmonese, Mr. Steffen was a Principal and Director with Navigant Economics, LLC, a Partner with Bates White, LLC, a Senior Consultant with the Antitrust, Finance, and Damages Practice of the Economics and Policy Group of LECG, Inc. and a Senior Staff member of the Federal Trade Commission, Bureau of Competition. Mr. Steffen has also served as a Manager of Acquisitions in Corporate Development for U.S. Generating, Inc. and a Group Leader/Accountant and Auditor in Corporate Finance for Inland Steel Industries, Inc. Education • M.M., Management, with specializations in Accounting and Finance, Northwestern University, J.L. Kellogg Graduate School of Management • B.S., Finance, DePaul University (with honor) • B.M., Applied Music, with emphasis in trumpet performance, DePaul University Distinctions and Professional Certifications • FTC Superior Service Award for “Outstanding Work in the Time Warner/Turner Broadcasting and Jones Intercable/Intermedia Partners matters” • FTC Meritorious Service Award for “Outstanding Performance in furthering the Commission’s Antitrust Enforcement Program in R.R. Donnelley, Docket No. 9143” • FTC Outstanding Team Effort Award for “Outstanding Contributions to the Staples/Office Depot Team” • Beta Gamma Sigma • Certified Public Accountant, Illinois • Certificate in Distressed Business Valuation, Association of Insolvency and Restructuring Advisors Page 15 of 21 Boris J. Steffen, CPA, ASA, ABV, CDBV, CGMA • Accredited Senior Appraiser, American Society of Appraisers • Accredited in Business Valuation, American Institute of Certified Public Accountants • Chartered Global Management Accountant, American Institute of Certified Public Accountants Professional activities • Coordinating Editor, Value & Cents, American Bankruptcy Institute Journal • American Institute of Certified Public Accountants and Member, Business Valuation/Forensic and Litigation Services section • Co-Chair, Appraisal & Valuation Sub-Committee of the American Bar Association, Section of Litigation Expert Witness Committee • American Bar Association, Associate Member, Antitrust, Business, Intellectual Property, Litigation and International Law sections • Member, American Bankruptcy Institute, American Finance Association, Association of Insolvency and Restructuring Advisors, Insol International and American Society of Appraisers Conferences, presentations, publications and seminars • “Validity of Appraisal Arbitrage Affirmed in Delaware,” Association of Insolvency & Restructuring Advisors Journal, Vol. 29 No. 3 - 2015 • “Reasonableness of Projections from the Outside Looking In,” American Bankruptcy Institute Journal, Vol XXXIV No. 9, 14-15, 76-77, September 1, 2015 • “Bouchard Bucks The Trend In His 1st Appraisal Ruling,” Law360.com, Expert Analysis, August 10, 2015 • “Proposed Expert Testimony in Refco Limited under Federal Rule of Evidence 702,” ABA Section of Litigation, Expert Witnesses, News & Developments, June 28, 2015 • “Use of MAC Clauses to Mitigate and Litigate Acquisition Risk,” American Bankruptcy Institute Journal, VOL XXXIV, No. 6, 24 – 25, 84 – 85. June 1, 2015 • “The Cram Down Debate In Re: MPM Silicones, LLC,” ABA Section of Litigation, Expert Witnesses, News & Developments, December 31, 2014 • Panelist, Business Bankruptcy Nuts & Bolts CLE Program, American Bankruptcy Institute, December 15, 2014 Page 16 of 21 Boris J. Steffen, CPA, ASA, ABV, CDBV, CGMA • “Russian Government Ordered to Pay $50 Billion,” ABA Section of Litigation, Expert Witnesses, Fall 2014, Vol. 10, No. 1, News & Developments, September 16, 2014 • “What is Fair Value? It Depends”, American Bankruptcy Institute Journal, Vol. XXXIII, No. 9, September 2014 • “Anadarko Settles Tronox Fraudulent Transfer Litigation with $5 Billion Payment”, ABA Section of Litigation, Expert Witnesses, News & Developments, April 20, 2014 • “Market Evidence vs. Expert Opinion: And the Winner Is…”, Association of Insolvency & Restructuring Advisors Journal, Vol. 28, No. 2, Spring 2014 • Q&A with Boris Steffen, Managing Director, Gavin / Solmonese, LLC, IBIS World, January 23, 2014 • “An Overview of the USPAP,” ABA Section of Litigation, Expert Witnesses, Winter 2014, Vol. 9, No. 1, January 2014 • “Understanding Damages and Compensation in International Commercial and Investment Arbitration,” American University, Washington College of Law, Center on International Commercial Arbitration, September 26 – 27, 2013 • ‘It Ain’t Over Til It’s Over: American Airlines-US Airways,” Law360.com, Expert Analysis, August 2013 • “Appraisal Rights Redux: Resurgence, Trend or Afterthought?” Law360.com, Expert Analysis, August 2013 • “Valuation and Confirmation Issues,” Delaware Bankruptcy Inns of Court, April 2013 • “Is the Decline in Corporate Restructurings Since 2008 Due for a Reversal?” Association of Insolvency and Restructuring Advisors Journal; Volume 26, Number 5, February 2013 • “Decline in corporate restructurings since 2008 is due for a reversal?” Financier Worldwide, January 2013 • Panelist, American Bankruptcy Institute, Mid-Atlantic Bankruptcy Seminar, August 2 – 4, 2012, “Section 1129(a) Issues” • “Fair Value v Fair Market Value & Other Valuation Standards: Considerations in Corporate and Shareholder Litigation,” In-House Continuing Legal Education Program, Richards, Layton & Finger, June 14, 2011 • “Valuation of Complex Financial Assets in Illiquid Markets,” University of San Diego School of Law Business Valuation and Tax Conference, October 9, 2009 Page 17 of 21 Boris J. Steffen, CPA, ASA, ABV, CDBV, CGMA • “Meeting Future Energy Needs: Kelson Energy LLC’s Plant Acquisition,” Immersion Residency in Finance, Georgetown University McDonough School of Business, February, 2009 • “The Federal bailout of the Big Three can, will and must be successful,” American Bankruptcy Institute “ Bankruptcy Town Hall” web site, January 20, 2009 • “FAS 157: Changes to Market Value Accounting as a result of the ‘Credit Crunch,’” Association of Insolvency and Restructuring Advisors’ panel, January 6, 2009 • “Accounting for Fair Value in the Subprime Market Meltdown,” Financier Worldwide, November 2008, and INSOL electronic newsletter, December, 2008 • “The Role of Valuation in Corporate Restructuring,” Financier Worldwide, June 2008 • “Valuation and Solvency Analysis in Failing Firm Claims.” 2008 International Mergers & Acquisitions ebook, Financier Worldwide, May 2008 • “Regulations and Synergies in Utility Mergers.” Financier Worldwide, October 2007 • Lessons Learned from M&A in 2006, 4th Annual Platt’s Utility M&A Conference, June 26, 2007 • Information Exchange, Merger Synergies, and the Failing Firm Defense; IncreMental Advantage’s Mergers & Acquisitions Due Diligence Conference, October 16, 2006 • M&A Transaction Drivers & Trends; 3rd Annual Platt’s Utility M&A Conference, June 26, 2006 Mergers, acquisitions, and joint ventures Acquirer Target Transaction App. Value Shell Oil Company Texaco, Inc. Joint venture of Midwestern and $17,000,000,000 Western refining /marketing operations Exelon Corporation Public Service Enterprise Group Merger $12,685,000,000 Time Warner, Inc. Turner Broadcasting System, Inc. Merger $11,900,000,000 Verizon Communications, Inc. MCI, Inc. Acquisition $8,500,000,000 Page 18 of 21 Boris J. Steffen, CPA, ASA, ABV, CDBV, CGMA Mergers, acquisitions, and joint ventures (continued) Acquirer Target Transaction App. Value Ultramar Diamond Shamrock Corporation Phillips Petroleum Company Joint Venture of refining, marketing, & transportation operations $8,000,000,000 Marathon Oil Co. Ashland Petroleum Co. Joint Venture of refining, $7,000,000,000 marketing, & transportation operations First Data Corporation First Financial Management Merger $6,600,000,000 Xerox Corporation Affiliated Computer Services, Inc. Acquisition $6,400,000,000 Martin Marietta Materials Inc. Vulcan Materials Inc. Acquisition $4,700,000,000 Reed Elsevier ChoicePoint, Inc. Acquisition $4,100,000,000 Staples, Inc. Office Depot, Inc. Merger $3,967,000,000 Grifols S.A. Talecris Biotherapeutics Holdings Corp. Acquisition $3,630,000,000 Cardinal Health, Inc. Bergen Brunswig Corporation Merger $2,800,000,000 Koninklijke Ahold NV Giant Food Inc. Acquisition $2,600,000,000 Tele-Communications, Inc. Time Warner, Inc. Acquisition of minority interest via TWX/TBS exchange offer $2,400,000,000 McKesson Corp. AmeriSource Health Corp. Merger $2,250,000,000 Pennzoil Company Chevron Corporation Acquisition $2,100,000,000 Page 19 of 21 Boris J. Steffen, CPA, ASA, ABV, CDBV, CGMA Mergers, acquisitions, and joint ventures (continued) Acquirer Target Transaction App. Value Comcast Corporation Tele-Communications, Inc. QVC, Inc. Joint Acquisition $1,316,900,000 First Financial Management Corporation New Valley Corporation Acquisition of Western Union Financial Services, Inc. $1,159,000,000 JBS SA National Beef Packing Company Acquisition $970,000,000 R.R. Donnelley & Sons Meredith Corporation Acquisition of Meredith/Burda printing plants $536,500,000 Allied Signal, Inc. Textron, Inc. Acquisition by Allied Signal Engines of Lycomming Turbine Engine Division $375,000,000 Armstrong World Industries, Inc. Sommer Alibert S.A. North American floor covering business $353,000,000 Borg-Warner Automotive Inc. Eaton Corporation Acquisition of Eaton Corp Fluid Power Division $310,000,000 CompUSA Tandy Corporation Computer City Divestiture of subsidiary $275,000,000 Ozite Corporation Occidental Divestiture of Burlington, NJ $104,000,000 Borden Chemicals & Plastics LP Petroleum and Addis, LA PVC plants Jones Intercable, Inc. Intermedia Partners, III L.P. Acquisition of CATV assets $96,000,000 Litton Industries, Inc. Imo Industries, Inc. Acquisition by Litton Systems of Electro-Optical Systems $70,700,000 Israel Chemicals LTD Olin Corporation Divestiture of isocyanurate manufacturing and pool sanitizer tableting and packaging plants $55,000,000 Page 20 of 21 Boris J. Steffen, CPA, ASA, ABV, CDBV, CGMA Mergers, acquisitions, and joint ventures (continued) Acquirer Target Transaction App. Value Sara Lee Corporation Reckitt & Colman PLC Kiwi Brands, Inc. acquisition of Meltonian, Griffin & Magix shoe care brands $25,800,000 Ferro Corporation Sara Lee Corporation Chi-Vit Corporation Papercraft Corporation Acquisition Acquisition by Kiwi Brands, Inc. of the Esquire shoe care brand $20,000,000 $14,500,000 Foodmaker, Inc. Consul, Inc. Leveraged acquisition by Chi Chi’s of Consul, Inc. restaurants $12,700,000 Aqua Clear Industries Olin Corporation Divestiture of the Sun Brand of swimming pool chemicals $3,000,000 All American Bottling Company PepsiCo, Inc. Divestiture of Twin Ports SevenUp $1,750,000 Federal News Service Group, Inc. News Transcripts, Inc. Acquisition of Current News transcript business n/a C II Acquisition, Inc. Brown Bridge Corporation Leveraged acquisition n/a Butterick Company McCall Pattern Corporation Leveraged acquisition n/a Page 21 of 21