Energy and the Environment

advertisement

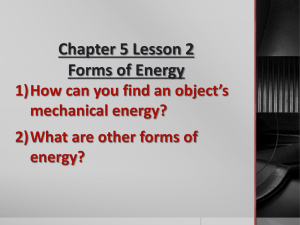

Energy and the Environment: Policy Advice for the New Administration The Matrix Jeffrey Frankel Harpel Professor for Capital Formation and Growth, Harvard Kennedy School Joint session of the American Economics Association and the Association of Environmental & Resource Economists San Francisco, January 3, 2009 The Principle of Targets and Instruments 2 Targets & instruments • Politicians are tempted to think that a policy to help one environmental goal will also help other environmental goals, and sometimes even non-environmental goals -- that it will be “good for everything.” (E.g., Porter hypothesis.) • Economists tend to presume tradeoffs, and the principle of targets & instruments, – which says you cannot expect to hit more than one bird with one stone, except by coincidence. • Examples go either way. 3 My favorite example of hitting several birds with a single stone is a gas tax. I claim this one instrument hits 7 targets: • • • • • • • Traffic congestion (time lost) Traffic accidents Local air pollution (including health benefits) Global climate change National security (cutting oil import dependence) Trade deficit (oil imports are a big component) Budget deficit, or else use revenue from a higher gas tax to reduce other distortionary taxes (fix AMT or eliminate payroll taxes on low-income American workers). 4 But my main point: independent policy instruments have independent effects. A policy measure that helps one goal might hurt another. • An example of an initiative that successfully addressed one important environmental goal with the side effect of making another worse: the Montreal Protocol. – It successfully addressed stratospheric ozone depletion, – but banning CFCs led to substitution of HFCs and (worse) PFCs, which are Greenhouse Gases (GHGs). 5 Another example, • arousing greater passion: whether to start building nuclear power plants again. – On the plus side, nuclear power is an energy source that does not create GHGs; – on the minus side, nobody wants to store the nuclear waste in their state. • Even the national security implications go both ways: – on the plus side it helps reduce dependence on imported oil, – on the minus side, nuclear plants in other countries increase proliferation risk. 6 • Government in practice makes major decisions in largely independent policy processes (“stovepipes”). • We need an overarching framework such as the matrix I am now suggesting. – Across the top are the labels of columns each of which represents a different objective: – Down the side are the labels of rows each of which represents a different policy instrument. 7 Objectives → Policy Measures ↓ GHG measures, Miti- Clean Cut gate Air traffic GCC Natnl. Species Taxes/Budget Water Secur- Habitat & & Econ. Bio-diversity ity efficiency + + + + +/- Long run - - - + - _ Coal-to-liquids - - - + e.g., energy taxes * Drill Medium Run Ethanol Subsidies - - Help Everglades; Hurt Amazon? + + + + + + End import quotas on Brazil sugar + + + + R&D + + + + Forestation (vs.ag.) + + Ban fossil fuel subsidies + + + + SPR: Short Run + - + - + - + + + + - + Long Run Nuclear 8 * Measures to reduce GHG emissions include a wide variety of possible policies -• Domestic measures include: – Tightened CAFE standards – Subsidy of renewables – Price • • • • Cap & trade for power sector Oil tax Gas tax Carbon tax • Effects of some differ from others’. Thus they cannot all be captured by the single first row. • Any measure to cut GHGs would of course more likely help slow GCC if undertaken as part of a multilateral successor to the Kyoto Protocol. 9 Most of these GHG measures would also work in the same direction with respect to local air pollution, traffic congestion, accidents, and improving national security. • But CAFE standards – – as other performance standards or “command & control” policies, are an inefficient way to attain a given environmental goal, and so should receive a “minus“ in the Economic Efficiency column. – The decision to grant more lenient standards to “light trucks” probably allowed the SUV craze, thereby perversely worsening emissions and increasing congestion & traffic accidents. 10 GHG measures continued – Alternative energy sources (wind, solar, nuclear & hydro…) would help plug-in hybrids come in on a mass scale, reducing tailpipe emissions. • But they (like R&D to improve gas mileage) would continue the trend toward higher miles driven, and thus have adverse effects in the “Traffic congestion & accidents” column. – Subsidies to renewables of course have a negative effect on the budget. – Most of the other measures, however, could both correct a distortion & raise revenue. – Hence the “+/-“ entry in 2nd-to-last column. 11 Using the table for policy-making – In principle, the President should choose simultaneously a combination of policy measures that are listed along the left column, so as to attain the goals along the top. – Technically, it is a matter of formulating a big objective function, and then solving Lagrangian equations (or linear programming, if environmental constraints are absolute) – Of course one could debate the signs of some entries – I particularly welcome such a discussion – and one could add some additional policy measures & goals. – But this sort of framework is the appropriate approach, 12 not the “stove pipe” approach government uses. Let’s move to today’s policy context, January 2009 • Priority #1 for the new Administration will be a fiscal stimulus package. • Making it “green” is a good idea, so long as it doesn’t lead to wasteful spending in the name of the environment (like synfuels, corn-based ethanol....) • Try to (1) disburse quickly, but (2) commit now to reinstate fiscal discipline in future • So (1) spend green in 2009 (E.g., money to states to keep public transit in operation) (2) tax green in future years 13 Current political context, cont. • If the President issues an endangerment finding for CO2, it would tie up progress with litigation and accomplish little – R.Stavins • A top principle should be measures to raise gradually the price of energy/carbon • Decide today to raise future energy taxes 14 Three ways to make energy tax more palatable politically 1. Commit to a future path of gradual tax rise 1. Micro: right signal. 2. Macro: upward price trend not unwelcome at time of deflation threat 2. Commit to a floor under domestic fuel prices at current levels. 1. The political resistance is to change. 2. Floor would make low-energy investments profitable. 3. If another 9/11 happens (g.f.), when the public asks how it can sacrifice, answer not “go shopping,” but “oil tax/tariff.” 15 16 Appendix: In two places, I have distinguished the long run from a shorter or medium run 1. The Cheney-McCain policy of “drill, baby, drill,” i.e., free up oil leases in ANWR & other federal lands, and allow a resumption of offshore drilling. Leases are often given to industry at below-market rates, even aside from a premium for externalities -- inefficient economically. Drilling has received a new “lease on life” in the name of national security, especially after record high oil prices in 2008. – In the short run, new exploration & drilling will have little effect, because the start-up time is at least 10 years. – In the medium run, I have scored drilling a “plus” for national security: oil flow reduces (slightly) our vulnerability to political risks among Gulf or other oil producers. – But in the long run, I have scored it a national security “minus”: if the worst were to happen and the West were cut off from the Gulf for a prolonged period of time, we would have already drained the last drops from domestic oil reserves. 17 2. The SPR • I have assumed that a federal policy of adding to the Strategic Petroleum Reserve – would raise the price of oil a little in the short run (with positive environmental effects), whereas – it would lower the price of oil a little in the long run (with negative environmental effects, but positive national security implications). • Some economists would argue that government stockpiles simply displace private stockpiles. – But this argument neglects the political economy facts of life: there is no way that a government can credibly commit that in the event of a future shock that raises the price of oil to $300 a barrel it will allow private stockpilers 18 to keep the full “windfall profits” accruing to them.