Managerial Accounting Chapter 2

advertisement

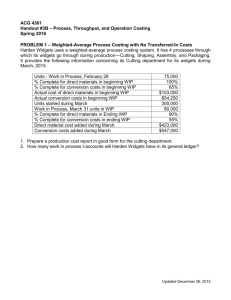

Chapter 4 Job Costing Concepts Prepared by Diane Tanner University of North Florida Methods of Tracking Product Costs Job Costing Process Costing Homogeneous products manufactured Costs are traced or allocated to each process Examples: Dog food, cereal, canned vegetables, bottles of beer Operation Costing 2 Manufactured to order Costs are traced or allocated to jobs Separate cost records for each distinct ‘job’ or batch Examples: Patients, printing, buildings, patients, clients Flow of costs is For products with differing materials and similar the same under processes all methods: Material costs are traced while RM → WIP → conversion costs are allocated FG → CGS Overview of Job Costing Also called job order costing Appropriate for production of Tangible items—ships, bridges, cabinets, etc. Services—tax returns, lawn care, divorce cases, etc. Involves costs accumulated by ‘job’ usually for a particular order or batch • Normal costing used to apply MOH – Applied using a predetermined OH rate based on actual activity 3 4 Job Costing Accounting General ledger One WIP ‘control’ account Subsidiary ledger Used with job costing systems to track the individual job costs Consists of multiple job cost sheets One account/job cost sheet for each job Used to track/capture costs of a job Reconcile at end of period Totals of all costs posted to each 'job' in the subsidiary ledger = Total amounts posted to the control account in the general ledger Tracking Job Costs Job cost sheet Primary document for tracking individual job costs Direct Materials Traced from materials requisition forms Job Cost Sheet Job Number A - 143 Department B3 Item Wooden cargo crate Date Initiated March 3 Date Completed Units Completed Direct Materials Direct Labor Req. No. Amount Ticket Hours Amount Manufacturing Overhead Hours Rate Amount Cost Summary Direct Labor Traced from time tickets Direct Materials Direct Labor Manufacturing overhead Total Cost Unit Cost Manufacturing Overhead Applied using a predetermined rate 5 6 Subsidiary Ledger Individual costs are posted to each job in the WIP subsidiary ledger. The total of direct material, direct labor, and overhead applied is posted to the WIP control account. WIP Control 1,360 2,110 2,265 1,812 WIP - Job 27 800 570 450 360 WIP - Job 28 560 440 840 672 5,687 2,180 2,512 1,860 0 0 WIP - Job 30 WIP - Job 31 780 600 480 320 375 300 995 1,860 0 The balance of the WIP control account must equal the balance of the jobs in the WIP subsidiary ledger. 7 Job Cost Example Sanja Enterprises uses job costing and applies overhead based on machine hours. Sanja’s budgeted annual information follows: Direct labor cost Factory overhead Machine hours 14,800 hours @ $14.60 per hour $248,492 8,875 machine hours Actual data for Job #178 Direct materials requisitioned $400 Direct labor hours 70 hours @ $15.20 per hour Machine-hours 42 machine hours Actual direct labor cost for all jobs for the entire year totaled $220,200. Actual annual manufacturing overhead cost was $247,000. Actual machine hours for all jobs for the entire year totaled 96,050. Show the calculation of the total cost of Job 178. POHR = $248,492 = $28.00 per machine hour 8,875 DM DL (70 x $15.20) MOH ($28 x 42) Total job cost $ 400 1,064 1,176 $2,640 The End 8