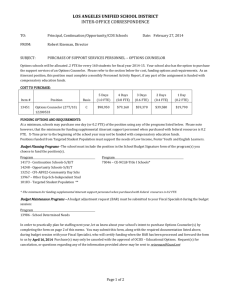

FTE from Systemwide Perspective

advertisement

FTE from a SW Perspective Sherry Pickering Year-End Legal Training May 2010 What is FTE? • Full Time Equivalent (FTE) • Statistic required to be reported with all Salary FIRMS Object Codes, except for 601301Overtime • Payroll transactions fed from the Human Resources module are posted in the Finance module with FTE • The payroll expenses for one employee are posted with an FTE of one each month Preparation Schedules for the State • The FTE from FIRMS is used for the annual reporting of Salaries and Wages to the State Department of Finance. • The published CSU Salaries and Wages with FTE includes detail for past year, current year and budget year by campus, program code and FIRMS Salaries and Wages object codes. May 2010 Year-End Legal Training 3 May 2010 Year-End Legal Training 4 FTE in Finance • Fed with payroll expenses from Human Resources into Finance monthly. • Manual journal entries to Salary Object codes must be booked with FTE May 2010 Year-End Legal Training 5 Derivation • Payroll expenses are derived using Rule 3, Rule 3b or Rule 4 • A split Rule 4 allocates both dollar amounts and FTE amounts to the indicated program codes May 2010 Year-End Legal Training 6 Derivation Rule 4 May 2010 Year-End Legal Training 7 Ledger Data with NACUBO Program Code May 2010 Year-End Legal Training 8 FIRMS Reporting and FTE • Systemwide receives campus data via the FIRMS submission that is aggregated by unique combinations of CSU fund, Object Code and Program Code • But FTE amount reported to FIRMS is different than the ledger amount May 2010 Year-End Legal Training 9 FIRMS Reported FTE is Annualized • Derived campus data is divided by 12 • Rounded to two decimal places May 2010 Year-End Legal Training 10 .01 is Added when FTE is 0.00 • After the ledger FTE is divided by 12 and rounded, if the calculated amount is 0.00 the program will insert 0.01. • The sign of the 0.01 (+/-) will match the dollars. May 2010 Year-End Legal Training 11 FTE *-1 if FTE and Dollar Sign Disagree • If the calculated FTE and the dollar amount to be reported disagree, calculated FTE amount is multiplied by -1. May 2010 Year-End Legal Training 12 FIRMS Business Rules for FTE • FTE must be reported with Salary Object Codes, 601xxx, except for 601301-Overtime • If there are positive dollar amounts, the reported FTE must be positive. • If there are negative dollar amounts, the reported FTE must be negative. May 2010 Year-End Legal Training 13 FTE Calculations vs. FIRMS Aggregated Reporting • FTE Calculations are performed at the aggregated PeopleSoft Account, Fund, Dept ID, & Program Code • Data aggregated by FIRMS Object Code, CSU Fund and Program Code May 2010 Year-End Legal Training 14 Scenario 1 May 2010 Year-End Legal Training 15 Scenario 1 Outcome Program Added .01 May 2010 Year-End Legal Training 16 Scenario 2 May 2010 Year-End Legal Training 17 Scenario 2 Outcome Program *-1 FTE to flip sign to agree to sign of dollar May 2010 Year-End Legal Training 18 CSU_FIRMS_FILE • Populated by the extract process, it shows the FIRMS file line number along with the campus local Fund, Account and Department that were summarized to create the line. • FTE Amount is reported in the Amount2 field. • FTE Amount is amount reported to FIRMS (i.e. after calculations). May 2010 Year-End Legal Training 19 19 CSU_FIRMS_FILE Table May 2010 Year-End Legal Training 20 20 FTE Review Query Fields May 2010 Year-End Legal Training 21 FTE Review Query Criteria May 2010 Year-End Legal Training 22 FTE Review Query Results May 2010 Year-End Legal Training 23 FTE and FIRMS Errors • Use the CSU_FIRMS_FILE table to find the campus chartfields using the line # from the error message • In a second query over the LEDGER table, use the campus chartfields to determine the adjustment May 2010 Year-End Legal Training 24 FTE FIRMS Error Query 1 Fields May 2010 Year-End Legal Training 25 FTE FIRMS Error Query 1 Criteria May 2010 Year-End Legal Training 26 FTE FIRMS Error Query 1 Results May 2010 Year-End Legal Training 27 FTE FIRMS Error Query 2 Fields May 2010 Year-End Legal Training 28 FTE FIRMS Error Query 2 Criteria May 2010 Year-End Legal Training 29 Activity Periods vs. Accounting Period May 2010 Year-End Legal Training 30 FTE FIRMS Error Query 2 Results May 2010 Year-End Legal Training 31 FTE FIRMS Error Tips • Use the LEDGER query results spreadsheet to determine the amounts to adjust. Don’t forget: • The program will add +/- .01 if calculated FTE is 0.00. • The program will flip the sign of the FTE (*-1) if FTE and dollar direction posted to the ledger do not agree. May 2010 Year-End Legal Training 32 www.calstate.edu May 2010 Year-End Legal Training 33