JUN08-POINCIANA-0900-BCC 2015 Intro to Captives and the

advertisement

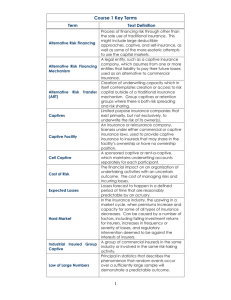

JUN 8 – 10, 2015 Title Slide Intro to Captives www.bermudacaptive.bm Intro to Captives Speakers: Dale Fenwick, President, Sovereign Insurance Services, LLC Adam Rekerdres, Vice President, Rekerdres & Sons Insurance Agency Inc Chiara Nannini, Associate, Conyers Dill & Pearman Limited Moderator: Peter Willitts , President, Liberty Mutual Management Bermuda Ltd Intro to Captives 1.Mid 1980s: Excess Liability market – ACE, XL 2.1960s: Frederic Reiss – Birth of captives in Bermuda 3.1990s: Reinsurance market – Hurricane Andrew 4.New waves of capital • 2001 response to September 11, 2001 • 2005 response to hurricanes • Innovation in Policy Forms, Cell Companies, Captive Pooling and other specialized commercial vehicles, such as SPIs and Sidecars Intro to Captives A Few Facts from 2013: Bermuda Captives wrote $48 Billion in premium They had $59 Billion in capital. Impressive ????? Bermuda Insurers had $448 billion in Assets !!! 32 Bermuda re/insurers write captive business Bermuda is vibrant Largest Captive Market in the world Last year there were also: 28 New SPIs 16 Commercial Insurers 10 Long term license 12 agents 7 Managers 5 Brokers Intro to Captives An Introduction to Captives Dale Fenwick CRM, ARM, MBA, CIC President, Sovereign Insurance Services, LLC Intro to Captives 1. Captive Insurance Overview 2. Fronting 3. Risk Transfer and Risk Distribution 4. Captive Feasibility Study 5. Loss Projections 6. Captive Taxes 7. Domicile Selection 8. Advantages & Disadvantages Intro to Captives 1. What is a Captive a. A captive insurance company is a legal entity created for the purpose of insuring the loss exposures of its owner(s). b. A closely held insurance company whose insurance business is supplied by and controlled by its owners, and in which the insured are the beneficiaries. c. Any insurance company that is owned and controlled by its policyholders(s). Why are they called “captives?” • Fred Reiss • Ohio – 1950s • Youngstown Sheet & Tube Company • Mining operations called “captive” mines • The insurance subsidiary became another form of “captive” operation. • “The policyholder owns the insurance company; therefore, the insurer is captive to the policyholder.” -Fred Reiss Captive Categories 1. Ownership – Who Owns the Captive? 2. Structure – How is the Captive Owned? 3. Policy – How are the Policies Issued? Captive Ownership – Who? 1. Who Owns the Captive? a. Single Owner 1) Single Parent/Pure Captive 2) Economic Family Captive “Pure” Captive (Single Owner) Insured Premiums Policies Underwriting & Investments Profits Captive 12 “Economic Family” Captive Parent Sub 1 Sub 2 Sub3 Sub 4 Sub 5 Premiums Sub 6 Sub 7 Captive Captive Ownership – Who? b. Multiple Owners 1) Group Captive 2) Association Captive 3) Risk Retention Group c. “Related” Owners (3rd Party Risk) 1) Agency Captive 2) “Franchisor” Captive Captive Ownership – How? 2. Ownership Structures 1) Owned Captive 2) Rent-a-Captive a) Protected Cell Company (Guernsey) b) Segregated Account Company (BDA) c) Segregated Portfolio Company (KY) d) Sponsored Captives (VT) Rent-A-Captive CORE (Owned by Sponsor) Cell A Cell B Cell C Cell D Cell E Claims Premiums Cell A Owner Cell B Owner Cell C Owner Cell D Owner Cell E Owner Cell Captive Fees 1. Fixed Annual Fee 2. Variable Fees a. Percentage of Premium b. Percentage of Invested Assets c. Exposure-Based 1. Percentage of Payroll 2. Per Location / Unit 3. Combination (Fixed + Variable) Captive Policies 3. Policy Structures 1) Direct-Write Captive 2) Fronted Captive Direct-Write Captive Program Insured Captive Reinsurer Issues Policy Example: $1 Million Limit Retains Primary Layer Example: First $250,000 of each claim Provides Excess Reinsurance Example: 750,000 x 250,000 19 Fronted Captive Program Insured Commercial Insurer (aka Front) (No Risk) Captive Reinsurer (First 250K) Commercial Reinsurer (750x250) 20 Fronting Fronting – using one insurance company, usually a domestic, admitted carrier, to issue policies that will meet the regulatory and contractual needs of the captive. • Captive reinsures the fronting carrier • Policyholder pays premium to the front • Front cedes premium designated to pay “retained” losses to the captive and purchases “excess” reinsurance from a commercial reinsurer Fronting • Front issues policies and pays losses. • Front recovers claim payments from the captive via a reinsurance contract. • Front provides the use of its license, name, balance sheet, and services in exchange for a fronting fee. • Fronting carrier generally requires security from the captive to insure reimbursement for claim payments. • The front assumes no underwriting risk. Fronting When to use a front • Licensed (Authorized) Policy • Workers Compensation • Auto Liability • CGL (if required for permits, etc…) • Rated Paper (AM Best) What is an Insurance Company? Court rulings require the “commonly accepted notion of insurance,” which include, but are not limited to: • Sufficiently capitalized (5:1 Surplus Ratio Max) • Formed for non-tax business reasons • Premiums are charged at an arms-length rate • The activities of the company should be typical of commercial insurance enterprises • Risk Transfer and Risk Distribution Risk Transfer 1. Is the Present Value of the Benefit (limit) greater than the Premium? Example: $1 Million Premium for $1 Million Limit 2. Whose Balance Sheet suffers the impact of a claim? Risk Transfer Business Owner(s) Premiums Operating Company Policies & Claim Payments Captive Insurance Company Risk Distribution – Pre-2015 Revenue Ruling 2005-40 • 12 Subsidiaries – 12 Policies • No One Policy > 15% of Premium Risk Distribution – Pre-2015 Business Owner(s) OC 2 OC 1 OC 4 OC 3 OC 6 OC 5 OC 7 OC 8 OC 10 OC 9 OC 12 OC 11 Captive Insurance Company Risk Distribution – Post 2014? Rent-A-Center • Bermuda captive • 15 brother-sister companies • 66% of premium in one of the companies • Tax Court focused on exposure units not the number of entities o 3,000 stores o 15,000 employees o 8,000 vehicles Risk Distribution – Post 2014? Securitas • • • • • • Vermont captive 11 brother-sister companies in 2003 4 brother-sister companies in 2004 90% of premium in 4 companies in 2003 90% of premium in one company in 2004 “It is the pooling of exposures that brings about the risk distribution--who owns the exposures is not crucial.” - Dr. Neil Doherty • The captive “was exposed to.” a large pool of statistically independent risk exposures.” Step 1: Feasibility Study Step 2: Select Domicile Step 3: Form Company Step 4: Obtain License 1. Cost of Risk Analysis a. Analysis of Historic Loss and Exposure Data b. Retention Selection (Stratification Analysis) c. Projected Losses Number of Percent in Cummulative Loss Interval Losses Interval Percentage $0 to $25,000 2,372 94.7% 94.7% $25,000 to $100,000 126 5.0% 99.7% $100,000 to $250,000 5 0.2% 99.9% $250,000 to $500,000 2 0.1% 100.0% $500,000 to $1,000,000 0 0.0% 100.0% > $1,000,000 0 0.0% 100.0% Totals 2,505 100.0% Loss Interval $0 to $25,000 $25,000 to $100,000 $100,000 to $250,000 $250,000 to $500,000 $500,000 to $1,000,000 > $1,000,000 Losses Percent in Cummulative ($) Interval Percentage 4,810,000 45.2% 45.2% 4,200,000 39.4% 84.6% 875,000 8.2% 92.8% 762,000 7.2% 100.0% 0 0.0% 100.0% 0 0.0% 100.0% Total Severity Ultimate Inflation Year Incurred Development Total Index ($) Factor Losses ($) 2010 2011 2012 2013 2014 125,986 469,091 386,550 291,555 357,171 1.00 1.11 1.30 1.57 2.51 125,986 520,691 502,515 457,741 896,449 1.76 1.57 1.41 1.25 1.12 Inflation Indexed Losses 221,987 819,568 706,034 574,007 1,004,023 Year Developed Employees & Indexed (Exposure) Losses Loss Rate 2010 2011 2012 2013 2014 221,987 819,568 706,034 574,007 1,004,023 449 1,532 1,300 1,040 1,777 494 535 543 552 565 Average Loss Rate = $1,220 per Employee 2015 Projected Employees = 589 Projected Losses = 589 x 1,220 = $718,000 1. Cost of Risk Analysis a. Analysis of Historic Loss and Exposure Data b. Retention Selection (Stratification Analysis) c. Projected Losses 2. Administrative (non-Loss) Expenses a. Domicile Fees (Fixed Costs) b. Policy-Related Fees (Variable Costs) c. Taxes Captive Administrative Costs Annual Domicile Fees (Fixed Costs) Captive Management $10,000 to $50,000 Audit Fees $10,000 to $50,000 Actuarial Fees $5,000 to $50,000 Government Fees $5,000 to $15,000 Legal Fees $1,000 to $10,000 Meeting Costs $1,000 to $100,000 Misc. $5,000 to $20,000 Total $50,000 to $150,000 Captive Administrative Costs Policy-Related Fees (Variable Costs) Fronting 5% to 15% TPA 2% to 8% Premium Taxes 2% to 5% Commissions 2% to 10% Consulting 2% to 5% Misc. 1% to 3% Total 14% to 46% 1. U.S. Federal Income Tax • 831(a) Tax on underwriting income (>1.2 M) • 831(b) Tax only on Investment Income (<1.2M) Note: To be eligible to make the 831(b) election the entity must be an Insurance Company in the eyes of the IRS… Federal Income Tax Comparison Extreme Example – Zero Losses Premium Administrative Expenses Losses Underwrting Profit Investment Income Net Income 831(a) 1,100,000 100,000 1,000,000 100,000 1,100,000 831(b) 1,100,000 100,000 1,000,000 100,000 1,100,000 Taxable Income Taxes After Tax Income 1,100,000 (374,000) 726,000 100,000 (34,000) 1,066,000 1. Federal Income Tax • 831(a) Tax on underwriting income (>1.2 M) • 831(b) Tax only on Investment Income (<1.2M) 2. Federal Excise Tax – Offshore Captives • Direct Premiums (4%) • Assumed Insurance (1%) 3. Premium Taxes • Onshore Domiciles = 0% to 0.5% • Offshore Domiciles = 0% 4. Direct Procurement Taxes • 5.0% in many states Captive Premium Tax Rates Domicile Arizona Utah Oklahoma Delaware District of Columbia Hawaii Missouri Vermont Montana South Carolina Tennessee Nevada Kentucky Texas Direct Procurement 3.00% 4.25% 6.00% 2.00% 0.00% 4.68% 5.00% 3.00% 2.75% 0.00% 0.00% 3.50% 2.00% 4.85% Captive Premium 0.00% 0.00% 0.20% 0.20% 0.25% 0.25% 0.38% 0.38% 0.40% 0.40% 0.40% 0.40% 0.40% 0.50% Minimum $5,000 $5,000 $5,000 $5,000 $7,500 $7,500 $7,500 $5,000 $5,000 $5,000 $5,000 $5,000 $7,500 43 1. 5-Year Pro Forma Financial Statement 2. Risk Transfer Analysis 3. Risk Distribution Analysis 4. Non-Tax Business Purpose 5. Captive Ownership Structure 6. Capital Structure 7. Reinsurance Structure 8. Domicile Recommendations Captive Domicile Selection 1. Domicile – The jurisdiction that issues a license and is responsible for regulating the captive insurance company. Established Domiciles 2014 Captive Activity Domicile Bermuda Cayman Vermont Utah Delaware Hawaii Montana Nevada South Carolina Kentucky DC Arizona Jan 841 758 588 343 298 184 150 148 145 128 126 106 New 16 22 16 106 87 15 34 26 20 5 13 Closed 16 21 17 25 52 5 7 9 5 6 6 5 Dec 841 759 587 424 333 194 177 165 160 122 125 114 Growth 0% 0% 0% 24% 12% 5% 18% 11% 10% -5% -1% 8% 47 Emerging Domiciles 2014 Captive Activity Domicile Jan New Closed Dec Growth North Carolina 4 49 0 53 1,225% Tennessee 29 43 0 72 148% Oklahoma 10 37 0 47 370% Missouri 35 12 0 47 34% Texas 0 12 0 12 NM Connecticut 4 3 0 7 75% New Jersey 14 3 0 17 21% Total 96 159 0 255 166% 1. Capitalization required 2. Surplus required 3. Premium Taxes 4. Ownership structure 5. Reserving requirements 6. Regulatory environment 7. Meeting requirements 8. Investment regulations 9. Geographic convenience 10. Offshore v. onshore Step 1: Feasibility Study - 30 to 90 Days $20,000 to $30,000 Step 2: Select Domicile - 0 to 10 Days Step 3: Form Company – 10 to 30 Days $5,000 to $10,000 Step 4: Obtain License - 30 to 60 Days $10,000 to $20,000 Use a Rent-a-Captive facility. Still need a Feasibility Study. 10 to 30 days from post-Feasibility Study decision 1. Reduced Long-term Total Cost of Risk 2. Stabilize Premium & Availability 3. Greater Control Over Claims 4. Tailored / Increased Coverage 5. Investment Income 6. Direct Access to Reinsurance Markets 1. Risk of Loss 2. Initial Capital Investment 3. Formation Time 4. Runoff Time 5. Long-term Commitment 1. >$1 Million Premium 2. “Good” Loss Ratios 3. “Good” Risk Management Programs 4. Risk Tolerance 5. Predictable Losses 6. Limited Choices for Coverage 7. Funds for Capitalization 8. Long-Term Outlook Working Example Mr. Adam Rekerdres, MBA, CIC, ACI Captive Benefits Cost Coverage Capacity Control • Benefit of positive loss experience • Reinsurance • Cost Allocation • Reduced volatility • Tailored • Uninsured Risks • DIC • Access to Reinsurance Market • Good faith to primary insurers • Claims • Service Provider • Focused Risk Management • Enhanced Loss Control & Prevention Captive Considerations Claims Costs Regulatory Fronting • Impact of adverse claims experience • Start up costs • Operating costs • Capitalization costs • Some countries don’t allow non-admitted insurance • Special non-admitted taxes • An additional cost • Collateral requirement • Financial information Real World Examples 1. Corporate Visibility 2. Management Attention 3. Market Flexibility Real World Examples Before… • Global properties “insured” internally Assets = $75mil After • Global properties insured by captive Assets = $125mil Real World Examples Other Benefits… • formalized claim history • formalized history of risk improvements • quick notifications from local mangers Real World Examples Management Attention to Claims “Turn on the lights and the cockroaches run” • How quickly can you get the director’s attention when the captive insurance company is running a loss? Real World Examples Market Flexibility Have the flexibility to assume more risk when the market is hard and less risk when the market is soft. Real World Examples Ocean Marine Cargo ($35mil Building, $30mil Vessel, no limit #) Global Liability Excess Property Program $60,000,000 Global Liability Various Deductibles Various Deductibles Real World Examples Ocean Marine Cargo ($35mil Building, $30mil Vessel, no limit #) Global Liability Excess Property Program $60,000,000 Captive Insures US$2mil Deductible Captive Self Insures Captive Insures $1mil Deductible Real World Examples Ocean Marine Cargo Captive takes $5mil x of $10mil ($35mil Building, $30mil Vessel, no limit #) Global Liability Excess Property Program $60,000,000 Captive Insures US$2mil Deductible Captive Self Insures Captive Insures $1mil Deductible Real World Examples Before After Place Title Here Overview Legal & Governance Issues Chiara T. Nannini Conyers Dill & Pearman Limited Key Governing Statutes 1. Companies Act 1981 2. Insurance Act 1978 - Insurance Accounts Regulations 1980 - Insurance Returns & Solvency Regulations 1980 (together, the “Regulations”) 3. Segregated Accounts Companies Act 2000 (for segregated account companies) Insurance Act – License Classifications 1. General Business a. Classes 1, 2 & 3 – Captives b. Classes 3A, 3B, 4 – Commercial 2. Long Term Business (annuity, life accident & health) a. Classes A&B – Captives b. Classes C, D, E – Commercial 3. SPIs (insurer fully funds liabilities through a debt issuance or some other approved financing mechanism) Segregated Accounts Any general business or long-term insurer wishing to operate segregated accounts may apply to be registered under the Segregated Accounts Companies Act 2000 (the “SAC Act”). Process to Establish a Company in Bermuda 1. Application to incorporation / amalgamate / merge/ continue into Bermuda / register under the SAC Act is made to the Registrar of Companies. 2. Beneficial owners (10%+ beneficial owners) are vetted by the lawyers and approved by the Bermuda Monetary Authority (in accordance with the Exchange Control Act 1972). 3. Application to incorporate can be made separately from the insurance license application (before or after), but is often made in tandem. 4. For amalgamations / mergers / continuances / SAC registrations, completion of the transfer may not occur until the BMA provides its no-objection to the Registrar of Companies. Registration under the Insurance Act Pre-Licensing Considerations 1. Decisions made to form captive / re-domicile into Bermuda 2. Consideration given to class of captive 3. Selection of service providers: a. Insurance managers b. Lawyers c. Auditors d. Banker e. Actuary / Loss Reserve Specialist Registration under the Insurance Act Pre-Licensing Documentation Consists of: 1. Business Plan 2. 5 year pro-forma financials (Balance Sheet and Income Statement) 3. Pre-Incorporation Form (for registration as an insurer) 4. Parent company financial statements 5. Resumes (senior management / directors) 6. Acceptance letters for service providers 7. SAC Form 1 (if applying for SAC registration) Registration under the Insurance Act Pre-Licensing Application 1. Application filed with BMA by 5:00 p.m. on Monday prior to Assessment and Licensing Committee consideration at their weekly meeting the following Friday. 2. Four possible outcomes: a. Approved b. Approved, but subject to [x] c. Deferred d. Declined Organising the Company (A) Meetings to be held: a. Provisional Meeting b. Statutory Meeting c. First Board Meeting (B) Items to be approved: a. Approval of service providers (auditors, insurance manager, principal representative, resident representative, approved actuary / loss reserve specialist etc.) b. Bank account opening c. Bye-laws Formal Insurance License Application • Once required capital is paid into the company, Form 1B (registration application) may be submitted to the BMA. • Insurance license may be issued in three days if application complete. • Captive can start writing business once certificate of registration has been issued. Insurance Act – Main Provisions 1. Minimum Paid – Up Share Capital a. $120,000 for Classes 1, 2 & 3 b. $120,000 for Class A c. $250,000 for Class B 2. Principal Representative and Principal Office / SAC Representative a. All Bermuda insurers are required to maintain a principal office and appoint a principal representative resident in Bermuda (usually the insurance manager). b. SACs must appoint a SAC representative resident in Bermuda. Insurance Act – Main Provisions 3. Independent Approved Auditor All Bermuda Insurers are required to appoint an independent approved auditor who will audit and report on the insurer’s statutory financial statements and statutory financial returns. 4. Actuary / Loss Reserve Specialist (LRS) • Class A& B insurers must appoint an approved actuary – must be an individual – responsible for preparing the actuary’s certificate filed with the annual statutory return. • Class 2 and 3 insurers (and Class 1s if required by the BMA) must appoint an approved loss reserve specialist – must be an individual- responsible for preparing the LRS opinion in respect of company’s loss and loss expense provisions in its annual statutory return. Insurance Act – Main Provisions 5. Statutory Financial Statements and Returns a. Every insurer must prepare annual audited statutory financial statements and submit to the BMA with its statutory financial return. b. Rules and guidance for preparation are set out in the Regulations. c. Statutory financial statements not prepared in accordance with GAAP. d. The statutory financial statements and statutory return are not public documents. An insurer is also required to submit, at the same time as it files its statutory financial statements, a declaration of compliance declaring whether or not that insurer has, with respect to the preceding financial year, (i) complied with the minimum criteria applicable to it, and (ii) compiled with its minimum solvency margin and enhanced capital requirement (if applicable) as at its financial yearend. Insurance Act – Main Provisions 6. Minimum Solvency Margin An insurer’s statutory assets must exceed its statutory liabilities by an amount greater than its prescribed minimum solvency margin. 7. Minimum Liquidity Ratio (MLR) Every general business insurer must maintain the value of its relevant assets at not less than 75% of the amount of its relevant liabilities. Insurance Act – Main Provisions 8. 9. Restrictions on Dividends and Distributions a. A company may not declare or pay a dividend or distribution if it is in breach of its MSM (or MLR for general business) of if declaration or payment would cause such as breach. b. Any company that fails to meet its MSM (or MLR for general business) on the last day of any financial year is prohibited from declaring or paying any dividends during the next financial year without BMA consent. Restrictions on Reduction of Capital a. No Bermuda insurer may reduce its total statutory capital (as per previous year’s financial statements) by 15% or more without prior BMA approval. Insurance Act – Main Provisions 10. Insurance Code of Conduct All Bermuda insurers must comply with the Insurance Code of Conduct. - Designed to ensure sound corporate governance, risk management and internal controls are implemented. - Captive insurers should be mindful of the proportionality principle in establishing a sound corporate governance, risk management and internal controls framework. Captive Governance What is Corporate Governance? • A system of rules, practices and processes by which a company is directed and controlled. • Per the Insurance Code of Conduct, every insurer must establish and maintain a sound corporate governance framework. The framework should have regard for international best practice on effective corporate governance. Corporate governance includes principles on corporate discipline, accountability, responsibility, compliance and oversight. • Every insurer is required to implement such corporate governance policies and processes as the BMA deems appropriate given the nature, size, complexity and risk profile of the company in question. The insurer is also required to appoint such number of non-executive directors as it considers appropriate having regard to its circumstances and the nature and scale of its operations. The Role of the Directors • Directors manage the affairs of the company – “mind and will”. • Appointed by the shareholder(s) on an annual basis. • Powers generally derive from the constitutional documents of a company e.g. bye-laws. • Cannot act outside powers – a company may be able to recover from its directors any loss to the company arising from acts of the directors which constitute a breach of their duties to the company. • Duties are generally owed to the company, not individual shareholders. Board Meetings • Notice – generally, any director may call a Board meeting at any time on reasonable notice. • Quorum – usually 2. • Voting - one man/one vote. - resolutions are passed by simple majority. - if allowed in the bye-laws, the chairman may cast a tie-breaker vote. • Personal Interests – whenever a director has a personal interest in the business of the Company, he must declare it to his co-directors at the first board meeting where the matter is discussed. • Written Consents – anything done at a Board meeting can be done by the unanimous written consent of the directors (often called a UWR). Directors Duties Fiduciary Duties • A duty to act in good faith in the best interests of the company (and not for any collateral purpose). • A duty to exercise powers for a proper purpose. • A director must not put himself in a position where there is an actual or potential conflict between his personal interest and his duty to the company. • A director must not take a personal profit from opportunities that result from his directorship. Directors Duties Duty of Skill and Care • A director must exercise the care, diligence and skill that a reasonably prudent person would exercise in comparable circumstances. • A director must diligently attend to the affairs of the company, but he is not bound to give continuous attention to the affairs. • A director is entitled to rely on a subordinate put in a position of charge for the express purpose of attending the detail of management. However, directors cannot absolve themselves entirely of their responsibility by delegation to others. Questions? DaleFenwick@Sovereign.ky Chiara.Nannini@conyersdill.com adam@reksons.com Peter.willitts@libertybermuda.com