Managerial Economics - Columbia Business School

advertisement

Managerial Economics

Professor Geoffrey Heal

616 Uris Hall

Phone: (212) 854-6459

e-mail: gmh1@columbia.edu

(note - gmh “one” not “L”)

Course Outline:

(I) Analyzing the structure of a market

Part A: Demand & Supply

Part B: Costs

(II) Pricing (most important part of course)

(III) e-con.com (application and review)

(IV) Foundations of Strategy

Analyzing the Structure of a Market

Aim: to understand key aspects of markets:

nature of demands for the products

closeness or otherwise of competitors

structure of costs

dependence of profits on the level of output

Material to be covered:

Analysis of demand

– demand curves,

– price, income & cross elasticities of demand

– use of demand parameters in forecasting

Structure of costs:

– fixed & variable costs

– break-even analysis

– opportunity costs and sunk costs

– learning curves & economies of scale.

Pricing

How much product should you produce and what

price should you charge for it?

How can you best segment your market if there are

different types of buyers with different demand

characteristics (e.g., business travelers vs. vacation

travelers, home PC buyers vs. corporate buyers)?

What are the types of pricing schemes available

(e.g., bundling, promotional offers, loyalty bonuses,

volume discounts)?

e-con.com

Applications of market analysis to electronic

commerce

How does the internet affect demand,

pricing, and other aspects of running a

business.

e-commerce business strategies.

Auctions and the internet.

Foundations of Strategy

Interacting with competitors

Anticipating their reactions

Forecasting the final outcome when

everyone has reacted.

Aim of Course

To teach you to use basic economic ideas in

making business decisions.

Decisions about opening and closing

businesses.

Decisions about pricing and other policies.

Level of Course

Emphasis on understanding concepts and

where and how they can be used.

Don’t aim to make you an economist, but an

intelligent consumer of economics.

Evaluate and understand works of

consultants, staff. Ask the right questions.

Recognize BS when you see it!

Consumption & Price of Copper

1880-1998

Profit margin

1999/2001

Operating margin

1999/2001

MSFT

40.0%/30.5%

49.5%/46.3%

INTC

25%/17.7%

34.2%/20.7%

CPQ

1.5%/0.8%

2.4%/1.2%

DELL

7%/6.7%

9.9%/8%

Compare Internet companies

eBay

AOL

Yahoo

Amazon.com

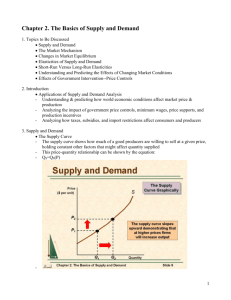

Demand and Supply

Demand Curve

Shows amount purchased as a function of price

Depends on:

- income

- tastes

- prices of competitive products

- prices of complementary products

Supply Curve

Amount offered for sale as a function of price

Depends on costs of production, which in turn

depend on

- costs of inputs

- technology

The Market Mechanism

Price

($ per unit)

S

The curves intersect at

equilibrium, or marketclearing, price. At P0 the

quantity supplied is equal

to the quantity demanded

at Q0 .

P0

D

Q0

Quantity

The Market Mechanism

Characteristics of the equilibrium or market

clearing price:

QD = QS

No shortage

No excess supply

No pressure on the price to change

Demand Curve -Income Rises

Demand Shifts

Supply shifts

D & S shift

The Market Mechanism

Price

($ per unit)

S

Surplus

P1

Assume the price is P1 , then:

1) Qs : Q1 > Qd : Q2

2) Excess supply is Q1:Q2.

3) Producers lower price.

4) Quantity supplied decreases

and quantity demanded

increases.

5) Equilibrium at P2Q3

P2

D

Q1

Q3

Q2 Quantity

The Market Mechanism

A Surplus

The market price is above equilibrium

There is excess supply

Producers lower prices

Quantity demanded increases and quantity

supplied decreases

The market continues to adjust until the

equilibrium price is reached.

The Market Mechanism

Price

($ per unit)

S

Assume the price is P2 , then:

1) Qd : Q2 > Qs : Q1

2) Shortage is Q1:Q2.

3) Producers raise price.

4) Quantity supplied increases

and quantity demanded

decreases.

5) Equilibrium at P3, Q3

P3

P2

Shortage

Q1

Q3

D

Q2 Quantity

The Market Mechanism

Shortage

The market price is below equilibrium:

There is a shortage

Producers raise prices

Quantity demanded decreases and quantity

supplied increases

The market continues to adjust until the new

equilibrium price is reached.

The Market Mechanism

Market Mechanism - Summary:

1) Supply and demand interact to

determine the market-clearing price.

2) When not in equilibrium, the market

will adjust to alleviate a shortage or

surplus and return the market to equilibrium.

3) Markets must be competitive for the

mechanism to be efficient.

Consumption & Price of Copper

1880-1998

The Long-Run Behavior

of Natural Resource Prices

Observations

Consumption of copper has increased about a

hundred fold from 1880 through 1998 indicating

a large increase in demand.

The real price for copper has remained

relatively constant.

Changes In Market Equilibrium

S1998

Price

S1900

S1950

D1998

D1950

D1900

Quantity

Changes In Market Equilibrium

Conclusion

Decreases in the costs of production have

increased the supply by more than enough to

offset the increase in demand.

Changes In Market Equilibrium

Wage Inequality in the United States

Real after-tax income from 1977 to 1999:

– Rose 40+% for the top 20% of the income

distribution

– Fell 10+% for the bottom 20%

Changes In Market Equilibrium

Question

Why did the income distribution become more

unequal for 1977 to 1999?

Price elasticity of demand:

Measures responsiveness of demand to price.

Defined as E = (DQ/Q)/(DP/P) = (DQ/DP)*(P/Q)

Why is it defined in proportional terms?

- Unit free.

- Scale sensitive.

A negative number.

Q = 8 - 2P or P = 4 - 0.5Q

Elasticity = (DQ/Q)/(DP/P) = (DQ/DP)*(P/Q) = -2*(P/Q)

Elasticity and Pricing

If elasticity is between 0 and -1 then raising

price will raise profits - it will raise revenues

and lower costs.

If elasticity is lower than -1 then raising

price will lower revenues and also costs, so

the effect on profits is not clear.

Moral - never operate where the elasticity is

between 0 and -1.

Relationship between demand,

quantity and revenue:

Q = 8 - 2P

or

P = 4 - 0.5Q

so as revenue R is price times quantity

R = 4Q - 0.5Q2

Revenue rises as price rises

Revenue falls

as price rises

PED = -1

PED = 0

This is a quadratic pointing up.

The slope is:

DR

=4-Q

DQ

which is zero at Q = 4.

Slope is positive for Q<4 and vice versa.

Maximum revenue comes when Q = 4, therefore

P = 2, and max revenue is 8

PED when revenue is maximum

Revenue is max when Q = 4, P = 2.

E = (DQ/Q)/(DP/P) = (DQ/DP)*(P/Q)

So E = (DQ/DP)*(1/2) and

DQ/DP = -2 so E = -2 * 1/2 = -1 when R is

at a maximum.

Cross price elasticity of demand:

The responsiveness of demand for good A to

change in price of good B:

DQA/QA = DQA * PB

DPB/PB

DPB PA

Example:

responsiveness of demand for Dell computers to

prices of Gateway computers

Supply Elasticity

The responsiveness of supply to price

changes.

(DS/S)/(DP/P), proportional change in

supply divided by proportional change in

price.

Usually positive.

Elasticities of Supply and Demand

The Market for Wheat

1981 Supply Curve for Wheat

QS = 1,800 + 240P

1981 Demand Curve for Wheat

QD = 3,550 - 266P

Elasticities of Supply and Demand

The Market for Wheat

Equilibrium: Q S = Q D

1,800 240 P 3,550 266 P

506 P 1,750

P 3.46 / bushel

Q 1,800 (240)(3.46) 2,630 million bushels

Elasticities of Supply and

Demand

The Market for Wheat

ED=(P/Q) (DQD/DP) = (3.46/2630)(-266)= 0.35

ES=(P/Q) (DQS/DP) = (3.46/2630)(+240)= 0.32

Changes in the Market: 1981-1998

The Market for Wheat

Supply (Qs) Demand (QD)

Equilibrium Price (Qs = QD)

1981

1800 + 240P

3550 - 266P

1800+240P = 3550-266P

506P = 1750

P1981 = $3.46/bushel

1998

1,944 + 207P

3,244 - 283P

1,944+207P = 3,244-283P

P1998 = $2.65/bushel

Marginal Revenue

Increase in revenue from one extra sale

Rate of change of revenue with respect to

sales

Typically less than price as demand curve

slopes down

Depends on PED

Marginal Revenue & PED

MR

= P{1 + 1/PED}

Remember PED < 0 so MR < P.

The larger PED as a number the nearer MR is to P

If PED = - 1, then MR = 0. (Top of revenue curve)

…………………………………………

Derivation - dR/dQ = d{P(Q).Q}/dQ

= P + Q*dP/dQ

= P{1 + (Q/P)*dP/dQ}

Income Elasticity of Demand:

Responsiveness of demand to changes in

income

IED = (DQ/Q)/DI/I) = (DQ/DI)*(I/Q)

Use to define necessities and luxuries

Necessities - IED < 1

Luxuries - IED > 1

Cyclical vs. defensive sectors

Cyclical - high IED - foreign travel, consumer

durables

Defensive - low IED - food, utilities

Short-run vs. long-run elasticities

Critical in understanding oil market, energy

markets, metal markets

Responding to a price movement takes time possibly many years

Long-run elasticity measures total response

Short-run elasticity measures immediate

response

Short-run

demand

P1

Po

Long-run drop

in demand

Long-run

demand

Short-run drop

in demand

Short-Run Versus

Long-Run Elasticities

The Demand for Gasoline

Years Following Price or Income Change

Elasticity

1

2

3

4

5

6

Price

-0.11 -0.22 -0.32 -0.49 -0.82 -1.17

Income

0.07

0.13

0.20

0.32

0.54

0.78

Short-Run Versus

Long-Run Elasticities

The Demand for Automobiles

Years Following Price or Income Change

Elasticity

Price

Income

1

2

3

4

5

6

-1.20 -0.93 -0.75 -0.55 -0.42 -0.40

3.00

2.33

1.88

1.38

1.02

1.00

Short-Run Versus

Long-Run Elasticities

The Demand for

Gasoline and Automobiles

Data Explains:

1) Why the price of oil did not continue to

rise above $30/barrel even though it

rose very rapidly in the early 1970s.

2) Why automobile sales are so sensitive to

the business cycle.

The World Oil Market

In 1995:

P* = $18/barrel

World demand and total supply = 23 bb/yr (= 63

mbd)

OPEC supply = 10 bb/yr (= 27 mbd)

Non-OPEC supply = 13 bb/yr (= 35 mbd)

US consumption about 17 mbd = 5.5 bb/yr

Price of Crude Oil

Impact of Saudi Production Cut

SC

D S’T ST

Price 45

($ per

barrel) 40

Short-Run

Effect

35

30

25

20

18

15

10

5

0

5

10

15

20 23 25

30

Quantity

35 (billions barrels/yr)

Impact of Saudi Production Cut

SC

Price 45

D

($ per

barrel) 40

S’T ST

Long-run Effect

Due to the elasticity

of the long-run

supply and demand

curves, the long-run

effect of a cut

in production is

much less.

35

30

25

20

18

15

10

5

0

5

10

15

20 23 25

30

35

Quantity

(billions barrels/yr)

AMAX Case

Price (1980 $)

10

9

8

7

6

5

Price (1980 $)

4

3

2

1

0

1975

1976

1977

1978

Year

1979

1980

Moly Consumption & Production

250

200

150

Consumption

Production

100

50

0

1975

1976

1977

Year

1978

1979

Output

350

325

300

275

250

225

200

175

150

125

100

75

50

25

0

Marginal Cost

Marginal Costs

MC

14

12

10

8

6

MC

4

2

0