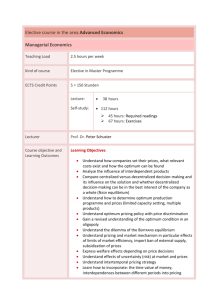

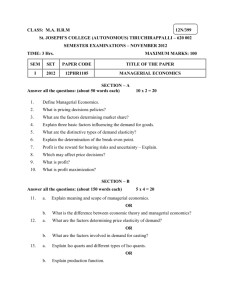

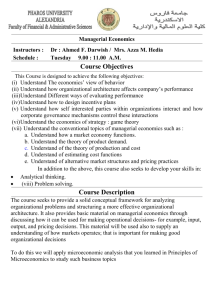

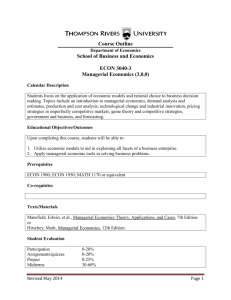

Managerial Economics - Budi Hermana

advertisement