Chapter 14

advertisement

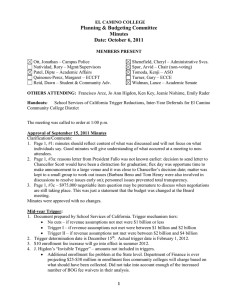

PowerPoint Slides for Professors Spring 2010 Version This file as well as all other PowerPoint files for the book, “Risk Management and Insurance: Perspectives in a Global Economy” authored by Skipper and Kwon and published by Blackwell (2007), has been created solely for classes where the book is used as a text. Use or reproduction of the file for any other purposes, known or to be known, is prohibited without prior written permission by the authors. Visit the following site for updates: http://facpub.stjohns.edu/~kwonw/Blackwell.html. To change the slide design/background, [View] [Slide Master] W. Jean Kwon, Ph.D., CPCU School of Risk Management, St. John’s University 101 Murray Street New York, NY 10007, USA Phone: +1 (212) 277-5196 E-mail: Kwonw@stjohns.edu Risk Management and Insurance: Perspectives in a Global Economy 14. External Loss Financing Arrangements There are two sections discussing alternative risk transfers. Click Here to Add Professor and Course Information Study Points Risk financing through derivatives Risk financing through insurance Integrated loss financing arrangements 3 Risk Financing Through Derivatives 4 The Markets Barter markets Cash-and-carry markets Spot markets Futures/options markets 5 Forwards and Futures Forward Contract Futures Contract Specifies the price and delivery date of the underlying For the future purchase and sale of goods or services Traders in the forward market must honor the contract, regardless of the outcome. This gives rise to a potential problem of credit risk, as forwards are not regulated. Futures are regulated, liquid and traded on organized exchanges. They contain standard contract terms and cannot be customized to individual needs. 6 Basics 7 Options Call vs. put option Option premium Strike price European vs. American option 8 Options (Figure 14.1) 9 Arbitrage The possibility of making a riskless gain with no chance of loss • An example of the January effect (page 353) A true arbitrage always works with certainty; that is, a norisk money machine. An efficient market does not allow arbitrage. • However, the presence of some persistent anomalies seems to indicate a lack of efficiency and the possibility of arbitrage profits. 10 Swaps The exchange of one security for another Currency swaps Interest rate swaps 11 Managing Financial Risks Foreign exchange (FX) risk Weather risk Pages 355-358 12 Risk Financing Through Insurance: Focusing on Liability Risk Refer to Chapter 19 for Insurance Principles and Fundamentals of Insurance Contracts 13 Court Awards (Insight 14.1) Economic (general) damages Non-economic (special) damages Punitive damages 14 Liability Insurance for MNCs General business liability • Also known as “public liability” in commonwealth countries • Liability to third parties Employment practices liability • See next page • Liability to employees Directors and officers (D&O) liability • Liability as decision makers of the organization 15 Preventing Employment Practices Liability (Insight 14.3) Establish hiring practices in compliance with local laws. Distribute employee handbooks that clearly document the entity’s employment policies and procedures. Provide all employees with a formal, published policy dealing with sexual harassment and discrimination. Conduct scrupulous annual performance reviews with interim reviews to correct unacceptable behaviors. Strictly follow established policy for terminating employees. Conduct and document exit interviews. Promptly investigate all allegations of harassment or discrimination. 16 Directors and Officers Liability Insurance D&O liability coverage Corporate reimbursement coverage Entity coverage 17 Insurance for MNCs Admitted insurance Nonadmitted insurance Global master program 18 Admitted Insurance Benefits from purchasing coverage locally • • • • The policy will be serviced locally. Premiums and claims will be paid in the local currency. The local insurer and broker provide advice and RM services. The insurance program is complying with local laws. Disadvantages • Policies difficult to evaluate and manage by the MNC’s risk manager. • Local policies may be more costly. • The MNC may loose negotiation power and the spread of risk associated with centralized purchasing. 19 Nonadmitted Insurance Benefits • • • • Centralized administrative control Possible broader terms and conditions Possible lower cost The premium will be payable in the home country currency, as will losses potential drawback as well. Disadvantages • Claims settlement can become more complicated without local coverage and the assistance of local insurer representatives. • Local management may not understand the nonadmitted coverage. 20 Global Master Program (Figure 14.2) Whole Account Coverage Umbrella Liability Coverage Excess/DIC/DIL Coverage (Master Policy) Corporate Office Primary Property Coverage LOCAL INSURER Other Property & Liability Coverage Placed Locally Local Compulsory Coverage Corporate Office Primary Liability Coverage 21 Not in the book! Integrated Loss Financing Arrangements 22 Multi-line/Multi-year Products Coverage over multiple lines of insurance, where lines are different classes of insurance Coverage a single deductible and policy limit applicable to all losses and over time The more exposures included, the closer such a contract is aligned to the ERM concept, as it takes a holistic approach to loss payouts. 23 Multi-trigger Products Claims are paid only if, in addition to an insurance event (“first trigger”) during the contract period, a non-insurance event (“second trigger”) also occurs. Given that the probability of experiencing both losses is lower that the probability of any one of the two events, the premium will be lower than otherwise. Such a contract is probably more consistent with ERM programs. 24 Understanding Multi (Two) Triggers Traditional insurance • Fire damage resulting in business income loss • If business income loss is the first trigger, there is a serious moral hazard problem New approach • First trigger being a traditionally covered peril • Second trigger being a financial loss exposure 25 Triggers Fixed trigger • Payout depending the “occurrence” of a covered event • Likely the first trigger Variable trigger • As an index (e.g., loss exceeding $20 M or price falling below $35 per barrel) • Likely the second trigger Switching trigger • Varies based on some weighting scheme of the multiple risks 26 Other ART Techniques: Contingent Capital Not in the book! 27 Fundamentals Contingent capital • Simply, an option to issue a corporate security Contingent capital facility • • • • Right to issue new debt, equity or structured security During a specified period At a predefined issue price On the occurrence of a triggering event • Unexpected & substantial loss by the right holder • High correlation between the loss exposure and the price of the security 28 Contingent Capital - Elements Underlying • Debt, equity or hybrid security defined at the beginning of the option period; that is, before the security is issued • Tends to be deeply subordinated debt or preferred stock Tenor • Limited duration; for example, right to issue five-year, fixed rate subordinate debt at any time during the next three months 29 Contingent Capital - Elements Intrinsic value (strike price) • Usually at-the-money at inception; that is, • Price set prior to loss realization • Value tied to the price of the underlying on the date of contingent capital negotiation • Cost-of-capital difference between [1] One under the arrangement and [2] The other in the open market at the time of exercise • No option exercise if [1] > [2] 30 Contingent Capital - Elements Exercisability – dual triggers • The underlying with a greater-than-market value and an objectively defined loss event • First trigger usually American, thus giving the right holder to issue the securities at any time during the tenor period • Instead of loss, the second occasionally tied to a variable beyond the firm’s influence, thus minimizing problems of moral hazard • Linking the firm’s negative earnings shock to the average industry earnings, for example 31 Contingent Capital - Elements Placement • Commonly a private placement with a (lead) option writer • Until exercise, the writer collects a periodic commitment (premium) until the facility is exercised • On exercise and in case of a put option, the writer gets a security in return for the (cash) payment to the owner of the facility Compare it with an insurance contract! 32 Committed Capital Facility Example Insurer Purchase the option, pay the premium until exercise Issue Securities w/ Collateral Put Option Cash Commitment Fee/Premium SPV Prior to exercise, holds capital, say, commercial papers On exercise by the insurer, liquidate its own securities to purchase, say, preferred stock issued by the insurer Investment Investors Coupon + Premium Trust 33 Discussion Questions 34 Discussion Question 1 What are the common methods to control or finance loss exposures? Why would a typical MNC consider control methods before financing methods? What role does insurance play in managing the exposures? 35 Discussion Question 2 Describe two important distinctions between forward and future contracts. 36 Discussion Question 3 Describe the corporate liability environment in your country? Are there new laws governing how corporations should handle employment-related issues such as age and gender discrimination or what is defined as “unlawful discharge from employment” in your country? If so, what changes can you identify that have been taken by corporations in response to such new laws? 37 Discussion Question 4 A multi-trigger policy contains a condition that the traditionally insurable loss event (e.g., fire) must be the first trigger, followed by, say, a financial loss? • What adverse effect would the insurance market experience in offering policies with a financial loss as a first trigger? • Based on the second example in the multi-trigger coverage, explain the reason why the insurance premium for this multi-trigger policy would be much, if not significantly, lower than the premium for a single-event coverage? 38