handling and transportation of cash

advertisement

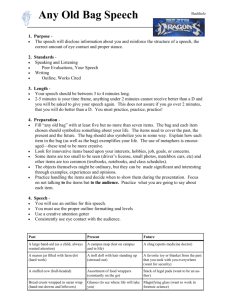

HANDLING & TRANSPORTATION OF CASH POLICY (SCHOOLS and SMALL ESTABLISHMENTS) Updated: January 2014 CONTENTS: Page 1. Introduction 2. Cash Handling - Cash & Security 3. Cash Handling – Cash & Bankings 4. Additional notes for collection/banking officers 5. Security of cash and valuables in transit 6. Minimising the risks to safety - robbery situation 7. Additional good practice guidelines 8. Insurance 9. Preparation of Bankings at a Bank Branch 10. Preparation of Bankings at a Designated Post Office 1-2 3-4 5-6 7 8-9 10 11 12 13 - 15 16 - 18 Appendices: (A) Security Carrier Procedures (B) Over/Under Banking Investigation Form (C) FMS 17 – Income Collection (D) Anti-Money Laundering Policy (E) Corporate Record Management Policy (F) Document Retention Guidelines 19 20 - 23 24 24 25 25 HANDLING & TRANSPORTATION OF CASH POLICY (SCHOOLS and SMALL ESTABLISHMENTS) 1. INTRODUCTION The key controls for the collection and handling of cash, and responsibilities placed upon Chief Officers, are set out in Financial Management Standard 17 – Income Collection (FMS 17). FMS’s form part of the Council’s constitution under part 4 – Rules of Procedure (Financial Procedure Rules) and therefore apply to all Council employees. 1.1. A copy of FMS 17 can be accessed electronically (see Appendix C). 1.2. Many Council employees are involved in handling and transporting cash and it is important to provide a reference for consistent treatment in addition to considering the safety of staff. 1.3. This policy applies to all staff who process or collect payments on behalf of Durham County Council. Compliance is mandatory in accordance with the Council’s Financial Procedure Rules. This procedure does not apply to handling and transportation of unofficial monies e.g. Private School Funds, however it is recommended that staff who are responsible for any ‘non DCC’ income consider the advice and guidance contained in this document. 1.4. Robberies are quite rare, but it is important that everyone involved in the handling and transporting of cash is aware of the potential risk involved. 1.5. There are a number of steps which employees can take to minimise this risk, and help to avoid any incidents occurring whilst at the same time enhancing personal safety. 1.6. Under the provisions of the Health and Safety at Work Act employers can be liable for failing to ensure the safety of their employees and others, therefore this policy should be incorporated as part of the training programme for any staff who may take payments in the course of their employment. 1.7. It is the intention of this policy to minimise, so far as is practical, cash being transported by Council employees. 1.8. It is accepted that volunteer workers will be required to handle cash at times. Managers supervising such operations should ensure that all workers who may be required to handle cash have read this document and are aware of their responsibilities. In addition managers should ensure that there are appropriate controls in place which will allow regular reconciliation of income and bankings at the earliest opportunity. Page | 1 HANDLING & TRANSPORTATION OF CASH POLICY (SCHOOLS and SMALL ESTABLISHMENTS) 1.9. This document presents the main areas of concern with regard to the Handling and Transportation of Cash and it is designed for schools and small establishments where the facilities provided may not be as complete as larger Council establishments. Small establishments may be defined, for the purposes of this report as those which bank less than £500 per week though it should be stressed that if the facilities described in the policy are available, they should be utilised. Page | 2 HANDLING & TRANSPORTATION OF CASH POLICY (SCHOOLS and SMALL ESTABLISHMENTS) 2. CASH HANDLING – CASH & SECURITY 2.1. So far as is practical cash should not be transported by Council employees. The use of a professional security firm is recommended especially for the banking of income. Staff should verify the identity of security staff before handing over any monies. 2.2. Keep as little cash in a cash container as possible by regularly transferring cash (particularly notes) to somewhere more secure, e.g. a locked safe. This procedure should be openly advertised. 2.3. The location of safe keys and knowledge of safe combinations should be restricted to the key staff involved in the income collection process. Consideration should be given to the location of keys for secure storage facilities so that their locations do not become known to nonauthorised staff, members of the public, pupils etc. 2.4. Keys used to access cash containers should be held securely by those officers who require access to them. The number of keys in operation should be minimised so far as is practical. Officers should not have their own personal key. Where more than one person has access to keys a suitable system should be in place for the keys to be signed in and out of a secure lock box. Refer to 2.3. 2.5. Do not leave cash containers open for longer than necessary. 2.6. Ensure that cash containers are not easily accessible to the public. 2.7. Do not leave cash lying where it can be easily accessed by the other persons and wherever possible keep cash out of view from the other persons. 2.8. Cash should be counted/prepared for banking in a concealed and secure area by 2 officers, where possible. In establishments where it is not possible for more than one member of staff to be in attendance, suitable controls should be in place to ensure that the banking is as per official records. 2.9. Cash receipts of £100 or more should always be counted in the presence of the customer and where possible a second officer. 2.10. Floats must be checked and accounted for on a daily basis or whenever they are utilised if not on a daily basis. 2.11. Staff should be aware of their responsibilities when handling cash. Whenever cash is received from a member of the public or any other person it is important that an approved receipt is issued where appropriate. An exception is dinner monies, although schools must ensure they adhere to existing controls and procedures e.g. maintenance of School Meals Registers. Page | 3 HANDLING & TRANSPORTATION OF CASH POLICY (SCHOOLS and SMALL ESTABLISHMENTS) 2.12. Official DCC receipts can be obtained from the Income Section by emailing income@durham.gov.uk. 2.13. The receipt should contain sufficient information to identify the date, and amount of the transaction as well as the reason for payment (together with a relevant account/reference number) and the name or user number of the collection/banking officer issuing the receipt. This provides an adequate Audit trail in case of dispute. Staff are accountable for all sums of money in their care and it is their responsibility to keep such sums secure until they are handed over for banking. DCC receipts must not be issued in respect of unofficial monies e.g. Private School Funds. 2.14. Every transfer of official money from one member of staff to another must be evidenced in the records of the Establishment(s) concerned by the signature of the receiving Officer. It is up to the receiving Officer to ensure that all amounts received are verified as complete. 2.15. Wherever possible there should be more than one member of staff present when moving cash / cheques. 2.16. Details of cheques received should be maintained within the establishment for audit trail purposes. This should include Sort Code, Account Number, Cheque Number and Name. (Please use the spreadsheet which will be issued with the instructions on ICON EReturns) or contact the income section at income@durham.gov.uk 2.17. All receipting systems should be cashed up at the close of business or whenever appropriate to the establishment and regular bankings declared and prepared. 2.18. Banking procedures should be followed and stipulated accounting/analysis reports and returns must be produced. 2.19. Financial records must be maintained and retained in accordance with the Council’s Corporate Record Management Policy (see Appendix E). Page | 4 HANDLING & TRANSPORTATION OF CASH POLICY (SCHOOLS and SMALL ESTABLISHMENTS) 3. CASH HANDLING – CASH & BANKINGS 3.1. All bankings must be reconciled to the relevant supporting documentation of the monies taken. 3.2. Any discrepancies must be reported to the line manager and entered as either ‘under’ or ‘over’ within the analysis. 3.3. Any discrepancy of less than £10.00 must be investigated by the officer cashing up and if possible corrected. Any outstanding discrepancy following investigation should be recorded as an over/under and should be reported to their line manager. 3.4. For any discrepancy of £10.00 or over, whether the discrepancy represents an over or under banking, the Under/Over Banking Investigation Form (see Appendix B) must be fully completed and passed to the Head teacher or Service Area Manager for certification. The discrepancy must be fully investigated and findings recorded. If there is any suspicion of fraud, theft or patterns in over / under bankings the matter, with a copy of Under Banking Investigation Form, should be referred to internal audit via an email to fraud-internalaudit@durham.gov.uk and to the Income Section at income@durham.gov.uk. 3.5. Random checks in respect of ‘over and under’ bankings will be undertaken by the Council’s Income Team to verify that the required investigations have taken place and findings have been recorded. Checks will also be undertaken by Internal Audit. 3.6. All discrepancies of £50.00 or over must be reported to internal audit via an email to fraud-internalaudit@durham.gov.uk and to the Income Section at income@durham.gov.uk within 7 days. A copy of the Under / Over Banking Investigation Form should also be forwarded. 3.7. Any suspicion of theft or fraud should be referred to Internal Audit in line with the Council’s Fraud Response Plan. Any disclosure can be made in line with the Council’s Confidential Reporting Code. 3.8. Bankings for the security firm must be prepared in accordance with their published procedures. 3.9. Bankings must be made on at least a weekly basis. Cash Deposits in excess of £500 where practicable should be banked within 24 hours. 3.10. Where the cash security firm is being used to collect the deposits it is accepted that this limit may be exceeded, as this collection method is preferable to a member of staff walking to the post office with the deposit. Page | 5 HANDLING & TRANSPORTATION OF CASH POLICY (SCHOOLS and SMALL ESTABLISHMENTS) 3.11. Schools should determine the frequency of banking and the maximum amount that can be held in school. The Council recommends that schools bank at least weekly. Schools should note that the maximum amount insured is £50 in a locked box. For a safe, the maximum limit is the ‘safe cash rating’ (providing that the safe is kept locked). To obtain the ‘safe cash rating’ please contact CorporateInsuranceTeam@durham.gov.uk stating the make and model of the safe. 3.12. Change should be efficiently managed as there maybe cost implications for obtaining change, particularly if using the Council’s cash security company. Any requests for change should be directed to the Income Section who will make the necessary arrangements for it to be delivered by the security company at the time of a planned collection. 3.13. Line managers should inform the Income Section of any staff who have access to ICON who leave the authority, to enable access to be terminated. 3.14. All staff must comply with the Authority’s Anti Money Laundering Policy (See Appendix D). 3.15. All staff must comply with the Authority’s Corporate Record Management Policy (See Appendix E). Page | 6 HANDLING & TRANSPORTATION OF CASH POLICY (SCHOOLS and SMALL ESTABLISHMENTS) 4. ADDITIONAL NOTES FOR COLLECTION/BANKING OFFICERS (It is recognised that schools may not have a separate cash handling area, but where this is the case schools should still review their cash-handling arrangements in the light of this policy to minimise the risks to staff and allow for secure handling of cash). 4.1. Ensure that the cash handling area is as secure as possible with limited access; video surveillance may also be appropriate in some circumstances. Any ‘entry’ door to the area where cash is handled should be locked. 4.2. Only known, authorised, personnel should be allowed access. 4.3. Staff should be vigilant when transferring funds from one area to another. 4.4. Staff dealing with cash should be aware of the location and operation of any panic attack alarms if installed. 4.5. Where a collection/banking officer is alone, another member of staff should have access to the cash receipting area in case of emergency. 4.6. Locks on doors and windows and the condition of any security grilles should be routinely checked and any faults immediately reported. 4.7. Staff must be vigilant and report any suspicious circumstances to their line manager immediately. Page | 7 HANDLING & TRANSPORTATION OF CASH POLICY (SCHOOLS and SMALL ESTABLISHMENTS) 5. SECURITY OF CASH AND VALUABLES IN TRANSIT 5.1. Durham County Council recommends that cash is only moved by a designated security company. However, where schools do not take this advice please note the following: 5.2. Movement by cash holders own vehicle 5.2.1. Should cash be required to be moved by means of an officer’s own vehicle, they should take reasonable precautions in order to limit risks. Areas to consider are: 5.3. Conceal the fact that you are collecting or carrying cash Consider security at both departure and arrival points The times of collection and deposit should be varied Vary your route whenever possible and avoid isolated areas Vary the vehicle used where possible Keep vehicle doors locked at all times Two persons should be used wherever possible and movement on foot limited (see below for guidelines) Where appropriate notify the destination of estimated time of arrival so alarm may be raised at an early stage A mobile telephone must be carried and staff must remain vigilant at all times. Movement on foot 5.3.1. Ideally, staff should never be placed at risk by being made responsible for carrying cash to the bank or post office. However, there may be situations where it is not possible to do this and even where the use of staff is unavoidable, cash should only be undertaken on foot in exceptional circumstances, or other options are impossible. Areas to consider are: The first and last 100 metres of any journey are the most likely places for any attack Avoid routine vary times and routes where appropriate. Consider carrying small amounts of cash on a person are less of a risk than larger amounts in bags. Page | 8 HANDLING & TRANSPORTATION OF CASH POLICY (SCHOOLS and SMALL ESTABLISHMENTS) A second employee would be advisable to act as an escort in order to raise the alarm if necessary. A mobile phone must be carried. Consideration should also be given to a policy of dividing the risk by using more than one person to carry the money. Officers should always use their discretion to minimise any risk. Page | 9 HANDLING & TRANSPORTATION OF CASH POLICY (SCHOOLS and SMALL ESTABLISHMENTS) 6.0 MINIMISING RISKS TO SAFETY - ROBBERY SITUATION 6.1 There is always a very small risk that at some stage during your working life you may be faced with a robbery situation. 6.2 Staff are less likely to be hurt if they co-operate with the robber’s demands. 6.3 Under no circumstances should staff put their lives at risk by attempting to prevent the robbery from occurring. The Council’s income is insured against loss due to robbery. 6.4 Staff will obviously be frightened in such a situation, but it will be useful for any subsequent Police investigation if they could try to observe details of the robber’s description (Height, colour of hair, age, accent etc.) This has the effect of making staff feel less helpless in such a situation and will significantly improve the Police’s chances of detection later. 6.5 Do not stare at a robber for any length of time as this may aggravate him/her. 6.6 Following an incident staff should contact the police immediately and must not leave the crime scene until the police arrive. As far as possible the crime scene should not be disturbed. This is to ensure that police forensic staff have the best possible chance of finding any clues. 6.7 It is advisable that vulnerable staff carry a portable personal attack alarm with them. Page | 10 HANDLING & TRANSPORTATION OF CASH POLICY (SCHOOLS and SMALL ESTABLISHMENTS) 7 ADDITIONAL GOOD PRACTICE & GUIDELINES 7.1 Some additional good practice measures to be considered are: Examine all notes for forgeries. There are a number of ways to determine whether a note is a forgery – A poster will be supplied with this policy for guidance. When cashing up, where possible ensure that a 2nd staff member verifies all amounts. At the end of day if a security company is not collecting monies or they are not to be banked immediately they should be securely locked away in an approved safe where available or otherwise a lockable container Any over or under bankings should be clearly highlighted and documented. Personal cheques must not be cashed. Financial stationery should be strictly controlled Staff who take payments should be subjected to random independent scrutiny and checks. Page | 11 HANDLING & TRANSPORTATION OF CASH POLICY (SCHOOLS and SMALL ESTABLISHMENTS) 8 INSURANCE 8.1 The Council arranges insurance against loss of income through fraud, theft and robbery. Fidelity Guarantee insurance covers loss of income by fraud or dishonesty on the part of an employee. 8.2 Durham County Council funds held on site are insured while maintained on site at schools and other establishments up to designated levels, depending on the type of establishment and security arrangements. Schools and small establishments should follow the Local Authority’s recommendation for cash limits held in locked safes. Responsible officers should contact the DCC Insurance Team via email to: CorporateInsuranceTeam@durham.gov.uk if they are in any doubt as to insurance cover for their school or establishment. 8.3 It should be noted that private funds held on site such as school funds are not insured by DCC. Establishments are advised to seek alternative insurance for such funds, where they deem levels require it. Responsible officers should contact the DCC Insurance Team via email to: CorporateInsuranceTeam@durham.gov.uk if they are in any doubt as to insurance cover for their school or establishment. 8.4 It should be emphasised that sensible procedures are vital in order to ensure personal safety at all times and to minimise any risks to staff. Page | 12 HANDLING & TRANSPORTATION OF CASH POLICY (SCHOOLS and SMALL ESTABLISHMENTS) 9 PREPARATION OF BANKINGS TO BE DEPOSITED AT A BANK BRANCH 9.1 Following cash up – banking must be prepared. NB: Do not enter cash and cheque amounts on the same paying in slips. Individual paying in slips must be completed for cash and cheques. 9.2 CASH 9.2.1 9.2.2 9.2.3 9.2.4 9.2.5 9.2.6 9.2.7 9.2.8 9.2.9 9.2.10 9.2.11 9.2.12 9.2.13 All monies must be in following denominations: Notes £20.00 notes: should be grouped together with an elastic band, if the total exceeds £1000 you must band them with a £20.00 note band (red), sign and date this band, these should be placed in plastic £20(red) coop bag which must be sealed via the security slip. The outside of the bag must detail the site name and collection/banking officers initials £10.00 notes: should be grouped together with an elastic band, if the total exceeds £1000 you must band these notes with a £10.00 note band (blue), sign and date this band, these should be placed in plastic £10(blue) coop bag which must be sealed via the security slip. The outside of the bag must detail the site name and collection/banking officers initials £5.00 notes: should be grouped together with an elastic band, if the total exceeds £500 you must band these notes with a £5.00 note band (green), sign and date this band, these should be placed in plastic £5(green) coop bag which must be sealed via the security slip. The outside of the bag must detail the site name and collection/banking officers initials. Coins £2: should be placed in a clear coin bag to the maximum of £20.00 £1: should be placed in a clear coin bag to the maximum of £20.00 50p: should be placed in a clear coin bag to the maximum of £10.00 20p: should be placed in a clear coin bag to the maximum of £10.00 10p: should be placed in a clear coin bag to the maximum of £5.00 5p: should be placed in a clear coin bag to the maximum of £5.00 2p: should be placed in a clear coin bag to the maximum of £1.00 1p: should be placed in a clear coin bag to the maximum of £1.00 Any remaining coins should be placed in a separate coin bag. Page | 13 HANDLING & TRANSPORTATION OF CASH POLICY (SCHOOLS and SMALL ESTABLISHMENTS) 9.2.14 Once you have finalised your cash you need to complete the appropriate paying in slip with the following details:- Paid in by Date Address/ref Money Column 9.3 Must be the person’s signature who has completed the cash up Date of the cash up Site name, i.e. Crook Office Complete as following screenshot CHEQUES 9.3.1 All cheques and a cheque list should be banded together with an elastic band. 9.3.2 Once you have finalised your cheques you need to complete the appropriate paying in slip with the following details:- Paid in by Date Address/ref No. of Cheques Cheque Column Must be the person’s signature who has completed the cash up Date of the cash up Site name, e.g. Crook Office Enter number of cheques being sent to bank Complete as following screenshot Page | 14 HANDLING & TRANSPORTATION OF CASH POLICY (SCHOOLS and SMALL ESTABLISHMENTS) Page | 15 HANDLING & TRANSPORTATION OF CASH POLICY (SCHOOLS and SMALL ESTABLISHMENTS) 10 PREPARATION OF BANKINGS FOR SCHOOLS AT A DESIGNATED POST OFFICE 10.1 Following cash up – banking must be prepared – NB: Do not enter cash and cheque amounts on the same paying in slips. Individual paying in slips must be completed for cash and cheques. 10.2 CASH 10.2.1 All monies must be in following denominations: 10.2.2 Notes £20.00 notes: should be grouped together with an elastic band, if the total exceeds £1000 you must band them with a £20.00 note band (red), sign and date this band, these should be placed in plastic £20(red) coop bag which must be sealed via the security slip. The outside of the bag must detail the site name and cashiers initials 10.2.3 £10.00 notes: should be grouped together with an elastic band, if the total exceeds £1000 you must band these notes with a £10.00 note band (blue), sign and date this band, these should be placed in plastic £10(blue) coop bag which must be sealed via the security slip. The outside of the bag must detail the site name and cashiers initials 10.2.4 £5.00 notes: should be grouped together with an elastic band, if the total exceeds £500 you must band these notes with a £5.00 note band (green), sign and date this band, these should be placed in plastic £5(green) coop bag which must be sealed via the security slip. The outside of the bag must detail the site name and cashiers initials. Coins 10.2.5 £2: should be placed in a clear coin bag to the maximum of £20.00 10.2.6 £1: should be placed in a clear coin bag to the maximum of £20.00 10.2.7 50p: should be placed in a clear coin bag to the maximum of £10.00 10.2.8 20p: should be placed in a clear coin bag to the maximum of £10.00 10.2.9 10p: should be placed in a clear coin bag to the maximum of £5.00 10.2.10 5p: should be placed in a clear coin bag to the maximum of £5.00 Page | 16 HANDLING & TRANSPORTATION OF CASH POLICY (SCHOOLS and SMALL ESTABLISHMENTS) 10.2.11 2p: should be placed in a clear coin bag to the maximum of £1.00 10.2.12 1p: should be placed in a clear coin bag to the maximum of £1.00 10.2.13 Any remaining coins should be placed in a separate coin bag. 10.2.14 Once you have finalised your cash you need to complete the appropriate paying in slip with the following details:Paid in by Date School Name Money Column Must be the person’s signature who has completed the cash up Date of the cash up Place underneath the signature line Complete as attached screenshot 10.2.15 See example of completed paying in slip below: 10.2.16 Staff should take the money to the Post Office to be paid in to the Durham County Council Income bank account. Page | 17 HANDLING & TRANSPORTATION OF CASH POLICY (SCHOOLS and SMALL ESTABLISHMENTS) 10.3 CHEQUES 10.3.1 All cheques and a cheque list (to include the cheque line details) should be banded together with an elastic band. NB A copy of the cheque list should be retained within the school for audit purposes 10.3.2 Once you have finalised your cheques you need to complete the appropriate paying in slip with the following details:- Paid in by Date School Name No. of Cheques Cheque Column Must be the person’s signature who has completed the cash up Date of the cash up Place underneath the signature line Enter number of cheques being sent to bank Complete as attached screenshot 10.3.3 See example of completed paying in slip below: 10.3.4 Staff should then place the cheques and cheque list into the brown Giro bank deposit cheque envelopes and take to the Post Office to be paid into the Durham County Council Income bank account Page | 18 Appendix A HANDLING & TRANSPORTATION OF CASH POLICY (SCHOOLS and SMALL ESTABLISHMENTS) SECURITY CARRIER (Loomis) - PROCEDURES This procedure will apply where the banking is for a single site for a single cash collection session i.e. a single day. Cash The Grey Loomis Cash bag must have the following information provided on the front of the bag: Location ID and Cash Centre, Co-op Washington, value of contents, signature and date. Cash and completed individual paying in slip should be placed inside the grey cash bag Once all documentation and monies are in grey bag this can be sealed via the security strip The value of the Loomis outer bag should be no more than £20,000 Cheques Cheques should be placed in Clear Loomis bag together with paying in slip and printed cheque list safely secured with elastic band Once all cheques have been placed in Loomis bag it must be sealed via the security strip. The Clear Loomis bag must have the following information provided on the front of the bag: location ID and IPSL Northampton, value of contents, signature and date There is no maximum value on these bags COLLECTION SUMMARY SHEETS – only to be completed where a service is leaving the cash collection at a customer services point for security personnel to pick up. Once all the collections have been placed into the appropriate bags, these must then be taken to a customer services access point for collection via Loomis, a collection summary sheet must be completed, with date, Cash/Cheque and Loomis bag number. The collection sheet should then be signed by a customer services representative, one copy is retained by them and the other is given to the person handing over the collection to retain as confirmation. This form is a receipt to verify that customer services have taken a credit (NB Customer services are signing that they have received the bag of monies and are not signing to verify the accuracy of the contents). Collection by Loomis If the value of the cash is less than £20,000 both the cash and the cheques are placed into the security box. The security officer issues a receipt via a hand held scanner, which the collection/banking officer must sign to verify bags. The security personnel must then take the box to the security van and deliver it to the depot. If the value of the cash is more than £20,000 and there are two grey bags or more, then each cash bag must be put into a separate box. The security personnel will put one of the cash bags and the cheques in to the security box, and will take the box directly to the security van, he will return with an empty box in order to place the remaining cash bag into empty box. The security personnel will then issue a receipt via a hand held scanner, which the collection/banking officer must sign to verify bags. The security personnel must then take the box to the security van and deliver both boxes to the depot. This process is repeated should there be more than 2 cash bags. The identification of the Loomis security personnel must be verified before any monies are handed over. NB: Security personnel must be attended to immediately and should not be kept waiting under any circumstances. Significant amounts of money may be involved and any safety risks must be minimised. Page | 19 Appendix B HANDLING & TRANSPORTATION OF CASH POLICY (SCHOOLS and SMALL ESTABLISHMENTS) DURHAM COUNTY COUNCIL OVER / UNDER BANKING INVESTIGATION FORM This form must be completed by the responsible collecting/banking officer concerned and notified to the Head Teacher or Service Area Manager for review and certification, as soon as possible after the discovery of all discrepancies of £10.00 or over. The completion / distribution of the form should be in accordance with the attached guidance notes. LOCATION Service Establishment Details of Under/Over Banking Date Under / Over banking Relates Amount of Under / Over banking (N.B. See guidance notes) What Type of Payment is the Under / Banking In Respect Of Are Staff within the establishment aware of the guidance on Handling & Transportation of Cash Policy. Particularly those relating to banking and the custody of money held overnight? Yes/No Page | 20 Appendix B HANDLING & TRANSPORTATION OF CASH POLICY (SCHOOLS and SMALL ESTABLISHMENTS) UNDER / OVER BANKING INVESTIGATION DETAILS Section 1 (to be completed by collecting/banking officer) Please detail the circumstances of the discrepancy including what investigations have been carried out. (Include as much detail as possible, including the names of officers who have receipted/accessed the payments received during the period, detail what checks have been undertaken to identify how the inaccuracy has occurred.) Page | 21 Appendix B HANDLING & TRANSPORTATION OF CASH POLICY (SCHOOLS and SMALL ESTABLISHMENTS) Section 2 (to be completed by Service Area Manager) Management investigation/findings – Please indicate details of any analysis of documentation, discussions with staff etc. I declare that the above answers are true and correct Signed ………………………………….. Certified ……………………………………. (Collecting/Banking Officer) (Service Area Manager) Print Name……………………………… Print Name ……………………………….. Date ……………………………………… Date ………………………………………. The Head Teacher or Service Area Manager must ensure that in either of the following circumstances a copy is forwarded to Internal Audit via an email to fraudinternalaudit@durham.gov.uk and also the Income Team income@durham.gov.uk for information and action as appropriate: Discrepancies over £10 where theft or theft is suspected or patterns of under banking have been identified Any discrepancy over £50 whether or not theft or fraud etc., is suspected Page | 22 Appendix B HANDLING & TRANSPORTATION OF CASH POLICY (SCHOOLS and SMALL ESTABLISHMENTS) Guidance Notes Any discrepancy of less than £10.00 must be investigated by the officer cashing up and if possible corrected. Any outstanding discrepancy following investigation should be recorded as an over/under and should be reported to the line manager. Any discrepancy of £10.00 or over must be reported to the manager for that service area by completion of the Under Banking Investigation Form who must investigate it and record findings. If there is any suspicion of fraud, theft or patterns in over / under bankings the matter should be referred to internal audit via an email to fraud-internalaudit@durham.gov.uk and to the Income Section at income@durham.gov.uk. A copy of the duly completed form must be retained by the Service Area Manager as evidence of the investigation and for management inspection. All discrepancies of £50.00 or over must be reported to internal audit immediately by forwarding a copy of the duly completed and certified Under Banking Investigation form via an email to fraud-internalaudit@durham.gov.uk and to the Income Section at income@durham.gov.uk within 7 days. A copy of the form should also be reported to the Head of Service for information. These guidance notes are based on information contained within the Council’s approved Handling and Transportation of Cash Policy. Any queries should be directed to the Income Team: Karon Riddell, Income Assistant Team Manager - 03000 260440 Sarah Dominick, Income Team Leader - 03000 260765 Sharon Carpenter, Income Team Leader - 03000 260407 Page | 23 Appendix C HANDLING & TRANSPORTATION OF CASH POLICY (SCHOOLS and SMALL ESTABLISHMENTS) FMS 17 – Income Collection Due to the size of the Policy it is not appropriate to replicate the full document as part of this appendix. The following file can be opened to display the full document. FMS17 Income Collection.doc A copy of the policy can also be found on the DCC website at the following URL: http://www.durham.gov.uk/Pages/Service.aspx?ServiceId=6632 For schools a copy of the policy can also be found on the Schools Extranet at the following Link: FMS17 Income Collection Appendix D ANTI MONEY LAUNDERING POLICY Due to the size of the Policy it is not appropriate to replicate the full document as part of this appendix. The following file can be opened to display the full document. Anti Money Laundering Policy.pdf A copy of the policy can also be found on the DCC Intranet at the following URL: http://intranet/Pages/PoliciesandProceduresDetails.aspx?ItemId=1700 For schools a copy of the policy can also be found on the Schools Extranet at the following Link: Anti-Money Laundering Policy Page | 24 Appendix E HANDLING & TRANSPORTATION OF CASH POLICY (SCHOOLS and SMALL ESTABLISHMENTS) CORPORATE RECORD MANAGEMENT POLICY Due to the size of the Policy it is not appropriate to replicate the full document as part of this appendix. The following file can be opened to display the full document. Corporate Records Management Policy.pdf This is also available on the Council’s intranet at the following location: http://content.durham.gov.uk/PDFRepository/DCC_Corporate_Records_Management_Policy.p df Appendix F For schools this is also available on the School Extranet at the following location: Corporate Records Management Policy Please note that general guidelines for specific documents are not included in this document. The hyperlink on page 9 of the document “retention guidelines for local authorities” gives indicative retention periods for a large number of typical local authority documents. This is replicated below. However, individual sections are advised to develop their own retention guidelines in consultation with the Information Management Team within ACE. Record management Society LA guidance.pdf For schools a copy of this document can also be found on the Schools Extranet at the following URL: The Records Management Society - Retention Guidelines for Local Authorities Page | 25