Ch. 7: Forecasting

advertisement

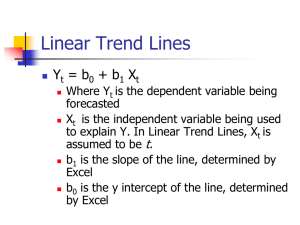

Advance forecasting Forecasting by identifying patterns in the past data Chapter outline: 1. Extrapolation from the past • Cause and effect relationships • Trend analysis - Regression analysis - Simple linear regression analysis - Multiple linear regression analysis - Quadratic regression analysis 3. Cyclical and seasonal issues Seasonal decomposition of time series data • Type of seasonal variation • Computing Multiplication seasonal indices • Using seasonal indices to forecast • A caution regarding seasonal indices BIS APPLICATION 2002-2003 MANAGEMENT INFORMATION SYSTEM 1 Extrapolation from the past Cause-and-effect Relationships - Causal forecasting seeks to identify specific cause-effect relationships that will influence the pattern of future data. Causes appear as independent variables, and effects as dependent , response variables in forecasting models. Independent variable Dependent, response variable Price demand Decrease in population decrease in demand Number of teenager demand for jeans - Causal relationships exist even when there is no specific time series aspect involved. - The most common technique used in causal modeling is least squares regression. BIS APPLICATION 2002-2003 MANAGEMENT INFORMATION SYSTEM 2 Extrapolation from the past Linear Trend analysis D Its noticed from this figure that there is a growth trend influencing the demand, which should be extrapolated into the future. D D P = P = D D D BIS APPLICATION 2002-2003 MANAGEMENT INFORMATION SYSTEM 3 Extrapolation from the past Linear Trend analysis The linear trend model or sloping line rather than horizontal line. The forecasting equation for the linear trend model is Y = +X or Y = a + bX Where X is the time index (independent variable). The parameters alpha and beta ( a and b) (the “intercept” and “slope” of the trend line) are usually estimated via a simple regression in which Y is the dependent variable and the time index X is the independent variable. BIS APPLICATION 2002-2003 MANAGEMENT INFORMATION SYSTEM 4 Extrapolation from the past Linear Trend analysis Although linear trend models have their uses, they are often inappropriate for business and economic data. Most naturally occurring business time series do not behave as though there are straight lines fixed in space that they are trying to follow: real trends change their slopes and/or their intercepts over time. The linear trend model tries to find the slope and intercept that give the best average fit to all the past data, and unfortunately its deviation from the data is often greatest near the end of the time series, where the forecasting action is. BIS APPLICATION 2002-2003 MANAGEMENT INFORMATION SYSTEM 5 Extrapolation from the past Linear Trend analysis Forecasting using three data items Current Intercept: Current Slope: Period 1 2 3 42 Using a data table (what if analysis ) to determine the best-fitting straight line with the lowest MSE 8 Straight Line Demand Forecast 50 50 60 58 64 66 Sums of Squares: MSE: Squared Deviaton 0 4 4 8 1.63 Table of MSE Slope Intercept 1.632993 38 40 42 44 46 48 50 52 BIS APPLICATION 2002-2003 4 12.33 10.39 8.49 6.63 4.90 3.46 2.83 3.46 5 10.23 8.29 6.38 4.55 2.94 2.16 2.94 4.55 MANAGEMENT INFORMATION SYSTEM 6 8.16 6.22 4.32 2.58 1.63 2.58 4.32 6.22 7 6.16 4.24 2.45 1.41 2.45 4.24 6.16 8.12 8 4.32 2.58 1.63 2.58 4.32 6.22 8.16 10.13 9 2.94 2.16 2.94 4.55 6.38 8.29 10.23 12.19 10 2.83 3.46 4.90 6.63 8.49 10.39 12.33 14.28 6 Extrapolation from the past Linear Trend analysis Simple linear Regression Analysis Regression analysis is a statistical method of taking one or more variable called independent or predictor variable- and developing a mathematical equation that show how they relate to the value of a single variable- called the dependent variable. Regression analysis applies least-squares analysis to find the best-fitting line, where best is defined as minimizing the mean square error (MSE) between the historical sample and the calculated forecast. Regression analysis is one of the tools provided by Excel. BIS APPLICATION 2002-2003 MANAGEMENT INFORMATION SYSTEM 7 Simple linear Regression Analysis Quarters 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 1 4 9 16 25 36 49 64 81 100 121 144 169 196 225 256 289 324 361 400 441 484 529 576 BIS APPLICATION 2002-2003 Demand 3.47 3.12 3.97 4.50 4.06 6.90 3.60 6.47 4.27 5.24 6.39 5.45 5.88 8.99 4.12 6.68 9.44 7.75 9.91 9.14 14.25 14.89 14.22 15.56 SUMMARY OUTPUT Regression Statistics Multiple R R Square Adjusted R Square Standard Error Observations 0.866 0.749 0.738 1.986 24 ANOVA df Regression Residual Total Intercept Quarters 1 22 23 SS MS 259.031 259.031 86.750 3.943 345.782 F Significance F 65.691 0.000 Coefficients Standard Error t Stat P-value 1.495 0.837 1.787 0.088 0.475 0.059 8.105 0.000 Slope MANAGEMENT INFORMATION SYSTEM Lower 95% Upper 95% -0.240 3.231 0.353 0.596 Intercept 8 Quarters Demand 1 3.47 2 3.12 3 3.97 4 4.50 5 4.06 6 6.90 7 3.60 8 6.47 9 4.27 10 5.24 11 6.39 12 5.45 13 5.88 14 8.99 15 4.12 16 6.68 17 9.44 18 7.75 19 9.91 20 9.14 21 14.25 22 14.89 23 14.22 24 15.56 25 26 27 28 BIS APPLICATION 2002-2003 Fitted Demand Difference 1.97 2.24 2.45 0.45 2.92 1.11 3.40 1.23 3.87 0.04 4.35 6.54 4.82 1.48 5.30 1.39 5.77 2.26 6.25 1.01 6.72 0.11 7.20 3.03 7.67 3.22 8.15 0.71 8.62 20.25 9.10 5.83 9.57 0.02 10.05 5.26 10.52 0.38 11.00 3.45 11.47 7.74 11.95 8.70 12.42 3.24 12.90 7.09 13.37 13.85 14.32 14.80 MANAGEMENT INFORMATION SYSTEM Intercept Slope MSE 1.495 0.475 1.901 20.00 15.00 10.00 5.00 0.00 1 5 9 13 17 21 25 9 Extrapolation from the past Linear Trend analysis Multiple linear Regression Analysis Simple linear regression analysis use one variable (quarter number) as the independent variable in order to predict the future value. In many situations, it is advantageous to use more than one independent variable in a forecast. BIS APPLICATION 2002-2003 MANAGEMENT INFORMATION SYSTEM 10 Multiple linear Regression Analysis Hours Before Breakdown 205 236 260 176 245 123 176 150 148 265 200 45 110 216 176 90 176 112 230 280 BIS APPLICATION 2002-2003 Age 59 48 25 39 20 66 40 62 70 20 52 75 75 25 63 75 69 65 30 23 Number of Computer Controls 1 1 0 0 1 2 0 0 0 0 1 0 0 0 1 0 2 0 0 1 Two factors that control the frequency of breakdown. So they are the independent variables. Y = a + bX1 + cX2 Intercept MANAGEMENT INFORMATION SYSTEM Slope 1 Slope2 11 Multiple linear Regression Analysis SUMMARY OUTPUT Regression Statistics Multiple R R Square Adjusted R Square Standard Error Observations 0.905 0.818 0.797 28.651 20 ANOVA df Regression Residual Total 2 17 19 SS MS 62,920.044 31,460.022 13,954.906 820.877 76,874.950 Coefficients Standard Error Intercept 308.451 17.552 Age -2.800 0.325 No of Computer Controls 25.232 9.631 Intercept BIS APPLICATION 2002-2003 MANAGEMENT INFORMATION SYSTEM F Significance F 38.325 0.000 t Stat P-value Lower 95% Upper 95% 17.573 0.000 271.419 345.484 -8.622 0.000 -3.485 -2.115 2.620 0.018 4.912 45.551 Slope 1 Slope 2 12 Hours Before Breakdown 205 236 260 176 245 123 176 150 148 265 200 45 110 216 176 90 176 112 230 280 Age 59 48 25 39 20 66 40 62 70 20 52 75 75 25 63 75 69 65 30 23 BIS APPLICATION 2002-2003 Number of Computer Controls 1 1 0 0 1 2 0 0 0 0 1 0 0 0 1 0 2 0 0 1 Hourse to breakdown Difference 169 1332 199 1347 238 464 199 541 278 1069 174 2616 196 419 135 229 112 1261 252 157 188 141 98 2861 98 133 238 505 157 349 98 72 166 105 126 210 224 31 269 115 MANAGEMENT INFORMATION SYSTEM Intercept Age No of Computer Controls MSE 308.451 -2.800 25.232 26.41487 300 250 200 150 100 50 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 13 Extrapolation from the past Linear Trend analysis Quadratic Regression Analysis Quadratic regression analysis fits a second-order curve of the form Y = a + bX + cX2 Quadratic regression is prepared by adding the squared value of the time periods. The coefficients in the quadratic formula are calculated again using regression, where time periods and the squared time periods are the independent variables and the demand remains the dependent variable. BIS APPLICATION 2002-2003 MANAGEMENT INFORMATION SYSTEM 14 Quadratic Regression Analysis SUMMARY OUTPUT Regression Statistics Multiple R R Square Adjusted R Square Standard Error Observations 0.927 0.859 0.846 1.524 24 ANOVA df Regression Residual Total 2 21 23 Intercept Quarters Quarters Squared BIS APPLICATION 2002-2003 SS MS 297.037 148.518 48.745 2.321 345.782 F Significance F 63.984 0.000 Coefficients Standard Error t Stat P-value 4.685 1.017 4.609 0.000 -0.261 0.187 -1.395 0.178 0.029 0.007 4.046 0.001 MANAGEMENT INFORMATION SYSTEM Lower 95% Upper 95% Upper 95.0% 2.571 6.799 6.799 -0.651 0.128 0.128 0.014 0.045 0.045 15 Quadratic Regression Analysis BIS APPLICATION 2002-2003 MANAGEMENT INFORMATION SYSTEM Intercept Slope 1 Slope 2 MSE 3.500 0.000 0.019 1.494 20.00 Forecast 15.00 10.00 5.00 28 25 22 16 13 10 7 19 Demand 0.00 4 Demand 3.47 3.12 3.97 4.50 4.06 6.90 3.60 6.47 4.27 5.24 6.39 5.45 5.88 8.99 4.12 6.68 9.44 7.75 9.91 9.14 14.25 14.89 14.22 15.56 Fitted Demand Difference 3.52 0.00 3.58 0.21 3.67 0.09 3.80 0.49 3.98 0.01 4.18 7.39 4.43 0.69 4.72 3.09 5.04 0.60 5.40 0.03 5.80 0.35 6.24 0.61 6.71 0.70 7.22 3.10 7.78 13.36 8.36 2.83 8.99 0.20 9.66 3.63 10.36 0.20 11.10 3.85 11.88 5.63 12.70 4.83 13.55 0.45 14.44 1.24 15.38 16.34 17.35 18.40 1 Quarters 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 Quarters Squared 1 4 9 16 25 36 49 64 81 100 121 144 169 196 225 256 289 324 361 400 441 484 529 576 625 676 729 784 16 Extrapolation from the past Cyclical and Seasonal Issues The fundamental approach to including cyclical or seasonal factors is to break the forecast into two components: (1) The underlying growth component (2) The seasonal variations To prepare a forecast model: - Use a method to fit a growth curve to the historical record - Determine the pattern of the seasonal variability In general, two sets of parameters to be estimated: ( the coefficients in the trend line, and the percents in the seasonal patterns ) BIS APPLICATION 2002-2003 MANAGEMENT INFORMATION SYSTEM 17 Extrapolation from the past Cyclical and Seasonal Issues Basically two things must be done: 1- determine the trend line 2- take the trend line out ( calculate deviations from the trend) 3- create a pie, radar, or polar chart of the average period value 1 3 2 43,000 2 2,500 3 4 1 2 1 1,000 2 500 3 2 2 1 1,500 4 1 3 4 2,000 1 4 3 3 4 0 3 2 4 4 3 1 2 1 1 4 2 3 3 2 2 3 1 4 3 2 1 4 4 1 BIS APPLICATION 2002-2003 MANAGEMENT INFORMATION SYSTEM 18 Cyclical and Seasonal Issues Seasonal Decomposition of Time Series Data Time series data are usually considered to consist of six component : 1. Average demand: is simply the long-term mean demand 2. Trend component : is how rapidly demand is growing or shrinking 3. Autocorrelation: is simply a statement that demand next period is related to demand this period 4. Seasonal component: is that portion of demand that follows a shortterm pattern 5. Cyclical component: is much like the seasonal component, only its period is much longer. 6. Random component is the unpredictable component of demand BIS APPLICATION 2002-2003 MANAGEMENT INFORMATION SYSTEM 19 Cyclical and Seasonal Issues Type of Seasonal Variation There are two types of seasonal variation: Additive seasonal variation : Occurs when the seasonal effects are the same regardless of the trend. Multiplication seasonal variation : Occurs when the seasonal effects vary with the trend effects. It’s the most common type of seasonal variation BIS APPLICATION 2002-2003 MANAGEMENT INFORMATION SYSTEM 20 Cyclical and Seasonal Issues Computing Multiplicative Seasonal Indices Steps of Multiplicative Time Series Model: 1. Decide that the data is seasonal in nature. 2. Then realized that the seasonal variation is quarterly 3. If the variation of the data is larger to the right, then that seasonal variation is multiplicative. 4. Seasonal indices is needed to produce the seasonal forecast model. BIS APPLICATION 2002-2003 MANAGEMENT INFORMATION SYSTEM 21 Cyclical and Seasonal Issues Computing Multiplicative Seasonal Indices 1. Computing seasonal indices requires data that match the seasonal period. If the seasonal period is monthly, then monthly data are required. A quarterly seasonal period requires quarterly data. 2. Calculate the centered moving averages (CMAs) whose length matches the seasonal cycle. The seasonal cycle is the time required for one cycle to be completed. Quarterly seasonality requires a 4-period moving average, monthly seasonality requires a 12-period moving average and so on. 3. Determine the Seasonal-Irregular Factors or components. This can be done by dividing the raw data by the corresponding depersonalized value. 4. Determine the average seasonal factors. In this step the random and cyclical components will be eliminated by averaging them. BIS APPLICATION 2002-2003 MANAGEMENT INFORMATION SYSTEM 22 Cyclical and Seasonal Issues Computing Multiplicative Seasonal Indices Step 1 Quarter 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 Seasonal Four Period Irregular Data Moving Average Component 560 990 1,100 0.90000 1,740 1,120 1.55357 1,110 1,088 1.02069 640 1,133 0.56512 860 1,080 0.79630 1,920 1,090 1.76147 900 1,150 0.78261 680 1,163 0.58495 1,100 1,190 0.92437 1,970 1,198 1.64509 1,010 1,198 0.84342 710 1,263 0.56238 1,100 1,313 0.83810 2,230 1,275 1.74902 1,210 1,363 0.88807 560 1,393 0.40215 1,450 1,475 0.98305 2,350 1,573 1.49444 1,540 1,525 1.00984 950 1,648 0.57663 1,260 1,575 0.80000 2,840 1,250 BIS APPLICATION 2002-2003 MANAGEMENT INFORMATION SYSTEM Seasonal Index 0.87364 1.64072 0.90893 0.53825 Step 4 =AVERAGE(D3,D7,D11,D15,D19,D23) =AVERAGE(D4,D8,D12,D16,D20) =AVERAGE(D5,D9,D13,D17,D21) =AVERAGE(D6,D10,D14,D18,D22) Step 2 = AVERAGE(B2:B5) Step 3 = B3/C3 23 Cyclical and Seasonal Issues Using Seasonal Indices to Forecast To forecast using seasonal indices 1- Compute the forecast using an annual values. Any forecasting techniques can be used. 2- Use the seasonal indices to share out the annual forecast by periods Year 1 2 3 4 5 6 7 7 Data 4,400 4,320 4,760 5,250 5,900 6,300 6,754 BIS APPLICATION 2002-2003 Forecast Including Trend Forecast 4,125 4,000 4,498 4,290 4,545 4,391 4,893 4,674 5,433 5,107 6,179 5,713 6,754 6,252 1 912 2 1469 3 2769 4 1537 MANAGEMENT INFORMATION SYSTEM Trend 125 208 154 219 326 466 502 MAD 275 178 215 357 467 121 Q1 Q2 Q3 Q4 Alpha Delta MAD 0.6 0.5 269 0.54 0.87 1.64 0.91 24 BIS APPLICATION 2002-2003 MANAGEMENT INFORMATION SYSTEM 25