Open

advertisement

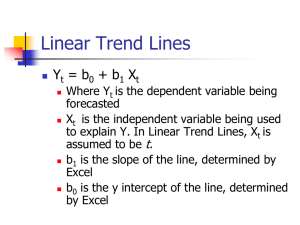

Methodology Glossary Tier 1 Time Series Monitoring underlying change over time A time series is a sequence of measurements taken at regular time intervals and in a consistent way. There are two kinds of time series data: 1. Continuous, where we have an observation at every instant of time, e.g. lie detectors, electrocardiograms. 2. Discrete, where we have an observation at (usually regularly) spaced intervals, e.g. Economics - weekly share prices, monthly profits Meteorology daily rainfall Time series analysis can show valuable information about the factors influencing a variable by looking at any changes that occur over time. An important function of this kind of analysis is to help decision making by forecasting future levels of the variable. Time series methods can enable the separation of processes of interest from those that are not of interest by breaking down variation in the data over time into the following components: Trend: a smooth, long term underlying pattern in the data. Diagram 1 Diagram 2 Diagram 1 shows a constant series where the measurements stay roughly the same over time. Diagram 2 shows a series with an increasing trend. Seasonal effect: variation which is cyclic and predictable in nature. Common timescales for seasonal effects are monthly (e.g. sales of sandwiches fall during months when fewer people are at work), weekly (sandwich sales may dip on a Friday when workers may buy a different type of lunch), daily (e.g. sandwich sales will peak at lunchtime). Diagram 3 Diagram 4 Diagram 3 shows a seasonal series where the graph follows a pattern that repeats itself at regular intervals. E.g. consumer spending is always greatest at Christmas. Diagram 4 shows a seasonal series with an increasing trend. Notice that each peak is greater than the previous peak. Fluctuations: These can be long-term or short-term but their cause is different to that producing the trend, e.g. the economic cycle typical of a developed country. Diagram 5 Diagram 6 Diagram 5 shows a series with a sudden fluctuation where the graph takes an unsuspected rise but quickly returns to normal. Diagram 6 shows a step series where the graph takes a sudden rise but then stays at the new level. Random effects- irregular and unpredictable residual variation left after other identifiable effects have been removed. Notice that in the diagrams above none of the lines are perfectly smooth – this is caused by the random effects. In this way time series analysis can divide and statistically remove the parts of the variation other than the one of interest. For example, if the interest is in the relationship between unemployment and Gross Domestic Product (GDP), it is desirable to eliminate or minimise 1. the seasonal effect, 2. any long term trend not due to economic conditions and, 3. random effects, in order to get the clearest picture of the underlying relationship between unemployment and GDP. Further Information Link Office for National Statistics information on time series