Old Spice Media Plan - Christina Bockisch

advertisement

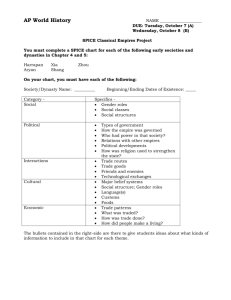

Old Spice Media Plan Christina Bockisch Dr. Cooper, Spring 2013 Executive Summary Product: Old Spice Year: July 1, 2013 – May 31, 2014 Budget: $40,000,000 Target Audience Men ages 18-34 who use or are interested in using men’s grooming and toiletry products. Positioning: Established in 1937, Old Spice is the leader in the men’s body care and toiletry market. For men who demand superior body care products, Old Spice offers you the highest quality and best-scented body care products on the market. Old Spice will make you smell like the best smelling man in the world. Spot Markets: Spot market advertising will account for 20.8% of our budget. These markets include Atlanta, GA; Boston, MA; Chicago, IL; Dallas-Ft. Worth, TX; Houston, TX; Los Angeles, CA; New York, NY; Philadelphia, PA; San Francisco et al, CA; and Washington, DC. Market Share Goal: To increase Old Spice’s market share by 2% by the end of May 2014, raising their market share from 23% to 25% by targeting adult men ages 18-34. Media Objectives 2 Media Mix and Budget Allocation 3 Table of Contents I. Situation Analysis a. Company Background b. Analysis of Product c. Promotions d. Uncontrollable Variables e. Positioning Statement f. Competition i. Market Shares ii. Advertising Shares iii. Share of Voice iv. Media Mix g. SWOT Analysis h. Marketing Objectives i. Market share goals ii. Strategy for Achieving Market Share Goals iii. Communication Objectives 5-18 5 6 7-8 II. Target Audience a. Rationale for Target Audience b. Product Usage c. Demographic Analysis d. Geographic Analysis e. Weighting of Target Audience 18-20 18-20 18-20 18-20 20 20 III. Media Objectives a. Reach and Frequency Range Chart b. Reach Goals c. Frequency Goals d. Continuity 21-24 21 21-24 21-24 24 IV. Media Mix a. Media Types b. Weighting of Media Types c. Computer Analysis d. Budget Recap 24-29 24-28 29 29 29 4 9 12-13 15 16 17 17-18 17 18 9 9-16 14 17 I. Situation Analysis Company Background Old Spice is considered to be an American icon in the world of men’s fragrances. For the past 75 years, Old Spice has made men smell good. Old Spice is experiencing a rebirth due to Procter and Gamble (P&G) and their efforts to position the brand as the gold standard in the men’s grooming product category. In 1934, William Lightfoot Schultz founded the Shulton Company. In 1937, Schultz created a fragrance for women called Early American Old Spice, and the men’s fragrance was launched the following year. Procter and Gamble acquired Old Spice in 1990 and updated the brand by changing the logo and expanding the brand to take advantage of the growing market. The Old Spice brand currently consists of deodorants, antiperspirants, aftershave, body washes, body sprays and fragrances in a wide variety of scents. Old Spice had long been associated with older gentlemen, but in 2008 all that changed when Old Spice launched their “Old Spice Swagger” campaign. In 2010, the brand launched four new fragrances known as the Fresh Collection. The collection was designed for men who preferred scents that weren’t overpowering. Each scent in the Fresh Collection was inspired by a wellknown country or region: Fiji, Matterhorn, Cyprus and Denali. In the next year, Procter and 5 Gamble plans to expand the Old Spice line to include body lotion that will be available in their current scents. Analysis of Product Product The Old Spice brand consists of men’s grooming products and toiletries that fall into the following categories: antiperspirant, deodorant, body wash, body spray and fragrance. Antiperspirants and deodorants are sold in the form of long-lasting sticks or an aerosol spray. The Old Spice fragrance category consists of aftershave and cologne. Old Spice has products in a variety of scents, and they have five different collections: classic, red zone, endurance, fresh collection and wild collection. Price Old Spice products range in price from $3.99 – $11.99 with the majority of products in the $3.99 – $6.99 range. Old Spice products are priced similar to other men’s grooming brands such as Axe, Degree Men and Dove Men. Place Old Spice products are available at a variety of retailers, both in-store and online. Old Spice is available at grocery stores, drug stores and online retailers. According to Old Spice’s 6 website, their products are available at stores such as CVS/Pharmacy, Walgreen’s, Sam’s Club, Target and Walmart. Old Spice products can also be purchased online from the P&G eStore, drugstore.com and Amazon.com. Promotions Past and Current Promotions At the beginning of March 2013, there was an Old Spice coupon in the P&G coupon insert of the Sunday paper. The coupon was for $2.00 off two products from the Old Spice Wild Collection. The coupon expired March 31, 2013. Many of Old Spice’s coupons can be found in the P&G coupon insert in the Sunday paper. Past Old Spice coupons have included $1.00 off one Old Spice deodorant and $1.00 off two Old Spice products. On July 1, 2012, there was a $2.00 off two Old Spice products coupon in the P&G coupon insert. On August 28, 2011, there was a buy one get one free coupon for Old Spice body wash in a P&G coupon insert. Proposed Promotions Old Spice should launch the following promotions in order to increase sales and brand awareness: 1. Coupon: Coupon for $1.00 off a two-pack of Old Spice deodorant 2. Coupon: Coupon for $1 off one Old Spice body wash 7 3. Event: Partnership with the NFL to promote Old Spice’s wild collection Old Spice’s campaign will begin on June 1, 2013 and end May 31, 2014. To launch the campaign, Old Spice will distribute a coupon for $1 off a two-pack of deodorant during the month of June. This coupon is occurring during June because men sweat more during the summer, and the coupon is encouraging men to stay fresh during the hot summer months. The coupon will be distributed through magazine advertisements. This promotion will be advertised through male-focused magazines, Internet, radio, network TV and cable TV. Spot media will also be used during this promotion to increase awareness and product sales. The coupon for $1 off one Old Spice body wash will be distributed during the month of February. Since Valentine’s Day occurs during this month, the idea is to encourage men to smell fresh for the women in their lives and to spice up the romance. This coupon will be distributed through Old Spice’s social media accounts and will be available for redemption at any store where Old Spice is sold. This promotion will be advertised through malefocused magazines, Internet, radio, network TV and cable TV. Spot media will be used during this period to increase awareness of Old Spice products as well as to help increase sales. The large promotional event for this campaign will occur during the month of October. The promotional event will include a partnership with the NFL to promote Old Spice’s wild collection. Since the NFL season runs from September 5 – December 29, 2013, October is a 8 good month to have a promotion with the NFL. According to an AdWeek Poll in 2011, almost three quarters of men (73%) watch NFL football (“No Surprise,” 2011). The AdWeek Poll also found that 64% of people watch NFL games on their TVs and 60% watch games on their computers. Respondents were allowed to select more than one option in this poll. Because of these factors, the promotion will be advertised using male-focused magazines, Internet, radio, network TV and cable TV. Spot media will be used during this period to increase awareness about the promotion as well as about Old Spice products. Uncontrollable Variables Old Spice cannot change the following factors and will have to work with these in mind. First, Old Spice will have to work within the boundaries of the $40,000,000 budget. Old Spice cannot exceed this budget and must work with what they were given. Second, the economy is still something to be considered and is out of Old Spice’s control. The economy is slowly improving, but the 2008 recession has lead people to be more cautious of what they buy and how much they spend. Consumers are trying to save money by choosing cheaper brands whenever possible. Positioning Statement Established in 1937, Old Spice is the leader in the men’s body care and toiletry market. For men who demand superior body care products, Old Spice offers you the highest quality and best-scented body care products on the market. Old Spice will make you smell like the best smelling man in the world. 9 Competition Key Points: Unilever is the largest player in the category, with sales reaching more than $490 million in 2012. Axe is a leader in the men’s grooming category and drives sales growth for Unilever. Procter and Gamble (P&G) is a close second in terms of sales and share but saw a dip in the market share in the 52-weeks ending July 8, 2012. This is primarily due to declines by Gillette in the shaving products category. Combined, Unilever and P&G are responsible for more than 50% of the market share in the men’s grooming category. The category is dominated by power brands like Axe and Degree (Unilever) and Old Spice and Gillette (P&G). Manufacturer Sales of Men’s Body Care, 2011 and 2012 Company 52 weeks Market Share 52 weeks ending July 10, ending July 8, 2011 2012 $ million % $ million Unilever 126.4 46.8 131.7 Procter & 87 32.2 89.8 Gamble Henkel Group 31.7 11.7 31.7 Other 24.9 9.2 25.3 Source: Mintel/SymphonyIRI Group InfoScan Reviews Market Share % 47.3 32.3 11.4 9.1 Manufacturer Sales of Men’s Deodorant/Antiperspirant, 2011 and 2012 Company 52 weeks Market Share 52 weeks Market Share ending July 10, ending July 8, 2011 2012 10 $ million 230.8 % 37.7 Procter & Gamble Unilever 178.2 29.1 Henkel Group 84.6 13.8 Colgate69.7 11.4 Palmolive Other 49.2 8 Source: Mintel/SymphonyIRI Group InfoScan Review $ million 232.8 % 37.2 207.2 73.6 64.3 33.1 11.7 10.3 48.3 7.7 Brands of Deodorant and Antiperspirant Used Among Men, January 2011 - March 2012 35 32 30 25 22 20 15 15 13 12 11 10 5 4 4 Adidas Arm & Hammer Ultramax 0 Degree Axe Old Spice Right Guard Speed Stick Gillette Series Source: Mintel/Experian Simmons NCS/NHCS Winter 2012 Adult Full Year – POP 11 Market Shares Procter & Gamble competes with Unilever, Henkel Group and Colgate-Palmolive in the male grooming market. Unilever is the largest category player in the male grooming market. Axe continues to be a leader in the men’s grooming category and helps drive sales for Unilever. Procter & Gamble is a close second to Unilever in the market. Combined, Unilever and Procter & Gamble are responsible for nearly 80% of the market share in the men’s grooming category. 12 Men's Body Care Market Shares 2012 9% 12% Unilever 47% Procter & Gamble Henkel Group Other 32% Source: Mintel/SymphonyIRI Group InfoScan Reviews Axe and Old Spice dominate the men’s body care market and account for over 50% of the market. Axe accounts for 22.8% of the market, and Old Spice accounts for 23.4%. Dove Men Plus Care is the third leader in the market and accounts for 13.4% of the market. 13 Men's Body Care Market Share (Brands) 9% 2% 23% Axe 7% Dove Men Plus Care Suave for Men 1% Vaseline Men Lotion 3% Old Spice Gillette 6% Dial for Men 2% 13% Right Guard Total Defense 5 Unilever - Other P&G - Other Henkel Group - Other 23% 6% Other 5% Advertising Shares Unilever/Axe have the largest advertising share in the market with 46%. Unilever/Dove Men has the second largest advertising share at 20%, but is far behind Axe in terms of 14 advertising. Combined, Unilever products account for 73% of the advertising share, while P&G only has 17%. Unilever is the dominant brand when it comes to advertising. Advertising Shares 6% 3% 7% Unilever/Axe P&G/Old Spice 7% 46% Unilever/Dove Men Unilever/Degree Men Henkel Group/Right Guard P&G/Gillette 20% Colgate Palmolive/Mennen 11% Share of Voice Axe stands out as the loudest voice in the market, and Dove Men is the second loudest. Although Old Spice is third, it’s significantly less dominant than Axe and Dove Men. Old 15 Spice ties three other companies in outdoor advertising. There is an opportunity for growth in Spanish language TV, Spanish language network TV, network radio, national paper, local paper and spot radio seeing as only a few brands are present in these categories. Media Mix 16 Old Spice is currently putting most of their advertising money into cable TV, national magazine and network TV. Other companies such as Axe and Dove men also put most of their advertising money into cable TV and national magazine, but Axe had a higher share of voice in both categories while Dove Men had a higher share of voice in national magazine. Almost every company is investing in cable TV, Internet and spot TV. Local paper, Sunday supplement, national newspaper, Spanish language TV, Spanish language network TV, spot radio and syndicated TV are very underused by nearly all companies. SWOT Analysis 17 Strengths Weaknesses Strong branding No recent campaigns High brand awareness Brand image leans toward the older generation Successful advertising campaigns Shift in target audience Affordable Creative messages Recent repositioning to target the age group that uses men’s grooming products Opportunities Potential to target women in future ad campaigns Creation of new product line that targets women New products (lotion) Threats Male population growth in men 2564, a segment that doesn’t use men’s grooming products High level of competition Brand competition Product competition Marketing Objectives Market Share Goal To increase Old Spice’s market share by 2% by the end of May 2014, raising their market share from 23% to 25% by targeting adult men ages 18-34. Strategy for Achieving Market Share Goals Advertising will allow consumers to see why Old Spice is the superior brand in the men’s grooming market and how they can smell like the best smelling man in the world. By highlighting Old Spice’s superiority, great-smelling products and usefulness, Old Spice will appeal to adult men ages 18-34. Advertising will work to increase product sales and generate brand awareness, thereby helping to make Old Spice the dominant brand in the market. 18 Communication Objectives 1. This plan is designed to target male consumers of Old Spice ages 18-34 to give the message that Old Spice is the best in the men’s grooming and toiletries market. 2. Advertising efforts will increase brand awareness of Old Spice products among men ages 18-34 as a superior brand of men’s toiletry products by two percent by the end of May 2014. 3. Advertising efforts will increase purchase intention among men ages 18-34 by five percent by the end of May 2014. II. Target Audience Rationale for Target Audience, Product Usage & Demographic Analysis After reviewing Simmons OneView crosstabs as well as market trends, the most efficient primary audience for Old Spice is men ages 18-34. The men’s grooming and toiletries market appeals to men 18-34. Ninety-three percent of men ages 18-24 reported using deodorant/antiperspirant as part of their daily routine, and 59% reported using shower gel as part of their daily routine. Ninety-one percent of men 25-34 reported using deodorant/antiperspirant as part of their daily routine, and 58% reported using shower gel as part of their daily routine. Men 18-24 are 79% more likely to use Old Spice high endurance body wash than the general population, according to a Simmons OneView crosstab. The same crosstab showed that men 25-34 are 35% more likely than the general population to use Old Spice high 19 endurance. A separate crosstab through SimmonsOne View showed that men 18-24 are 146% more likely to use Old Spice classic than the general population. Additionally, men 18-24 are 98% more likely to use Old Spice high endurance and 245% more likely to use Old Spice red zone than the general population. Men 25-34 are 51% more likely to use Old Spice classic, 165% more likely to use Old Spice high endurance and 177% more likely to use Old Spice red zone than the general population. When Procter & Gamble acquired Old Spice in 1990, they began repositioning the brand to appeal to a younger market. Newer marketing campaigns have given Old Spice a young, fresh feel. Old Spice’s current advertisements focus on a younger age group, mainly men 18-34, because this age group places a greater emphasis on male grooming. Men 18-34 believe that a deodorant that smells good eliminates the need to wear cologne. In addition, they perceive male grooming as having a direct impact on attraction. Eighty-three percent of men ages 18-34 believe that using personal care products boosts their self-esteem. Men 18-34 are likely to be influenced by a variety of factors when it comes to product selection. According to Mintel, 84% of men 18-24 are influenced by recommendations from family and friends while 41% are influenced by websites and blogs. Magazines influence an additional 36% of men in this age group. Sixty-three percent of men 25-34 are influenced by recommendations from friends and family while 32% are influenced by websites and blogs. Additionally, magazines influence 30% of men 25-34 when it comes to purchasing grooming products. Nearly 90% of men in this age group believe that people look more professional when they are well groomed, and 86% said they feel more 20 attractive when they’re well groomed (Mintel – Men’s Grooming and Toiletries – US – October 2012). Since men 18-24 and 25-34 are both large drivers in the men’s grooming and toiletry market, I decided to use both for the primary audience instead of having a primary and secondary audience. Geographic Analysis Old Spice is a nationally sold product and is available at grocery stores, pharmacies, online and large national retailers such as Target and Walmart. Old Spice can also be purchased straight from Procter and Gamble from the P&G eStore. After analyzing a SimmonsOne View crosstab, men and women in all regions of the United States use Old Spice products. In the Northeast region, males are 3% less likely than the general population to use Old Spice high endurance body wash. In the other three regions – Midwest, South, and West – males are 31%, 22% and 6% more likely than the general population to use Old Spice high endurance boy wash, respectively. Overall, there is no geographic pattern to Old Spice purchases as it is a national brand and available at retailers all over the United States. Weighting of Target Audience Since there is only a primary audience and no secondary audience, 100% of the budget will be allocated to the primary audience. 21 III. Media Objectives Reach and Frequency Range Chart Level Reach Reach Frequency Frequency Range Average Range Average High 75-95% 80% 9-10+ 10 Medium 60-75% 68% 6-8 7 Low 50-55% 53% 1-5 3 Reach and Frequency Goals Old Spice currently holds a strong position in the market with 23.4% of the men’s body care market. Axe is a close second and accounts for 22.5% of the market. Old Spice is sold nationally and there is room for growth when it comes to national advertising. It is important that advertisements reach a high percentage of our target audience. Additionally, because Old Spice and Axe are direct competitors and hold similar shares of the market, a medium frequency will be important to ensure the product is remembered. High reach/medium frequency is common throughout the schedule to account for promotions and high selling periods. 22 Reach/Frequency Goals by Period Period 1: June, July The first promotion occurs in June (coupon for $1 off a two-pack of deodorant). Ninety-two percent of men report using a deodorant or antiperspirant, and younger men (18-24) are more likely to use men’s grooming products. Therefore, a deodorant coupon would be a good fit for our target audience, especially during the summer months. To account for the kickoff of the campaign and promotion, there will be a high reach (80%) and medium frequency (7) during this period. Spot reach will be slightly higher (85%) along with spot frequency (8). The total gross rating point (GRP) goal for each month including national and spot is 680. Period 2: August, September Although the first promotion period is over, it wouldn’t be wise to stop advertising completely because consumers are still purchasing Old Spice products. Therefore, there 23 should be a medium reach (68%) and low frequency (3) during this time period. The total gross rating point (GRP) goal for each month is 204. Period 3: October, November Period three is a high reach (80%) and medium frequency (7) period because the biggest promotion occurs during October. In October, Old Spice will partner with the NFL to promote the wild collection. Spot reach during this period will be higher (85%) along with spot frequency (8). The total gross rating point (GRP) goal for each month for national and spot is 680. Period 4: December, January After a period of high reach/medium frequency in national and spot, period four only needs to be medium reach/low frequency. During this period, we will use medium reach (68%) and low frequency (3) to ensure that Old Spice isn’t forgotton but also to avoid any annoyance on the part of the consumer. The total gross rating point (GRP) goal for each month is 204. Period 5: February, March Period five is a high reach (80%) and medium frequency (7) period due to our third promotion ($1 off one Old Spice body wash) taking place during the month of February. Fifty-nine percent of men report using shower gels, and men 18-34 are more likely to use men’s grooming products. Therefore, a coupon for body wash would be a good promotion for our target audience to help increase Old Spice body wash sales. Spot reach during this period will be higher (85%) along with spot frequency (8). The total gross rating point (GRP) goal for each month is 680. Period 6: April, May 24 April and May is the last period of advertising for the campaign. Since the last promotion is over and much of the target audience has been reached effectively, the lowest levels of reach (53%) and frequency (3) will be used. It wouldn’t be wise to stop advertising completely because consumers are still purchasing Old Spice products. The total gross rating point (GRP) goal for each month is 159. Continuity Advertising for Old Spice will be on a continuous schedule starting June 1, 2013 and ending May 31, 2014, with an occasional pulsing pattern to ensure that messages reach our target audience during promotions. Advertising is divided into six periods. Reach and frequency peaks during the month of a sales promotion and will continue to peak the month immediately following the promotion because consumers are more likely to remember the brand after seeing increased advertising or sales promotions. IV. Media Mix Media Types A majority of the campaign advertising is split between three media: television, radio and Internet. A mix of network and cable television is used to reach the widest possible audience. Radio is used heavily due to its ability to reach the audience more frequently and it has a large reach as most people have at least one radio. Internet is used most heavily because it’s the best way to reach our target audience of men 18-34. Men in this age group 25 are heavy online users; therefore Internet is the best way to reach them. Finally, magazines are used because they are great for visual displays as well as for distributing coupons. Old Spice Media Mix 5% 6% 9% 3% Net TV- Prime Net TV - Sports 7% Net Cable - Prime 8% Net Cable - Late Fringe 12% Net Radio - Morning Drive Net Radio - Evening Drive Net Radio - Nighttime 4% 18% Magazines - Men's Internet - Targeted Sites 10% 8% 3% Spot TV - Prime Spot TV - Late Fringe/News Spot Radio - Morning Drive 7% National Programming Network Television – Prime and Sports (15.7%) Prime time and sports are the only types of network television that will be used in this plan. Although most men 18-34 have cable, network television has traditionally been the medium available to and watched by the highest number of households. Since one of the promotions includes a partnership with the NFL, it makes sense to advertise during sports broadcasts. Men 18-34 will be reached well during the prime time daypart since they will be getting home from work or school and will likely want to unwind. They will also be reached well during sports broadcasts because many men spend their weekends watching sports. Advertising will take place during popular prime time shows such as The Big Bang Theory, Two and a Half Men, Criminal Minds and Modern Family. All of these shows were 26 ranked in the top 20 network prime time series during the season-to-date (“Nielsen Television Ratings,” n.d.). Overall, network television accounts for 300 GRPs and costs $6,029,300, which is 15.7% of the total budget. Network Cable – Prime and Late Fringe (16.1%) In the US, 90.4% of households have cable television, making it an important part of Old Spice’s media strategy (“How American’s Are Spending Their Media Time and Money,” 2012). Since there are more programs available on cable compared to broadcast, we can pinpoint networks and programs to best reach the target audience more effectively. By doing this, we can make media buys at a better price to make room for other important mediums. Prime time and late fringe are the dayparts used for network cable. Both of these dayparts are a perfect fit for men 18-34 because this is the time they will be home from school, relaxing and watching television. We will target male-focused channels such as TBS, G4/Esquire, Discovery Channel, Adult Swim and BBC America. Some of the shows that will be targeted for the late fringe daypart are Chelsea Lately, Saturday Night Live and Conan. Overall, network cable accounts for 620 GRPs and costs $6,203,800, which is 16.1% of the total budget. Network Radio – Morning Drive, Evening Drive and Nighttime (20.6%) Radio is an efficient way to reach our target audience. Radio reaches a total of 241 million American adults each week, which is 93% of the US. Each week across the US, radio is heard by 94% of adults ages 18-34 (“Radio by the Numbers, Winter 2012”). Therefore, radio is a great way to reach a large portion of our target audience. For this plan, we will utilize three dayparts – morning drive, evening drive and nighttime. Morning drive and evening drive is when our target audience will be in the car driving to school or work, and 27 nighttime is used because research shows that adults 18-34 are likely to be in their car during later evening hours (“Arbitron Radio Today 2010,” 2010). Overall, network radio accounts for 2,960 GRPs and costs $7,921,600, which is 20.6% of the total budget. Magazines – Men’s (8.3%) Old Spice’s visually appealing advertisements and bold colors make them a perfect fit for visual-intensive advertising that will come with the full-color advertisements in magazines. A study by Pew Center research in 2012 that 42% of people under 30 read magazines (“Young People Frequent Libraries,” 2012). A coupon during the first promotion will be displayed in magazines as opposed to newspapers because of the visual quality and high retention rates within the medium. Advertising will be done solely through male-focused magazines since our target audience is men 18-34. Examples of magazines that will be targeted are Sports Illustrated, Men’s Health, Esquire, GQ, Men’s Fitness and Men’s Journal. Overall, men’s magazines account for 300 GRPs and costs $3,181,500, which is 8.3% of the total budget. Internet – Targeted Sites (18.5%) The second coupon promotion in February is based largely around the Internet, as a coupon for $1 off one Old Spice body wash will be featured on the brands social media sites. However, Internet will be used throughout the entire campaign because adults ages 18-34 are heavy Internet users, and a large part of their day is spent online. Research has shown that Millenials spend 26 hours per week online (“Millenials Up Their Time Online,” 2013). The same research shows that on average, Millenials spend six hours per week on social media, though men spend less time on social media than women (five vs. seven hours per week). The type of Internet advertising used for this plan is targeted sites. Banner and 28 full-length ads will be placed on sites such as Facebook and YouTube as well as on malefocused television shows that are available online, such as Big Bang Theory and Modern Family. Overall, Internet advertisements account for 300 GRPs and costs $7,095,000, which is 18.5% of the total budget. Spot Programming **Justification for the use of cable, network and radio can be found in their previous sections. This section is meant to explain the campaign’s use of spot marketing** Spot Television – Prime and Late Fringe/News (10.6%) Prime time and late fringe/news dayparts will be used for this plan. Both of these dayparts are effective at targeting males 18-34 because this is when they’ll be home from school, taking a break from homework and watching television before bed. The late fringe daypart is especially effective for our target audience because adults 18-34 tend to stay up longer than those in other age groups. Overall, spot television accounts for 240 GRPs and costs $4,069,500, which is 10.6% of the total budget. Spot Radio – Morning Drive and Evening Drive (10.2%) The morning drive and evening drive dayparts will be used for this plan. Justification for using these dayparts can be founded in a previous section titled, “network radio.” Overall, spot radio accounts for 480 GRPs and costs $3,910,300, which is 10.2% of the total budget. Spot Markets Used 29 Weighting of Media Types Computer Analysis & Budget Recap The following pages contain the computer analysis and budget recap charts that were generated through Media Flight Plan. 30 31