2015 February Presentation - Society for Information Management

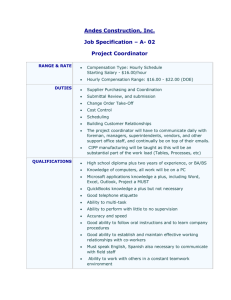

advertisement

2014/2015 Trends in Compensation Society for Information Management Minnesota Chapter Presented by: Maureen Driscoll Principal, Compensation Consulting Today’s Presenter – Maureen Driscoll • Principal with Verisight’s compensation consulting group • 35 years of compensation experience • 23 years of consulting experience 1 Agenda – Trend data • Verisight’s 2014/2015 Compensation, Retirement and Benefits Trend Survey – Total rewards philosophy – Base pay considerations • Job families and career pathing – Variable pay considerations – Nontraditional rewards – What employees want: rewards of work 2 Why is This Topic Important? • Attracting and retaining skilled employees is critical • 81% of IT professionals are open to hearing about new job opportunities, even if they are happily employed* • IT professionals report receiving an average of 34 job solicitations each week* • Total compensation costs usually represent the greatest expense to organizations • Turnover is costly • Saratoga Institute 1x salary • World At Work 1.5x salary *Minneapolis/St. Paul Business Journal-Dec 2014 3 Verisight and McGladrey 2014/2015 Compensation, Retirement and Benefits Trends Report 2014/2015 Compensation, Retirement and Benefits Trends Report 2014/2015 Compensation, Retirement and Benefits Trends Report • • • • Fourth annual survey More than 1,000 participants from across the country Respondents span a range of industries Deepest penetration in manufacturing, not-for-profit, health care and professional services industries 5 Compensation Philosophy The total compensation philosophy of the majority of employers is to position base salary at market. However, a fairly large segment of employers (34 percent), typically from firms with 500 or fewer employees, have no formal philosophy for positioning bonus and incentive compensation. 14% 22% 37% 30% 36% 62% Position Above Market 47% 8% 44% Position at Market Position Below Market No Formal Philosophy 10% 34% 14% Base Salary Compensation Practices Incentive Compensation 5% 7% 14% 16% Health and Welfare Benefits Retirement Benefits Base = 521 6 Salary Increases Identical to the past two years, median salary increases for executive, managerial, salaried and hourly non-exempt workers remained at 3.0 percent. 2014 Actual Base Salary Increases 2015 Anticipated Base Salary Increases Mean 2.8% 2.8% Median 3.0% 3.0% Mean 2.6% 2.8% Median 3.0% 3.0% Mean 2.5% 2.6% Median 3.0% 3.0% Mean 2.6% 2.7% Median 3.0% 3.0% Mean 1.8% 2.0% Median 2.3% 2.5% Executives Salaried (Exempt) Salaried (Non-exempt) Hourly (Non-exempt) Hourly (Union) Includes zeros (i.e., salary freezes) Compensation Practices 7 Salary Structures Only half of organizations (50 percent) have a formal salary structure with grades, minimums, midpoints and maximums to manage compensation. The Financial/Banking/Insurance, Health Care and Not-for-profit industry sectors are far more likely than other industry groups to have a formal salary structure to manage their compensation investment, as are larger organizations with 1,000 or more employees. No 50% Yes 50% Base = 515 Compensation Practices 8 Salary Structures Salary structures are anticipated to move up slightly in 2015 compared to 2014 . 2014 Actual Salary Structure Adjustments 2015 Anticipated Salary Structure Adjustments Mean 1.1% 1.4% Median 1.0% 1.5% Mean 1.4% 1.6% Median 1.7% 2.0% Mean 1.2% 1.5% Median 1.2% 1.8% Mean 1.4% 1.7% Median 1.7% 2.1% Mean 0.9% 1.0% Median 0.9% 0.9% Base 163 148 Executives Salaried (Exempt) Salaried (Non-exempt) Hourly (Non-exempt) Hourly (Union) Includes zeros (i.e., no adjustments) Compensation Practices 9 Pay for Performance More than half (56 percent) of the organizations surveyed have implemented or plan to implement some type of pay-for-performance program. Larger organizations with 1,000 or more employees are much more likely to utilize pay-for-performance compared to smaller organizations. 27% Implemented Throughout the Organization 20% Implemented with Some Employee Groups 9% Considered Implementing in Next 12 Months Not Implemented 41% Previously Implemented But Eliminated 3% Base = 508 Compensation Practices 10 Pay for Performance While average salary increases for high performers and satisfactory performers increased slightly from 2012 to 2013, they remained relatively steady over last year at 4.8 percent and 2.9 percent respectively. 4.8% High Performers 4.4% 2.9% Satisfactory Performers 3.0% 1.1% Low Performers 1.2% Base = 390 Mean Compensation Practices Median 11 Incentive Plans Eligibility for short-term incentive pay is substantially more available to executives and salariedexempt management than to hourly and non-exempt workers. Long-term incentive pay remains largely reserved for executives. 59% Executives 34% 60% Salaried (Exempt) 14% 35% Salaried (Non-exempt) 7% 41% Hourly (Non-exempt) Hourly (Union) 7% 6% 1% Short-Term Incentives (1 year or less) Long-Term Incentives (More than 1 year) Compensation Practices Base = 462 12 Incentive Plans What is the targeted short-term incentive pay opportunity at your company for 2014? 23% Executives 20% 12% Salaried (Exempt) 12% 6% Salaried (Non-exempt) 7% 5% Hourly (Non-exempt) 6% 8% Mean Median Base = 133 Compensation Practices 47% Executives 32% 21% Salaried (Exempt) 21% 12% Salaried (Non-exempt) 12% 9% Hourly (Non-exempt) 5% Hourly (Union) What is the maximum short-term incentive pay opportunity at your company for 2014? 9% 10% Hourly (Union) 8% Mean Median Base = 133 13 Incentive Plans The most important measurement criteria for executives is organizational performance, while for workers at most other levels, individual performance is most important. 87% 70% 69% 67% 63% 62% 58% 55% 49% 46% 37% Organization Performance 46% 36% 34% 31% Division/Department Performance Individual Performance Other Measures 18% 8% Executives 6% 8% Salaried (Exempt) Salaried (Nonexempt) 10% Hourly (Nonexempt) Hourly (Union) Base = 325 Compensation Practices 14 Incentive Plans By far, the most commonly used measure for organizational performance continues to be earnings before income, taxes, depreciation and amortization (EBITDA), cited by 60 percent of respondents. EBITDA 60% ROA 8% ROE 8% ROIC Other 6% 38% Base = 227 Compensation Practices 15 Incentive Plans While most incentive plans are designed to set expectations up front, spot bonuses, which are usually more subjective, are also used by 40 percent of responding organizations. Under Consideration 10% Yes 40% No 50% Base = 484 Compensation Practices 16 Total Rewards Philosophy 17 Business Strategies Pay & Reward Objectives Organization Style & Culture Information & Support Systems Compensation Strategies Stakeholder Concerns & Objectives Competitive Pay & Reward Policies Industry, Legislation, Market & Economic Development Long Term Incentives Short Term Incentives Base Salary Benefits Perquisites 18 Total Rewards Package Example Organization “X” vs. Market Organization X 70K Variable Pay * 65K 60K Benefits Market Variable Pay * Benefits * Variable Pay = Bonus/Incentive 55K 50K 45K Base Pay Base Pay 40K 19 Elements of a Total Rewards Philosophy • • • • • • Reward program objectives (overall and for each element) Market position (who and how competitive against) Reward mix (base versus variable pay versus benefits) Reward focus (individual versus group) Basis of job value (internal versus external) Structure (traditional versus non-traditional) 20 Sample Philosophy Questions for Leadership • What results/outcomes will be connected with what reward system? • Who are our labor market competitors? How should our rewards compare to the market – overall and for each reward element? Does this differ by employee group (such as IT)? • Which is more important – how jobs compare to one another internally, or how they compare to the external market? 21 Outcome • Serves as a blueprint for the design of the company’s total rewards program • Written document that is a powerful communication tool for employees and applicants • Articulates the company’s “value proposition” – Tangibles and intangibles – Why should they work for you? 22 Base Pay Considerations 23 Salary Survey Sources • Be sure to use: – data sources that are reflective of your company’s total rewards philosophy – multiple data sources, whenever possible – data sources that have a reputation for quality control – matches that reasonably reflect job responsibilities – sound sample sizes (company and incumbent) 24 Reliability Issues with Internet Compensation Data • Primary purpose of the site and the host – Hook/lure to sell HR/non-HR related services or products – Re-seller of data • Site’s targeted customers − Employers or consumers? • Underlying database for the reported pay data – Often self-reported – Jobs matched on title (results in mismatch) and no level differentiation • Methodology used to gather data – Lack of disclosure on effective date and data parameters – No quality control 25 Job Families • Can represent a broad grouping of functionally related jobs – Accounting – Information Technology • Can represent career progression within a particular job – Business Systems Analyst – Database Administrator – Systems Administrator 26 Career Pathing and Job Families Technical Track Management Track Information Technology Principal Senior Advanced Associate 27 Movement Between Job Families May or May Not be Feasible Level 3 Level 3 Level 2 Level 2 Level 2 Level 1 Level 1 Level 1 28 Job Family Leveling Criteria - Examples • • • • • • Education and Experience Knowledge, Skills and Abilities Credentials, Licenses or Designations Problem Solving/Decision Making Freedom to Act Relationships 29 Job Family/Career Pathing Example • Large Twin Cities employer • IT Department with the following job families: – Systems Analysis – Systems Administration – Business Systems Analysis – Data Base Administration – Telecommunications – Project management 30 Job Family/Career Pathing Example (continued) • Each family has 3 or 4 generic “levels” based on generally defined criteria. • This is the primary tool to: – Describe what is needed to advance to higher levels within each family – Assist employees and their managers/supervisors in establishing a development plan 31 Job Family/Career Pathing Example (continued) • Technical toolbox: – identifies the specific technical competencies (knowledge, skills and/or abilities) needed within a given job family • can include identification of ascending and descending skills – complementary tool to identify training and development needs for the respective job families – should be consistent with the company’s technology management, architecture and business strategies 32 Succession Planning • IT professionals report receiving an average of 34 job solicitations each week* • Attrition, promotion and organizational change can happen quickly and unexpectedly • Critical that companies put programs in place to cultivate highpotential internal talent who can step into key roles when needed • A strong succession management program serves as a powerful retention tool in a highly competitive market for IT talent *Minneapolis/St. Paul Business Journal-Dec 2014 33 Variable Pay Considerations 34 Types of Variable Pay Systems • Bonuses (usually “after the fact”) – Recognition – Project completion – Sign-on/hiring – Retention – Spot awards – Discretionary • • Short-term incentives (“before the fact”) – Formula driven – May reflect balanced score card Long-term incentives (usually 3-5 years) – Usually only available at upper management levels – Balance short- and longterm decision making – Retention 35 Performance Criteria vs. Reward Vehicles Base Pay Behavioral Competencies Objectives Variable Pay (Incentives or Bonuses) Reward Vehicles Performance Criteria Job Responsibilities Developmental Performance Improvement Recognition Special Goals or Objectives 36 Pros and Cons of Variable Pay Opportunities Cautions • Increased compensation • Can become an “entitlement” if expense is a variable cost not properly designed, and communicated • Depending on plan design, can reward for individual, team • Discretionary bonuses typically and/or company-wide don’t reinforce “pay for performance measures performance” • Allows for targeted distribution • FLSA provision complicates of limited compensation dollars incentive payouts for nonexempt employees who work overtime 37 Why Do Incentive Plans Fail? • • • • • • Lack of buy-in, involvement (employees and managers) Plan done in a hurry Too complicated Employees feel impact is too indirect Poor communication No payout, first or second measurement period • Plan lacks flexibility • Too many major changes during first year (instability) • Administration too costly/confusing 38 Key Design Steps for Short-Term Plans 1 Determine Objectives 2 Determine Basis of Eligibility 3 Determine Funding Mechanism(s) 4 Determine Payout Basis/Size of Awards/Payout Timing 5 Determine Plan Measures and Formulas 6 Determine Plan Administration & Communication 39 Nontraditional Rewards 40 Nontraditional Rewards • • • • • • • • • Flexible work arrangements Telecommuting Wellness and career counseling Family/child care Home office set-up stipends On-site health facilities Casual dress “Cutting edge” technology Leased automobiles • • • • • • • • • Company paid spousal travel Discounted weekend trips Training and certification Prepaid legal advice Paid parking Company paid outings Free meals Sabbaticals True work/life balance 41 What Employees Want: Rewards of Work 42 What Employees Want: Rewards of Work • Study co-sponsored by World At Work and Sibson & Company • 1200+ respondents in U.S. • Questions: – How do they feel about rewards of work? – What do they value? – What leads them to remain? 43 What Employees Want: Rewards Of Work (continued) • Five categories studied: – Direct financial (pay) – Indirect financial (benefits) – Work content (work itself) – Careers (long-term opportunity) – Affiliation (feelings of belonging) WorldatWork and Sibson & Co. survey of 1200+ U.S. companies regarding employees feelings about rewards of work, related values, and retention 44 Findings • Work content was most highly rated • Level of satisfaction with pay was high • Satisfaction with pay process was low • 75% prefer traditional forms of changes in pay Merit Individual incentives Promotional increases 45 Retention Drivers Component Driver Driver Driver Base Pay Satisfaction with process Pay level Pay raises Indirect Pay Satisfaction with time off Benefits process Benefit levels Career Career opportunities Satisfaction with manager Job security Work Content Feedback from supervisor and coworkers Job responsibilities Autonomy 46 Overall Best Practices • Total Rewards Philosophy – Formalized and continuously communicated • Base Pay – Competitive with defined market – Includes opportunities for growth and development • Variable Pay – Rewards outcomes distinct from base pay and other programs • Non-traditional rewards – Appropriate for culture 47 THANK YOU! Contact Info: Maureen Driscoll Principal, Compensation Consulting Maureen.Driscoll@verisightgroup.com 651.900.8111 48