Class 10: Conversion and Dismissal

8: Conversion and Dismissal

© Charles Tabb 2010

Where you start isn’t always where you finish

Problem 2.3(a)

• June 1: Debtor filed chapter 7

– owes debts of $25,000.

– no nonexempt assets -> creditors will not be paid anything

• June 5: Debtor accidentally runs stop sign and crashes into Creditor’s Lamborghini, causing

$55,000 in damages.

• Debtor’s insurance had lapsed a week earlier.

What Debtor wants

• -> Debtor files a motion to dismiss her chapter 7

• Wants to refile her case in order to

discharge her debt to Creditor.

Debtor’s problem

• Discharge only applies to PRE-bankruptcy debts (§ 727(b))

– “fresh start, not head start”

• $55,000 debt to Lamborghini owner arose

POST-bankruptcy (June 5 is after June 1)

• If Debtor could just dismiss and refile, she’d discharge Lamborghini debt and still pay nothing

Debtor’s dismissal right?

• Debtor does NOT have an absolute dismissal right in chapter 7

• Has to show cause just like anybody else,

§ 707(a)

• Judicial Test: no “legal prejudice”

Legal prejudice?

• Would it be legal prejudice to the owner of this car to get paid nothing?

• Of course

• DENY debtor’s dismissal motion

– Basically, rule of thumb is: “if debtor wants it, it’s bad for her creditors, so deny”

– Exs: Discharge debt; add exemption NOPE

File another bankruptcy case?

• Ok, fine, so Debtor can’t dismiss this case.

• So why not just file a second bankruptcy case, and discharge the Lamborghini debt?

Case 1:

Not discharge

Lamborghini debt

Case 2:

Discharge

Lamborghini debt

Case 2 discharge??

• No discharge in 2 nd case for EIGHT years

– See § 727(a)(8)

• Could do in FOUR years if file a chapter 13 case the 2 nd time around

Case 2:

Discharge Lamborghini debt

Problem 2.3(b)

• Debtor filed chapter 7.

• She has debts of $25,000

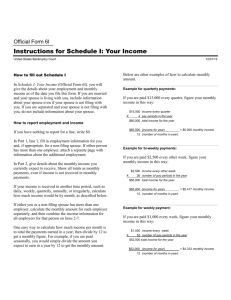

• She receives a monthly social security check of

$750.

• Debtor decides she wants to try to repay some of her debts.

Does Debtor have an absolute right to convert to chapter 13?

Debtor convert 7 -> 13

DR

7 13

• YES, DR can convert 7 to 13 -- § 706(a)

One time right

• As long as filed originally under chapter 7

– If was converted TO 7, then Debtor doesn’t have right to convert back to a reorg chapter

Debtor eligible in new chapter

• Debtor must be ELIGIBLE in new chapter, see 706(d)

• Here, is eligible in chapter 13:

– Individual

– Regular income (monthly social security check)

– Under debt limits

Hold on Marrama for now

• For now, let’s hold off on Marrama’s “bad faith” exception to 706(a)

• That comes under the “judicial limitations” section

• Now we are just trying to figure out the statutory scheme

Problem 2.3(c)

• Same facts as in (b), except that Debtor is content to remain in chapter 7

• Her trustee moves to convert her case to chapter 13

TEE

7 13

Answer to 2.3(c)

• NO

• The debtor’s case cannot be converted to

Chapter 13 involuntarily. See § 706(c)

• This is consistent with the rule prohibiting involuntary chapter 13 cases. See § 303(a)

– Otherwise could get an involuntary 13 through the back door of conversion

Problem 2.3(d)

• Same facts as in (b) [e.g., DR debts = $25k, monthly social security = $750]

• except that Debtor first filed for relief under chapter 13.

• DR has given up hope: can’t make payments

1.

Does Debtor have an absolute right to convert to chapter 7?

2.

Does DR have absolute right to dismiss?

Good-bye chapter 13

• Yes

• DR has absolute right to convert a ch. 13 to 7

• DR also has absolute right to dismiss a ch. 13

• Consistent with idea that debtor cannot be compelled to be in Chapter 13

– See § 1307(a) (convert to 7)

– See § 1307(b) (dismiss)

Problem 2.3(e)

• Same facts as in (d), except that Debtor is content to remain in chapter 13

• The trustee moves to convert her case to chapter 7.

13

TEE

7

“Cause” and you’re out!

• Tee does not have an absolute right to convert DR to chapter 7

• But Dr does not have an absolute right to stay in chapter 13 either

• Can be converted to 7 OR dismissed if TEE shows CAUSE

See § 1307(c)

What would be “cause”?

• Look at various illustrative grounds in §

1307(c)(1)-(11)

• Bottom line the 13 isn’t working for benefit of creditors

• Need more facts in 2.3(e) to know if

“cause” exists to convert

Court could dismiss instead

• Note that if TEE shows “cause” under 1307(c) in support of motion to convert to 7, the court may choose to dismiss instead

• Test is “best interests of creditors and the estate”

Problem 2.3(f)

• Debtor, Inc. filed chapter 11, hoping to reorganize, and was continued as debtor in possession.

• Some months later, Debtor realized that the reorganization effort was hopeless.

-> Does Debtor have an absolute right to convert to chapter 7?

-> Does Debtor have an absolute right to dismiss?

DR conversion 11-7

DR

11 7

Absolute right IF:

●

DR originally filed Ch 11

-> not converted TO 11

-> not commenced as involuntary 11

●

No Tee appointed in the 11 (i.e., Dr still DIP)

See § 1112(a)

DR dismiss 11?

• DR does NOT have an absolute right to dismiss a chapter 11 case

DR

11

DISMISS

• Must show “cause” under § 1112(b), just like anyone else

– Differs from 13, where DR has absolute dismissal right

Problem 2.3(g)

• Same facts as in (f), except that Debtor wants to keep trying to reorganize, but the unsecured creditors’ committee moves to convert the case to chapter 7. What result?

11

CR Comm

7

Involuntary conversion

• Cause

– See § 1112(b)

• Court may choose to dismiss as alternative

• Test: “best interests of creditors and estate”

“Cause”?

• What is “cause” for involuntary conversion to ch. 7 or dismissal from ch. 11?

– See § 1112(b)(4) for illustrative grounds

• Again, common theme ch 11 case not working for benefit of CRs at an acceptable cost

Appoint Tee as alternative?

• Court has discretion to Appoint TEE instead of dismissing or converting the ch 11 case

– See § 1104(a)(3)

• Even if movant shows “cause” under § 1112(b)

• In short – Ct may decide that ch 11 case

COULD work for benefit of CRs – just not with

DR running the show

Marrama

• What bad things did Debtor Robert

Marrama do?

Marrama’s bad acts

• Lied about his property in Maine in his ch 7 bankruptcy schedules

• Said it had no value

– Actually it had considerable value

• Said no transfers

– Actually transferred that property to himself in trust 7 months before filing

The Maine property

• If he stays in ch 7, what will happen to

Debtor’s property in Maine?

Lose property in 7

• Debtor will lose his Maine house if stays in chapter 7

• Has to turn over to Trustee

– Who wants it now that he knows has value

Why 13, then?

• If Debtor is in chapter 13, though – KEEPS his property, including the Maine house

Has to pay for it, though

• Not free – under “best interests” test of

1325(a)(4), DR must pay unsecured CRs as much under Ch 13 plan as would get in CH 7 liquidation

• Means has to pay value of Maine property over time, with interest, in CH 13 plan

Discharge?

• Would Marrama get a discharge if he stayed in chapter 7?

No discharge in 7

• NO

• See 727(a)(2), (4)

Might get discharge in 13

• The 727(a) discharge denial grounds in chapter 7 do not apply in ch 13 at all

• So is possible would get discharge in 13

• Note that some of the 523(a) exceptions to discharge do apply in 13

– But Marrama’s misdeeds appear to be of the 727 type rather than the 523 type

Incentive for conversion

• So – now that he’s been “found out”, can see why Robert Marrama would like chapter 13 more than chapter 7

Keep property

Get discharge

But would he stay in 13?

• The supposed benefits of 13 over 7 only will help Marrama if he actually gets to stay in 13, though

• Under 1307(c), the ch 13 trustee or a creditor

(likely the Bank, here), could move to convert back to 7, or dismiss, for “cause”

• And Marrama’s misdeeds = “cause”

So what difference does it make?

• The 1307(c) conversion/dismissal threat raises practical Q:

what difference does it make whether just deny conversion in the 1 st place from 7 to 13, or allow that conversion, then convert right back to 7?

706(a) 1307(c)

7 13 7

1

st

difference

• Reconversion is not automatic

• Someone (a CR, ch 13 Tee) would have to move for reconversion under 1307(c)

• Dr has right to be heard – commences a

“contested matter” under Rule 9014

• Dr might file a workable Ch 13 plan, which Ct might take into account

2

nd

difference

• Who’s guarding the henhouse? The debtor

“fox”?

• DR takes over as DIP once files CH 13

• CH 7 TEE out of picture

• CH 13 TEE lacks same supervisory/monitoring role

Worry – DR dissipate assets

• The concern is that the “bad” DR who is now the DIP in CH 13 and thus in charge of the assets would be able to dissipate the assets before the re-conversion

Statute?

§706

(a) The debtor may convert a case under this chapter to a case under chapter 11, 12, or 13 of this title at any time, if the case has not been converted under section 1112, 1208, or 1307 of this title. Any waiver of the right to convert a case under this subsection is unenforceable.

…

(d) Notwithstanding any other provision of this section, a case may not be converted to a case under another chapter of this title unless the debtor may be a debtor under such chapter.

What the statute appears to say

• The debtor may convert to chapter 13 at any time

• Unless either:

– 1. was previously converted TO ch 7 –> 706(a)

• NOPE – Dr filed originally under ch 7

OR

– 2 . Dr not eligible under ch 13 –> 706(d)

• NOPE – Robert Marrama is an individual debtor, apparently under the debt limits, assume has regular income. See 109(e)

Whole statute -- “knew how to”

• In other conversion rules, Congress gave the court discretion whether or not to convert, and uses language “the court may convert”

– See e.g., 1112(b)

• Whereas 706(a) says “the debtor may convert”

• Strong indication that Congress “knew how to” – and did – craft qualified conversion rules, with the court having the final say

And 706(a) is NOT one of those qualified rules

Legislative history to 706

• “Subsection (a) of this section gives the debtor the one-time absolute right of conversion of a liquidation case to a reorganization or individual repayment plan case. If the case has already once been converted from chapter 11 or 13 to chapter

7, then the debtor does not have that right. The policy of the provision is that the debtor should always be given the opportunity to repay his debts, and a waiver of the right to convert a case is unenforceable.”

How clear does Congress have to be??

• Given:

– The specific language in § 706

– The contrasting textual language of other conversion rules in the Bankruptcy Code

– The legislative history

How much clearer could Congress have been?

- Do they have to say, “and we really mean it”!

Supreme Court holds

• Debtor Robert Marrama does NOT have an absolute one-time conversion right from chapter 7 to chapter 13 under 706(a)

– WHAT???

HOW did they come up with THAT holding, given the seemingly crystal clear statutory language?

1

st

: statutory argument

• 706(d)

• “a case may not be converted to a case under another chapter of this title unless the debtor

may be a debtor under such chapter.”

“may be a debtor”

• “may be a debtor under such chapter”

• But isn’t Robert Marrama eligible for chapter

13 relief, under 109(e)?

– [individual, regular income, under debt limits]

SURE

So what on earth is Supreme Court thinking of?

Ch 13 dismissal/conversion as ELIGIBILITY rule?

• Court says that DR’s susceptibility to dismissal or conversion under 1307(c) means he falls within the “may be a debtor” exclusion in 706(d):

“ In practical effect, a ruling that an individual's Chapter

13 case should be dismissed or converted to Chapter 7 because of prepetition bad-faith conduct, including fraudulent acts committed in an earlier Chapter 7 proceeding, is tantamount to a ruling that the individual

does not qualify as a debtor under Chapter 13.”

WRONG

“May be a debtor”

• ONLY 109(e) governs the question of whether

Marrama “may be a debtor” under chapter 13

• The clue is that in 109(e) it says “only” a Dr who meets the listed requirements “may be a debtor

under chapter 13”

• And 706(d) is keyed to whether the DR “may be a debtor under” the chapter to which converted

Not in conversion/dismissal rule

• NOTHING in 1307(c)’s rule allowing a debtor’s ch

13 case to be converted or dismissed on the motion of another party establishes an eligibility rule

• 1307(c) says nary a word about whether the DR

“may be a debtor”

– Which obviously is a term of art in Code

What 1307(c) IS saying is that even though such-and-so

“may be a debtor” (i.e., is eligible), the court is going to kick them out for one of the statutory “causes”

2d: equitable power 105(a)

• Alternative basis for Supreme Court’s holding:

§ 105(a)

• “court may issue any order, process, or judgment that is necessary or appropriate to carry out the provisions of this title”

• And then says court may “prevent an abuse of process”

• Bankruptcy version of All Writs Act

Court’s position

• Supreme Court holds that 105(a) gives bankruptcy court authority “to take appropriate action in response to fraudulent conduct”

• Here, denying motion to convert when that is abusive and in “bad faith”

Inherent power

• Supreme Court then says that even without

105(a), a court has the inherent power to sanction “abusive litigation practices”

• And what Robert Marrama was doing would qualify as such

“bad faith” exception

• Court thus established a “bad faith” exception to otherwise absolute conversion right

Dissent’s response?

• So is the Dissent arguing in favor of allowing a

“bad faith” debtor to get away with sneaky acts that abuse the bankruptcy system?

Dissent – separation of powers

• NO, of course not. Dissent isn’t for bad faith

• Instead, the concern is over whether judiciary has a trump card to ignore the statute

• A separation of powers issue

VERSUS

Dissent’s approach

“Obviously, however, neither of these sources of authority authorizes a bankruptcy court to contravene the Code. On the contrary, a bankruptcy court's general and equitable powers

‘must and can only be exercised within the confines of the Bankruptcy Code.’ …

But whatever steps a bankruptcy court may take pursuant to § 105(a) or its general equitable powers, a bankruptcy court cannot contravene the provisions of the Code.”

Dissent -- no judicial “trump card”

• Bottom line -> dissenting Justices would NOT give bankruptcy judges a trump card to ignore the statute that Congress passed

NO

Ubiquitous issue in bankruptcy

• Issue of whether bankruptcy judge has a freefloating equitable power to do as she sees fit, the Code be damned, is one of the most central and pervasive issues in bankruptcy today

Extending rationale of Marrama

• JUST in the context of converting, filing, and dismissing cases, Marrama would appear to be powerful authority for a bankruptcy judge to:

-> imply a good faith filing requirement

Marrama, extended

• Deny a request of a debtor to convert a reorganization case to a liquidation case

– § 1112(a) -- chapter 11

– § 1208(a) – chapter 12

– § 1307(a) – chapter 13

Marrama, extended

• Deny a request of a debtor to dismiss “at any time” a voluntary case under 12 or 13

– chapter 13 (§1307(b))

– chapter 12 (§ 1208(b))

Marrama, extended

• Bar a debtor from refiling a case after a previous dismissal

– even if the debtor does not fall within the serial filer eligibility bar of § 109(g) that is referenced in the last clause of § 349(a)

Marrama, extended

• Beyond context of conversion, dismissal, filing,

Marrama can be invoked as a broad authority for expansive interpretation of 105(a)

– 1 st day orders – pay claims

– GM & Chrysler sales?

How broad is “bad faith” exception?

• See note 11 in Court’s opinion

• Court says:

– “the debtor’s conduct must, in fact, be atypical”

– Limited to “extraordinary cases”

– Case cited (Love) involved dismissal of ch 13 case as a bad faith filing when DR’s sole purpose apparently was to thwart payment of income taxes

What else could a court do?

• Assume that the dissent’s position prevailed

• Would courts be remediless to combat abusive debtors such as Robert Marrama? NO

• See dissent:

– “requiring accountings or reporting of assets;

– enjoining debtors from alienating estate property;

– penalizing counsel;

– assessing costs and fees; or

– holding the debtor in contempt.”

SGL Carbon: good faith filing debate

• Raises fundamental question whether the filing of a chapter 11 reorganization is subject to a threshold good faith test

• And if so – what constitutes the requisite

“good faith”?

Yes to good faith

• 3 rd Circuit holds – as do the vast majority of courts – that there IS a threshold “good faith filing” requirement

• And holds that DR here fails that good faith inquiry

Why Dr filed

• Why did DR (SGL Carbon) file chapter 11, and why did it file when it did?

Trying to put pressure on πs in huge civil antitrust litigation against DR to settle

* i.e., seeking negotiating leverage

Why might that work?

• What is it about bankruptcy that made DR think it would give it leverage against the πs if it filed chapter 11?

delay (automatic stay)

Maybe discriminate agst them in terms of plan

Reasons for GF requirement

• Why did the Third Circuit conclude that a chapter 11 case may be dismissed for bad faith in filing?

– i.e., not why was THIS case dismissed, but why is it

EVER allowed to use “bad faith” in filing as a basis for dismissal?

4 reasons

• 1. Statute (1112(b)), along with legis. history

• 2. Other cts so hold

• 3. “equitable nature of bankruptcy”

• 4. “purposes underpinning Chapter 11”

Statute?

• No express reqmt in 1112(b) that petition be filed in good faith

Other statutes? “knew how to”

• Compare chapter 13 – to confirm plan court must find good faith in filing (1325(a)(7))

• Express good faith test in chapter 11, at time

of confirmation (1129(a)(3)) (plan must be filed in good faith)

Time of Plan, not at outset?

• Any reason why Congress might have wanted to wait to test the good faith of a ch. 11 case until the end of the case, when plan is being confirmed?

• Anything BAD about testing good faith up front?

Statutory language

• While 1112(b) does not have an express good faith test, neither is one necessarily precluded

• The only statutory test is cause

– 1112(b)(1)

– Then illustrations of “cause” in (b)(4)

Not exclusive list

• the 16 illustrative examples of “cause” in the statute (1112(b)(4)) are not exhaustive

“including” is defined as “not limiting”

(§102(3))

Legislative history to 1112 says the same

“Not an exclusive list”

≠

“ good faith is included”

• Even if it is POSSIBLE to include a good faith filing test in 1112(b), given that the enumerated exs of “cause” in 1112(b)(4) is not exclusive, does not then necessarily mean that bad faith in filing SHOULD be a reason to dismiss

– Fact that Dr’s CEO was a left-handed redhead would not be a permissible reason to dismiss

– Have to establish why SHOULD require good faith

But, what add to list?

• What, if anything, does implying a “good faith filing” basis for dismissal add to the sixteen illustrative specifications for “cause” for dismissal in § 1112(b)(4)(A)-(P)?

– Stated otherwise – if a ch. 11 case does NOT run afoul of any of the 16 grounds – what might conceivably (if anything) be a basis for dismissing the case?

History?

Prior to 1978 Code:

• Chapter X: express good faith filing reqmt

• Chapter XI: none

1978 Code:

• Combine X and XI into single ch. 11

• No express GF filing reqmt

Does this suggest that Congress intended to adopt the ch.

XI practice rather than ch. X?

And did NOT want good-faith-filing to be a threshold test?

Marrama?

• Is the Supreme Court’s decision in Marrama v.

Citizens Bank of Massachusetts, 549 U.S. 365

(2007), relevant to the good faith filing debate?

– Note was decided several years after SGL Carbon

Bottom line

• Notwithstanding some very good legal arguments that there should NOT be a threshold good faith filing reqmt, the reality now is that virtually every ct so holds

• So the real Q is how that good faith filing test should be applied in a particular case

Subjective, objective, or both?

• One puzzle in application is whether the good faith filing test requires:

1) EITHER

– Subjective bad faith of filing DR or

– Objective departure from ch. 11 goals

2) Or BOTH?

3) Or just one of them? And if so, which?

District court

• Why did District Ct in SGL conclude that petition was filed in good faith?

Antitrust litigation a serious threat to Dr’s business

Litigation a distraction for Dr’s senior management

Third Circuit?

• Why did 3 rd Circuit not agree with (indeed, found clearly erroneous) the factors relied on by the District Ct as supporting the good faith filing?

Test?

• What was the 3 rd Circuit’s test for good faith filing?

“valid reorganizational purpose”

Test …

• What does the test “valid reorganizational purpose” mean?

• Is it vacuous?

• How relate to goals of bankruptcy?

Applying test

• Didn’t the Dr SGL want to reorganize under ch.

11?

• And, didn’t SGL have a high probability of success in chapter 11?

• Wasn’t SGL trying to deal with the threat to its business posed by large debts?

Limits of ch. 11 itself

• Would DR really be able to “stick it to” the antitrust πs in ch. 11, either by unduly delaying the prosecution of the case or by confirming a plan that’s unfair to those πs?

Use existing limits?

NO

1. Delay:

– time to propose and confirm plan limited,1121(d)

– If delay too long & not likely to reorganize – THEN ct has clear power to dismiss or convert (1112(b)(4)(A),

(J))

2. Financial & confirmation standards

Crs get to vote on plan

Protections agst giving less than in liquidation, unfair discrimination

Reasoning of 3

rd

Circuit

• What reasons did the 3d Circuit give for holding that the Dr did NOT have a “valid reorganizational purpose”?

Said using ch 11 solely as litigation tactic

And that company was not in financial distress

Policy favor early or late filing?

• In enacting the 1978 Code, did Congress want to encourage DRs to file early, before their financial problems became unsalvageable, or

later, after things had gone bad?

Clear policy choice to encourage early filing

* Does 3d Circuit’s decision undermine that policy?

Insolvency required?

• Must a Dr be “insolvent” as a requirement of filing ch. 11?

NO

• Does 3d Circuit effectively impose an insolvency requirement, or something close to it?

• Is that a good choice?

Facing big litigation

• Did the 3d Circuit conclude (expressly or at least effectively) that a DR facing a potentially huge litigation exposure must wait until the judgment is entered before it files ch. 11?

Texaco?

• How did the 3d Circuit distinguish Texaco?

Manville?

• How did the 3d Circuit distinguish the Johns-

Manville case?

Bible Speaks?

• How did the 3d Circuit distinguish The Bible

Speaks?

What about movants?

• Does it matter how fast the movants seeking dismissal act?

• Does, or should, the court care about their motivations?

SARE?

• Given the decision in SGL Carbon, how would you decide the “good faith” of a typical SARE

(single asset real estate) case?

– Have essentially a “2-party” dispute [DR vs a major secured creditor]

– Ch. 11 typically filed on eve of foreclosure