Clinical Trial Offshoring - The University of Chicago Booth School of

advertisement

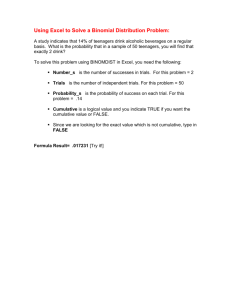

Pharma R&D Moves Offshore A.T. Kearney’s Pharmaceutical R&D Location Attractiveness Index University of Chicago Graduate School of Business Bio-Pharma Alumni Organization October 2006 A.T. Kearney’s Pharma R&D off-shoring research has generated extensive interest in the media Bio-Pharmaceutical R&D Statistical Sourcebook 2006/2007 A Publication of the TIMES OF INDIA Group Clinical Trial Offshoring 2 Executive Summary Although Pharmaceuticals is a global industry, clinical studies are largely conducted in the U.S. and Western Europe driven by relevant expertise and intellectual property protection considerations In the last two years, companies have increasingly turned to offshore locations to supplement their primary clinical trials, with the goal of increasing speed to market and the benefit of lower costs To provide a systematic framework for evaluating geographical options for offshoring clinical trials, A.T. Kearney developed a structured country attractiveness index We evaluated15 representative countries – the outcome: China ranked the highest overall, followed by India and Russia The fact-based approach to the index provides insight into the future direction of clinical trials and specifically the attractiveness of locations based on structured criteria The index should be considered a tool to support decision making in offshoring decisions and is flexible to be customized based on corporate priorities Country attractiveness doesn’t suggest a narrow focus, but rather should be leveraged as a basis for diversifying clinical trial activities Risks clearly exist in any offshoring of clinical trials, requiring careful planning and management in trial design and execution Clinical Trial Offshoring 3 The pharmaceutical industry has historically lagged other industries in off-shoring Offshore Industry Lifecycle Curve – Pharmaceutical vs. Other Industries Stage 1 Capacity Augmentation Stage 2 Proof of Concept Stage 3 Value Realization Consumer Products & Retail P&G, Nestlé Utilities Southern Company AEP Stage 4 Strategic Supplier Management Stage 5 Global Operating Model Automotive Ford Financial Institutions GE, Citi, Amex, HSBC Pharmaceuticals Other However, the pace of off-shoring within the pharmaceutical industry has intensified over the last 1 – 2 years Source: A.T. Kearney analysis Clinical Trial Offshoring 4 Stages of a Drug’s Life Cycle R&D, particularly clinical trials, is better suited to off-shoring when compared to other parts of the pharmaceutical value chain Post Approval Trials and Drug Sales Clinical Trials and Lifecycle Management New Compound Discovery FDA Approval Sub Activities Early Exploratory Late Exploratory Discovery Pre-Clinical Evaluation Comments • New molecules are discovered here • Molecules are formulated as drugs tested on animals for efficacy and safety as part of pre-clinical development and evaluation Phase Comments I Testing an experimental drug or treatment in a small group of people (20-80) for the first time to evaluate its safety, determine a safe dosage range, and identify side effects II The experimental study drug or treatment is given to a larger group of people (100-300) to see if it is effective and to further evaluate its safety III Phase IV Comments Post marketing studies delineate additional information including the drug's risks, benefits, and optimal use The experimental study drug or treatment is given to large groups of people (1,000-3,000) to confirm its effectiveness, monitor side effects, compare it to commonly used treatments, and collect information that will allow the experimental drug or treatment to be used safely Clinical trials for a drug can cost up to $1 Billion and can take as many as 14 years to complete Clinical Trial Offshoring 5 Top pharmaceutical companies are increasingly conducting clinical studies outside the US and in offshore locations Number of studies by top 12 Pharma companies1 Pharma companyranked by total # of studies Total # of studies Studies with location in the US Top 12 Pharma companies as a percentage of total industry studies Studies with location outside the US BMS 186 180 87 GSK 173 142 90 Roche 148 129 70 Pfizer 147 129 67 Novartis 139 119 37 Eli Lilly 131 105 72 Abbott 67 60 29 Astra Zeneca 56 49 19 Johnson & Johnson 48 41 24 Schering-Plough 44 40 27 Wyeth-Ayerst 35 29 13 Aventis 27 23 9 1,201 1,046 544 Total Notes: Source: Number of studies sponsored by industry Number of studies conducted by Top 12 Pharma Percentage of studies conducted by Top 12 Pharma 2910 1201 41% Number of studies sponsored by industry with location outside the US Number of studies with location outside the US sponsored by Top 12 Pharma companies Percentage of studies with location outside the US by Top 12 Pharma companies 1125 544 48% 48% of trials conducted by Top 12 Pharma have locations outside the US (1)The top 12 companies account for only 2% of all pharma companies. Posting on the site clinicaltrials.gov is voluntary but increasingly popular. The data represent a snapshot in time and covers almost 600 companies worldwide Clinicaltrials.gov (as of 08/26/05) and A.T. Kearney analysis; excludes studies where locations were not provided Clinical Trial Offshoring 6 Most major pharma companies are pro-actively off-shoring clinical trials to attractive, low-cost destinations Number of active clinical trial studies sponsored by Top 12 Pharma outside the US (March 2006, Feb. 2007) 300 288 294 (2) 279 250 199 200 180 182 161 169 148 150 135 124 100 81 77 69 50 23 26 12 16 Biogen Am gen 0 Eli Lilly Novartis Mar-06 Notes: Source: GSK Merck BMS Sanofi Aventis Pfizer Feb-07 (1) Posting on the site clinicaltrials.gov is voluntary but increasingly popular. The data represent a snapshot in time (2) Total number of studies is less than the sum over all countries due to the use of multiple locations for most trials Clinicaltrials.gov (as of March 2006, February 2007) and A.T. Kearney analysis; excludes studies where locations were not provided Clinical Trial Offshoring 7 Off-shore clinical trial activity has increased by ~20% in just the past year Number of active clinical trial studies sponsored by Top 12 Pharma outside the US 150 137 124 119 20% increase in offshoring activity in ~ 1 year 109 101 100 93 88 84 80 73 68 65 69 54 63 56 49 50 5254 51 49 41 36 29 28 39 36 26 37 26 35 29 34 27 32 28 29 28 28 18 25 25 23 24 23 19 20 24 18 18 8 12 Mar-06 Notes: Source: Costa Rica Philippines Colombia Ukraine Croatia Bulgaria New Zealand Malaysia Thailand Hong Kong Peru Singapore Romania China Turkey Chile Japan Israel Taiwan South Africa South Korea Brazil Argentina Russia Mexico Australia 0 Feb-07 (1) Posting on the site clinicaltrials.gov is voluntary but increasingly popular. The data represent a snapshot in time (2) Total number of studies is less than the sum over all countries due to the use of multiple locations for most trials Clinicaltrials.gov, A.T. Kearney analysis; excludes studies where locations were not provided Clinical Trial Offshoring 8 A higher percentage of Phase 3 clinical trials are conducted offshore relative to other phases Percentage and Number of Studies in US and Offshore Locations – by Phase 606 1549 1299 Observations 284 100% • Phase 3 studies are more likely to have locations outside the US: 80% – Patient populations required are large 807 60% – Investigator grants and patient compensation is a large part of trial cost, making certain offshore locations attractive 200 1142 531 40% 38% 30% 26% 20% 492 12% 407 84 75 0% Phase 1 Phase 2 Phase 3 Phase 4 • Phase 1 studies have comparatively fewer offshore locations: – Ethical considerations as this phase determines safety of the trial drug – Focus on healthy volunteers vs. specific patient profile • Phase 4 studies are increasingly including locations/ data from patients in countries outside the US once the drug is on the market Studies with location in US only Studies with location outside US Source: Clinicaltrials.gov ( as of 8/10/05) and A.T. Kearney analysis Clinical Trial Offshoring 9 Speed to market and reduced costs have been cited as primary reasons for offshoring clinical trials Short Term Offshoring Goals – Supplement U.S. and Western European Trials Offshore trials can “rescue” a U.S. trial that is lagging due to slow patient recruitment Companies have used offshore trials for parallel development tracks when FDA concerns caused delays in the U.S. Long Term Offshoring Goals – Reduce Costs, Gain InCountry Experience, Develop New Markets Selection of Offshoring Location ? • Full disclosure with the offshore country’s regulatory authorities is needed to avert ethical concerns Introduction of vaccines in developing countries prior to introduction in U.S. has been shown to be successful Many low-cost countries are improving their regulatory conditions and level of clinical trials expertise Pharma companies are positioning themselves to gain operating experience in these countries, where per patient costs can be as low as one third of the U.S. costs Several low-cost countries, including India and China are attractive as potential new markets for innovative drugs A structured and fact-based approach to identifying country attractive for clinical trials is an important component of any offshoring strategy Source: Global clinical trial conference discussions and and A.T. Kearney analysis Clinical Trial Offshoring 10 A.T. Kearney developed an index to assess the attractiveness of countries for conducting clinical trials Country Attractiveness Index Criteria and Weighting Patient Pool (30%) Size and availability of suitable patient pool Regulatory Conditions (20%) Cost Efficiency (20%) Cost efficiency of labor Cost efficiency of facilities and travel Food and Drug Administration visibility Country’s regulatory laws Strength of intellectual protection Relevant Expertise (15%) Number of clinical research organizations Number of clinical trials Size and availability of labor force with relevant skills Infrastructure and Environment (15%) Protection of intellectual property Health-care infrastructure Country infrastructure Country risk factors Clinical Trial Offshoring 11 Our research indicates that China and India are the most attractive offshore locations to perform clinical trials outside the US Overall Country Attractiveness Index1 6.10 China India 5.58 Russia 5.55 5.26 Brazil Czech Republic 5.00 UK 5.00 4.90 Argentina Poland 4.84 Hungary 4.81 4.69 Germany 4.56 South Africa 4.46 Taiwan Israel 4.28 Singapore 4.27 3.86 Ireland 6.88 USA Patient Pool Note: Cost Efficiency Regulatory Conditions Relevant Expertise Infrastructure/Environment Total Score (1) Higher scores indicate higher level of attractiveness (2) The set of 15 countries analyzed has been selected based on size, diversity, and geographical distribution, and is not meant to be comprehensive across all potential locations for offshoring Clinical Trial Offshoring 12 Large patient pools, availability of relevant expertise, and lower costs make China and India attractive Country Attractiveness Components – Patient Pool, Relative Expertise and Cost Efficiency Large Relative Cost Efficiency1 China India Increasing bubble size indicates greater cost efficiencies Brazil Patient Pool Russia Czech Republic USA Argentina Poland Taiwan United Kingdom Germany Israel Ireland Singapore Hungary (hidden) South Africa Small Low Relevant Expertise High Sources: World Bank 2003, World Development Indicators database 2003 and A.T. Kearney analysis Clinical Trial Offshoring 13 Improvements in regulatory conditions and the infrastructure of emerging markets will drive the pace of change of offshoring Country Attractiveness Components – Regulatory Conditions, Infrastructure/Environment and Patient Pool Available patient pool – size of bubble is proportional to the size of the available patient pool Favorable Regulatory Conditions USA UK Poland Germany South Africa Russia Czech Republic Singapore Israel Argentina India Ireland Brazil Taiwan Hungary China Unfavorable Unfavorable Source: Infrastructure and environment Favorable A.T. Kearney analysis Clinical Trial Offshoring 14 Patient Pool: The large populations of China and India provide the greatest potential for patient recruitment Urban Population1 (millions) China India Brazil Russia Germany UK Taiwan Argentina South Africa Poland Czech Republic Hungary Israel Singapore Ireland Overall Patient Pool Score3 298 6.56 Brazil 73 53 48 33 26 24 6.13 Russia 8 7 6 4 2 233 Treatment Naïve Population Score2 Russia India China Brazil Poland Hungary Argentina Czech Republic Taiwan South Africa Israel Ireland Singapore UK Germany 1 1 USA 1 Source: 8.04 India 147 105 USA Notes: 9.94 China 350 5 5 5 5 4 4 4 4 3 3 3 2 2 Argentina 4.38 Poland 4.24 Hungary 3.98 Czech Republic 3.97 Taiwan 3.96 South Africa 3.34 Israel 3.33 Germany 3.14 UK 2.81 Singapore 2.69 Ireland 2.66 USA 5.64 Urban Population Score Professional Delivery Score Treatment Naïve Population Score (1) Urban population is capped at 350 million due to limited benefit from extremely large populations (2) Higher scores indicate more treatment naïve populations (3) Higher scores denote large available patient pools; urban population weighted 55%, professional deliveries weighted 20%, treatment naïve populations weighted 25% World Bank 2003; UNICEF WDI Database; A.T. Kearney analysis Clinical Trial Offshoring 15 Cost: Russia has the lowest overall cost structure followed by Argentina, China and India Cost of Labor1 (Indexed to US=1) Russia Argentina China India Brazil Czech Republic Hungary Poland Taiw an Israel UK South Africa Ireland Singapore Germany Overall Indexed Costs3 Overall Country Average Russia Clinical Professional Average Argentina China India 1 1.5 2 Facilities Rental and CRO Cost Perspective2 South Africa Argentina Poland Czech Republic Brazil China Hungary Israel Singapore India Taiw an Russia Germany Ireland UK 0.61 Poland Israel Taiwan South Africa UK 0.77 0.86 0.90 0.99 1.09 1.19 1.25 Ireland 1.58 Germany USA 0 Source: 0.68 Singapore USA Notes: 0.56 Czech Republic Facilities Rental CRO Cost Perspective 0.52 0.61 Hungary 0.5 0.48 Brazil USA 0 0.40 0.5 1 1.5 2 2.5 Labor Cost 1.00 Facilities and Travel Cost CRO Cost Perspective (1) Clinical professional average includes physicians weighted 47%, nurses weighted 29%, and statistical mathematician weighted 24% (2) Facilities rental and CRO cost perspective are indexed to US = 1.0 (3) Higher scores denote higher cost; labor index weighted 80%, facilities and travel index weighted 10%, CRO cost perspective weighted 10%. This metric is converted to a cost efficiency metric when incorporating into the overall country attractiveness index Clinical Trial Offshoring 16 SalaryExpert.com; WDI Database; Economist Intelligence Unit; CBRE Global Markets Rent 2005; A.T. Kearney analysis Regulatory Conditions: Central/ Eastern European countries are attractive for regulatory conditions, while India and China are lagging FDA Visibility1 UK Germany South Africa Russia Argentina Poland Brazil Czech Republic Hungary Israel China India Singapore Taiw an Ireland Overall Regulatory Conditions Score1,3 4.62 4.04 4.03 4.03 3.72 3.61 2.15 UK 6.23 5.51 Poland 5.28 4.77 Russia 0.40 0.40 0.40 0.40 0.40 0.40 Voluntary Action Score No. of Inspections Score 8.67 USA Germany Singapore UK Israel Ireland Czech Republic South Africa Poland Taiwan Hungary Russia Brazil Argentina India China 6.26 South Africa 1.15 1.15 Country Specific Protection1 Germany Laws1,2 and General IP 7.73 7.37 7.30 7.13 7.00 6.77 6.50 6.40 6.23 6.23 5.27 4.80 4.70 4.62 2.20 Country Specific Laws IPR Protection Singapore 4.58 Czech Republic 4.52 Israel 4.44 Ireland 4.36 Argentina 4.31 Hungary 4.20 3.90 Taiwan Brazil 3.74 India China 2.93 1.48 8.23 USA FDA visibility Country Specific Laws 7.93 USA Notes: (1) Higher scores indicate higher attractiveness (2) Country specific laws include ease of shipping lab samples and regulatory approval times (3) FDA visibility is weighted 40%, country specific laws are weighted 40%, and General IP protection is weighted 20% Source: FDA CDER; WEF Global Competitiveness Report; A.T. Kearney analysis General IP Protection Clinical Trial Offshoring 17 Relevant Expertise: China and Russia scored highest on relevant skilled labor Organizational Expertise and Experience1 Germany UK Poland South Africa Argentina India Hungary Czech Republic Israel Taiwan Russia Singapore China Brazil Ireland Overall Relevant Expertise Score2 7.37 6.94 6.34 1.90 9.81 USA Relevant Skilled Labor Pool China Russia India Germany Brazil UK Poland Hungary Czech Republic Israel Ireland South Africa Singapore Taiwan Argentina No. of doctors No. of nurses No. of scientific degrees 4.93 UK 4.35 Poland 4.22 Russia 4.09 India 3.45 South Africa Argentina 3.19 Hungary 3.18 Czech Republic 3.12 Brazil 3.02 2.90 Taiwan 2.76 Singapore 2.64 Ireland 1.49 USA 0 Source: 5.32 China Israel USA Notes: 5.68 Germany 5.20 4.83 4.61 4.60 4.53 4.24 4.07 4.05 3.86 CRO presence 3.78 Volume of clinical trials 3.71 500 1000 1500 2000 2500 3000 3500 Organization Expertise/Experience 8.47 Relevant Skilled Labor Pool (1) Based on the market presence of the 12 largest clinical research organizations (weighted 50%) and amount of clinical trials conducted (weighted 50%) (2) Higher scores denote greater availability of relevant expertise; organizational expertise and experience weighted 60%, relevant skilled labor pool weighted 40% clinicaltrials.gov; Physician Index Annual; WHO/EIP/HRH; NSF; A.T. Kearney analysis Clinical Trial Offshoring 18 Infrastructure / Environment: Ireland, UK, Germany and Singapore provide the most attractive environment driven by strong IP protection Pharma IP Protection and Market Access Germany South Africa Singapore Ireland UK Czech Republic Taiwan Hungary Israel Argentina Brazil China India Russia Poland 10.0 10.0 10.0 10.0 10.0 6.7 6.7 6.7 3.3 3.3 3.3 0.0 0.0 0.0 0.0 10.0 Infrastructure Index (Healthcare and Country)1 USA Notes: Sources: 8.93 Singapore 8.48 UK Germany 8.16 Ireland 8.10 6.95 Czech Republic USA Singapore UK Germany Ireland Israel Czech Republic Taiwan Hungary Poland Argentina Brazil Russia China India South Africa Overall Infrastructure / Environmental Score2 7.87 7.52 7.34 7.07 6.89 6.52 6.23 5.78 5.73 4.98 4.97 4.97 3.86 3.83 Taiwan 6.50 Hungary 6.50 Country Score 7.71 5.50 Israel 4.81 Argentina 4.65 Brazil Poland 4.20 China 3.63 India 3.53 Russia 3.49 USA Healthcare Score 6.17 South Africa 8.48 Pharma IP Protection and Market Access Healthcare Infrastructure Country Infrastructure Country Risk (1) Healthcare criteria includes number of beds per 1000 people. Country infrastructure includes transportation, use of English and “personal contact” rank (2) Higher scores denote increased attractiveness; IP weighted 30%, Country Infrastructure weighted 25% , country risk weighted 25%, healthcare infrastructure weighted 20% World Bank; PhRMA and Office of US Trade Representative Special 301 Report; Economist Intelligence Unit; CIA World Factbook; TOEFL; A.T. Kearney analysis Clinical Trial Offshoring 19 Agenda Current Situation Key Findings Overview of Top-Ranking Locations Offshoring Considerations Appendix Clinical Trial Offshoring 20 China offers large patient pools, low costs and sufficient qualified investigators, but a challenging regulatory environment Current Situation Country Attractiveness Scores – China vs. Median Trials / Regulatory 24 trials conducted in China by Top 12 pharma in 2005; 31 in 2006 1 FDA inspection 2000 – 2005 Patient Pool With the largest urban population in the world, China provides a large pool of treatment compliant patients from multiethnic and multiracial backgrounds Wide spectrum of disease types is represented China 10 9.94 Median Score (Error Bars indicate Min/Max Score) 8 7.38 6.34 5.91 6 6.10 5.31 4.87 4.48 3.98 4 3.32 2 3.63 1.48 0 Patient Pool Cost Efficiency Regulatory Conditions Relevant Expertise Infrastructure / Environment Total Score Environmental Factors China’s attractiveness is challenged by: High country risk Lack of national infrastructure Limited enforcement of IP protection Bureaucracy and government regulations requiring trials to be approved by the SDA, drug import license required for every shipment Expected Future Trends Government initiatives have helped to improve GCP in China with the establishment of GCP centers to provide training to investigators and staff Key Takeaways While patient pool and cost factors are attractive, cultural, regulatory, and infrastructure concerns must be adequately addressed for trials to be conducted successfully in China High enrollment rates can balance against the lengthy 9-12 month domestic trial approval process Language can be a hurdle – data is often recorded in Chinese and must be translated before it can be used China’s attractiveness as growing drug market is also a consideration in conducting clinical trials in China Sources: ClinicalTrials.gov (August 2005, March 2006); CenterWatch July 2002, FDA Clinical Trial Offshoring 21 China: Attractiveness for Clinical Trials - Summary Strengths • Large Patient Pools and Relatively Easy Access – Patient treatment of major diseases centralized to major hospitals making patient access easier – Large patient populations • Availability of Relevant Expertise – Availability of co-operative doctor networks throughout the country – Chinese CRAs are physicians from the institutions with clinical trial experience and have attended some international clinical trial training – Real understanding of the science tends to result in fewer queries per trial – Most major pharmacos have already set up captive R&D centers in China • Expected to be 4th largest commercial market globally in the next 5 years Areas for development • Regulatory environment – Study startup tends to take 6-9 months, making early phase trials less attractive – SDA committed to making regulatory changes • Lack of national infrastructure • Limited enforcement of IP protection • Bureaucracy and government regulations requiring trials to be approved by the SDA, drug import license required for every shipment Clinical Trial Offshoring 22 With large patient pools and a low cost structure, India’s attractiveness is likely to increase with expected regulatory improvements Current Situation Country Attractiveness Scores – India vs. Median 26 trials conducted by Top 12 pharma in 2005; 40 in 2006 No FDA inspections 2000 – 2005 Clinical research is considered high quality – trial data has been accepted at major conferences and journals India has already been established as a popular manufacturing destination – pharma executives are familiar with the business environment India 10 Median Score (Error Bars indicate Min/Max Score) 8.04 8 7.18 6.34 5.91 6 5.58 4.48 3.98 4 2.93 4.09 3.32 3.53 2 0 Patient Pool Cost Efficiency Regulatory Conditions Expected Future Trends 4.87 Relevant Expertise Infrastructure / Environment Total Score Recently adopted laws will increase IP protection Legislative changes in Q1 2005 now allow India to participate in simultaneous international Phase 2 and 3 trials. It is also probable that the government will allow Phase I tests in the near future (for drugs that did not originate in India) Strong overall economic growth will lead to improvements in general and healthcare infrastructure The CRO supply base is likely to increase as pharmas continue to increase manufacturing and testing in India Key Takeaways While patient pool and cost factors are attractive, regulatory, IP, and infrastructure concerns must be adequately addressed IP protection of trial data is a concern that should be monitored for compliance with new laws Mandatory toxicology tests after Phase 2 completion requires 6 month delay before start of Phase 3 Source: PharmaHandbook 2005 Coordination with local physicians and hospitals is mandatory The practical approach in India is to target large cities and conduct clinical trials in large hospitals India’s attractiveness as growing drug market with expanding private health insurance is also a consideration in conducting clinical trials in India Clinical Trial Offshoring 23 Russia achieved strong scores on multiple criteria with the exception of environment Current Situation Country Attractiveness Scores – Russia vs. Median Russia 10 Median Score (Error Bars indicate Min/Max Score) 8.02 8 6.13 6.34 5.91 6 5.55 4.77 4.48 3.98 4 4.87 4.22 3.32 3.49 2 Trials / Regulatory 5 trials conducted by Top 12 pharma in 2005; 80 in 2006 12 FDA inspections 2000 – 2005 Patient Pool Medical care is centralized – patients with similar symptoms are treated in the same ward, allowing for ease of patient recruitment (i.e., 2,400 patients recruited in 2 weeks for phase 3 trial of hypertension drug) Russia has a large population that are treatment naïve and whose diseases are at advanced stages Lack of quality medical care has led to eagerness among patients to sign up for clinical trials and to comply with trial protocols Environment Russia imposes a clinical trials tax IP concerns have placed Russia on the US’s priority ‘watch list’ 0 Patient Pool Cost Efficiency Regulatory Conditions Relevant Expertise Infrastructure / Environment Total Score Expected Future Trends Drug companies are well established in Poland and the Czech Republic – Russia and other eastern European countries are increasingly attractive due to patient pool, lower costs, relevant skill labor pool Key Takeaways Russia is attractive for trials where recruitment of a large patient pool is required in a short time frame Ethics of recruitment requires careful attention; physicians can make up to 10 times their salary through clinical trials potentially creating an incentive to neglect to inform patients of risk factors Clear procedures for and close monitoring of patient recruitment is necessary to ensure compliance with international ethical standards Sources: clinicaltrials.gov; Fortune, July 26, 2005, Special 301 Report of the Office of the US Trade Representative Clinical Trial Offshoring 24 Brazil has a large patient pool and significant cost efficiencies, but lags in the areas of regulatory and environment Current Situation Country Attractiveness Scores – Brazil vs. Median Brazil 10 Median Score (Error Bars indicate Min/Max Score) 8 6.97 6.56 6.34 5.91 6 5.26 4.65 4.48 3.98 3.74 4 3.02 4.87 3.32 2 94 trials conducted by Top 12 pharma in 2005, 73 in 2006 5 FDA inspections 2000 – 2005 Brazil is primarily attractive because of its large patient pool and low costs ICH GCP has been implemented A substantial portion of Brazil’s population is ethnically close to US and European population Clinical trial costs are about 70% of US costs Brazil is attractive for trials of drugs for the Japan market Japan is the second largest pharmaceutical market Brazil has the largest (1.1 million) ethnic Japanese population outside of Japan Foreign trial results on ethnic Japanese are now accepted by Japan authorities 0 Patient Pool Cost Efficiency Regulatory Conditions Relevant Expertise Infrastructure / Environment Total Score Expected Future Trends Stem cell research has been legalized Key Takeaways Brazil has had a long track record for clinical trials and remains attractive based on the scoring across the criteria Clinical trials approval is traditionally slow Source: clinicaltrials.gov There are strong IP protection laws; however, enforcement is generally weak Clinical Trial Offshoring 25 The Czech Republic’s attractiveness is based on its low cost structure and favorable regulatory environment Country Attractiveness Scores – Czech Republic vs. Median Current Situation Czech Republic 10 Median Score (Error Bars indicate Min/Max Score) 8 6.96 6.95 6.34 5.91 6 5.00 4.87 4.52 4.48 3.97 3.98 4 3.12 3.32 44 trials conducted by Top 12 pharma in 2005, 85 in 2006 2 FDA inspections 2000 – 2005 Pharmas are already well established in the Czech Republic for conducting clinical trials The Czech healthcare system operates at low cost Average Czech physicians’ monthly salary is $550 Investigator fees and CRO/monitoring fees are approximately 5070% of U.S. amounts 2 Expected Future Trends 0 Patient Pool Cost Efficiency Regulatory Conditions Relevant Expertise Infrastructure / Environment Total Score The Czech Republic’s accession to EU membership will likely lead to a narrowing of its cost advantage over time Key Takeaways Although the available patient pool is not particularly high, the Czech Republic has strong IP protection, low operating costs, and a strong healthcare infrastructure The Czech Republic is ideal for companies beginning to offshore clinical trials based on proximity to western Europe, relative absence of cultural, regulatory, and environment barriers, and tested/ track record in clinical trials Source: clinicaltrials.gov, Pharma Handbook 2005, PhRMA Special 301 Report Clinical Trial Offshoring 26 Agenda Current Situation Key Findings Overview of Top-Ranking Locations Offshoring Considerations Appendix Clinical Trial Offshoring 27 Pharma companies must consider a variety of factors in developing their clinical trial offshoring strategy Key Considerations • Consider the organizational, language-related and supply chain implications of off-shoring trials • Develop relationships with 3rd parties with local experience (e.g. multinational/ local CROs) • Develop detailed/ practical contingency plans Assess Operational Implications • Ethnicity may affect trial results due to metabolic and genetic variations • Reduce overall risk by diversifying trial locations over multiple countries Understand Culture and Ethnic Differences Development of Off-Shoring Criteria Know the Local Regulatory Environment • The Food and Drug Administration (FDA) has guidelines for clinical trials and relies on pharmaceutical companies to adhere to Good Clinical Practice (GCP) • Keep a pulse on regulatory environment changes in attractive off-shoring locations Protect Intellectual Property • Most developing countries have Intellectual Property infringement issues, although the landscape is improving (e.g. India) • Maintain a strong emphasis on due diligence and tight contracts Clinical Trial Offshoring 28 Concerns often surface about offshoring clinical trials Pharma Concerns Intellectual Property Protection • Data exclusivity may not be protected – Advance knowledge of a trial’s progress will give competitors unfair market advantage Regulatory Requirements • Regulatory differences across countries may impact timing and cost of clinical trials – E.g., drug import licenses required for each shipment, mandatory toxicology tests, language requirements for documents FDA Acceptability • FDA statements on clinical trials offshoring are considered guidelines; pharmas companies are cautious about entering new countries Cultural Differences • Differences in the practice of medicine may impact trial results or affect trial execution – Concurrent use of herbal medicines may potentially be unreported – Use of physicians (but not nurses) in taking blood samples • In countries where doctors are culturally authoritative, investigators avoid using consent forms, as patients misunderstand the reason for them Ethnicity • Ethnicity may impact trial results due to different metabolic rates and other genetic effects • FDA guidelines limit the percentage of a drug’s trials conducted in developing countries Ethics • Wide disparity between investigator fees and standard salaries could lead to unethical patient recruiting – E.g., misleading patients about risk factors, enrolling patients that do not fit the trial parameters • Investigators may under-report adverse reactions, believing they are doing sponsors a favor Clinical Trial Offshoring 29 Many risk factors can be mitigated with careful planning and execution Selected Risk Mitigation Strategies Knowledge/ Information • Monitor IP legislation and enforcement – do not rely on unsubstantiated information • Leverage CROs to understand a target country’s customs, regulations, and medical practices before establishing trials Operational – Structure to Manage Risk • • • • Start initially with a smaller trial(s) in entering a new country Work with multinational and/ or established local CROs with hands-on in-country experience Develop partnerships, while maintaining healthy competition among vendors Develop detailed/ practical contingency plans Ensure Adherence to Standards of Conduct and Trial Protocols – ‘Build Quality In’ • Conduct rigorous training and monitoring of new investigators, to ensure compliance with ethical standards and to ensure quality of clinical trial • Conduct audits to ensure compliance with standards (quality, ethical, etc.) • Ensure incentive structure does not cause unanticipated behavior • If using CROs, work with those that have strong IP policies and operating practices with investigators and patients • Hold partners accountable for meeting appropriate FDA standards Diversify • Diversify portfolio of clinical trail geographies to balance patient pool opportunities, cost efficiencies, expertise, and regulatory risk • Design clinical trials to recognize ethnic diversity • Ensure sufficient percentage of trials is conducted in other countries • Set up trial parameters to include range of ethnicities consistent with FDA guidelines • Ethnic diversity may be an asset if future plans involve sale within clinical trial country Clinical Trial Offshoring 30 Agenda Current Situation Key Findings Overview of Top-Ranking Locations Offshoring Considerations Appendix Clinical Trial Offshoring 31 Weighting of criteria reflects the relative importance in assessing location attractiveness Weights Assigned to Areas of Evaluation Area of Evaluation/ Criteria Weighting Patient Base 30% Cost Efficiency 20% Regulatory Conditions 20% Relevant Expertise 15% Environment 15% Weights can be tailored to specific offshoring needs Clinical Trial Offshoring 32 Available patient base is evaluated by the size of the urban population and the propensity to seek medical attention Area of Evaluation Sub-Category Size of Available Patient Pool Patient Base Note: Sources: Measurement Relevance Urban Population Size Clinical trials conducted in urban areas to facilitate patient recruitment Percent of Urban Childbirths Delivered by Physicians Proxy for propensity of urban population to seek medical attention Treatment Naïve Population Many clinical trials require that patients have not had prior treatments Measurements are converted into a score (range 0-10), and their weighted average is used to arrive at the composite score for the evaluation area 2003 World Bank Data; 2003 WDI Database Clinical Trial Offshoring 33 Cost structure is assessed based on relevant labor and infrastructure costs and investigator grants Area of Evaluation Sub-Category Cost of Labor Cost Efficiency Infrastructure Costs CRO Cost Perspective Note: Sources: Measurement Relevance Average Physician Salary Investigator fees/grants represent a significant portion of the total costs of the trial Average Nurse Salary (proxy for clinical research assistant) Clinical research assistants (CRAs) monitor trial patients, collect data, etc and represent a significant cost of conducting clinical trials Average Statistical Mathematician Salary (proxy for data management personnel) Statisticians responsible for data management, data analysis, maintaining database, etc. Average Wages Average wages account for overhead labor costs and services, such as administrative Average Rental For Office Space (proxy for lab space or office space) Cost of space for labs, office space, etc. Round Trip Airfare from London and JFK to Largest City in Country (weighted average) Management of the trial will likely involve some travel to/ from country Relative Grant Levels Compared to the US Estimate of country variation in total grant costs Measurements converted to a score (0-10), weighted average applied to determine composite score for the evaluation area Salaryexpert.com; WDI Database; Economist Intelligence Unit; CBRE Global Markets Rent; Expedia.com Clinical Trial Offshoring 34 Regulatory conditions considers FDA visibility, in-country regulatory conditions and level of IP protection Area of Evaluation Sub-Category FDA Acceptability and Visibility Regulatory Conditions Country Specific Regulatory Conditions Intellectual Property Protection Measurement Relevance Number of Trials On the CDER Clinical Investigator Inspection List Number of inspections reflects the FDA view of a country’s importance in clinical trials Percent of Trials Where Inspection Resulted in Voluntary Action Indicated (VAI) Countries with higher success rates with FDA inspections are more attractive Ease of Approval for Shipping Laboratory Samples (Rating) Restrictions on biological shipments may extend lead time and delay initiation of trial Clinical Trials Regulatory Approval Time (Estimated) Regulatory approval time varies significantly across countries and is a potential bottleneck EIU IPR Protection Index Pharmas are concerned about potential reverse engineering of trial drugs Note: Measurements converted to a score (0-10), weighted average applied to determine composite score for the evaluation area Sources: US FDA CDER Clinical Investigator Inspection List (1999-2004); US National Institutes of Health; Economist Intelligence Unit WEF Global Competition Report; A.T. Kearney Research Clinical Trial Offshoring 35 Relevant expertise is driven by CRO presence, the country’s clinical trial experience and availability of the relevant skilled professionals Area of Evaluation Relevant Expertise Sub-Category Measurement CRO Presence and Clinical Trial Experience Percent of Top 12 CROs Present in Country Presence of top CROs indicates the availability of the local supply market Number of Clinical Trials Voluntarily Listed in ClinicalTrials.gov Number of clinical trials is an indicator for the level of experience Number of Physicians Used as proxy for the availability of suitable physicians for clinical trials Number of CRAs/Nurses Used as proxy for the availability of clinical research associates Number of First Degrees in Math / Computer Science / Engineering Used as proxy for the availability of statisticians Availability of Talent Pool Overall assessment of availability of talent needed for conducting clinical trials Availability of Relevant Skilled Professionals Relevance Note: Measurements converted to a score (0-10), weighted average applied to determine composite score for the evaluation area Sources: ClinicalTrials.gov; Annual Physician Index; 2004 WHO / EIP / HRH; NSF Clinical Trial Offshoring 36 Environment is evaluated based on IP protection, healthcare and country infrastructure, and country risk Area of Evaluation Sub-Category Measurement Relevance Pharma Intellectual Designation by USTR on Countries’ Property Protection and Adequacy and Effectiveness of IP Market Access Rights Protection Countries that have good IP protection are less likely to have theft or misuse of clinical trial data and materials Healthcare Under 5 mortality rate and adult (15- Mortality rate is proxy for the level of Infrastructure 60) mortality rate healthcare infrastructure Country Overall Overall Infrastructure Quality Measures ease of conducting clinical InfraTransportation Quality and Density of Road and Rail trials structure System Language TOEFL Score Average Culture "Personal Contact" Rank Environment Adaptability Country Business Overall Business Environment Rating General risk and costs of conducting Risk Environment FDI Confidence Index Rankings business in the country regardless of industry; import duty metric is specific Political Political Stability Rating to pharmaceutical industry Environment Financial Environment Currency Fluctuations Relative to the US Dollar Tax Costs Percent Duty on Drug Importation Government Support Extent of Bureaucratic Red Tape Note: Measurements converted to a score (0-10), weighted average applied to determine composite score for the evaluation area Sources: PhRMA (http://www.phrma.org/international/) Special 301 Report; Office of the US Trade Representative Special 301 Annual Review (2005); World Bank; World Development Indicators (2004); Global Competitiveness Report (2004-2005); CIA World Factbook (2004); Economist Intelligence Unit (2004), Dorlong Kindersley Atlas; Educational Testing Service TOEFL Scores (2001-2002); A.T. Kearney Globalization Index (2005), USDA Trade Information Center (1-800-USA-TRADE) Clinical Trial Offshoring 37