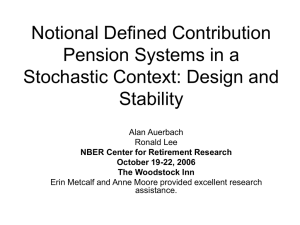

Notional Defined Contribution Pension Systems in a Stochastic

advertisement

Notional Defined Contribution Pension Systems in a Stochastic Context: Design and Stability Alan J. Auerbach and Ronald Lee University of California, Berkeley What are NDC plans? • Motivation: can one obtain some of the benefits of a defined contribution scheme without confronting the difficult funding transition? – property rights – transparency – solvency in the face of demographic shifts • Answer: possibly, if use “biological” rate of return instead of the market rate of return Example: Sweden’s NDC Plan • Two phases: pre-retirement and retirement • Pre-retirement: each year’s payroll taxes added to stock of “notional pension wealth” (NPW); NPW compounded annually using growth rate of average wage • Retirement: level real annuity based on trend wage growth rate, but adjusted up or down if actual growth rate faster or slower Example: Sweden’s NDC Plan • No guarantee that NDC plan as used in Sweden will be stable, in terms of evolution of debt-payroll ratio • This is recognized in Sweden, so an additional “brake” mechanism is included • Construct a balance ratio, b, meant to approximate ratio of system assets to liabilities • If b < 1, then multiply by b the rate of return called for by the basic formula Potential Problems with the Brake • Asymmetry (applies only when b < 1) means potential asset accumulation • Applying brake to net return – Imposes lower bound of 0 on adjusted return – Has other anomalous properties – An alternative that eliminates these problems is a brake applied to gross return • Either the gross brake or the net brake can be applied symmetrically (for b > 1) The Model • Stochastic population projections – Eliminate drift term in mortality process to generate quasi-stationary equilibrium • Stationary stochastic interest rate and wage growth rate processes • Estimate distribution of outcomes using 1000 paths followed for 500 years • Implement NDC system based on US OASI system parameters Simulation Results • Consider versions of NDC system that vary by – Rate of return used: wage rate growth (g) vs. wage bill growth (n+g) – Type of brake (none/asymmetric/symmetric; net/gross) • To evaluate stability, look at distribution of assets-payroll paths Figure 2. Assets/ Payroll (r=g, no brake) Figure 2. Assets/ Payroll (r=g, no brake) Figure 3. Assets/Payroll (r=g, asymmetric brake, net) Figure 4. Assets/Payroll (r=g, asymmetric brake, gross) Figure 5. Assets/Payroll (r=g, symmetric brake, gross) Figure 6. Assets/Payroll (r=n+g, no brake) Figure 6.a. Assets/Payroll (r=n+g, no brake); constant i,g Conclusions • Swedish-style NDC system not stable, even with brake • System can be made stable, using brake that is stronger and symmetric • Using growth rate of wage bill rather than of wage rate is inherently more stable • A considerable share of instability is attributable to economic, as opposed to demographic, fluctuations