Document

advertisement

OR 2006 Karlsruhe

Welfare Economy under

Rough Sets Information

Takashi Matsuhisa

Ibaraki National College of Technology

Ibaraki 312-8508, Japan

E-mail: mathisa@ge.ibaraki-ct.ac.jp

September 8, 2006

1

Background

Economy under uncertainty consists of

Economy:

Trader set, Consumption set, Utility functions

Uncertainty

1. By Exact set information:

Partition structure on a state-space, or equiv.

Knowledge structure.

2. By Rough sets information:

Non-partition structure on a state-space, or

equiv. Belief structure.

2

Aim and Scope

Economy under Exact Sets Information

1.

Core equivalence theorem: There is no incentive among

all traders to improve their equilibrium allocations.

Fundamental Theorem for Welfare Economy: Each Pareto

optimal allocation is an equilibrium allocation.

Others; e.g., No trade theorem: There is no trade among

traders if the initial endowments are an equilibrium.

2.

3.

Economy under Rough Sets Information

Can we extend these results into the economy

There are a few extensions of “No trade.”

We extend the welfare theorem.

3

Purpose

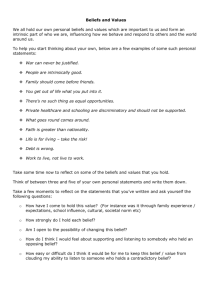

1. “Rough sets” information structure

induced from a belief structure

2. Economy with belief structure and

expectation equilibria in belief

3. Characterization of the extended

equilibria by Ex-post Pareto optimal

allocations in traders.

4

Chronicle of Extensions

Author(s)

Aumann

Result

(1962) Core equiv

Geanakoplos

(1989)

No Trade

Einy et al (2000) Core equiv

Matsuhisa and

Core equiv

Ishikawa (2005)

Matsuhisa (2005)

Welfare

Economy

Uncertainty

Information sets

×

Pt ()(Exact set)

○

Pt := non Partition

○

Pt := Partition(Exact set)

○

Pt := non Partition

○

(Ref, Trn: Rough set)

(Ref: Rough set)

Pt := non Partition(None:

Rough set)

5

Outline

Belief structure and Rough sets

information

Economy on belief

Expectations equilibrium in Belief

Fundamental Theorem for Welfare

Remark

6

Economy under Uncertainty

〈T, S,m,W, e, (Ut)t∈T, (πt)t∈T, (Pt)t∈T,〉

l : the number of commodities

R+l : the consumption set of trader t

T: a finite set of traders t∈T

e : T×W R+l : an initial endowment

Ut : R+l×W→R : t’s utility function

πt : subjective prior on W for t∈T

Pt : partition on Wwhich represents trader t’s

uncertainty

7

Economy on Belief

〈T, W, e, (Ut)t∈T, (πt)t∈T, (Bt)t∈T, (Pt)t∈T〉

l : the number of commodities

R+l : the consumption set

T : a finite set of traders t

e : T×WR+l : an endowment

Ut : R+l×W→R : t’s utility function initial

πt : subjective prior on Wfor t∈T

〈 W, (Bt)t∈T, (Pt) t∈T 〉: the belief structure

8

Belief structure

〈 W, (Bt)t∈T, (Pt)t∈T 〉

W : a non-empty finite set of states

2 W∋E : an event

T : a set of traders

E ∋: “E occurs at ”

9

Belief structure

〈 W, (Bt)t∈T, (Pt)t∈T 〉

t’s belief operator Bt : 2 W → 2 W

Bt E ∋ : “t believes E at ”

t’s possibility operator

Pt : 2 W → 2 W,E → Pt(E):= W∖ Bt (W∖ E)

Pt E ∋ : “E is possible for t at ”

Pt():= Pt({) : t’s information set at

10

Livedoor v.s. Fuji TV Japan

L

F

11

L-F Example

T = { L, F }

1 = L does not commit the

injustice

W= {1 , 2 }

2 = L commits the injustice

Belief structure:

E

BL E

φ

φ

{1}

{1}

{2}

{2}

W

W

BF E

φ

{1}

φ

W

12

L-F Example T = { L, F }

The possibility operators

E

PL E

φ

φ

{1}

{1}

{2}

{2}

W

W

PF E

φ

W

{2}

W

The Information Sets: Pt()= Pt({})

1

2

PL

1

2

PF

13

Rough Set Theory

An event E is exact if Pt(E) = Bt (E)

An event E is rough if Pt(E) ≠ Bt(E)

If 〈W, (Bt )〉 is the Kripke semantics for

Modal logic S5 then {Pt()|∈W} is a

partition of W,and every Pt() is exact.

Our interest is the case that Pt() does

not make a partition, and so Pt() is rough

in general.

14

Economy on Belief

〈 T, S, m, W, e, (Ut)t∈T, (πt)t∈T, (Bt)t∈T, (Pt)t∈T〉

(A-1) Se (t, ) ≩ 0

t∈T

Dom (Pt) := { | Pt(ω) ≠ φ }

= the domain of Pt

(A-2) For ∀t, Dom (Pt) = Dom (Ps) ≠ φ

15

Allocations

An assignment x : T×W R+l

An allocation a : T×WR+l

Sa (t, ) ≦ S e (t, )

t ∈T

t ∈T

16

Price and Budget

Price system p : WR+l ≠0

⊿(p) = the partition of W induced by p;

⊿(p)() = { x | p(ξ) = p() }

= “the information given by p at ”

Budget set of t at

Bt(, p) = { x | p()x ≦ p()e(t, ) }

17

Expectations in belief

t’s interim expectation

Et[Ut(x (t, * )) | ⊿(p)∩Pt ]()

:= ∑Ut(x (t, x),x))πt({x} | ⊿(p) ()∩Pt())

x∈Dom( Pt )

t’s ex-ant expectation

Et[Ut(x (t, * )]():= ∑Ut(x (t, x),x))πt({x})

x∈Dom( Pt )

18

Expectation equilibrium in belief

(p, x) : = an expectations equilibrium in belief

(EE1) x(t, ) ∈ Bt(, p)

(EE2) y(t, ) ∈ Bt(, p)

if

⇒ Et[Ut(x(t, *))|⊿(p)∩Pt]()

≧ Et[Ut(y(t, *))|⊿(p)∩Pt]()

(EE3) Sx(t, ) = Se(t, )

t∈T

t∈T

19

Existence Theorem for EE

Trader t is risk averse if:

(A-3) Ut(x , ∙) = ‘‘strictly increasing, quasi concave on R+l, etc’’

Measurability of Utility:

(A-4) Ut(x , ∙) = ‘‘measurable for the finest

field generated by Pt for all t ∈ T ’’

Theorem 1: Economy on belief with (A-1),

(A-2), (A-3) and (A4). There exists an

expectation equilibrium.

20

Question

Question : What’s characteristics of the

expectations equilibrium in belief?

Answer 1. Welfare theorem: The expectations

equilibrium is an ex-ante Pareto-optimal

Answer 2. Core equivalence: The expectations

equilibrium is a core allocation, and vice versa.

21

Pareto Optimality

An allocation a = ‘‘ex-ante Pareto optimal’’

if there is no allocation x such that

(1) ∀t∈T

Et[Ut(x (t, * ))] ≧ Et[Ut(a (t, * ))]

(2) ヨs∈T

Es[Us(x (s, * ))] >Es[Us(a (s, * ))]

22

Welfare Theorem

Economy with belief structure:

(A-1), (A-2), (A-3), and (A-4)

An allocation a = ‘‘ex-ante Pareto optimal’’

For ∃p = price,

⇔ (p, a) = ‘‘an expectations equilibrium’’

for some initial endowments.

23

Concluding remark

Propose an extended economy under rough sets

information.

Emphasize with the epistemic aspect of belief of

the traders

Remove out: Partition structure of traders’

information.

Extend Fundamental Theorem for Welfare.

Bounded rationality point of view :The relaxation of the

partition structure for player’s information can

potentially yield important results in a world with

imperfectly Bayesian agents

24

Thank you!

Danken !

25