Ch. 1

advertisement

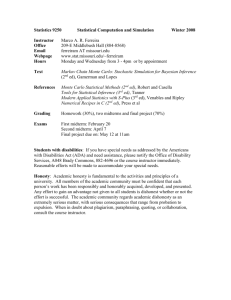

Book Review: ‘Energy Derivatives: Pricing and Risk Management’ by Clewlow and Strickland, 2000 Anatoliy Swishchuk Math & Comp Lab Dept of Math & Stat, U of C ‘Lunch at the Lab’ Talk November 7th, 2006 About the Authors: Clewlow, Les About the Authors: Strickland, Chris About the Authors: Kaminski, Vince About the Authors: Kaminski, Vince About the Authors: Masson, Grant About the Authors: Chahal, Ronnie Contents Preface 11 Chapters References: 125 Index Chapter 1 Chapter 2 Chapter 3 Chapter 3 (cntd) Chapter 4 Chapter 5 Chapter 6 Chapter 7 Chapter 8 Chapter 8 (cntd) Chapter 9 Chapter 10 Chapter 11 Chapter 11 (cntd) Chapter 1 Ch. 1 (1.1. Intro to Energy Derivatives) A Derivative Security: security whose payoff depends on the value of other more basic variables Deregulation of energy markets: the need for risk management Energy derivatives-one of the fastest growing of all derivatives markets The simplest types of derivatives: forward and futures contracts Ch.1 (Forwards and Futures) A Futures contract: agreement to buy or sell the underlying asset in the spot market (spot asset) at a predetermined time in the future for a certain price, which is agreed today. A Forward contract: agreement to transact on fixed terms at a future date, but these are direct between two parties. F=S exp [(c - y) (T-t)] Ch.1 (Options Contracts) Two types: Call and Put Call Options: gives the holder the right, but not obligation, to buy the spot asset on or before the predetermined date (the maturity date) at a certain price (the strike price), which is agreed today. Differ from forward and futures: payment at the time the contract is entered into (option price) Ch.1 (Options Contracts II) Ch. 1(1.2. Fundamentals of Modelling and Pricing) F. Black, M. Scholes, R. Merton (1973)-BSM approach SDE (GBM) Ch. 1 (1.2. Fundamentals of Modelling and Pricing II) F. Black, M. Scholes, R. Merton (1973)-BSM approach PDE Ch. 1 (1.2. Fundamentals of Modelling and Pricing III) F. Black, M. Scholes, R. Merton (1973)BSM approach Solution Ch. 1 (1.2. Fundamentals of Modelling and Pricing IV) Merton (1973) P(T,t)-price at time t of a pure discount bond with maturity date T BSM formula Ch. 1 (1.3. Numerical Techniques) Trinomial Tree Method (this book) Monte Carlo Simulation (this book) Finite difference schemes (another one) Numerical integration (-//-) Finite element methods (-//-) Ch. 1 (1.3.1. The Trinomial Method) Alternative to binomial model by Cox, Ross, Rubinstein (1979): continuous-time limit is the GBM Provide a better approximation to a continuous price process Easier to work with (more regular grid and more flexible) Ch. 1 (1.3.1. The Trinomial Method II) Ch. 1 (1.3.1. The Trinomial Method III) Ch. 1 (1.3.1. The Trinomial Method IV) Ch. 1 (1.3.1. The Trinomial Method V) Ch. 1 (1.3.1. The Trinomial Method VI) Ch. 1 (1.3.1. The Trinomial Method VII) Ch. 1 (1.3.1. The Trinomial Method VIII) (The value of option) Ch. 1 (1.3.1. The Trinomial Method IX) (‘backward induction’) Ch. 1 (1.3.1. The Trinomial Method X) (The value of option) Monte Carlo Simulation (MCS) MCS: estimation of the expectation of the discounted payoff of an option by computing the average of a large number of discounted payoff computed via simulation Felim Boyle (UW, 1977)-first applied MCS to the pricing of financial instruments Monte Carlo Simulation (MCS) II Monte Carlo Simulation (MCS) III Monte Carlo Simulation (MCS): Criticisms The speed with which derivative values can be evaluated (treatment: variance reduction technique) Inability to handle American options (treatment: combination of tree and simulation) Summary The End Thank You for Your Attention! Next Talk: Chapter 2: Understanding and Analysing Spot Prices Speaker: Ouyang, Yuyuan (Lance) November 17, 2006, 12:00pm, MS 543 Distribution list of Chapters: Ch 1,3,6-Anatoliy Ch 2,7-Lance Ch 4,8-Matt Ch 5,9-Matthew Ch 10-Xu Ch 11-Greg