Class 11: dismissal for abuse and the *means test*

advertisement

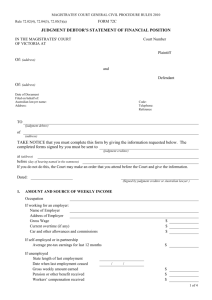

10: dismissal for abuse and the “means test,” cont. © Charles Tabb 2010 May have to pay to play Blausey • Issue: • are private disability benefits, for which the DR has paid the premiums, “income” within the meaning of “current monthly income”? holding • Court held = “income” – Under 101(10A)(A) – Did not decide whether was income under 101(10A)(B) as an amount received from another entity on a regular basis for household expenses Relevance of IRS concepts? • Dr argued should NOT be “income” because under IRC, private disability benefits for which taxpayer paid the premiums are NOT “gross income” Court rejected IRC analogy • Court rejected the DR’s profferred IRC analogy • Rely on Bankruptcy Code dfn that says CMI is determined “without regard to whether such income is taxable income” • And, in Bk Code Congress “knew how to” incorporate IRC rules where wanted (cites means test expenses) Gross v. taxable • DRs were arguing that the private disability benefits were not “gross” income under IRC • And that Bk Code “income” should adopt IRC “gross” income tests • Under IRC, “gross” income and “taxable” income are 2 very different concepts “Taxable income” disavowal? • The Blausey court’s reference to Bk Code’s disavowal of “taxable income” as basis for determining “income” under BK Code thus is totally meaningless here • Court did not understand that gross income and taxable income are not the same thing! It still has to be INCOME • Under 101(10A), dfn. still requires that what Dr receives must be “income” • And thus must have some way of figuring out what Income means Need a positive theory Question 2.a • Using the Blausey court’s approach, would it count as CMI if in the six months prior to bankruptcy the Debtor was paid $2,000 by her employer to reimburse her for expenses she incurred on business trips on behalf of the Company? “Every dime”? • What about this approach? CMI includes “every dime a debtor gets during the relevant period except for those specifically excluded”? See In re DeThample, 390 B.R. 716, 721 (Bankr. D. Kan. 2008) Reimbursement of expenses? • Does the “every dime” theory really extend to reimbursement of expenses? • Surely not • But if not – on what theory?? How do we conceptualize that expense reimbursement is not “income”? Gross income IRC § 61. Gross income defined (a) General definition.--Except as otherwise provided in this subtitle, gross income means all income from whatever source derived, including (but not limited to) the following items: (1) Compensation for services, including fees, commissions, fringe benefits, and similar items; (2) Gross income derived from business; (3) Gains derived from dealings in property; (4) Interest; (5) Rents; (6) Royalties; (7) Dividends; (8) Alimony and separate maintenance payments; (9) Annuities; (10) Income from life insurance and endowment contracts; (11) Pensions; (12) Income from discharge of indebtedness; (13) Distributive share of partnership gross income; (14) Income in respect of a decedent; and (15) Income from an interest in an estate or trust. “income” under IRC 61 • Need to have concept of “income” • under IRC 61, Supreme Court has held: “’Income’ for tax purposes is the gain derived from capital, from labor, or from both combined” Workable definition in bankruptcy? • Would that “gain” definition under IRC be a workable basis for defining “income” under Bk Code 101(10A)(A)? Reimburse expenses? • Under that Dfn of “income,” whereby look to gain derived from capital or labor, surely reimbursing expenses does not qualify Disability benefits: Why possibly NOT income? • Under IRC, why might it be the case that private disability benefits for which the Dr paid the premium are not counted as “gross income”? No “gain” to dr/taxpayer • Simply recovering benefit that he has already paid for, via the premiums • i.e. – no “gain” • Which is why IS part of income if employer, rather than dr/taxpayer, paid the premiums Capital sale? • What if a month prior to bankruptcy the Debtor sold her BMW (which she had purchased five years ago for $45,000) for $20,000? Is that CMI? Only if a gain • Sale of an asset = “income” only if is a gain • So answer depends on what DR’s basis was before $20K sale • But surely the entire $20K (even though is 200,000 “dimes”) is NOT “income” Tax refund? • What if Debtor received a tax refund of $4,000 two weeks before she filed bankruptcy? Is that CMI? See In re Curcio, 387 B.R. 278 (Bankr. N.D. Fla. 2008) is 40,000 dimes! Tax refund ≠ “income” • Held ≠ income • Why not? • No “gain” simply repayment of debt the govt owes the taxpayer What about “income” under 101(10A)(B)? • Blausey court did not have to decide if private disability benefits were “CMI” under 101(10A)(B) • Brings into CMI “any amount paid by any entity other than the debtor … on a regular basis for the household expenses of the debtor” “amount” ≠ “income” • Use of word “amount” in 101(10A)(B) is distinct from “income” • Indeed word “income” is not found anywhere in 101(10A)(B) So what limits? • Does that mean that ANY $ that Dr receives on a “regular basis” is included in CMI under 101(10A)(B)? • Blausey court might say yes – in last full ¶ said that focus is on whether is $ that Drs can use to repay their debts “for the household expenses” • But that might be too expansive a reading of the statute • Statutory language is that Dr receives the “amount “ on a regular basis “for the household expenses” of the Dr - would private disability benefits for which Dr has paid premium satisfy this functionality test? Not clear Problem 2.7(a) “CMI” under 101(10A): Debtor’s salary of $5,000 per month from the previous year as an employee of Company, Inc. Answer 2.7(a) • Salary of $5k /month for 6 full months pre-bk is included Even if no longer have the job • Purely historic income calculation • Does not matter if DR no longer has that job b/c laid off • Would have to raise via rebuttal 2.7(b) • CMI? • A one-time bonus of $2,000, paid on December 31. Answer 2.7(b) • One-time bonus counts • Was received in last full 6 month period prebankruptcy • Fact was one time only would only be relevant for rebuttal 2.7(c) • CMI? • Debtor will be starting a new job on January 15 in which he will earn $30,000 a month. Answer 2.7(c) • New job does NOT count • Again only historic • Could come up under 707(b)(3) bad faith or totality • But not under means test 2.7(d) • CMI? • Debtor’s spouse earned $30,000 in the previous six months. Debtor files a non-joint case. Do you need more information? Answer 2.7(d) • Non-filing spouse’s income will not count under 101(10A)(A) • Might count under subsection (B) IF is regularly contributed toward household expenses 2.7(e) • CMI? • Social security benefits of $1,800 received by the Debtor from July through December of the prior year. Answer 2.7(e) • Social security benefits are expressly excluded 2.7(f) • CMI? • Non-taxable municipal bond income of $3,000, paid on December 31. Answer 2.7(f) • Bond income IS included as CMI • Fact is excluded from “taxable income” is by statute expressly made irrelevant • And otherwise is “income” 2.7(g) • CMI? • Debtor’s elderly mother lives with the debtor. Debtor’s mother is financially independent and has a sizeable estate which generates income of $8,000 per month. However, mother is chronically ill and has trouble getting around, which is why she lives with debtor. What portion, if any, of the debtor’s mother’s income should be included? Do you need more information? Answer 2.7(g) • Part of Grandma’s income might be included in CMI under 101(10A)(B) on “regular contribution” basis • Simply a fact Q of how much Grandma chips in Code § 707(b)(2)(A)(ii)-(iv) • In the Code, the allowable expense deductions are found in §707(b)(2)(A)(ii)-(iv) - (ii): Living expenses (IRS) (subsec. (I)) miscellany ((I)-(V)) - (iii): secured debts - (iv): priority debts Form B22A Official Form B22A http://www.uscourts.gov/rules/BK_Forms_08 _Official/B_022A_0108f.pdf Part V IRS living expenses (National, Local) • § 707(b)(2)(a)(ii)(I) • Part V, subpart A – – – – – Line 19A: National Std – food, clothing, etc Line 19B: National Std – health care Line 20A: Local Std – housing: non-mortgage Line 20B: Local Std – housing: mortgage or rent Line 22A: Local Std – transportation: operating, public transportation – Line 22B: Local Std – transportation: additional public transportation – Line 23, 24: Local Std – transportation: ownership “Amounts specified” • For National Standards and Local Standards, Dr may deduct the “applicable monthly expense amounts specified,” even if greater than DR’s actual expenses Deduct payments for debts • “the monthly expenses of the debtor shall not include any payments for debts.” • Get to deduct secured debts as well, see 707(b)(2)(A)(iii) • BUT only count once (under secured debts) Subtract secured debt payments from IRS allowances for mortgage, car ownership Websites for National and Local • National (food, clothing): http://www.justice.gov/ust/eo/bapcpa/20100315/bci_ data/national_expense_standards.htm • National (health): http://www.justice.gov/ust/eo/bapcpa/20100315/bci_ data/national_oop_healthcare.htm • Local (housing) [by state, county –Illinois ex.]: http://www.justice.gov/ust/eo/bapcpa/20100315/bci_ data/housing_charts/irs_housing_charts_IL.htm • Local (transportation) [by region – Midwest ex.]: http://www.justice.gov/ust/eo/bapcpa/20100315/bci_ data/IRS_Trans_Exp_Stds_MW.htm IRS – “Other Necessary Expenses” • The IRS defines these as “the allowable payments you make to support you and your family's health and welfare and/or the production of income.” “Other Necessary Expenses” • Only ACTUAL expenses are allowed here, unlike for National and Local Standards Examples of “Other Nec. Exp.” • Examples see Internal Revenue Manual, § 5.15.1.10, http://www.irs.gov/irm/part5/irm_05-015-001.html#d0e1302 and Form B22A (lines 25-32): – income and social security taxes – involuntary deductions for employment (e.g., mandatory retirement contributions) – term life insurance – court-ordered payments (e.g., child support or alimony) – child care – health care – education (if required for one to keep her job) – telecommunication services. Secured debts • §707(b)(2)(A)(iii) • Form B22A, part V, subpart C – Line 42: scheduled payments due next 60 months – Line 43: cure amounts on house, car, or other – items necessary for support (e.g., refrigerator) Secured – no limit! • For purposes of the means test, there is NO LIMIT on the $ amount of secured debt deduct • Only issue is whether is actual debt scheduled to be due in next 60 months, + cure amounts reason: would have to pay secured debt in chapter 13, and means test is sorting whether DR “can pay” unsecured debts in chapter 13 Caveat: bad faith/totality • very large secured debt payments may help DR pass means test • But Ct may find that DR is in “bad faith” or that “totality of circumstances” requires dismissal for abuse, see 707(b)(3) Priority debts • DR may deduct all priority debts due, projected over 60 months, see 707(b)(2)(A)(iv) • Form B22A, part V, subpart C – Line 44: note is for prepetition obligations pastdue – Line 28 “other necessary expenses” brings in support obligations that will come due during the next 60 months priority • See § 507(a) for priority debts • Rationale for allowing same as for secured debts have to pay all priority debts in chapter 13 plan, see 1322(a)(2) Chapter 13 expenses • actual chapter 13 administrative expenses in district where the debtor resides http://www.justice.gov/ust/eo/bapcpa/20100 315/bci_data/ch13_exp_mult.htm • District allowance, up to 10% cap • § 707(b)(2)(A)(ii)(III) • Same rationale as for secured, priority would have to pay in a chapter 13 plan Charitable contributions? • “the court may not take into consideration whether the debtor has made, or continues to make” charitable monetary contributions to a qualified religious or charitable organization. § 707(b)(1). • Form B22A, line 40 • Charity exclusion does not specify any limit on the amount of charitable contributions a debtor may make for means test and dismissal purposes. Problem 2.8(a) Debtor’s monthly paycheck includes deductions for the following items. She wants to know if the expense is deductible under the means test. a. Income tax withholding Income taxes • Yes, of course, deduct • “Other Necessary Expenses,” 707(b)(2)(A)(ii)(I) • No doubt Dr has to pay these!! • Line 25 on Form B22A • See Internal Revenue Manual 5.15.1.10 http://www.irs.gov/irm/part5/irm_05-015001.html#d0e1302 2.8(b) Debtor’s monthly paycheck includes deductions for the following items. She wants to know if the expense is deductible under the means test. b. Term life insurance Term life • Same answer as for income taxes • Yes, allow as “Other Necessary Expenses” • See line 27 on Form B22A 2.8(c) Debtor’s monthly paycheck includes deductions for the following items. She wants to know if the expense is deductible under the means test. Mandatory contribution of 8% of salary to state retirement plan c. Mandatory retirement • Yes, allow as “Other Necessary Expense” • Line 26 on Form B22A 2.8(d) Debtor’s monthly paycheck includes deductions for the following items. She wants to know if the expense is deductible under the means test. d. Voluntary contribution to 401(k) retirement plan. Voluntary retirement • NOT allow • Lots of cases so hold • Note line 26 on Form B22A expressly excludes • Would have to demonstrate why meets basic test of supporting family’s health or welfare or the production of income 2.8(e) Debtor’s monthly paycheck includes deductions for the following items. She wants to know if the expense is deductible under the means test. e. Charitable contribution to United Way charity • Allow • “the court may not take into consideration whether the debtor has made, or continues to make” charitable monetary contributions to a qualified religious or charitable organization. 707(b)(1) • Line 40 on Form B22A Problem 2.9(a) When Debtor files chapter 7, she owns a Ferrari automobile. How much can she deduct under the means test with regard to her ownership of the Ferrari in the following cases: a. She has 60 remaining payments of $900 per month Ferrari • Deduct $900 per month as secured debt contractually due over next 60 months. 707(b)(2)(A)(iii)(I) • What about also claiming IRS Local Standard for transportation, ownership expense? – $496 per month – Better (and majority) view zero – wiped out by deduction for secured debt payments – Minority view also get the $496 (under this view, thus get $1,396 month!) 2.9(b) • When Debtor files chapter 7, she owns a Ferrari automobile. How much can she deduct under the means test with regard to her ownership of the Ferrari in the following cases: b. She has 10 remaining payments of $900 per month Less than 60 payments left • For secured debt deduction, take total remaining ($900 x 10 months = $9000) and divide by 60 months = $150 month Plus also • Get IRS Local Standard transportation ownership expense (= $496) minus secured debt payment ($150) = $346 month • For grand total of $496 month – Which = transportation ownership expense Minority views: Relationship Secured/Local Standard • In 2.9(b), minority views on how the secured debt deduction and the allowance for IRS Local Standard (transportation) interact: 1. In addition to secured debt ($150 month), also get full IRS Local Std transportation ownership ($496) thus would be $646 month allowed 2. Once secured debt paid off (i.e. after 10 months), no longer get any Local Std allowance b/c not “applicable” (thus only $496 for 10 months) 2.9(c) When Debtor files chapter 7, she owns a Ferrari automobile. How much can she deduct under the means test with regard to her ownership of the Ferrari in the following cases: c. She has 60 remaining payments of $300 per month Secured debt < local std • Under secured debt deduction, get the $300 per month for 60 months • Issue – how interact with Local Std transportation ownership allowance of $496? • Majority view must deduct the $300 secured debt payments from $496 Local Std – Thus get total of $496 ($196 Local, $300 Secured) 2.9(d) When Debtor files chapter 7, she owns a Ferrari automobile. How much can she deduct under the means test with regard to her ownership of the Ferrari in the following cases: d. She owns the car free and clear Free and clear • Majority view Dr still can claim entire “amount specified” under Local Std, i.e., $496 • Minority view – no “applicable” amount, so deduct nothing for car ownership – But if owed even $1, get full $496! • More sensible economically majority view – Either paying off current car or saving for new car 2.10 • Debtor and his spouse live alone. • First, two of their grown children, who have lost their jobs, move back into the house. • Then Debtor’s 80-year old mother moves in. • At the end of his rope, Debtor files chapter 7. How much can Debtor deduct as living expenses under the National Standards? 5-person family • All 5 of the people in this problem would be considered part of the Dr’s “household” • For 4-person family, get $1,611 per month – $1371 food etc, + health (4 x $60 = $240) • For extra person, get $262 + health care – Here, since Mom > 65, health = $144 – So extra person = $406 total = $2,017 per month Problem 2.11 • Debtor owes alimony and child support payments of $3,000 per month to his ex-wife. For a year prior to filing chapter 7, Debtor does not make any of the required alimony and child support payments, and thus owes her $36,000 when he files. May Debtor take any deductions on the means test for the unpaid alimony and support? If so, how much? Priority claims • Alimony & Child support are 1st priority “domestic support obligations” (507(a)(1)) • Thus all $36,000 is a deductible expense under 707(b)(2)(A)(iv) • Divide over 60 months, so = $600 per month