Microsoft Word - RFP for MAP Impact Evaluation 191212

advertisement

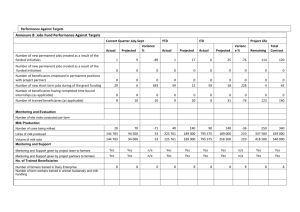

[Request for Proposal (RFP) for 2016 Impact Assessment of KMT’s Dairy and Water Sector] IMPACT ASSESSMENT – DAIRY AND WATER SECTORS Introduction Kenya Markets Trust has scheduled a series of evaluations and assessments for its interventions to measure and report progress against set target over the program period, but also use the findings from such evaluations to inform or improve sector or intervention strategies. The evaluations are sector and sometimes even intervention specific. They are commissioned based on the performance of intervention/s - when on-going monitoring activities indicate that desired changes are being realized. KMT conducted baseline surveys in the Dairy and Water sector among others in 2013. This assignment is focused on midline evaluation of our work in Dairy and Water sector using the methodology used in the baseline survey and measuring the same indicators measured at baseline. Terms of Reference 1. BACKGROUND 1.1. The Kenya Markets Trust The Kenya Gatsby Trust (KGT) was founded in 1993 as one of four independent country trusts set-up across Africa by the UK-based Gatsby Charitable Foundation to support enterprise development and wealth creation. In 2011, KGT realigned its organizational mission to focus on transforming the functioning of markets, and in doing so to make markets work better for the poor. This shift in KGT’s organizational mission was in response to a growing understanding among development partners around the importance of market “systems” as a transmission mechanism for economic growth and poverty reduction. In support of this shift in organizational focus, the Board of KGT also took the decision to change the name of KGT to the Kenya Markets Trust (KMT). KMT’s mission is embodied in its new motto: “better markets, better lives.” Water and Dairy sectors form part the core “portfolio” of KMT’s current activities. KMT is funded by the UK Department for International Development (DFID) and the Gatsby Charitable Foundation (GCF). KMT aims to improve the performance of selected market systems in order to boost overall competitiveness whilst strengthening the performance and position of poor people participating in markets whether as producers, employees or consumers. The main focus of KMT is on agricultural markets, although the programme also includes a basic services component designed to address inefficiencies in the delivery of clean safe, potable water to low income Kenyan households. The current KMT portfolio consists of interventions in water, dairy, agricultural inputs and seed, extensive livestock and aquaculture. The overall objective of KMT is measured against three key outcomes: 1. Major systemic change achieved within a “portfolio” of 4 to 8 market systems, resulting in the average proportion of the net attributable income change for farmers and entrepreneurs (disaggregating men and women) increasing by 20% over the life of the programme; 2. At least 148,000 poor people (as producers, employees, consumers) positively affected at the end of KMT measured in terms of increasing incomes, new jobs created and access to new and improved services; Page |1 [Request for Proposal (RFP) for 2016 Impact Assessment of KMT’s Dairy and Water Sector] 3. A 30% increase in peer perceptions of partners’ effectiveness and in stakeholders’ awareness and understanding of the approach. KMT will achieve these outcomes through application of an approach known as making markets work for the poor (M4P). M4P is based on facilitating the realignment of the incentives, capacities, relationships and rules which govern how markets work. In doing so, KMT will also be looking to catalyse private sector innovation, and support the emergence of more inclusive business models which deliver a better return to the poor. Programme interventions are already under way in dairy, rural water markets, agricultural inputs supply, seeds, aquaculture and Livestock. All interventions are articulated in the form of a theory of change. Below is the format of KMT’s theory of change. 1.2. The assignment 1.1 The theory of change for the Kenya Markets Trust is shown in figure 1. 1.2 This assessment focuses on the KMT Water and Dairy sector interventions after 3 years of implementation. It is necessary to validate the output level results of the programme and demonstrate how the programme has achieved this and also understand the relationship between programme activities and the resulting impact on the lives of programme beneficiaries. 1.3 KMT Water and Dairy sector strategies were crafted to address those Issues through various interventions stated below. Work commenced in Sept 2012 led by KMT’s implementing partner SNV and TechnoServe respectively. The key interventions/Initiatives areas are: Page |2 [Request for Proposal (RFP) for 2016 Impact Assessment of KMT’s Dairy and Water Sector] Water Building Knowledge and Confidence: KMT is improving professional operation of water services in rural areas by catalysing public private partnerships. The entry of private entities into these nascent water markets is expected to harness the drive, resources and know-how of businesses towards the sustainable growth of the sector. Improved knowledge, understanding and confidence of CGs, WSBs, WSPs and WUAs on private sector engagement and PPPs will result in improved business practices of WSPs and WUAs, which in turn will lead to improved services delivery to the consumers. Not only will the improved water services improve human health but reduce the heavy burden on women and girls in collecting water for their families. Improved capacity, knowledge and experience of PS in water services delivery will result in better, faster, reliable and affordable services and open the opportunities for more PS as operators of water utilities in both rural and urban areas. Key systemic changes KMT wants to achieve through this intervention are The key public sector institutions recognise the role of PS and proactively engage with them Contractual models, tools and guidelines for engagement of PS are in place Public utilities (WSPs) in the urban areas improve their management efficiency by partnering with private sector WUAs transform themselves into commercial WSPs or partner with PS firms as Operators Business Strategy Support: KMT is improving professional operation of water services in rural areas by catalysing public private community partnerships. The entry of private entities into these nascent water markets is expected to harness the drive, resources and know-how of businesses towards the sustainable growth of the sector. Moreover, reliable access to safe water will pay dividends by improving human health and reducing the burden on women and girls in spending long hours collecting water. Through introducing sustainable management models KMT has succeeded in engaging private firms as managers and operators of water projects to improve reliability, quality, and affordability of water services for underserved and un-served consumers. Not only will the improved water services improve human health but reduce the heavy burden on women and girls in collecting water for their families. Improved capacity, knowledge and experience of PS in water services delivery will result in better, faster, reliable and affordable services and open the opportunities for more PS as operators of water utilities in both rural and urban areas. Key systemic changes KMT wants to achieve through this intervention are Private sector operators improve their management capacity and deliver effective and efficient services PS deliver incremental performance changes and effectively utilize resources for growth and expansion PS enhance peer learning and knowledge sharing to improve services delivery More effective and interactive communications, media pushing reforms process Enabling Environment Improved enabling environment and availability of appropriate financial products in the market will attract private firms as managers of water systems, leading to more Page |3 [Request for Proposal (RFP) for 2016 Impact Assessment of KMT’s Dairy and Water Sector] water systems managed by competent private firms as Lease Operators or Management Contractors. Key systemic changes KMT wants to achieve through this intervention are Policy and regulatory framework incentivises private sector participation/finance CG prioritise PS participation and market finance including BOT, BOOT models Appropriate financing products (e.g. blended) for water sector are in place Key donors prioritise sustainability in their sector financing leading to no operational subsidies or only SMART subsidies PPP Unit, Ministry of Environment Water and Natural Resource (MEWNR), Water and Sanitation Regulatory Board (WASREB), Water Services Board (WSB)s; County Governments (CGs) are the major partner in this intervention. Furthermore, Donor Group/NRW Group at national level: World Bank, SIDA, DFID, AFD.IRC and RWSN at international level are also important stakeholders for donor coordination. Dairy Commercial Hay production The milk yield of most small holder dairy cows in Kenya is significantly below their potential because the nutrient intake of the animals is insufficient in both quantity and quality. The main reason for not using commercial feeds and hay is their high cost, with a significant percentage (30%) being attributed to transport costs. As a result, small scale farmers typically only buy hay during the height of the drought when the cows have to survive and there is no grass in the open pastures. Even then, the quality of hay purchased by farmers is poor and lacks nutritional value because regulations on the feed industry are weak, allowing substandard hay to be sold. Past programs have encouraged smallholders to produce their own hay. However, based upon a theory of change that uptake will grow faster if large scale, commercial hay production develops, TechnoServe is developing a commercial hay market to produce affordable products that meet the nutritional standards required by farmers. Formal Supply Chain One of KMT’s primary interventions in dairy is catalysing the improvement of practices and skills of supply chain management. A key early lesson has been that the dairy industry has a substantial number of underperforming businesses and assets. As a result, KMT has focused a component of its supply chain intervention on identifying turn-around opportunities. There are over 350 milk collection centers in Kenya. However, the majority of the active collection centres are primarily driven by donor subsidies. Whether the donors are crowding out commercial investments because the private sector has become reliant on donors to make the investment, or there is an underlying return on investment problem is unclear. Key to this is a better understanding of the return on capital from the relatively expensive collection centre model supported by donor efforts. At the same time, KMT recognises that it is important to investigate and support alternative supply chain investment models, such as processor directed models, independent business models, and some form of mixed ownership models to increase formal milk sales. Informal supply Chain Informal milk supply chain is the flow of milk from the producer to the end consumer without undergoing any type processing. The milk in the informal sector is sold raw which according to the regulator is illegal. The informal markets are concentrated in the urban to semi-urban areas and handles 80% of the marketed milk in the country. Page |4 [Request for Proposal (RFP) for 2016 Impact Assessment of KMT’s Dairy and Water Sector] Empirical evidence show that 80% of the marketed milk in Kenya is sold through the informal traders who service markets dominated by millions of consumers with low purchasing power and provide market for most of the smallholder farmers especially where the formal milk marketing co-operatives have collapsed. These informal traders sell raw milk and safety concerns have been raised prompting the regulator to increase restrictions on this trade. Taking cognizant of the key role the informal traders play by providing market to the farmers, employment to poor people and better priced and characteristic milk to the consumers, KMT is developing and facilitating business strategies to support the sale of safe, affordable milk by traders as well as enabling and increasing access to quality dairy inputs by the farmers delivering to the informal chain. Improving Artificial Insemination(AI) Stimulating greater demand for AI and veterinary services: Work under this intervention includes: Support AI and Vet service providers adapt customer focused business models using feedback loops; improving the efficiency of liquid nitrogen distribution strategies for freezing genetic resources. Support AI service providers to bundle their services in a “Herd Management Plan”; Support equipment and breeding suppliers to develop payment plans and credit options 1.4 2. The output from the study will also inform the development of a mechanism for the routinely tracking of the KMT program progress and set basis for comparison with the end-line to assess the attributable change in the said sectors. PURPOSE The purpose of this assignment is to support the Kenya Markets Trust in conducting an impact evaluation of the Water & Dairy sector interventions. The objectives of this assessment are: To identify and measure impact among programme beneficiaries of the water and dairy sector work through an assessment of the selected Market actors To measure and validate outcomes among programme beneficiaries of the said sectors interventions through this assessment of the selected market actors and beneficiaries. To measure and validate outputs among the selected market actors of the Water and Dairy sectors interventions through this assessment. To validate the framework provided from the baseline surveys and propose improvement if any for future impact assessment/evaluations(End-line evaluation) To identify lessons learned and make recommendations to inform current KMT Dairy and water sector strategies, and future programming in the application of market systems approaches in Kenya and other countries. To inform KMT’s logical framework targets. Page |5 [Request for Proposal (RFP) for 2016 Impact Assessment of KMT’s Dairy and Water Sector] 3. EVALUATION METHODOLOGY This is an assessment done for the purpose of determining whether and to what extent KMT water and Dairy interventions are making progress toward achieving their outcome and impact level results. 4. Desk/secondary data review The data collection techniques will adopt those detailed in the Water and Dairy baseline survey research design documents. These however do not limit the proposal of more efficient and effective methodologies within the time given. EVALUATION TASKS AND DELIVERABLES The assignment should ideally be completed by June 2016. The specific deliverables are: a) b) c) d) e) f) g) h) Revised water and dairy evaluation research design (If any revisions are done) Workplan including specific interview schedule and other timelines Data Collection Instruments Summary highlighting the key findings as per the objectives Two PowerPoint presentation of the findings Two draft Reports (Dairy and Water) for KMT input Two Final Reports (Dairy and Water) Cleaned survey data set for each market sector KMT together with implementing partners SNV and TNS will facilitate the interviews with the market actor and provide required information – customer lists, contact persons representing the market actors, relevant monitoring data. KMT will also provide respondents lists and all other materials from the baseline survey. 5. QUALIFICATIONS OF THE CONSULTANT 5.1 The Consultant will possess the following qualifications. o o o o o o o o 6. Experience developing and implementing mixed‐methods research designs. Experience implementing qualitative and quantitative field research in rural Kenya that includes survey research, in‐depth semi‐structured interviews, and focus group discussions. Demonstrated skills in qualitative and qualitative research, data capture and analysis, including the use of SPSS Experience working with a wide range of individuals in the private sector and government. Strong writing and verbal communication skills. Experience evaluating private sector development programmes, Experience interviewing high level personalities in society. Understanding of the Market systems approach is an added advantage. REPORTING The consultant shall report to the Knowledge and Results Manager in charge of Impact Evaluation work and Page |6 [Request for Proposal (RFP) for 2016 Impact Assessment of KMT’s Dairy and Water Sector] 7. the Knowledge and Results Lead TIMELINES The consultant will be required to develop a detailed work plan including the timelines. The table below presents an indicative time schedule. Activity Inception discussion Review of research design documents and prepare tools Testing tools and training Field Work Data cleaning and analysis Draft report Final report 8. Time 1 week 2 weeks 1 week 5 weeks 4 weeks 2 week 2 week BUDGET The consultant will be required to develop a reasonable budget to enable them carry out this budget. 9. RESPONDING TO RFP The proposals should include the following: A brief description of the consultant’s background including details of length of professional experience especially in similar assignment to date (minimum 3 years). Detail their understanding of the ToR and in doing so provide an appropriate evaluation/assessment design and plan. A detailed workplan with clear timelines. Copy of CV, including three referees. Financial proposal Proposals can be sent via email to procurement@kenyamarkets.org or physically dropped to the address below on or before 17th February, 2016. Interested eligible bidders may obtain further information from: Email: procurement@kenyamarkets.org Kenya Markets Trust, 14 Riverside, Cavendish Block, 3rd Floor, Suite B, Riverside Drive. T: (+254) 588343/2588323/444582/4445830/4445847 Office Page |7 [Request for Proposal (RFP) for 2016 Impact Assessment of KMT’s Dairy and Water Sector] Annex 1: Indicators to be assessed In general we would like to assess market system level indicators, Enterprise performance and Impact level Indicators where applicable. But for the changes at this level to happen activity level indicators must have been realized for causality purposes. We are also interested for interventions where applicable in understanding the emergence of 1. Quality partnerships among market actors and 2. Pro poor innovations that have been adopted because of KMT work. 3. Additional investments by the market actors for expansion, adaptation, deepening of the innovations adopted during partnership with KMT Below are Results and indicators of change for the two sector interventions: Water- Building knowledge and confidence of market actor in the role of private sector Level Impact/Target Group Change level Results Increased disposable income for underserved and unserved consumer Farmers increase farm production by using water for agriculture and livestock Reduction in water-borne disease and illness (leading to increased savings that would be invested ) Increased use of water in agriculture and livestock sectors Market systems Change Indicators No of people recording change in disposable income Yield per acre Litres produced per cow per day Average cost of livestock sold in KHz No. of water borne diseases reported % decrease in water borne diseases reported Increased consumption of safe (quality) water Number of HHs use water for agriculture and livestock Litres of water used for agriculture and livestock No. of connections, Revenue collected per month Increased access to quality water by the consumers Number of new connections to unserved Number of repaired connections underserved Increased demand for quality, safe and affordable water No. of new connections per service area Amount of water billed in Kshs No. of connection applications made No. of other WSP/WUAs adopt the PPP model Other WSPs/WUAs Crowd-in around the model Other donors in the water sectors focus their investment on sustainable interventions in the water sector WSPs Increase revenue/surplus from supply of quality water. WSPs/WUAs are delivering quality, safe and affordable water WSPs/WUAs increase efficiency in service delivery (reducing the unit cost of water) No. and name of donors change their strategy on investment Revenue in Ksh. Per month % increase in revenue Residual chlorine in mg/litre micro-organisms per 50ml of water Unit cost of water per cubic metre in KSH. Page |8 [Request for Proposal (RFP) for 2016 Impact Assessment of KMT’s Dairy and Water Sector] National Government and County Government policies, regulation standards for PPPs/PSP developed No. of policies, regulations and standards developed for the water sector Clearly defined mechanism for PPP arbitration Refinement of legal framework based on the lessons Amount invested by CG/NG WSP in PPP process guideline Water- Business strategy support to private operators Level Results Indicators Impact/Target Group change Level Increased disposable income for underserved and unserved consumer Change in income from productive activity; Amount saved from less disease; change in income from agriculture production No. of HH using project water for other economic activities; Change in productivity; No. of new connections per service area; No. of connection applications made to the WSP No. of connections Volume of water delivered Revenue collected in Kshs per month No. of consumers reporting faults. Consumers are satisfied with the water quality (SCI) No. of consumers knowledgeable about quality; No. of consumers recording satisfaction with the information on quality water Unit cost in Kshs per m3. Amount invested by operators (SCI) PO/LO investing technical inputs for service improvement No. of WSPs accessing financial products; Total Amount accessed to the WSPs; POs concerted efforts to bring sustainability in service delivery No. of WSPs reporting on KPIs to the board/WASREB and the CGs No. of functional partnerships formed; No. of legislations/policies /strategies developed to embed the PPP innovation No. of PPCP contracts renewed by the County Governments No. of events/channels providing information on quality water. No. of WUAs transformed into WSPs; WUAs satisfied with the partnership (SCI); Efforts made by the PO/LO to refine contractual obligations; Farmers increase farm production by using water for agriculture and livestock Increased demand for quality, safe, affordable water Increased consumption of safe (quality) water Consumers are more responsive to pay for quality water Consumers have increased knowledge and access to information on the value of quality water Market system change WSPs/LOs/POs increase efficiency in water service delivery LOs/POs and WSPs have access to finance for utility expansion WSPs/LOs/POs comply with KPIs and governance requirement Functional partnership between public sector (WSP & CG) & PS enhanced LOs/POs use various platforms to provide information on quality water WUAs transform into WSPs through own initiative or partner with private players Page |9 [Request for Proposal (RFP) for 2016 Impact Assessment of KMT’s Dairy and Water Sector] Partner satisfaction and intent to continue Water- Enabling environment and creating business opportunities for private sector Level Results Indicators Impact/Target Group change Time spent collecting water diverted to productive (revenue-generating) activity Market System Change WSPs Increase revenue/surplus from supply of quality water Revenue in kshs per month % increase in revenue WSPs/NG /CG engages PS in water asset development / water service provision No. of WSPs/NG/CG who are engaging PS in asset development 7.NG and CGs provide incentives for PPP/PSP such as blended finance, viability gap financing, tax exemptions No. of PI accessing the incentives/products No. of products developed. PPP nodes within the Ministry /CGs coordinate PPP/PSPs activities PPP secretariat offering advice on a regular basis for adoption of PPP/PSPs in WASH No. of activities the node is undertaking. Number of HHs save time in collecting water; Amount of time saved compared to without water connection The rest as the above intervention No. of Functional PPP/PSP advisory group Dairy- Formal Supply Chain Level Results as in the results chain Indicators Impact New jobs created Number of new jobs created Farmers increase income Revenue in Kshs. from the sale of milk % increase in income from sale of milk Volumes of milk sold in litres % increase in milk sales Yield per day per cow % increase in production per cow Yield per day per cow of non-target farmers % increase in production per cow No. of farmers accessing information and inputs Level of satisfaction of services being offered and relationship with service providers % of milk sold through DHs and formal channels No. of farmers who are active members and accessing improved supply chain services. Level of satisfaction of farmers on supply chain services and relationship with DH or processor Perception of utility by non-target DHs/processors on providing quality services Target Group change Farmers increase milk sales at farm level Farmers increase milk volumes at farm level Other farmers increase milk volumes at the farm level Farmers access better information and inputs through improved distribution and retail channels Farmers access better market for their milk Farmers have increased access to better supply chain services Market system Other DHs and processors improve their supply chain services to their farmers Page |10 [Request for Proposal (RFP) for 2016 Impact Assessment of KMT’s Dairy and Water Sector] Change to customers/farmers DHs and processors increase sales through improved customercentric distribution channels DHs and Processors have increased access to retail markets for their products Other DH and processors crowd in and invest in improved customer-centric distribution and retail strategies DH and processors invest in innovative products and/or new marketing strategies targeting different customer segments DH and processors invest in energy efficiency upgrades through technology firms DHs and processors negotiate agreements with finance providers for debt, equity, and/or private investment DHs and processors invest in ICT solutions for improved operational efficiency DHs and processors invest in improved supply chain management practices Sales of inputs through the use of customercentric distribution channels Amount of additional DH/processor revenue generated from the sale of new products or new retail channels. No of DHS with increased access to retail market No. of non-target DHs and processors investing in improved customer-centric distribution and retail strategies. Amount invested in improved customercentric distribution and retail strategies. No. of target DHs and processors renewing or continuing their investment in improved customer-centric distribution and retail strategies after initial engagement No. of DHs/processors with new product innovations and/or marketing strategies. Amount invested in innovative products and/or new marketing strategies targeting different customer segments No. of DHs/processors that have purchased new or additional energy efficiency solutions. Amount invested in energy efficiency upgrades through technology firms. Extent to which DHs and processors are continuing to invest in energy efficiency upgrades in new locations/other infrastructure. No. of DHs and processors who utilize annual energy audits. No. of contract agreements signed between DHs/processors and finance providers. Amount of debt, equity and/or private investment mobilized by DHs/processors No. of DHs/processors that purchased new or additional ICT solutions. Amount invested in ICT solutions for improved operational efficiency. Extent to which DHs and processors integrate the ICT platforms into business operations. No. of DHs and processors investing in improved supply chain management practices. Amount invested in improved supply chain management practices. No. of target DHs and processors renewing or continuing their investment in improved supply chain management practices after initial engagement/contract. Page |11 [Request for Proposal (RFP) for 2016 Impact Assessment of KMT’s Dairy and Water Sector] Extent to which DHs and processors value and continue to invest in professional management services Dairy-Informal Supply Chain Intervention Impact Results as in the results chain Indicators As the above intervention Target Group change Market system change Farmers Increasing quantity of milk produced and sold Yield per cow per day Other farmers increasing the use of inputs and services through milk traders No. of farmers accessing inputs through arrangements facilitated by the trader Farmers increase use of of quality inputs and services through traders 'Other Traders increase demand for quality milk from farmers and sale of milk to processors No. of farmers using quality inputs through arrangements facilitated by the trader No. of non-target farmers accessing inputs through arrangements facilitated by nontarget traders (SCI) No. of non-target traders adopting branding, new products and new retail models (SCI) No. of non-target traders utilizing improved supply chain management practices Litres of milk sold per day Other traders invest in branding, new products and new retail models Other traders crowd in on improved supply chain management practices Traders increase sales of milk due to improved supply chain management Traders increase efficiency in business operations and quality of production Traders have improved supply chain management Traders invest in processing and food grade handling equipment Processors utilise traders for procurement and retail Traders invest in the food and safety standards Qualitative assessment of the business operations; amount of quality milk produced Level of satisfaction of suppliers on relationship with trader No. of traders with Improved supply chain management No. of traders purchasing food grade handling and processing equipment. No. of traders who continue to independently invest in food grade handling and processing equipment No. of traders supplying to processors No. of traders adopting standards with the support of certification firms. Amount of investment (initial and subsequent) by traders in becoming compliant to food and safety standards Dairy- Improving and promoting AI service Level Impact Target group change Results as in the results chain Indicators Same As the intervention above Farmers receive higher price from the sales of the improved bulls and heifers Revenue generated in Kshs annually Revenue generated in Kshs annually Other farmers increase use of AI from well-rated AI providers % of non-target farmers who used accredited AI for last AI service Page |12 [Request for Proposal (RFP) for 2016 Impact Assessment of KMT’s Dairy and Water Sector] Farmers increase use of AI from well-rated accredited AI providers Target Group Change AI providers offer improved quality services Other AI providers offer improved quality services AI providers adopt private accreditation components to promote AI services Other AI providers adopt private accreditation components to promote AI services Other AI providers have consistent access to affordable liquid nitrogen AI providers have consistent access to affordable liquid nitrogen AI providers have improved customer service and business skills to build farmer confidence in the service AI providers investing in formal feedback loops through ICT providers to authenticate, provide information and rate AI providers Liquid nitrogen dealers invest in improved distribution strategies Average price per insemination from internal/independent service providers Proportion of farmers who used accredited AI for last AI service. Proportion of farmers purchasing breed services from an accredited AI service provider. Proportion of farmers who "strongly agree" that they are receiving affordable, quality, available, trustworthy services from AI providers (average) % change in insemination success rate % change in awareness of existence of "accredited" AI services by farmers. % change in insemination success rate % change in awareness of existence of "accredited" AI services by farmers No. of internal/independent AI providers who are privately or self-accredited, or have adopted private accreditation components No. of non-target internal/independent AI providers who are privately or selfaccredited. No. of non-target internal/independent AI providers adopting private accreditation components to promote AI services. No. of non-target internal/independent AI providers following-up with marketing firms after mandatory training. % decrease in the retail price of liquid nitrogen in non-target areas Average number of deliveries per month by the dealer to local distributor. % change in the retail price of liquid nitrogen in target regions Extent to which internal/independent AI providers integrate customer service practices into normal business operations. No. of internal/independent AI providers investing in customer service training from relevant market actors No. of Internal and independent providers using ICT platforms to authenticate and rate AI providers. Amount invested in ICT platforms. Extent to which internal and independent AI providers integrate the ICT platforms into business operations No. of additional sales points contracted or established by target dealer. Amount invested in additional storage Page |13 [Request for Proposal (RFP) for 2016 Impact Assessment of KMT’s Dairy and Water Sector] capacity by local distributors Dairy-Commercial Hay Production Level Results as in the results chain Impact Target Group Change Same as the intervention above Other farmers increase use of quality assured fodder, both during No. of non-target farmers accessing quality the dry and rainy seasons assured fodder, both during the dry and rainy seasons Farmers increase use of quality assured fodder, both during the Proportion of farmers claiming to purchase dry and rainy seasons and use "very good" quality hay. % of farmers who "strongly agree" on the satisfaction of price, quality and availability of hay; including future investments in hay. No. of farmers accessing quality assured fodder, both during the dry and rainy seasons Other CHPs sell more affordable and high quality fodder No. of non-target farmers selling more affordable and high quality fodder Other CHPs invest in soil testing No. of Other CHPs investing in soil testing Market systems change Indicators CHPs investing in soil testing No. of CHPs investing in soil testing Other CHPs increase distribution and customer service to farmers No. of non-target CHPs with supply arrangements with DHs No. off CHPs with increased sales CHPs improve distribution and customer service to farmers Other CHPs invest in co-branding of fodder CHPs invest in co-branding of fodder CHPs access to working capital, asset-financing and/or equity No. of non-target CHPs investing in cobranding No. of CHPs investing with labs in cobranding. Amount invested by CHPs and labs in cobranding. No. of CHPs who renew or extend their contracts with labs for co-branding. No. of CHPs accessing working capital/assess financing and/or equity. Amount accessed by CHPs in working capital/asset financing and/or equity Page |14