Ch5MF

advertisement

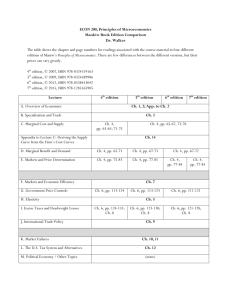

Chapter 5 Currency Derivatives Cost and Management International Accounting: FinancialAn Management, Introduction, 2nd7th edition edition Jeff Colin Madura Drury and Roland Fox ISBN 978-1-40803-213-9 ISBN 978-1-4080-3229-9 © 2011©Cengage 2011 Cengage Learning Learning EMEAEMEA Foreign Currency Derivatives • Financial management of the MNE in the 21st century involves financial derivatives. • These derivatives, so named because their values are derived from underlying assets, are a powerful tool used in business today. • These instruments can be used for two very distinct management objectives: – Speculation – use of derivative instruments to take a position in the expectation of a profit – Hedging – use of derivative instruments to reduce the risks associated with the everyday management of corporate cash flow Cost and Management Accounting: An Introduction, 7th edition Colin Drury ISBN 978-1-40803-213-9 © 2011 Cengage Learning EMEA Foreign Currency Derivatives • In this chapter, we will look at the following important instruments – Forwards – Futures – Swaps – Currency options Cost and Management Accounting: An Introduction, 7th edition Colin Drury ISBN 978-1-40803-213-9 © 2011 Cengage Learning EMEA Forward Market (1) • A forward contract is an agreement between a firm and a commercial bank to exchange a specified amount of a currency at a specified exchange rate (called the forward rate) on a specified date in the future. Cost and Management International Accounting: FinancialAn Management, Introduction, 2nd7th edition edition Jeff Colin Madura Drury and Roland Fox ISBN 978-1-40803-213-9 ISBN 978-1-4080-3229-9 © 2011©Cengage 2011 Cengage Learning Learning EMEAEMEA Forward Market • A forward contract is an agreement between a firm and an intermediary to exchange a specified amount of a currency at a specified exchange rate (called the forward rate) on a specified date in the future. • Let us assume that a UK company has a 6 month dollar receivable it wants to hedge. This raises the question of the price at which the intermediary should agree to buy the dollars and sell the customer sterling. The answer is based on the intermediary’s ability to hedge its exposure, a theory of forward pricing often referred to as the cost of carry model Cost and Management Accounting: An Introduction, 7th edition Colin Drury ISBN 978-1-40803-213-9 © 2011 Cengage Learning EMEA Forward Market • Let us assume at the $/£ spot rate is 1.5 and that the 6 m interest rate (per annum) for £ and $ is 10 % and 6 % resp. • In order to eliminate its risk, the intermediary will need to undertake the following: – – – – borrow US dollars today; exchange these into sterling at the current spot rate; deposit these for six months in sterling At the maturity of the forward contract the customer will pay the bank US dollars, which can be used to repay the initial dollar loan and the maturing sterling deposit is used to pay the customer the contracted sterling amount Cost and Management Accounting: An Introduction, 7th edition Colin Drury ISBN 978-1-40803-213-9 © 2011 Cengage Learning EMEA Forward Market • Assume the contract is for $ 1 000 000 – The bank will borrow 1 000 000/(1 + 0,06/2) = 970 874. This amounts to 970 874/1,5 = £ 647 249 – Future value of £ deposit 647 249 * (1+ 0,10/2) = 679 612 – Forward exchange rate 1 000 000/679 612 = $1.4714/£ (1 home interest) t Ft S0 (1 foreign interest) t 1 0, 06 / 2 Ft 1.5 1.4714 1 0,10 / 2 Cost and Management Accounting: An Introduction, 7th edition Colin Drury ISBN 978-1-40803-213-9 © 2011 Cengage Learning EMEA Forward Market • We saw that the forward rate is different from the spot rate, and this is normally the case. The % by which the forward rate (F ) differs from the spot rate (S ) is labelled p and is called the forward premium if p > 0 or discount if p < 0 and is normally expressed on an annual basis F S 360 S n 1.4714 1.500 360 p 0.0381 or 0.0191 non annualised 1.500 180 F S (1 p) i.e. F 1.5000 (1 0.0191) 1.4714 p Cost and Management Accounting: An Introduction, 7th edition Colin Drury ISBN 978-1-40803-213-9 © 2011 Cengage Learning EMEA Forward Market Janury 14 2013 Cost and Management Accounting: An Introduction, 7th edition Colin Drury ISBN 978-1-40803-213-9 © 2011 Cengage Learning EMEA Foreign Currency Futures • A foreign currency futures contract is an alternative to a forward contract that calls for future delivery of a standard amount of foreign exchange at a fixed time, place and price. • It is similar to futures contracts that exist for commodities such as cattle, lumber, interestbearing deposits, gold, the weather etc. • Futures more or less eliminate credit risk as a clearing house is the contract party Cost and Management Accounting: An Introduction, 7th edition Colin Drury ISBN 978-1-40803-213-9 © 2011 Cengage Learning EMEA Foreign Currency Futures • Foreign currency futures contracts differ from forward contracts in a number of important ways: – Futures are standardized in terms of size while forwards can be customized – Futures have fixed maturities while forwards can have any maturity (both typically have maturities of one year or less) – Trading on futures occurs on organized exchanges while forwards are traded between individuals and banks – Futures have an initial margin that is market to market on a daily basis while only a bank relationship is needed for a forward – Futures are rarely delivered upon (settled) while forwards are normally delivered upon (settled) Cost and Management Accounting: An Introduction, 7th edition Colin Drury ISBN 978-1-40803-213-9 © 2011 Cengage Learning EMEA Currency futures 14 January 2013 http://markets.ft.com/RESEARCH/markets/DataArchiveFetchReport?Category=CU&Type=CFUT&Date=01/14/2013 Cost and Management Accounting: An Introduction, 7th edition Colin Drury ISBN 978-1-40803-213-9 © 2011 Cengage Learning EMEA Currency Futures Market • Speculators often sell currency futures when they expect the underlying currency to depreciate, and vice versa. April 4 June 17 1. Contract to sell 500,000 pesos @ £.056/peso (£28,000) on June 17. 2. Buy 500,000 pesos @ £.050/peso (£25,000) from the spot market. 3. Sell the pesos to fulfill contract. Gain £3,000. Cost and Management International Accounting: FinancialAn Management, Introduction, 2nd7th edition edition Jeff Colin Madura Drury and Roland Fox ISBN 978-1-40803-213-9 ISBN 978-1-4080-3229-9 © 2011©Cengage 2011 Cengage Learning Learning EMEAEMEA Currency Futures Market • MNCs may purchase currency futures to hedge their foreign currency payables, or sell currency futures to hedge their receivables. April 4 June 17 1. Expect to receive 500,000 pesos. Contract to sell 500,000 pesos @ £.056/peso on June 17. 2. Receive 500,000 pesos as expected. 3. Sell the pesos at the locked-in rate. Cost and Management International Accounting: FinancialAn Management, Introduction, 2nd7th edition edition Jeff Colin Madura Drury and Roland Fox ISBN 978-1-40803-213-9 ISBN 978-1-4080-3229-9 © 2011©Cengage 2011 Cengage Learning Learning EMEAEMEA Daily Resettlement: An Example • Consider a long position in the CME Euro/U.S. Dollar contract. • It is written on €125,000 and quoted in $ per €. • The strike price is $1.30 the maturity is 3 months. • At initiation of the contract, the long posts an initial performance bond of $6,500. • The maintenance performance bond is $4,000. Cost and Management Accounting: An Introduction, 7th edition Colin Drury ISBN 978-1-40803-213-9 © 2011 Cengage Learning EMEA Daily Resettlement: An Example • An investor with a long position gains from increases in the price of the underlying asset. • Our investor has agreed to BUY €125,000 at $1.30 per euro in three months time. • With a forward contract, at the end of three months, if the euro was worth $1.24, he would lose $7,500 = ($1.24 – $1.30) × 125,000. • If instead at maturity the euro was worth $1.35, the counterparty to his forward contract would pay him $6,250 = ($1.35 – $1.30) × 125,000. Cost and Management Accounting: An Introduction, 7th edition Colin Drury ISBN 978-1-40803-213-9 © 2011 Cengage Learning EMEA Daily Resettlement: An Example • With futures, we have daily resettlement of gains an losses rather than one big settlement at maturity. • Every trading day: – if the price goes down, the long pays the short – if the price goes up, the short pays the long • After the daily resettlement, each party has a new contract at the new price with one-day-shorter maturity. Cost and Management Accounting: An Introduction, 7th edition Colin Drury ISBN 978-1-40803-213-9 © 2011 Cengage Learning EMEA Performance Bond Money • Each day’s losses are subtracted from the investor’s account. • Each day’s gains are added to the account. • In this example, at initiation the long posts an initial performance bond of $6,500. • The maintenance level is $4,000. – If this investor loses more than $2,500 he has a decision to make: he can maintain his long position only by adding more funds—if he fails to do so, his position will be closed out with an offsetting short position. Cost and Management Accounting: An Introduction, 7th edition Colin Drury ISBN 978-1-40803-213-9 © 2011 Cengage Learning EMEA Daily Resettlement: An Example • Over the first 3 days, the euro strengthens then depreciates in dollar terms: Settle Gain/Loss Account Balance $7,750 = ($1.31 – $1.30)×125,000 = $6,500 + $1,250 $1.31 $1,250 $1.30 –$1,250 $6,500 $1.27 –$3,750 $2,750 + $3,750 = $6,500 On third day suppose our investor keeps his long position open by posting an additional $3,750. Cost and Management Accounting: An Introduction, 7th edition Colin Drury ISBN 978-1-40803-213-9 © 2011 Cengage Learning EMEA Daily Resettlement: An Example • Over the next 2 days, the long keeps losing money and closes out his position at the end of day five. Settle Gain/Loss Account Balance $1.31 $1,250 $7,750 $1.30 –$1,250 $1.27 –$3,750 $1.26 –$1,250 $5,250 $1.24 –$2,500 $2,750 $6,500 $2,750 + $3,750 = $6,500 Cost and Management Accounting: An Introduction, 7th edition Colin Drury ISBN 978-1-40803-213-9 © 2011 Cengage Learning EMEA = $6,500 – $1,250 Toting Up • At the end of his adventures, our investor has three ways of computing his gains and losses: – Sum of daily gains and losses – $7,500 = $1,250 – $1,250 – $3,750 – $1,250 – $2,500 – Contract size times the difference between initial contract price and last settlement price. – $7,500 = ($1.24/€ – $1.30/€) × €125,000 – Ending balance on account minus beginning balance on account, adjusted for deposits or withdrawals. – $7,500 = $2,750 – ($6,500 + $3,750) Cost and Management Accounting: An Introduction, 7th edition Colin Drury ISBN 978-1-40803-213-9 © 2011 Cengage Learning EMEA Daily Resettlement: An Example Settle $1.30 Gain/Loss –$– Account Balance $6,500 $1.31 $1,250 $7,750 $1.30 –$1,250 $6,500 $1.27 –$3,750 $1.26 –$1,250 $5,250 $1.24 –$2,500 $2,750 Total loss = – $7,500 $2,750 + $3,750 = ($1.24 – $1.30) × 125,000 = $2,750 – ($6,500 + $3,750) Cost and Management Accounting: An Introduction, 7th edition Colin Drury ISBN 978-1-40803-213-9 © 2011 Cengage Learning EMEA Currency swaps • Swaps came to public knowledge in the early 1980s and is the newest member of the derivative product set • Widely used swaps are interest rate swaps and currency swaps • A currency swap involves the exchange of principal and interest in one currency for the same in another currency Cost and Management Accounting: An Introduction, 7th edition Colin Drury ISBN 978-1-40803-213-9 © 2011 Cengage Learning EMEA The first swap Cost and Management Accounting: An Introduction, 7th edition Colin Drury ISBN 978-1-40803-213-9 © 2011 Cengage Learning EMEA Interest rates and comparative advantage • AAACorp wants a floating interest rate • BBBCorp wants a fixed interest rate Fixed Floating AAACorp 4.0% 6-month LIBOR + 0.30% BBBCorp 5.2% 6-month LIBOR + 1.0% Cost and Management Accounting: An Introduction, 7th edition Colin Drury ISBN 978-1-40803-213-9 © 2011 Cengage Learning EMEA Comparative advantage • AAA can borrow at better terms in both markets since it is more creditworthy – 1.2 % lower in the market for fixed interest rates – 0.7 % lower in the market for floating interest rates – AAAs advantage is the highest in the market for fixed interest rates, hence AAA should borrow there according to comparative advantage – BBBs disadvantage is lowest in the market for floating interest rates, and it borrows floating – Both can gain by exploiting comparative advantage Cost and Management Accounting: An Introduction, 7th edition Colin Drury ISBN 978-1-40803-213-9 © 2011 Cengage Learning EMEA A good deal for both • AAA borrows fixed at 4 %, BBB floating at LIBOR + 1 %, men this is not the kind of finance the companies prefer – AAA agrees to pay BBB LIBOR – BBB agrees to pay AAA 3.95 % fixed – Interest rate for AAA is 4 % - 3.95 % + LIBOR = LIBOR + 0.05 % (0.25 % lower than what they could have obtained on their own) – Interest rate fo BBB now is LIBOR + 1 % - LIBOR + 3.95 % = 4.95 % (0.25 % lower) Cost and Management Accounting: An Introduction, 7th edition Colin Drury ISBN 978-1-40803-213-9 © 2011 Cengage Learning EMEA Currency swap - example • DuPont, the US chemicals company, needs to raise sterling for its UK operations. At the same time ICI, the British chemicals company, needs US dollars for its North American operations. They agree to swap (that is, exchange) sterling for dollars for, say, five years. The terms are that ICI pays the five year US$ rate of 5 per cent on the US dollar amount of US$15 million and DuPont the five year sterling rate at 6 per cent on £10 million. Payments are usually made on a net basis (that is, the differences). The effective exchange rate is therefore US$1.50 = £1. At the end of the transaction, the principal amounts are reexchanged by both parties (at the contracted rate). Cost and Management Accounting: An Introduction, 7th edition Colin Drury ISBN 978-1-40803-213-9 © 2011 Cengage Learning EMEA Du Pont – ICI swap Cost and Management Accounting: An Introduction, 7th edition Colin Drury ISBN 978-1-40803-213-9 © 2011 Cengage Learning EMEA Cash flow from ICI`s perspective Amount USD Amount GBP Exchange rate Interest USD Interest GBP Time 0 1 2 3 4 5 15 000 000 10 000 000 1,5 5% 6% USD 15 000 000 -750 000 -750 000 -750 000 -750 000 -15 750 000 GBP -10 000 000 600 000 600 000 600 000 600 000 10 600 000 Cost and Management Accounting: An Introduction, 7th edition Colin Drury ISBN 978-1-40803-213-9 © 2011 Cengage Learning EMEA Currency swaps • At initiation, the present value of the swap is 0 for both parties • Once the swap is active it may move away from the original valuation conditions. This means the swap will have a value to one party and be a liability to the other • Assume that after 2 years, the USD interest rate fall to 4.5% and the GBP interest rate increase to 7 %. Moreover, the spot rate changes to $1.45/£. • Is the swap an asset or a liability for ICI? Cost and Management Accounting: An Introduction, 7th edition Colin Drury ISBN 978-1-40803-213-9 © 2011 Cengage Learning EMEA Conditions change Remaining cash flows Time 0 1 2 3 4 5 USD 15 000 000 -750 000 -750 000 -750 000 -750 000 -15 750 000 GBP -10 000 000 600 000 600 000 600 000 -750 000 600 000 -750 000 10 600 000 -15 750 000 600 000 600 000 10 600 000 Present value -717 703 -686 797 -13 801 672 -15 206 172 at 1,45 560 748 524 063 8 652 757 9 737 568 -10 487 015 -749 447 ICI may now have incentive to walk away from the deal. Credit risk increases over time. Cost and Management Accounting: An Introduction, 7th edition Colin Drury ISBN 978-1-40803-213-9 © 2011 Cengage Learning EMEA Currency Options Market • Currency options provide the right to purchase or sell currencies at specified prices. They are classified as calls or puts. • Standardized options are traded on exchanges through brokers. • Customized options offered by brokerage firms and commercial banks are traded in the over-the-counter market. Cost and Management International Accounting: FinancialAn Management, Introduction, 2nd7th edition edition Jeff Colin Madura Drury and Roland Fox ISBN 978-1-40803-213-9 ISBN 978-1-4080-3229-9 © 2011©Cengage 2011 Cengage Learning Learning EMEAEMEA Foreign Currency Options • An American option gives the buyer the right to exercise the option at any time between the date of writing and the expiration or maturity date. • A European option can be exercised only on its expiration date, not before. • Options are traded on exchanges as well as OTC Cost and Management Accounting: An Introduction, 7th edition Colin Drury ISBN 978-1-40803-213-9 © 2011 Cengage Learning EMEA Currency Call Options • A currency call option grants the holder the right to buy a specific currency at a specific price (called the exercise or strike price) within a specific period of time. • A call option is – in the money if exchange rate > strike price – at the money if exchange rate = strike price – out of the money if exchange rate < strike price. Cost and Management International Accounting: FinancialAn Management, Introduction, 2nd7th edition edition Jeff Colin Madura Drury and Roland Fox ISBN 978-1-40803-213-9 ISBN 978-1-4080-3229-9 © 2011©Cengage 2011 Cengage Learning Learning EMEAEMEA Currency Call Options • Speculators may purchase call options on a currency that they expect to appreciate. – Profit = selling (spot) price – option premium – buying (strike) price – At breakeven, profit = 0 • They may also sell (write) call options on a currency that they expect to depreciate. – Profit = option premium – buying (spot) price + selling (strike) price Cost and Management International Accounting: FinancialAn Management, Introduction, 2nd7th edition edition Jeff Colin Madura Drury and Roland Fox ISBN 978-1-40803-213-9 ISBN 978-1-4080-3229-9 © 2011©Cengage 2011 Cengage Learning Learning EMEAEMEA Currency Put Options • A currency put option grants the holder the right to sell a specific currency at a specific price (the strike price) within a specific period of time. • A put option is – in the money if exchange rate < strike price – at the money if exchange rate = strike price – out of the money if exchange rate > strike price. Cost and Management International Accounting: FinancialAn Management, Introduction, 2nd7th edition edition Jeff Colin Madura Drury and Roland Fox ISBN 978-1-40803-213-9 ISBN 978-1-4080-3229-9 © 2011©Cengage 2011 Cengage Learning Learning EMEAEMEA Currency Put Options • Speculators may purchase put options on a currency that they expect to depreciate. – Profit = selling (strike) price – buying price – option premium • They may also sell (write) put options on a currency that they expect to appreciate. – Profit = option premium + selling price – buying (strike) price Cost and Management International Accounting: FinancialAn Management, Introduction, 2nd7th edition edition Jeff Colin Madura Drury and Roland Fox ISBN 978-1-40803-213-9 ISBN 978-1-4080-3229-9 © 2011©Cengage 2011 Cengage Learning Learning EMEAEMEA Currency Put Options • One possible speculative strategy for volatile currencies is to purchase both a put option and a call option at the same exercise price. This is called a straddle. • By purchasing both options, the speculator may gain if the currency moves substantially in either direction, or if it moves in one direction followed by the other. Cost and Management International Accounting: FinancialAn Management, Introduction, 2nd7th edition edition Jeff Colin Madura Drury and Roland Fox ISBN 978-1-40803-213-9 ISBN 978-1-4080-3229-9 © 2011©Cengage 2011 Cengage Learning Learning EMEAEMEA Efficiency of Currency Futures and Options • If foreign exchange markets are efficient, speculation in the currency futures and options markets should not consistently generate abnormally large profits. Cost and Management International Accounting: FinancialAn Management, Introduction, 2nd7th edition edition Jeff Colin Madura Drury and Roland Fox ISBN 978-1-40803-213-9 ISBN 978-1-4080-3229-9 © 2011©Cengage 2011 Cengage Learning Learning EMEAEMEA Contingency Graphs for Currency Options For Buyer of £ Call Option Strike price = £1.50 Premium For Seller of £ Call Option Strike price Premium = £ .02 Net Profit per Unit Net Profit per Unit +$.04 +£.04 +$.02 +£.02 0 0 $1.46 $1.50 $1.54 – $.02 – $.04 = £1.50 = £ .02 Futur e Spot Rate Future Spot Rate £1.46 – £.02 – £.04 Cost and Management International Accounting: FinancialAn Management, Introduction, 2nd7th edition edition Jeff Colin Madura Drury and Roland Fox ISBN 978-1-40803-213-9 ISBN 978-1-4080-3229-9 © 2011©Cengage 2011 Cengage Learning Learning EMEAEMEA £1.50 £1.54 Contingency Graphs for Currency Options For Buyer of $ Put Option Strike price Premium For Seller of $ Put Option = £1.50 = £ .03 Strike price Premium Net Profit per Unit Net Profit per Unit +£.04 +£.04 +£.02 Future Spot Rate = £1.50 = £ .03 +£.02 0 0 £0.58 £0.60 £0.62 £0.58 – £.02 – £.02 – £.04 – £.04 Cost and Management International Accounting: FinancialAn Management, Introduction, 2nd7th edition edition Jeff Colin Madura Drury and Roland Fox ISBN 978-1-40803-213-9 ISBN 978-1-4080-3229-9 © 2011©Cengage 2011 Cengage Learning Learning EMEAEMEA £0.60 £0.62 Future Spot Rate Example – page 164 • Jim is a speculator who buys a € call option from Linda with a strike price of £0.700 and a December settlement date. The current spot rate is about £0.682 and Jim pays a premium of £.005 per unit for the call option. Just before expiration, the spot rate reaches £0.724 • What is the profit? One contract equals € 150 000 Cost and Management Accounting: An Introduction, 7th edition Colin Drury ISBN 978-1-40803-213-9 © 2011 Cengage Learning EMEA Profit and loss Jim Selling price of € Purchase price of € Premium paid for option Net profit Linda Selling price of € Purchase price of € Premium received Net profit Per unit Per contract 0,724 108 600 0,700 105 000 0,005 750 2 850 0,700 0,724 0,005 Cost and Management Accounting: An Introduction, 7th edition Colin Drury ISBN 978-1-40803-213-9 © 2011 Cengage Learning EMEA 105 000 108 600 750 -2 850 Basic Option Pricing Relationships at Expiry • At expiry, an American call option is worth the same as a European option with the same characteristics. • If the call is in-the-money, it is worth ST – X, where ST is the spot rate at time T and X the exercise rate. • If the call is out-of-the-money, it is worthless. CaT = CeT = Max[ST - X, 0] Cost and Management Accounting: An Introduction, 7th edition Colin Drury ISBN 978-1-40803-213-9 © 2011 Cengage Learning EMEA Basic Option Pricing Relationships at Expiry • At expiry, an American put option is worth the same as a European option with the same characteristics. • If the put is in-the-money, it is worth X - ST. • If the put is out-of-the-money, it is worthless. PaT = PeT = Max[X - ST, 0] Cost and Management Accounting: An Introduction, 7th edition Colin Drury ISBN 978-1-40803-213-9 © 2011 Cengage Learning EMEA American Option Pricing Relationships • With an American option, you can do everything that you can do with a European option AND you can exercise prior to expiry—this option to exercise early has value, thus: CaT > CeT = Max[ST - X, 0] PaT > PeT = Max[X - ST, 0] Cost and Management Accounting: An Introduction, 7th edition Colin Drury ISBN 978-1-40803-213-9 © 2011 Cengage Learning EMEA Option Pricing and Valuation • The pricing of any currency option combines six elements: – Present spot rate – Exercise price – Time to maturity – Home currency interest rate – Foreign currency interest rate – Volatility (standard deviation of daily spot price movements) Cost and Management Accounting: An Introduction, 7th edition Colin Drury ISBN 978-1-40803-213-9 © 2011 Cengage Learning EMEA How can volatility be measured? • There are three ways of determining a value for volatility: the historical approach, the implied volatility approach and the forecast volatility method. – The historical way involves calculating the volatility based on a series of historical price data – The implied volatility is obtained by backing out of the pricing formula. The other variables can be observed – the only unknown is the volatility – so it can be implied from the values of the other variables. – Forecast volatility is derived by means of an estimating technique, typically a time series method, that aims to predict what volatility will be over the option period. Cost and Management Accounting: An Introduction, 7th edition Colin Drury ISBN 978-1-40803-213-9 © 2011 Cengage Learning EMEA Option Pricing and Valuation • The total value (premium) of an option is equal to the intrinsic value plus time value. • Intrinsic value is the financial gain if the option is exercised immediately. – For a call option, intrinsic value is zero when the strike price is above the market price – When the spot price rises above the strike price, the intrinsic value become positive – Put options behave in the opposite manner – On the date of maturity, an option will have a value equal to its intrinsic value (zero time remaining means zero time value) • The time value of an option exists because the price of the underlying currency, the spot rate, can potentially move further and further into the money between the present time and the option’s expiration date. Cost and Management Accounting: An Introduction, 7th edition Colin Drury ISBN 978-1-40803-213-9 © 2011 Cengage Learning EMEA Options Contracts: Preliminaries • Intrinsic Value – The difference between the exercise price of the option and the spot price of the underlying asset. • Time Value – The difference between the option premium and the intrinsic value of the option. Option Premium = Intrinsic Value + Cost and Management Accounting: An Introduction, 7th edition Colin Drury ISBN 978-1-40803-213-9 © 2011 Cengage Learning EMEA Time Value Market Value, Time Value and Intrinsic Value for an American Call Profit The red line shows the payoff at maturity, not profit, of a call option. Note that even an out-of-the-money option has value— time value. Long 1 call Intrinsic ST value Time value Out-of-theIn-the-money money loss X 7 edition Cost and Management Accounting: An Introduction, th Colin Drury ISBN 978-1-40803-213-9 © 2011 Cengage Learning EMEA Currency Option Pricing Sensitivity • If currency options are to be used effectively, either for the purposes of speculation or risk management, the individual trader needs to know how option values – premiums – react to their various components. • We only need to know the signs – calculating the values (option greeks) is not covered in this course Cost and Management Accounting: An Introduction, 7th edition Colin Drury ISBN 978-1-40803-213-9 © 2011 Cengage Learning EMEA Option Value Determinants Exchange rate Exercise price Interest rate home currency Interest rate in other country Variability in exchange rate Expiration date Call + + + + Cost and Management Accounting: An Introduction, 7th edition Colin Drury ISBN 978-1-40803-213-9 © 2011 Cengage Learning EMEA Put + + + + Option pricing • The Black-Scholes option-pricing model applied to currencies often goes by the name of the Garman -Kohlhagen model as these authors were the first to publish a closed form model – This model alleviates the restrictive assumption used in the Black Scholes model that borrowing and lending is performed at the same risk free rate. – In the foreign exchange market there is no reason that the risk free rate should be identical in each country – The risk free foreign interest rate in this case can be thought of as a continuous dividend yield being paid on the foreign currency Cost and Management Accounting: An Introduction, 7th edition Colin Drury ISBN 978-1-40803-213-9 © 2011 Cengage Learning EMEA Garman - Kohlhagen • Model assumptions include: – – – – – the option can only be exercised on the expiry date (European style); there are no taxes, margins or transaction costs; the risk free interest rates (domestic and foreign) are constant; the price volatility of the underlying instrument is constant; and the price movements of the underlying instrument follow a lognormal distribution. Cost and Management Accounting: An Introduction, 7th edition Colin Drury ISBN 978-1-40803-213-9 © 2011 Cengage Learning EMEA Garman - Kohlhagen Calls: C S e r *T Puts: P X e rT N(d1 ) X e rT N(d 2 ) N(d 2 ) S e r *T where ln(S / X) (r r / 2) T d1 T * 2 d 2 d1 T Cost and Management Accounting: An Introduction, 7th edition Colin Drury ISBN 978-1-40803-213-9 © 2011 Cengage Learning EMEA N(d1 ) Garman - Kohlhagen • Suppose we have – Spot exchange rate S = $1,49/€ – Exercise rate X = $1,45/€ – Standard deviation σ = 20 % – Dollar interest rate r = 5 % – Euro denominated interest rate r* = 3,7 % – Time to expiration: 365 days (T = 1) Cost and Management Accounting: An Introduction, 7th edition Colin Drury ISBN 978-1-40803-213-9 © 2011 Cengage Learning EMEA Garman - Kohlhagen Spot rate Exercise rate Risk free foreign Risk free domestic Volatility (SD) E Time to expiration Time to expiration d1 d2 N(d1) N(d2) N(-d1) N(-d2) Call option value Put option value S X r* r σ days T 1,4900 1,4500 3,70 % 5,00 % 20,00 % 2,718282 365 1,000 0,301063 0,101063 0,618317 0,540250 0,381683 0,459750 0,1427 0,0861 Cost and Management Accounting: An Introduction, 7th edition Colin Drury ISBN 978-1-40803-213-9 © 2011 Cengage Learning EMEA Currency option combinations • For various reasons, hedgers or speculators may own combinations of options • Two of the most popular combinations are: – Straddles (long stradde involves buying both call and put, and short straddle involves selling both call and put), exercise prices are identical in both cases – Strangles are almost identical to straddles, but exercise prices are different Cost and Management Accounting: An Introduction, 7th edition Colin Drury ISBN 978-1-40803-213-9 © 2011 Cengage Learning EMEA Long straddle Call option premium on dollar Put option premium on dollar Strike price Option contract in dollar 0,03 0,02 0,60 50 000 Own a call Own a put Net 0,50 -0,03 0,08 0,05 0,55 -0,03 0,03 0 0,60 -0,03 -0,02 -0,05 0,65 0,02 -0,02 0 When do you make money? What is the most you can lose? Cost and Management Accounting: An Introduction, 7th edition Colin Drury ISBN 978-1-40803-213-9 © 2011 Cengage Learning EMEA 0,70 0,07 -0,02 0,05 0,75 0,12 -0,02 0,10 Short straddle Call option premium on dollar Put option premium on dollar Strike price Option contract in dollar 0,03 0,02 0,60 50 000 Sell a call Sell a put Net 0,50 0,03 -0,08 -0,05 0,55 0,03 -0,03 0,00 0,60 0,03 0,02 0,05 0,65 -0,02 0,02 0,00 When do you make money? What is the most you can lose? Cost and Management Accounting: An Introduction, 7th edition Colin Drury ISBN 978-1-40803-213-9 © 2011 Cengage Learning EMEA 0,70 -0,07 0,02 -0,05 0,75 -0,12 0,02 -0,10 Long currency strangle • • • • • • Call option premium on $ Put option premium on $ Call option strike price Put option strike price One option contract What is the profit or loss? = £ 0.015 = £ 0.025 = £ 0.625/$ = £ 0,575/$ = A$ 50 000 Cost and Management Accounting: An Introduction, 7th edition Colin Drury ISBN 978-1-40803-213-9 © 2011 Cengage Learning EMEA Long currency strangle Call option premium on dollar Put option premium on dollar Call option strike price Put option strike price Option contract in dollar Own a call Own a put Net 0,015 0,025 0,625 0,575 50 000 0,525 -0,015 0,025 0,01 0,575 -0,015 -0,025 -0,04 Cost and Management Accounting: An Introduction, 7th edition Colin Drury ISBN 978-1-40803-213-9 © 2011 Cengage Learning EMEA 0,625 -0,015 -0,025 -0,04 0,675 0,035 -0,025 0,01 Currency spreads • A spread involves buying and writing options for the same underlying currency – Bull spread involves buying a call and at the same time selling a call with a higher exercise price. There will be a gain if the underlying currency appreciates somewhat – A bull spread can also be constructed using puts – A bear spread takes the opposite position, and there will be a gain if the underlying currency depreciates somewhat Cost and Management Accounting: An Introduction, 7th edition Colin Drury ISBN 978-1-40803-213-9 © 2011 Cengage Learning EMEA Currency bull spread • Two call options on A$ are available. One has a strike of £0,41 and a premium of £0,01. The next has a strike of £0,42 and premium of £0,005. One contract is A$ 50 000 • What is the profit or loss if the A$ is either £0,40 or £0,44 at expiry, and you have bought the 0,41 call and sold (written) the 0,42 call? Cost and Management Accounting: An Introduction, 7th edition Colin Drury ISBN 978-1-40803-213-9 © 2011 Cengage Learning EMEA Currency bull spread Call option A exercise Premium call A Call option B exercise Premium call B Option contract in A$ Buy option A Sell option B Net 0,41 0,010 0,42 0,005 50 000 0,400 -0,010 0,005 -0,005 0,410 -0,010 0,005 -0,005 0,415 -0,005 0,005 0 0,420 0,000 0,005 0,005 Cost and Management Accounting: An Introduction, 7th edition Colin Drury ISBN 978-1-40803-213-9 © 2011 Cengage Learning EMEA 0,430 0,010 -0,005 0,005 0,440 0,020 -0,015 0,005