i. best judgment assessment

advertisement

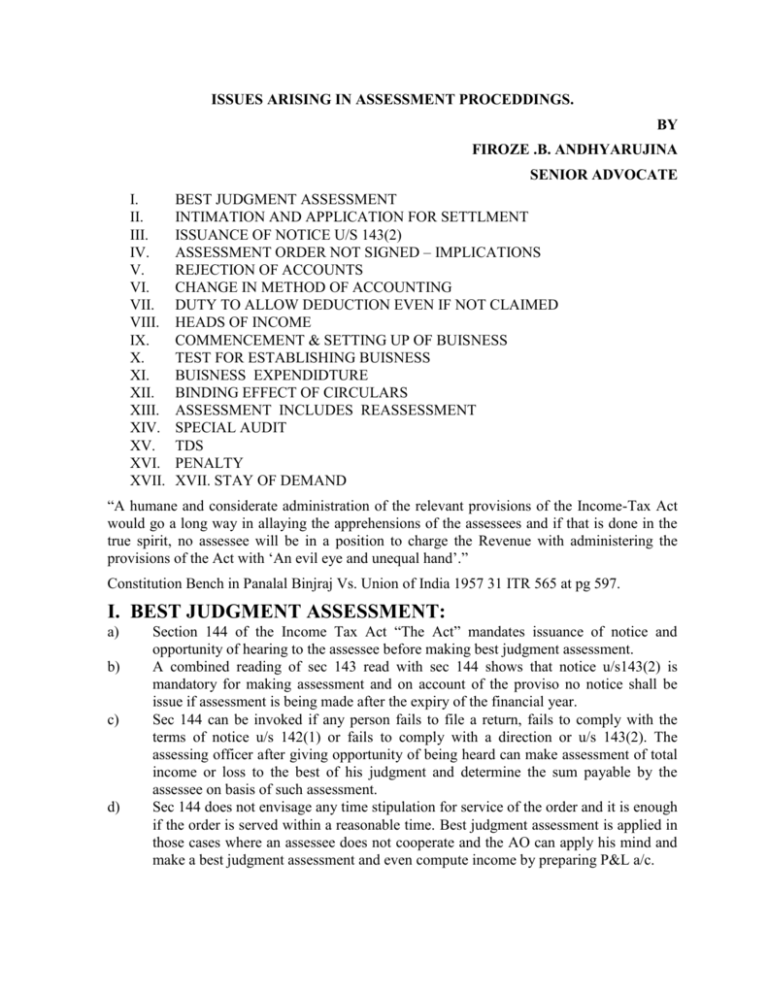

ISSUES ARISING IN ASSESSMENT PROCEDDINGS. BY FIROZE .B. ANDHYARUJINA SENIOR ADVOCATE I. II. III. IV. V. VI. VII. VIII. IX. X. XI. XII. XIII. XIV. XV. XVI. XVII. BEST JUDGMENT ASSESSMENT INTIMATION AND APPLICATION FOR SETTLMENT ISSUANCE OF NOTICE U/S 143(2) ASSESSMENT ORDER NOT SIGNED – IMPLICATIONS REJECTION OF ACCOUNTS CHANGE IN METHOD OF ACCOUNTING DUTY TO ALLOW DEDUCTION EVEN IF NOT CLAIMED HEADS OF INCOME COMMENCEMENT & SETTING UP OF BUISNESS TEST FOR ESTABLISHING BUISNESS BUISNESS EXPENDIDTURE BINDING EFFECT OF CIRCULARS ASSESSMENT INCLUDES REASSESSMENT SPECIAL AUDIT TDS PENALTY XVII. STAY OF DEMAND “A humane and considerate administration of the relevant provisions of the Income-Tax Act would go a long way in allaying the apprehensions of the assessees and if that is done in the true spirit, no assessee will be in a position to charge the Revenue with administering the provisions of the Act with ‘An evil eye and unequal hand’.” Constitution Bench in Panalal Binjraj Vs. Union of India 1957 31 ITR 565 at pg 597. I. BEST JUDGMENT ASSESSMENT: a) b) c) d) Section 144 of the Income Tax Act “The Act” mandates issuance of notice and opportunity of hearing to the assessee before making best judgment assessment. A combined reading of sec 143 read with sec 144 shows that notice u/s143(2) is mandatory for making assessment and on account of the proviso no notice shall be issue if assessment is being made after the expiry of the financial year. Sec 144 can be invoked if any person fails to file a return, fails to comply with the terms of notice u/s 142(1) or fails to comply with a direction or u/s 143(2). The assessing officer after giving opportunity of being heard can make assessment of total income or loss to the best of his judgment and determine the sum payable by the assessee on basis of such assessment. Sec 144 does not envisage any time stipulation for service of the order and it is enough if the order is served within a reasonable time. Best judgment assessment is applied in those cases where an assessee does not cooperate and the AO can apply his mind and make a best judgment assessment and even compute income by preparing P&L a/c. II. INTIMATION AND APPLICATION FOR SETTLMENT : Attention is drawn to circular no3 of 2008 dated 12 march 2008 – 2008 299 ITR (st.) 8 which specifically states that an intimation u/s 1443(1) is not an assessment order and there is no bar for filing an application before Settlement Commission. The circular provides that it is immaterial whether the time limit for issuing notice u/s 143(2) has expired or not, for the purpose of approaching settlement commission for settlement of case III. ISSUANCE OF NOTICE U/S 143(2): Asstt. CIT v/s. Hotel Blue Moon [(2010) 321 ITR 362 (SC)] CIT v/s. Virendra Kumar Agarwal [I.T.A. No. 2429 of 2009; Order dated: 07.01.2010; Bombay High Court] CIT v/s. Mundra Nanvati [(2009) 227 CTR (Bom) 387] Mangilal Jain v/s. I.T.O. [(2009) 315 ITR 105 (Mad)] CIT v/s. Cebon India Ltd. [(2009) 347 ITR 583 (P&H)] Dy. CIT v/s. Mahi Valley Hotels & Resorts [(2006) 287 ITR 360 (Guj)] CIT v/s. Parikalpana Estate Development P. Ltd. [(2012) 79 DTR (All) 246] CIT v/s. Pawan Gupta [(2008) 304 ITR 177 (Del.)] IN THE CONTEXT OF REASSESSMENT NOTICE U/S. 143 (2) IS MANDATORY ACIT v/s. Geno Pharmaceuticals Ltd. [(2013) 214 Taxman 83 (Bom.)] Notice under S. 143(2) is mandatory and in the absence of such service, the Assessing Officer cannot proceed to make an inquiry on the return filed in compliance with the notice issued under S. 148. Order of Tribunal quashing the reassessment proceedings was held to be valid. (AY. 2005-06, 2006-07) M/s. Hill Glade Co – op. Hsg. Society Ltd. v/s. Dy. CIT [I.T.A. No.: 2013 / M / 2009; Order dated: 05.07.2013; I.T.A.T. ‘H’ Bench, Mumbai] ITO v/s. Smt. Sukhini P. Modi [(2008) 112 ITD 1 (Ahd)] Bhagwat Prasad Verma v/s. ITO [(2006) 7 SOT 256 (Del)] St. Fidelis School v/s. Asstt. CIT [(2006) 152 Taxman 40 (Agra) (Mag)] ACIT v/s. Baikunth Nath Singhal & Ors. [(2004) 1 SOT 296 (Agra)] Raj Kumar Chawla & Ors. v/s. ITO [(2005) 94 ITD 1 (Del) (SB)] Jyoti Pat Ram v/s. ITO [(2005) 92 ITD 423 (Lucknow)] SECTION 292 BB CANNOT COME TO THE RESCUE WHERE 143 (2) NOTICE IS NOT ISSUED SECTION 292 BB APPLIES PROSPCETIVELY FROM A.Y. 2008 – 09 AND WILL NOT APPLY TO A.Y. 2007 – 08 Nawal Kishore & Sons Jewellers v/s. CIT [(2012) 79 DTR (All) 241] Once the notice under section 143 (2) of the Act was not issued, question of service, or improper service is not relevant. Therefore, section 292 BB is not attracted Assessment is to be annulled. Also: (a) CIT vs. Bihari Lal Agrawal [(2012) 346 ITR 67 (All)] (b) Manish Prakash Gupta v/s. CIT [(2012) 68 DTR (All) 112 ACIT v/s. Supreme Appar & Associates [(2009) 30 DTR (Mum) (Trib) 229] A.O. having not issued any notice u/s. 143 (2) of the Act before completing the assessment, assessment was held to be bad in law. Section 292 BB of the Act does not save the same. ITO v. Aligarh Auto Centre [(2013) 83 DTR (Agra) (Trib.) 418] In the absence of notice under section 143 (2) of the Act, the reassessment is not valid. Section 292 BB of the act has been inserted by Finance Act, 2008 w.e.f. 1st April, 2008 prospectively and is not applicable in the A.Y. 2001-2002. It was further held that even otherwise, in the absence of notice; the same was not a curable defect under section 292 BB of the Act and therefore C.I.T. (A) was justified in setting aside the reassessment. (AY.20012002) Also: (a) CIT v/s. Virendra Kumar Agarwal [I.T.X.A. No. 2429 of 2009; Order dated: 07.01.2010; Bombay High Court] (b) CIT v/s. Salman Khan [I.T.X.A. No. 508 of 2011; Order dated: 06.06.2011; Bombay High Court] Ashok B. Bafna v. Dy.CIT [( 2012) 18 ITR 43 (Mum.) (Trib.)] The assessment was completed on the basis that notice issued under section 143 (2) was received back unserved. When penalty proceedings were initiated the assessee challenged the assessment order stating that no notice were served on the assessee under section 143 (2), as the notice issued was not sent to correct address hence returned un-served .The Commissioner (Appeals) dismissed the appeal on the ground that the assessee participated in the proceedings through authorized representative and by virtue of section 292BB , the assessee was precluded from challenging the notice. On appeal Tribunal held that the service of notice at address other than address shown on return , which returned un served held to be not proper service. Provision precluding assessee from taking such objection is not applicable to assessment years prior to 2008-09, hence the assessment order passed by the Assessing Officer under section 143 (2) (ii) was held to be bad in law.( A.Y.2007-08) SECTION 292 BB CANNOT COME TO THE RESCUE WHERE 143 (2) NOTICE IS NOT ISSUED Manish Prakash Gupta v. CIT [(2012) 68 DTR (All) 112] This is a case of search and seizure and block assessment. Notice under section 143 (2) of the Act was not issued. The Allahabad High Court came to the conclusion that section 292 BB of the Act is a rule of evidence, which validates the notice in certain circumstances. Where 143 (2) notice is admittedly not issued the assessing authority does not have jurisdiction to proceed to make the assessment. Section 292 BB will have no effect or application since the very foundation of jurisdiction of the A.O. to issue notice under section 143 (2) of the Act is missing. Nawal Kishore & Sons Jewellers v/s. CIT [(2012) 79 DTR (All) 241] This is a case of search and seizure and block assessment. However, there was absence of notice under section 143 (2) of the Act. The High Court held that once it is admitted that the A.O. has repudiated the return filed by the assessee under section 158 BC of the Act the entire proceedings in the absence of notice under section 143 (2) of the Act subsequent thereto suffer from lack of jurisdiction. When the notice under section 143 (2) was not issued, question of service, or improper service is not relevant and section 292 BB is not attracted. CIT v. Panorama Builders (P.) Ltd. [(2014) 224 Taxman 203 (Guj)] Section 292BB of the Act does not apply to issuance of notice, neither it cures the defect or enlarges statutory period where a mandatory notice under section 143(2) is required to be issued within limitation fixed under the Act. In absence of issuance of the notice under the proviso to section 143(2) within a period of 12 months from the end of the month in which return was furnished by the assessee, the proceedings initiated by the Assessing Officer with regard to block assessment after the period of limitation was barred and the entire proceedings in pursuance of such notice is null and void. Shri Sanjeev R. Arora v Asstt. CIT [I.T.A. No.: 103 / M / 2004; Order dated: 25.07.2012; I.T.A.T. Mumbai ‘G’ Bench] This issue of non issuance of 143 (2) notice would make the entire assessment made under section 158 BC read with section 158 BD of the Act invalid was taken first time as an additional ground before the Mumbai Tribunal for the first time. The additional ground was admitted and the Tribunal held that non issuance of 143 (2) notice is fatal and the entire block assessment is bad in law. In para 6.8 of the order it was held that the irregularity in proper service of notice which can be treated as curable under section 292B of the income tax act is only in the cases where the notice under section 143 (2) was issued properly and within the period of limitation and the assessee did not raise any objection regarding the service of the notice during the assessment proceedings and also participated in the assessment proceedings then at a later stage the assessee is precluded from raising such objection. Therefore, the provisions of section 292B are not applicable in the case where the Assessing Officer has not at all issued notice under section 143 (2) within the period as prescribed. Accordingly, we hold that the block assessment in the case in hand is without jurisdiction and consequently, the same is set aside. The Hon’ble Delhi Tribunal in the case of, ACIT v. Sliverline – [I.T.A. Nos.: 1809 &1504 1506 / M / 2013 and C.O. Nos. 122 & 107 – 108 / Del / 2013; Order dated: 26.09.2014; I.T.A.T. New Delhi ‘G’ Bench] held that the provisions of section 292BB of the Act are not applicable in the case of non-issuance of a notice under section 143(2) of the Act. For this proposition, the Hon’ble Tribunal refer to the following decisions: CIT v. K.M.Ravji - [Tax Appeal No.771/2010 dated 18.7.2011; (Gujarat High Court)] Wherein the Hon’ble High Court has held that, “Section 292 BB does not save non-issuance of Notice before the expiry of limitation period. In our view, section 292 BB can cure only a defect in service, service within time, or improper service of notice. It is not aimed at curing the defect of nonissuance of notice within the statutory period.” CIT v. Panorama Builders Pvt Ltd [Tax Appeal No.435/2011 dated 30.08.2012] Now reported in [(2014) 224 Taxman 203 (Guj)], the Hon’ble Gujarat High Court had, further, emphasised that “Section 292BB of the Act does not apply to issuance of notice, neither it cures the defect or enlarges statutory period where a mandatory notice under section 143(2) of the Act is required to be issued within limitation fixed under Act.” Naval Kishore & Sons Jewellers v. CIT [(2012) 79 DTR 241(All)] “When the notice u/s 143(2) was not issued question of service, or improper service is no relevant. Therefore, Sec. 292BB is not attracted.” CIT v. Parikalpana Estate Development (P) Ltd. [(2012) 79 DTR 246 (All)] In this case also, it has been held that where Asstt. Has been framed without issuance of notice u/s. 143(2), Asstt. is invalid, Sec 292BB is not attracted in such cases. Manish Prakash Gupta v. CIT 68 DTR 112 (All.) CIT v. Mukesh Prakash Agarwal 345 ITR 29 (All.) CIT v. Biharilal Agarwal 346 ITR 67 (All.) In these cases it has been held that Sec. 292BB is a rule of evidence which validates the notice in certain circumstances. In this case, since, no notice u/s. 143(2) was issued, therefore, the AO did not have the jurisdiction to proceed further and make the Asstt. The Hon’ble ITAT of Agra Bench, in the case of, ITO v. Aligarh Auto Centre - [(2013) 152 TTJ (Agra) 767], on an identical issue that of the present issue, has recorded its findings as under: “5. We have considered the rival submissions and the material on record. It is not in dispute that the assessee filed original return of income and at the reassessment proceedings, the assessee contended before the AO that the original return filed earlier may be treated to have been filed in response to the notice u/s. 147, which isalso supported by order sheet entry dated 09.08.2006 (PB-20). It is also not in dispute that AO never issued any notice u/s. 143(2) of the IT Act. The Revenue merely contended that the CIT (A) should have appreciated the provisions of section 292BB of the IT Act. Section 292 BB of the IT Act provides as under: "292BB. Where an assessee has appeared in any proceeding or co-operated in any inquiry relating to an assessment or reassessment, it shall be deemed that any notice under any provision of this Act, which is required to be served upon him, has been duly served upon him in time in accordance with the provisions of this Act and such assessee shall be precluded from taking any objection in any proceeding or inquiry under this Act that the notice was— (a) not served upon him; or (b) not served upon him in time; or (c) served upon him in an improper manner: Provided that nothing contained in this section shall apply where the assessee has raised such objection before the completion of such assessment or reassessment. " The above provision has been inserted by the Finance Act, 2008 w.e.f. 01.04.2008.ITAT, Delhi Special Bench in the case of Kuber Tobacco Product Pvt. Ltd. vs. DCIT, 117 ITD 273 held that section 292BB has been inserted by Finance Act, 2008, has no retrospective effect and is to be construed prospectively. The assessment order under appeal is 2001-02. Therefore, the provision of section 292BB of the IT Act would not apply in the case of the assessee. Further, no notice u/s. 143(2) has been issued or served upon the assessee. Therefore, the decision of Hon’ble Punjab & Haryana High Court in the case of Cebon India Ltd. (supra) squarely applies against the revenue. It was held in this case that absence of notice is not curable defect u/s. 292BB of the IT Act. Considering the above discussion and the case laws cited above, the sole objection of the Revenue is not maintainable. Therefore, the ld. CIT (A) was justified in setting aside the entire assessment order. We, therefore, do not find any infirmity in the order of the ld. CIT (A) for interference.” The Hon’ble Mumbai Bench of the ITAT has, in the case of, Sanjeev R. Arora v. ACIT [IT (SS)A No.103/Mum/2004 dated 25.7.2012], recorded its findings as under: “Even, the irregularity in proper service of notice which can be treated as curable under section 292B of the Income-tax Act is only in the cases where the notice under section 143(2) was issued properly and within the period of limitation and the assessee did not raise any objection regarding the service of the notice during the assessment proceedings and also participated in the assessment proceedings then at a later stage the assessee is precluded from raising such objection. Therefore, the provisions of section 292B are not applicable in the case where the assessing officer has not at all issued notice under section 143 (2) within the period as prescribed.” IV. ASSESSMENT ORDER NOT SIGNED – IMPLICATIONS: Issue for consideration is that the assessment order passed u/s 143(3) is valid order in spite of the same not being signed by the Ao. However the notice of demand, computation formed etc attached along with the assessment order is signed and carries proper stamp and seal of the Ao, even ITNS -150 dispatched along with the assessment order has been signed. Contention is raised that assessment is one integrated process invoking not only the assessment of total income but also determination of tax. That it is the service of demand notice which is crucial, such failure would invalidate proceedings has held in Mohan Wahi vs CIT 248 ITR 799. Per contra it was held in Kilasho Devi Burman vs CIT 219 ITR 214(sc) that if the assessment order on the record of revenue bears no signature the order is not valid. In CWT vs Dhansukhlal Gajab 237 ITR 534 (Guj) It was held that assessment is invalid on the grounds that the Ao had not signed the order. An assessment order has to be signed as mandated in Kalyan Kumar Ray vs. CIT 1991 191 ITR 634. At page 638 of 191 ITR the SC observed that it is the duty of the AO to draw an order assessing the total income and indicating the adjustments so as to compute tax payable. It is only thereafter that computation sheets are signed or initialled. All these decisions emphasise the need there must be something in writing and should be signed by the Ao. In Vijay Corporation vs ITO ITA NO 1511/M/2010 A.Y. 2005-2006 dated 20/01/2012 (ITAT, Mumbai) .It was held that even the provision of sec 292B cannot come to the rescue of revenue. The requirement of signature of the AO is a legal requirement; the omission to sign the order cannot be explained by relying on provision of section 292B. Such an omission cannot be covered under provisions of sec 292B of the IT ACT and hence an unsigned order of assessment cannot be said to be in substance and effect in conformity with or according to the intent and purpose of the IT ACT. V. REJECTION OF ACCOUNTS: “The Income Tax Officer is not bound by any technical rules of the law of evidence. It is open to him to collect materials to facilitate assessment even by private enquiry but if he desires to use the material so collected, the assessee must be informed of the material and must be given an adequate opportunity of explaining it.” C.Vasantlal andCo vs. CIT 1962 45 206 (SC). Entries in books of account are not determinative or conclusive and the matter is to be examined on the touch stone of the provisions contained in the act : Kedernath Jute Manufacturing co. LTD VS. CIT 1971 82 ITR 363(SC) Sutlej cotton mills LTD VS. CIT 1997 116 ITR(1) (SC). Tuticorin Alkali Chemicals VS. CIT 1997 227 ITR 172 (SC). United Comercial Bank VS. CIT (1999) 240 ITR 355(SC). Taparia Tools LTD VS. CIT 2015 372 ITR 605 (SC). IN Ranji Lal and sons vs CST 1982 50 STC 344 (All) It was held that books of accounts of the assessee could not be rejected on the ground of not issuing separate cash memo of petty sales and in issuing consolidated cash memo at the end of the year. It was further held in CST vs Vishnuchandra Vipin 1982 50 STC 345 (All) that failure to issue cash memos by itself was insufficient to reject books of account, where the books were otherwise verifiable. The AO has power to reject books of account u/s 145 (3) by passing an order. Power is given to make addition on the basis of estimation. An estimation which is fairly made is a question of fact as held in Vijay Kumar Talwar Vs CIT 2011 330 ITR 1 (SC) Enhancement of gross profit rate on estimate basis could be made provided the same is reasonable and not on the grounds that the estimate is made because of absence of cash memos or other petty issues. Failure to maintain stock register is not a ground for rejection of accounts in CIT vs superior Crafts 2013 353 ITR 101(Delhi).It was held that where the AO did not disturb or dispute the closing stock of raw materials the books cannot be rejected further the valuation of the closing stock was also not disputed and the same was sold in the next assessment year and the value received was disclosed in the accounts in such circumstances the books of accounts cannot be rejected. In CIT vs. Dolphin Builders 2013 356 ITR 420(MP) It was held that where assessee carried construction business and maintaining audited books of account there is no question of disbelieving them in absence of cogent evidence. It was held when assessee is maintaining account books, vouchers and other documents as required u/s 44AA(2) and got them audited and furnished them along with tax audit report then there is no question of disbelieving them and the rejection of books of accounts in not permissible in absence of any cogent evidence VI. CHANGE IN METHOD OF ACCOUNTING: Change in method of accounting is permissible, however a change which results distorting picture for purposes of taxation cannot be regarded as a valid change and in such circumstances the Ao has power to recomputed the income and even make adjustment in the stock. Issue is whether developmet expenses can be allowed under applicable accounting standards read with sec 145/ 145A and commercial principles. In Rangoli Projects vs. CIT 2014 363 ITR 192 (Delhi) It was held that at the time of assessment it is to be examined whether the expenditure incurred on development of project should be taxed by applying Accounting Standard – AS 7 and if the AS-7 has not been followed, the effect thereof has to be ascertained and considered thus a harmony between AS and sec 145-A is to be examined depending upon the method of accounting regularly followed by the assessee. VII. DUTY TO ALLOW DEDUCTION EVEN IF NOT CLAIMED: “Income Tax department cannot take advantage of the assessee’s mistakes in not claiming exemption in Income –tax return and not deny him expemtion. The entire object of administration of tax is to secure the revenue for the development of the country and not to charge assessee more tax than that which is due and payable by the assessee.” Sanchit Software and Solutions P Ltd vs CIT 2012 349 ITR 404 (Bom). Circular Issued by CBDT dated 11/04/1995 clearly specifies the policy of the department not to deny any legitimate claim even when assessee has failed to claim the same. Where an assessee has made a claim based on wrong section but gave all supporting material and the same was also reflected in the audit report the claim should be allowed. In CIT vs. Prabhu Steel 1988 171 ITR 530 (Bom) it was held that even if claimed for special deduction was not made in the return but in the course of assessment proceedings the Ao failed to consider the same, it was open for the appellate authority to entertain the claim . In CIT vs. Kanpur Coal Syndicate 1964 53 ITR 225 (SC) It was observed that the power of CIT(A) were plenary and co- terminus with those of the Ao and that he can do what the Ao can do and also direct him to do what he has failed to do. In CIT vs. Ramco International 2011 33 ITR 306 (P&H) assessee claimed deduction u/s 80-IB and furnished form 10CCB it was held that even where there was a claim by way of application without filing revise return deduction cannot be disallowed. Attention is invited to the recent decision of Kerala High Court in South Indian Bank Vs CIT 2014 363 ITR 111(Ker) where the court upheld the disallowance even though a bonafied claim was made, disallowing the same on the ground that the revise return was belated. In my opinion the said judgment requires reconsideration. In this case issue was of allowance 0f leave encashment which is allowed only on payment as per sec 43B. The actual payment is made in succeeding year but before due date of filing the return. The assessee failed to make an adjustment in the original return and claimed the same in revised return. The revise return was belated. The rule of fairness would apply since all information pertaining to provision for leave encashment details were available even in the original return and also disclosed in the belated revised return it was duty of the Ao to allow deduction since the claim made was genuine and bonafide. VIII. HEADS OF INCOME : 8.1. Assessee’s main business is of construction and selling properties and letting it out. The rental income it receives is income from business or house property. This is a very tricky issue. A company has its main object of owning or sub letting the properties and the only income that it derives is rental income. It must be borne in mind that when the main object is letting out property and deriving income there from the income is income from business/income from house property/ income from other sources. 8.2. There are some cases where Service Charges are received against services of electricity, air-condition, security and the same have to be considered as Business income – Dhanrajgir Buisness Pvt. Ltd. VS. ACIT – ITA NO .6802/ MUM/2010-AY 2007 -2008. 8.3 Now the issue stands settle by the case of SC Chennai Properties VS. CIT Civil Appeal 4494 of 2004 Judgment dated 9th April 2015 in which SC held that the main objectives is to acquire properties and to let out those properties then the rental income received there from is business income. The SC referred to the judgment the sultan brothers which is a constitutional bench judgment. It was categorically laid down that if letting the properties is the business of the assessee then the income derived is income from business. 8.4. In this connection attention is also invited to the decision Karanpura Development CO Ltd VS. CIT 1962 44 ITR 362( SC). Where at page 377 it was held that a company formed with the specific object of acquiring properties not with the view of leasing them but to sell them or turn them to account even by way of leasing them out as an integral part of business, cannot be said to treat them as land owner but as trader. It was further laid down that in deciding whether a company dealt with its properties as owner one must see not to the form which it gave to the transaction but to the substance of the matter. The court further held that where a company acquies properties which it sells or leases out with a view to acquiring other properties to be dealt with in the same manner the company is not treating them as properties to be enjoyed in the shape or rents which they yield but as a kind of circulating capital leading to profits of business which profits may be either enjoyed or put back in to the business to acquire more properties for further profitable exploitation. 8.5 . In S.G Mercantile Corp VS. CIT 1972 83 ITR 700(SC) it was laid down that ownership of property and leasing it out may be done part of business or it may be done as land owner. Whether it is one or other must necessarily depend upon the object with which the act is done. But a company formed with the specific object for acquiring properties not with the view of leasing them as property but to sell them or turning them to account even by way of leasing then the income is to be treated as business income. In R. R. Industries Ltd Vs ITO 2013 356 ITR 97 (Mad) assessee was deriving rental income from towers constructed in industrial park and claimed deduction as business income for the purposes of special deduction under sec80-IA. The Ao denied the deduction on the ground that it was rental income The CIT (A) accepted the stand that income from an industrial undertaking located in an industrial park approved by designated authority would qualify as deduction. The tribunal remanded the matter to the Ao. The High Court came to the conclusion that conditions for deduction u/s 80- IA (4) (III) were satisfied and that the character of receipt was not questioned. Hence the income was allowed as business income. Assessee is engaged in business of commercial complexes and pending sale and properties were let out and income derived thereon. The question is whether such income is to be assessed under the head income from house property or business? The fact that assessee was in business, does not automatically mean that such income from property should also be assessed under the head business. In CIT Vs Ansal Housing Finance 2013 354 ITR 180(Delhi), It was held that rental income could not be assessed under the head income from business but was assessed under the head “Income from house property.” Where primary source of income is letting out of godowns and warehouses to manufacturers, traders and companies the business carried on is warehousing business and income is assessable as business income: CIT VS. NDR Warehousing Pltd 2015 372 ITR 690distinguishing Bombay High Court decision in Nutan Warehousing Company vs. DCIT 2010 326 ITR 94 (Bom). Interest is earned from short term investment of money and the issue is whether the same is business income or income from other sources. Sometimes company has surplus money or has raised money through bonds and has made short- term investment the fact that short term deposits are taken out cannot justify it is business income since the entire issue of deployment of capital is required to be examined. In this connection reference is invited to the decision of Tuticorin Alkali Chemical vs. CIT 997 227 ITR 172 (SC), CIT vs. Bokaro Steel 1999 236 ITR 315(SC), CIT Vs Karnal Co-operative Sugar Mills 243 ITR 2 (SC) and CIT Vs Karnataka Power Co –Operation 201 247 ITR 268 (SC). IX. COMMENCEMENT & SETTING UP OF BUISNESS : Section 3 of the IT ACT defines “previous years” which the financial year is immediately preceding the assessment year. Till the business is set up all expenses are capital in nature. The test is that all expenses incurred after setting up of business but before its commencement would be permissible as deduction. There is a distinction between commencing a business and setting up of business. The Bombay High court in western India Vegetable Products Vs CIT 1954 26 ITR 151 (Bom) held that the important point to be noted is setting up of business and not commencement of business. It was held that expenses incurred after setting up of business, but before commencement would be permissible as deduction. X. TEST FOR ESTABLISHING BUISNESS: In CWT VS Rama Raju Surgical Cotton Mills 1967 63 ITR 478 (Sc) It was observed that it is only when business is established and is ready to commence business that it can be said that the business is set up. Sometimes business consist of continuous processes the first activity is started whereby second third and other activities are embarked in this case one has to look in to as to when was the first activity started and when was it triggered so that other activities may commence. It may be that whole business is not set up but when plant and machinery is installed and manufacture starts then business is said to have commenced. As laid down as CIT vs. saurashtra cement and Chemicals 1973 91 ITR 170 (Guj) businesses would commence when the activity which is first in point of time commences and which precede other activities is the test. Another issue is whether business can be said to have commence when there was actual production or at the time when steps like securing orders are taken. One has to consider whether company has set up its business or not. Where there are different categories of activities then the earlier activity that actually commences production would be the important test if one of the categories of business is started then it can be said that business is set up and necessary deductions can be claimed : Prem Conductors Ltd VS CIT 1977 108 ITR 654 (Guj). Sometimes there are integrated activities. In such case the nature of business is to be examined whether it comprise of integrated activities and whether all these activities collectively would go to make the business, in such case the object clause of the memorandum of association and other materials available on the subject also needs to be examined, since the question whether business has been set up is essentially a mixed question of law and fact. XI. BUISNESS EXPENDIDTURE : For the purpose of allowing deduction u/s 37(1) of the IT ACT the following conditions – A. Expenditure should not be of the nature described in sections 30 to 36, B. It should be incurred in the accounting year, C. It should be in respect of business which is carried on by the assesssee and the profits are computed as business profits and assessed, D. It is not a personal expenditure E. It is laid out or expended wholly and exclusively for the purpose of business and F. It is not in the nature of capital expenditure. Expenditure must be for the purpose of business and the expenses are wholly and exclusively for purpose of business. If the expenditure are not covered by specific provision of section 30 to 36 the expenditure can be claimed under section under37. It may happen that there could be over lapping between section 30 to 36 and sec 37. If the expenditure qualifies under specific head then deduction is allowed under section 30 to 36 and section 37 cannot be applied. But if the expenses are not deductable under sec 30 to 36 then the residual section 37 would come in to play. The expression “for the purpose of business” was dealt with in CIT vs. Malayalam Plantations Ltd 1964 53 ITR 140 (SC) where the Supreme Court observed at page 150 of 53 ITR as follows: “The expression ‘for the purpose of business’ is wider in scope than the expression ‘for the purpose of earning profits’. Its range is wide : it may take in not only the day to day running of a business but also the rationalization of its administration and modernization of its machinery, It may include measures for preservation of the business and for the protection of its assets and property from expropriation, coercive process or assertion of hostile title, it may also comprehend payment of statutory dues and taxes imposed as a pre- condition to commence or for carrying on of a business, it may comprehend many other acts incidental to the carrying on of a business. It is not necessary that expenditure should result in profits say expenditure incurred on distribution of free samples would be deductable: CIT vs. Bazaar Decor 2014 364 ITR 389(P&H). It may be noted that very often issue arises of “current repairs” sometimes expenditure is incurred on replacement and the question is whether such expenditure is allowable as current repairs u/s 31 Essential point to be noted is that the replacement which is made should not be in the nature of plant and machinery but are attachments made to plant so that its functioning is made in a proper manner . That the replacement part is required for the functioning of the plant and machinery. IN CIT vs. Mysore spun Concrete pipe 1992 194 ITR 159(karn) dies and moulds were allowed as revenue expenditure since they undergo damage frequently and therefore they require replacement. An essential point to be noted is that as long as there is no change in the performance of the machinery and the parts replaced performed the same function, the expenditure is current repairs of plan and machinery as held in CIT vs. Mahalaxmi Textile mills 1967 66 ITR 710 (SC), CIT Vs Saravana Spg mills 2007 293 ITR 201(SC). Issue arises regarding replacement of machinery parts expenditure is incurred in replacement in certain machinery parts which are obsolete replacement of parts is also required for the purpose of running the machine efficiently and are required since the old part is not conducive or it is a modern part which increases efficiency in such circumstances also replacement can be current repairs under section 31(i). On the question of current repairs it would be appropriate to refer to the judgment of Ballimal Naval Kishore Vs CIT 1997 224 ITR 414 (SC) where the Supreme Court observed that a current repair is not mere repairs. Current repairs means expenditure on building, machinery, plan or furniture which is not for the purpose of renewal or restoration but which is only for purpose of preserving or maintaining an already existing assesst and which does not bring a new asset in to existence. Current repairs are required to be attended to as and when the need arises. PROVISION: Assessee made provisions on the basis of mercantile system of accounting. The AO held that this provision was not utilized by the assessee in the next assessment year. The provision was made for certain expenses and if the provision was not exhausted, then there is no question of its allowability. In this connection reference is invited to Bharath Earth Movers VS. CIT 2000 245 ITR 428 (SC). Where it was laid down that if a business liability has arisen definitely in the accounting year the deduction should be allowed although the liability may have to be quantified and discharged at a future date. What should be certain is the incurring of the liability. It should be capable of being estimated with reasonable certainty though the actual quantification may not be possible. If these requirements are satisfied the liability is not a contingent one the liability is in present though to be discharged in future. The estimates if made on past experience and rational basis then the provision should be allowed. In Rotork Controls Vs. CIT 2009 314 ITR 62 (SC) it was held while interpreting sec 37 “Provision” is a liability which can be measured only by using a substantial degree of estimation. A provision is recognized when a) An enterprise has a present obligation as a result of a past event. B) It is probable that out flow of resources will be required to settle the obligation c) A reliable estimate can be made of the amount of thee obligation. A past event that leads to a present obligation is called as an obligating event. Bad Debts: In Trf VS CIT 2010 323 ITR 397 (SC) it was held that it is not necessary for the assessee to establish that the Debt has become irrecoverable. It is enough that the bad debt is written off in the accounts of the assessee. Bad Debt can be written of the directors if they feel that the amount cannot be recovered in the near future, moreover the question of issuing notice or taking legal proceeding is no longer a requirement for claiming bad debt. SPECIAL DEDUCTIONS: INTREST ON FIXED DEPOSITS AND INTREST ON DELAYED PAYMENTS: Question arises of permissibility of interest on fix deposit, interest on delayed payments for the purpose of eligibility u/s - 80I. Interest received from customers on account of late payment beyond the credit period is permissible as business income and entitled to benefit u/s -80-I – CIT VS. Advance Detergent 2011 339 ITR 81(Delhi) and CIT VS. Jackson engineers 2012 341 ITR 518(Delhi). So far as Interest on FDR, bank guarantee and miscellaneous receipts are cornered the benefit of sec 80I is not available: CIT VS. SHRI Ram Honda Power Equip 2007 289 ITR 475(Delhi). INTREST ON DEBENTURES, LOAN AND INTERCORPORATE DEPOSITS DIVIDEND: It may be noted that these items are income from business and accordingly shown in Part II of the Sixth Schedule of the Companies ACT. Reference is invited of the decision in Apollo Tyres Ltd 2002 255 ITR 273 (SC). In the light of the same these are treated as business income. A Full Bench of the Kerela High Court Parri Agro Industries VS. CIT 2006 285 ITR 440 (kerela) (F.B) has taken a view after referring to companies act recorded that sec 32 AB, The legislature wanted profits from business and profession alone to be taken in to profits of business and not the net profits. The judgment of the Supreme Court in Apollo Tyres was interpreted as income from business as of the assesses own business and not any other income of the assessee could be included for calculating the deductions u/s 32 AB of the IT ACT. CARRY FORWARD AND SET OFF AGAINST INCOME OF CURRENT YEAR WITH REFERENCE TO SPECIAL DEDUCTION : Supreme Court in the case of Synco Industires VS. AO 2008 299 ITR 444(SC) came to the conclusion that once depreciation allowance and development rebate for the past assessment years were fully set off against the total income of the assessee for those assessment years, the question of carry forward of the same does not arise more particularly for determining deduction u./s 80I . In Vellayudhaswami Spinning Mills VS. ACIT 2012 340 ITR 477(MAD). While dealing with the benefit under Chapter VI – A of the IT ACT, placed reliance on the decision of liberty India VS. CIT 2009 317 ITR 218(SC), wherein the SC considered the scope of sec 80-I, 80-I A and IB and held that chapter VIA provides for incentives for the form of tax deduction essentially belonging to the category of “Profit- Link” .In CIT VS. Mewar oil 2004 271 ITR 311(Rajasthan). It was held that once the losses and other deduction have been set off against the income of the previous year it should not be reopened again for purpose of computation of current year income u/s 80 IA and the assessee should not be denied the admissible deduction u/s 80-IA of the IT ACT. The logic is if there is no unabsorbed depreciation or loss of the eligible undertaking as the same was already absorbed in the earlier years then the resultant income would be a positive figure to claim the benefits of chapter VIA. The decision on the subject are conflicting- IPCA Lab VS. DCIT 2004 266 ITR 521 (SC) and CIT VS.Shirke Construction 2007 291 ITR 380(SC). Attention is drawn to the decision of CIT VS. Salgaonkar and Bros 2015 372 ITR 248(Bom)Panaji Bench) where in computation of special deduction u/s 80HHC, it was held that the same would be allowable after setting of unabsorbed investment allowance. XII. BINDING EFFECT OF CIRCULARS: In Catholic Syrian Bank Ltd vs. CIT 2012 343 ITR 270(SC) It was held that circulars issued by CBDT which are beneficial to the assessee must be applied and that circulars issue by CBDT are to explain or tone down the rigorous of law and to ensure fair enforcement of its provisions. Circulars have the force of law and are binding on the income- Tax authorities and they cannot be enforced adversely against the assessee. Circulars issued by CBDT u/s 119 of the IT act are binding on all officers and persons employed in the execution of the act even if they deviate from the provisions of the IT ACT: Navnite Lal Javeri Vs K K Sen 1965 56 ITR 198( SC), ellerman lines vs CIT 1971 82 ITR 913 (SC). Infact in unit Trust of India vs. UK Unny 2001 249 ITR 612 (Bom) it was held that Revenue is stopped from raising any arguments contrary to the interpretation place upon the statutory provisions by CBDT therefore in assessments due weightage and regard should be made to the circulars issued by CBDT if they are beneficial to the assessee. XIII. ASSESSMENT INCLUDES REASSESSMENT: SUBJECTIVE SATISFACTION As to what amounts to subjective satisfaction of the AO when he holds the reasons to believe has come up in various judicial pronouncements 1. In ACIT Vs Rajesh Jhaveri stock Brokers PVT 2007 291 ITR 500 SC It was held that at the stage of issuance of notice of reopening the Ao must have reason to believe and not the established fact of escapement of income. “The expression reason to believe” in sec 147 would mean cause or justification if the assessing officer has cause or justification to know or suppose that income has escaped assessment , it can be said to have reason to believe that income has escaped assessment. The expression cannot be read to mean that the Ao should have finally ascertained the fact by legal evidence or conclusion. What is required is “Reason to Believe” but not the established fact of escapement of income at the stage of issue of notice, the only question is whether there was relevant material on which a reasonable person could have formed the requisite belief. Whether the materials would conclusively prove the escapement of income is not the concern at that stage. This is so because the formation of the belief is within the realm of subjective satisfaction of the Ao . 2. In Raymond Woollen Mills Ltd vs. ITO 1999 236 ITR 34 (sc)It was held that in determining whether the commencement of reassessment proceedings was valid, It has only to be seen whether there was prima facie some material on the basis of which the department could reopen the case .The sufficiency or correctness of the material is not a thing to be considered at such stage. 3. In GVK Gautami Power ltd vs ACIT 2011 336 ITR 451 (Ap) it was laid down that all that is necessary to give special jurisdiction the AO is that there must be some prima facie grounds for believing that there has been some non – disclosure of material facts .whether these grounds are adequate or not for arriving at the set conclusion is not open for the court’s investigation at the stage of examination of the validity of the notice u/.s 147 , 148 the only enquiry is to see whether there are reasonable grounds for the Ao to believe or not whether the omission /. Failure and escapement of income is established. CHANGE OF OPINION “Change of Opinion” cannot per se be reason to reopen assessment. In the original proceedings, once the AO has called for certain material and after taking that in to consideration framed assessment, cannot be permitted to reopen the reassessment once again if the concept of “change of Opinion” is removed the AO would be left with Unbridled and arbitrary powers. 4. In many cases details and information are called for and discussed at the time of original assessment proceedings .sometimes letters/ questionnaire is issued seeking details. Sometimes issues are orally discussed. Sometimes some issues are recorded in proceeding sheet. Sometimes the issue is so very obvious that details and discussions are made but the same are not commented or discussed in the assessment order. It is not as if all issues and queries are discussed in the assessment order by a speaking order in such a situation reference is invited to CIT VS Usha International Ltd 2012 358 ITR 485 (Delhi) [FB] where in it was observed at page 510 : “There may be cases where the Ao does not and may not raise any written enquiry but still the Ao in the first round /original proceedings may have examined the subject matter, claim, etc because the aspect of question may be to apparent and obvious to hold that AO in the first round did not examine the question or subject matter and formed a opinion would be contrary and opposed to normal human conduct such cases have to be examined individually. Some matters may require examination of the assessment order or queries raise by the Ao and answers given by the assessee but in other cases, a deeper scrutiny or examination may be required 5. In Deepalbhai Ramjibhai Patel vs ITO 2014 366 ITR 134 (Guj ) A notice of reassessment was issued to examine the taxability of capital gains. There was sail of agricultural land and investment in purchase of agricultural land. The claim of the assessee that it was exempt was examine in original assessment. the reopening notice u/s 148 denying exemption on the ground that what the assessee sold was not an agricultural land clearly amounted to change of opinion and was not permissible If a claim is examined and the nature of the transaction is agreed upon by the Ao after examination at the original assessment then to nullify its effect would not be permissible under the provision u/s 147 , 148 . 1. In Ralson India Ltd vs DCIT 2014 366 ITR 103 (Delhi) materials in respect of companies and documents were called for and examined at the time of original proceedings reopening notice issued relying upon the very same materials prior to assessment. It was held this amounted to change of opinion and the same is not permissible in law. the Delhi high court observed that there must be “Tangible material’’ that can lead to “Reasons To Believe” .The material must attributed to the assessee and not material that is attributable to a change of opinion of the Ao on the material already available on record .Thus in this case the reason to believe contained in notice Under 148 was not valid and there was no form of tangible material which came to the revenue after completion of original assessment. Thus a view can be canvassed that reopening beyond a period of 4 years would be possible only if there is new /fresh material or evidence in possession of the Ao to warrant reopening . Reopening on the basis of existing materials would not be permissible. RECENT DECISION OF MADRAS HIGH COURT IN KALANITHI MARAN In a recent judgment Jt Com Vs Kalanithi Maran and others 2014 366 ITR 453 (Mad) the entire law on reopening has been upset in this case reassessment notice along with the reasons were submitted objections were filed by the assessee and order was passed on the objections it was held that by the madras High Court disposing of the objections is not an order deciding disputes between parties as new contentions can be raised before the assessing officer in the appellate proceedings. Hence the court held that Writ petition challenging order passed on objection is not maintainable. At the outset it must be pointed out that in this case the issue was concerning land deals with number of persons and the question arose with regard to assessee involvement , it is under these circumstances that writ petition was not maintainable therefore the decision of the madras high court has to be confined to the facts of that case and cannot be read as laying down a general proposition or as a matter of fact dislodging the settled decision of the supreme court in GKN Driveshafts vs. ITO 2003 259 ITR 19 . The said judgment of the Madras High court needs reconsideration based on following analysis 2. At page 476 of 366 ITR at the end the court 0bserves “therefore considering the scheme of the enactment particularly, with reference to sec 147 to 153 of the act, we are of the view that an order passed on the objections of the assessee over adjudicating facts is not open to challenge by way of filling of writ petition”. In reassessment proceedings an issue is already examined and once again comes up for reopening which amounts to review or reappraisal hence the matter has to be decided by way of a writ petition . An assessee cannot be unnecessary subject to harassment or ordeal of undergoing once again the entire assessment procedure which is violation of the rule of finality to assessments. If order of assessments are not allowed by way of writ petition the entire concept of failure to disclose truly and fully which is an additional jurisdictional condition when reopening is beyond 4 years as per the proviso to sec 147 would render the entire section unworkable and would give a license to the Ao to reopen assessments AT ITS WHIMS AND FANCIES. 2. At page 477 of 366 ITR at the TOP the court observes “We have already held that the order passed on a consideration of the objections raised cannot be termed as an order having civil consequences. The court has completely misdirected itself by going in to the issue of civil consequences since this is not an issue germane to reassessment The court has failed to consider that the assessee can be subjected to a fishing and roving enquiry and that the tool of reopening can be used as an instrument of tax terrorism or as a vehicle of “Taxtorion On some information which may not be verifiable would be done and the objection even though totally valid would not be considered by the and in such circumstances the writ petition is justified. The issue is not of civil consequences but it’s definitely giving rise to huge financial implications and affecting fundamental rights of the tax payer. That it would give a go by to the settled cannons of taxation that no tax can be collected without due authority of law. Hence the observation are out of context 3. At page 477 of 365 ITR the court observed “when u/s 147 the Ao can even assessee any other income to chargable to tax, which has escaped assessment, which comesto his notice subsequently during the course of the proceedings, the power being wide it cannot be challenged on the ground of improper or in adequate consideration.” These comments go directly against the direction of the Supreme Court that an order disposing of the objection gives right to an assessee to file a writ petition the objections disposed of by the Ao In CIT vs. ICICI Bank Ltd 2012 349 ITR 482(Bom) it was held that where notice is issued for reopening within in less than 4 years from the end of the relevant assessment year, the reason to believe that income has escaped assessment and the basis of tangible material would be examined by the court or the exercise of power to reopen would be a review of the assessment order. On the pretext of reopening the Ao cannot be allowed to examine the entire assessment order when originally all the issues were examined and his mind had been applied on various issues 4. At page 477 of 366 ITR the court observed “Passing a separate order giving reasons or incorporating it in the assessment order itself on the further objections of thee assessee is procedural in nature. In any case, the same would not give any right to the assessee to approach this court.” By denying such a right it would amount of violation of fundamental right. In Ratna Trayi Reality Service Ltd Vs ITO 2013 356 ITR 493(Guj) It was held that merely because a assessment was not previously framed under scrutiny that would not give unlimited right to the Ao to reopen assessment by merely issuing the notice The court will have to examine whether the Ao has power to reopen, provided he has some tangible material and on basis of which he has formed reaso9n to believed that income has escaped assessment: Rajesh Jhaveri Stock Broker case(Supra). 5. AT page 474 of 366 ITR after going in to the unnecessary issue of Jurisdictional fact and adjudicated fact the court held “Such a jurisdictional issue is ancillary or prelude to an adjudicating fact as we discussed earlier, regarding the first part of the jurisdictional fact there is no difficulty in invoking the discretionary jurisdiction of this court . However, where element of adjudication is required, then the said exercise will have to be done by the AO or by the appellate authority before approaching the court of law It appears that the Madras High Court to undergo the entire exercise of assessment and appeals before approaching the High Court. There would be no finality to a completed assessment and the sword of reopening continues to hang on the head of the assessee if such a stand is taken. In Ritu Investments Ltd vs. DCIT 2012 345 ITR 214 (Delhi) It was held that change of opinion cannot clothe the Ao with jurisdiction to initiate reassessment proceedings u/s 147 of IT ACT. The decision of the Madras High Court run contrary to various decisions where the court in exercising jurisdiction under article 226 of the constitution would interfere with notice /objection or order passed by the revenue .In Indian Cardboard Industries vs. Collector of Central Excise 1992 58 ELT 508 (Cal) the court laid down following parameters where jurisdiction under article 226 can be invoked. 1. When the show –cause notice ex-facie or on the basis of admitted facts does not disclose the offence alleged to be committed. 2. When the show cause notice is otherwise without jurisdiction. 3. When the show cause notice suffers from an incurable infirmity. 4. When the show cause notice contrary to judicial decision or decision of the tribunal. 5. When there is no material justifying the issuance of the show cause notice”. XIV. SPECIAL AUDIT: While determining the question “complexity of accounts” the test to be applied is as to how a reasonable man with reasonable qualities would approach the accounts. It has to be judged by applying the yard stick or the test whether the accounts would be complex and difficult to understand to a normal Ao. It is also required to be seen whether aid, assistance and help of special auditor is required looking to the complexity and volume of accounts. Due regards has to be given to the nature and character of transactions, method of accounting, basis and effect thereof and mere volume of entries might not be a justification to determine complexity Accounts should be intricate and difficult to understand. It is not as if every scrutiny assessment would entail investigation and verification of books of accounts, genuiness of the transactions or entries reflected in the books or for computation of income Sec 142(2A) does not permit a fishing or a roving enquiry or a witch hunt, but is a regulated provision which accepts the need and necessity of the AO to take the help of an expert Chartered Accountant. Sahara India (Firm) vs. CIT 2008 300 ITR 403(SC). Care should be taken that special audit is not ordered and approved mechanically and certainly not for unauthorized purpose of extension of limitation to complete the assessment. Muthootu Mini Kuris Vs DCIT 2001 250 ITR 455 (Ker) Bata India vs. CIT 257 ITR 622 (Cal) Rajesh Kumar Vs DCIT 2006 287 ITR 91 (SC) XV. TDS : Where an employer had a duty to deduct TDS in respect of taxable amount under the head Income from other sources and where the tax was not deducted the employee is entitled to take in to account the amount of tax deductable though not actually deducted : CIT vs. Anil Kumar Nehru 2014 364 ITR 26 ( Bom ) . The second Proviso 40(a)(ia) with effect from April 1 2013 mandates requirement on the part of the payer to deduct TDS is not so strict if he is able to show that the payee or the recipient of the amount has paid tax in accordance with provisions of section 201(1) and the proviso. XVI. PENALTY : In order to levy penalty it must be shown that there was contumacious conduct on the part of the assesee in suppressing the income nearly making a claim which is not sustainable in law by itself would not amount to furnishing inaccurate particulars regarding income of the assessee. There should be independent finding in support of the conclusion to levy penalty and there must be some establishment of fact that there was deliberate design on the part of the assessee to make a false claim or to inflate expenses or cost of acquisition. Revenue should prove concealment of income and a claim for deduction not allowed is not a proof of concealment and penalty cannot be levied. If explanation is offered and the same is not false but is a plausible explanation then penal provision is not attracted. Om Sindhoori Capital Investments vs JCIT 2005 274 ITR 427 (Mad). 1. ADDITIONAL TAX ON INTIMATION AND RETROSPECTIVE AMMENDMENT : Sec 143 (1A) is clarificatory and levies 20% Income tax where the the total income as a result of adjustments made under sec 143(1)a exceeds the total income declared in the return. Income includes losses the effect of the amendment with retrospective effect was to effect converting loss in to income and additional income tax would be chargeable at 20%, as if it had been the total income of such person. The SC in CIT VS. Sati Oil Udyog 2015 372 ITR 746(SC) held that the object of sec 143(1A) is the prevention of evasion of tax and is meant to have a deterrent effect on persons who file returns and thereby evade tax it was held that retrospective provision is permissible since the assessee is attempting to evade tax, however the burden is on the revenue. The burden can be discharged by establishing facts and circumstances from which a reasonable inference can be drawn that the assessee has, attended to evade tax lawfully payable by it. XVII. STAY OF DEMAND : In KEC International Ltd vs. BR Balakrishnan 2001 251 ITR 158 the Bombay High Court laid down parameters for considering application for stay Authority must at least briefly set out the case of the assessee If the assessed income far exceeds written income, the Ao must examine questions involved the amount to be deposited and a short prima facie reason should be given. Where financial difficulties are indicated the reasons and viability to deposit the amount should be considered. It is observed that in number of cases the Ao refuses to grant stay or insist on 50% of the demand without satisfying the above parameters which is bad in law. Further the levy of penalty has become mechanical and in all cases without due application of mind and without considering the facts and circumstances of the case penalty is levied even in cases where there is no justification at all. In debatable views penalty is levied which is contrary to the spirit of law. It is only in extreme cases that penalty could be levied and provision should be amended that prior approval of CIT should be obtained before penal provisions are invoked and it should be in the rearest cases and circumstances. “In the comprehensive, if not complicated exercise to be undertaken with reference to a return, handling the depreciation and interest is an important step, as is the determination of the income itself. Whenever parliament wanted to deviate from the ordinary procedure for determination of income or for that matter, the deprecation in the process of reckoning the taxable income, specific provisions to that effect are made. While in some cases, such steps are reflected directly in the very provisions of the act or in other cases they are in the form of the cross- reference from other provisions. L. Narasimha Reddy J in CIT VS. Ramachandra Reddy 2015 372 ITR 77(T&AP).