File - Nancy C. O'Connell

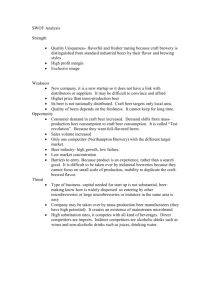

advertisement

“He was a wise man who invented beer” -Plato Boston Beer Strategic Recommendations Group 5 Checkpoint 3 Management 4970 12:30 Spring 2013 Andy Karpel, Nick Krakosky, Nick McGovern, Nancy O’Connell, Alex Reed, Thomas Schulte, Cam Tills Overview Strategic Planning Strategic Thinking • Brainstorming • SWOT Analysis • External- • Strategic History, 5F, MEA, SGA • Internal • SOGs, Business Level Strategy, VRIO, CCM, OCA, OSA, 5S Framework Strategy Making • SWOT Matrix • SO, ST, WO, WT Recommendations • Pre-Brainstorming • During • Post-Brainstorming Strategic Planning • SWOT Analysis • External• Strategic History, 5F, MEA, SGA • Internal • SOGs, Business Level Strategy, VRIO, CCM, OCA, OSA, 5S Framework Strategic Thinking • Brainstorming • Pre-Brainstorming • During • Post-Brainstorming Strategy Making • SWOT Matrix • SO, ST, WO, WT Recommendations SP: Strategic Position 5F: 5 Forces Analysis SH: Strategic History SP: Strategic Position Strengths: Brand recognition (SOG/VRIO) Continued emphasis on innovation (SOG/VRIO) Knowledge in industry (VRIO) Broad product offering (SOG) Customer loyalty (SOG) Perception as a “local craft beer” (SP) Steeped in tradition and quality (SP) Strong culture (STYLE) Quality control (VRIO) Open door policy (OSA) Family environment (OCA) Excellent fit between strategy and superior ordinate goals (SFA) Excellent fit between skills and superior ordinate goals (SFA) Excellent fit between structure and skills (SFA) Excellent fit between structure and style (SFA) Weaknesses: Much smaller compared to other brewers with broad differentiation (BLS)\ Large percentage of sales rely on young price conscious customers (BLS) Different laws across states may restrict or hinder contracts with distributors (BLS) Too bureaucratic (OCA) Competitiveness can create divisiveness amongst employees (OCA) Not focused on production as much as culture (OCA) No low cost segment (SOG) Hard to predict demand for seasonal beers (SOG) Work-life balance (OSA) Few options for career advancement (OSA) Highly political work environment (OSA) Strategy doesn’t fit well with organizational fit (DOF) High marketing costs (VRIO) SWOT ANALYSIS BLS: Business Level Strategy SOG: Super Ordinate Goals DOF: Degree of Fit MEA: Macro Environmental OCA: Organizational Culture OSA: Organizational Structure Analysis VRIO: Valuable, Rare, Inimitable, Organized SGA: Strategic Group Analysis Opportunities: Further expansion of “light” products (SH) Reach more consumers with a broader range of appeal from new products (SH) With-in their strategic group they have the largest market share with 20% (SGA) Craft brewing industry is experiencing rapid growth amidst a declining overall beer industry (SGA) Craft brewers working together against major brewers (TNE) Increased transportation ability allows geographic freedom (5F) High unemployment allows flexible compensation option for prospective employees (5F) Rapid sales growth despite overall industry decline (5F) Product differentiation and demand for new product lines (5F) Price flexibility due to low price sensitivity increasing potential profits (5F) With minor modifications substitute products can easily be imitated (5F) Higher production leads to increased sales (MEA) Recycling of man-made waste products (MEA) Alteration of drinking age/underage restrictions (MEA) Growing popularity of hard cider among women (MEA) Higher number of consumers reaching legal drinking age (MEA) Growing Hispanic population (MEA) All American trend (MEA) Do-It-Yourself trend (MEA) Electronic nose and tasting technology (MEA) Alternative packaging options (MEA) Mobile media boom (MEA) Real disposable income rising (MEA) Availability of financial capital (MEA) Threats Misperception as a “monster brewery” (SH) Oversaturated markets may lower profits (5F) Better farming techniques improve input quality of product giving suppliers leverage (5F) Major brewers ability to create similar products and steal market share (5F) Inability to do business without distributors and wholesalers (5F) Low switching costs, highly available and high price performance tradeoff (5F) Increased competition (5F) increased frequency of natural disasters (MEA) Limited Natural Resources, price of inputs dependent on climate (Hops, Barley, Etc.)(MEA) High excise tax on alcohol, legally cumbersome product to sell (MEA) Increased law enforcement of alcohol regulations (MEA) Increased consumer preference for wine up 2.5% since 2011 (MEA) Aggressive and attacking marketing by wine and spirits industry (MEA) High unemployment among beer market’s core consumers (MEA) Health conscious trends (MEA) Changing consumer preferences (MEA) Easy access brewing technology (MEA) Increase in taxation (MEA) Competing with brewers who have a much greater amount of bargaining power (SGA) Strategic Thinking • Brainstorming • Pre-Brainstorming • During • Post-Brainstorming Strategic Planning • SWOT Analysis • External- • Strategic History, 5F, MEA, SGA • Internal • SOGs, Business Level Strategy, VRIO, CCM, OCA, OSA, 5S Framework Strategy Making • SWOT Matrix • SO, ST, WO, WT Recommendations Brainstorming Creativity vs. Consumption Series 1 5 Level of Creative Thinking 4.5 4 3.5 3 2.5 2 1.5 1 0.5 0 0 1 2 3 Number of Drinks 4 5 Brainstorming After Before Sam Adams’s face on Mt.Rushmore Beer Bottle Buoy Overview Strategic Planning Strategic Thinking • Brainstorming • SWOT Analysis • External- • Strategic History, 5F, MEA, SGA • Internal Strategy Making • SOGs, Business Level Strategy, VRIO, CCM, OCA, OSA, 5S Framework • SWOT Matrix • SO, ST, WO, WT Recommendations • Pre-Brainstorming • During • Post-Brainstorming Threats: Misperception as a “monster brewery” (Strategic History) Oversaturated markets may lower profits (5-Forces) Better farming techniques improve input quality of product giving suppliers leverage (5 Forces) Major brewers ability to create similar products and steal market share (5 Forces) Inability to do business without Distributors and Wholesalers (5 Forces) Low switching costs, highly available and high price performance tradeoff (5 Forces) Increased competition (5 Forces) Increased frequency of natural disasters (Macro environmental) Limited natural resources, price of inputs dependent on climate (Hops, Barley, Etc.) High excise tax on alcohol, legally cumbersome product to sell (Macro environmental) Increased law enforcement of alcohol regulations (Macro environmental) Increased consumer preference for wine up 2.5% since 2011 (Macro Environmental) Aggressive and attacking marketing by wine and spirits industry (Macro Environmental) High unemployment among beer market’s core consumers (MEA) Health conscious trends (MEA) Changing consumer preferences (MEA )Opportunities: Further expansion of “light” products (SH) Reach more consumers with a broader range of appeal from new products (SH) With-in their strategic group they have the largest market share with 20% (SGA) Craft brewing industry is experiencing rapid growth amidst a declining overall beer industry (SGA) Craft brewers working together against major brewers (TNE) Increased transportation ability allows geographic freedom (PoS) High unemployment allows flexible compensation option for prospective employees (PoS) Rapid sales growth despite overall industry decline (RAEF) Product differentiation and demand for new product lines (PoB) Price flexibility due to low price sensitivity increasing potential profits (PoB) With minor modifications substitute products can easily be imitated (TS) Higher production leads to increased sales (Global) Recycling of man-made waste products (Natural Environment) Alteration of drinking age/underage restrictions (Political/Legal) Growing popularity of hard cider among women (Demographic) Higher number of consumers reaching legal drinking age (Demographic) Growing Hispanic population (Demographic) All American trend (Sociocultural) Do-It-Yourself trend (Sociocultural) Strengths: Brand recognition (SOG/VRIO) Continued emphasis on innovation (SOG/VRIO) Knowledge in industry (VRIO) Broad product offering (SOG) Customer loyalty (SOG) Perception as a “local craft beer” (SP) Steeped in tradition and quality (SP) Strong culture (STYLE) Quality control (VRIO) Open door policy (OSA) Family environment (OCA) Excellent fit between strategy and superior ordinate goals (SFA) Excellent fit between skills and superior ordinate goals (SFA) Excellent fit between structure and skills (SFA) Excellent fit between structure and style (SFA) STRENGTHS AND THREATS STRENGTHS AND OPPORTUNITIES 1. 1. 2. Weaknesses: Much smaller compared to other brewers with broad differentiation (BLS) Large percentage of sales rely on young price conscious customers (BLS) Different laws across states may restrict or hinder contracts with distributors (BLS) Too bureaucratic (OCA) Competitiveness can create divisiveness amongst employees (OCA) Not focused on production as much as culture (OCA) No low cost segment (SOG) Hard to predict demand for seasonal beers (SOG) Work-life balance (OSA) Few options for career advancement (OSA) Highly political work environment (OSA) Strategy doesn’t fit well with organizational fit (DOF) High marketing costs (VRIO) WEAKNESSES AND THREATS WEAKNESSES AND OPPORTUNITIES 1. Focus on increased product placement within bars and restaurants 2. Partner with Maritz to develop employee incentive programs that provide intrinsic motivation and help create a better means of promotion through the company 1. Create cheaper beer line under different name, produced in cans SWOT MATRIX Sponsor Boston athletic teams, such as the Red Sox, Bruins, and Celtics 2. Focus on being perceived as the “Real American Beer” capitalize on foreign ownership of other breweries 3. 4. 3. American presidents specially released beer released around July fourth 4. Create and sell, “brew it yourself” Sam Adams Kits New flagship brand focused on growing Hispanic market 3. Backward integration into the suppliers of barley, wheat and hops. Creation of a “light” cider line for angry orchard Creation of line that emphasizes historical traditions 2. 3. Create new spirits line that focuses on traditional American distilling processes Create mantra that unifies and motivates employees Franchise Sam Adams name to start up craft breweries Champion Recommendation #1 (SO) Strengths: • Brand recognition (SOG/VRIO) • Broad product offering (SOG) • Steeped in tradition and quality (SP) Opportunities: • Reach more consumers with a broader range of appeal for new products (SH) • Product differentiation and demand for new product lines (5F) • All-American trend (MEA) American President themed specialty beer line released annually around July fourth • • • • Independence Day release President themed; rotates every year Patriotic marketing Patriotic packaging structured around Presidential theme • Bottle caps • Labels • Packaging (6 pack, case) • Promotional merchandise to accompany beer release • https://vimeo.com/65196204 Champion Recommendation #2 (ST) Strengths: • Brand recognition (SOG/VRIO) • Customer loyalty (SOG) • Perception as a “local craft beer” (SP) Threats: • Major brewers ability to create similar products and steal market share (5F) • Increased competition (5F) • Competing with brewers who have a much greater amount of bargaining power (SGA) Focus on being perceived as the “Real American Beer” capitalize on foreign ownership of other breweries • • • • • Aggressive marketing techniques Recent acquisition of Anheuser Bush by InBev Symbol of patriotism Brewed by real Americans https://vimeo.com/65194408 Champion Recommendation #3 (WT) Weaknesses: • Different laws across states may restrict or hinder contracts with distributors (BLS) • Now low cost segment (SOG) • Hard to predict demand for seasonal beers (SOG) Threats: • Better farming techniques improve input quality of product giving suppliers leverage (5F) • Increased frequency of natural disasters (MEA) • Limited natural resources, price of inputs dependent on climate (hops, barley, etc.) (MEA) Backward integration into the suppliers of barley, wheat and hops. • • • • • Purchasing of farm lands taking on farmers on payroll Improve quality of products Increase inventory turnover rate Have control over quality of farming production equipment to ensure and enforce high standards • https://vimeo.com/65195032 Champion Recommendation #4 (WO) Weaknesses: • Large percentage of sales rely on young price conscious customers (BLS) • No low cost segment (SOG) Opportunities: • Reach more consumers with a broader range of appeal from new products (SH) • Higher production leads to increased sales (Global) Create cheaper beer line under different name, produced in cans • Alternative brand name- not under flagship Sam Adams name • Able to target unique market • Appreciation and desire for higher quality beers • Low price point • Cans vs. bottles, separated from other Boston Beer lines • High production and high revenue line • https://vimeo.com/65195769 Strategic Partnership Ideas: (You’re welcome other groups) • Boston Beer and Nike • Sam Adams golf collection • Sam Adams clothing line “I Run like Sam” • Boston Beer and Macy’s • Sell Sam Adam’s Nike product lines • Boston Beer and Walgreens • “Beer as Medicine” ad campaign • Sam Adams hangover pill • Boston Beer Netflix • Netflix original series titled “The Adventures of Sam Adams” • Boston Beer and Coke • Soda-Beer hybrid energy drink (the next Four Loko) “Thanks for your time, congrats on graduating, and DRINK UP!” -The Group 5 Appendix Strengths: 1. Brand recognition (SOG/VRIO) 2. Continued emphasis on innovation (SOG/VRIO) 3. Knowledge in industry (VRIO) 4. Broad product offering (SOG) 5. Customer loyalty (SOG) 6. Perception as a “local craft beer” (SP) 7. Steeped in tradition and quality (SP) 8. Strong culture (STYLE) 9. Quality control (VRIO) 10. Open door policy (OSA) 11. Family environment (OCA) 12. Excellent fit between strategy and superior ordinate goals (SFA) 13. Excellent fit between skills and superior ordinate goals (SFA) 14. Excellent fit between structure and skills (SFA) 15. Excellent fit between structure and style (SFA) Weaknesses: 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. Much smaller compared to other brewers with broad differentiation (BLS) Large percentage of sales rely on young price conscious customers (BLS) Different laws across states may restrict or hinder contracts with distributors (BLS) Too bureaucratic (OCA) Competitiveness can create divisiveness amongst employees (OCA) Not focused on production as much as culture (OCA) No low cost segment (SOG) Hard to predict demand for seasonal beers (SOG) Work-life balance (OSA) Few options for career advancement (OSA) Highly political work environment (OSA) Strategy doesn’t fit well with organizational fit (DOF) High marketing costs (VRIO) Opportunities 1. 2. 3. 4. Further expansion of “light” products (SH) Reach more consumers with a broader range of appeal from new products (SH) With-in their strategic group they have the largest market share with 20% (SGA) Craft brewing industry is experiencing rapid growth amidst a declining overall beer industry (SGA) 5. Craft brewers working together against major brewers (TNE) 6. Increased transportation ability allows geographic freedom (5F) 7. High unemployment allows flexible compensation option for prospective employees (5F) 8. Rapid sales growth despite overall industry decline (5F) 9. Product differentiation and demand for new product lines (5F) 10. Price flexibility due to low price sensitivity increasing potential profits (5F) Opportunities Cont. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. 21. 22. 23. With minor modifications substitute products can easily be imitated (5F) Higher production leads to increased sales (MEA) Recycling of man-made waste products (MEA) Alteration of drinking age/underage restrictions (MEA) Growing popularity of hard cider among women (MEA) Higher number of consumers reaching legal drinking age (MEA) Growing Hispanic population (MEA) All American trend (MEA) Do-It-Yourself trend (MEA) Electronic nose and tasting technology (MEA) Alternative packaging options (MEA) Mobile media boom (MEA) Real disposable income rising (MEA) Threats 1. Misperception as a “monster brewery” (SH) 2. Oversaturated markets may lower profits (5F) 3. Better farming techniques improve input quality of product giving suppliers leverage (5F) 4. Major brewers ability to create similar products and steal market share (5F) 5. Inability to do business without distributors and wholesalers (5F) 6. Low switching costs, highly available and high price performance tradeoff (5F) 7. Increased competition (5F) 8. Increased frequency of natural disasters (MEA) 9. Limited natural resources, price of inputs dependent on climate (Hops, Barley, Etc.)(MEA) Threats Cont. 10. High excise tax on alcohol, legally cumbersome product to sell (MEA) 11. Increased law enforcement of alcohol regulations (MEA) 12. Increased consumer preference for wine up 2.5% since 2011 (MEA) 13. Aggressive and attacking marketing by wine and spirits industry (MEA) 14. High unemployment among beer market’s core consumers (MEA) 15. Health conscious trends (MEA) 16. Changing consumer preferences (MEA) 17. Easy access brewing technology (MEA) 18. Increase in taxation (MEA) 19. Competing with brewers who have a much greater amount of bargaining power (SGA) SWOT MATRIX Strengths: 1. Brand recognition (SOG/VRIO) 2. Continued emphasis on innovation (SOG/VRIO) 3. Knowledge in industry (VRIO) 4. Broad product offering (SOG) 5. Customer loyalty (SOG) 6. Perception as a “local craft beer” (SP) 7. Steeped in tradition and quality (SP) 8. Strong culture (STYLE) 9. Quality control (VRIO) 10. Open door policy (OSA) 11. Family environment (OCA) 12. Excellent fit between strategy and superior ordinate goals (SFA) 13. Excellent fit between skills and superior ordinate goals (SFA) 14. Excellent fit between structure and skills (SFA) 15. Excellent fit between structure and style (SFA) Threats: 1. Misperception as a “monster brewery” (Strategic History) 2. Oversaturated markets may lower profits (5-Forces) 3. Better farming techniques improve input quality of product giving suppliers leverage (5 Forces) 4. Major brewers ability to create similar products and steal market share (5 Forces) 5. Inability to do business without Distributors and wholesalers (5 Forces) 6. Low switching costs, highly available and high price performance tradeoff (5 Forces) 7. Increased competition (5 Forces) 8. Increased frequency of natural disasters (Macro Environmental) 9. Limited natural resources, price of inputs dependent on climate (Hops, Barley, Etc.) (MEA) 10. High excise tax on alcohol, legally cumbersome product to sell (Macro Environmental) 11. Increased law enforcement of Alcohol Regulations (Macro environmental) 12. Increased consumer preference for wine up 2.5% since 2011 (Macro Environmental) 13. Aggressive and attacking marketing by wine and spirits industry (Macro Environmental) 14. High unemployment among beer market’s core consumers (MEA) 15. Health conscious trends (MEA) 16. Changing consumer preferences (MEA) STRENGTHS AND THREATS 1. Sponsor Boston athletic teams, such as the Red Sox, Bruins, and Celtics 2. Focus on being perceived as the “Real American Beer” capitalize on foreign ownership of other breweries 3. Create and sell, “brew it yourself” Sam Adams kits 4. New flagship brand focused on growing Hispanic market SWOT MATRIX Strengths: 1. Brand recognition (SOG/VRIO) 2. Continued emphasis on innovation (SOG/VRIO) 3. Knowledge in industry (VRIO) 4. Broad product offering (SOG) 5. Customer loyalty (SOG) 6. Perception as a “local craft beer” (SP) 7. Steeped in tradition and quality (SP) 8. Strong culture (STYLE) 9. Quality control (VRIO) 10. Open door policy (OSA) 11. Family environment (OCA) 12. Excellent fit between strategy and superior ordinate goals (SFA) 13. Excellent fit between skills and superior ordinate goals (SFA) 14. Excellent fit between structure and skills (SFA) 15. Excellent fit between structure and style (SFA) Opportunities: 1. Further expansion of “light” products (SH) 2. Reach more consumers with a broader range of appeal from new products (SH) 3. With-in their strategic group they have the largest market share with 20% (SGA) 4. Craft brewing industry is experiencing rapid growth amidst a declining overall beer industry (SGA) 5. Craft brewers working together against major brewers (TNE) 6. Increased transportation ability allows geographic freedom (PoS) 7. High unemployment allows flexible compensation option for prospective employees (PoS) 8. Rapid sales growth despite overall industry decline (RAEF) 9. Product differentiation and demand for new product lines (PoB) 10. Price flexibility due to low price sensitivity increasing potential profits (PoB) 11. With minor modifications substitute products can easily be imitated (TS) 12. Higher production leads to increased sales (Global) 13. Recycling of man-made waste products (Natural Environment) 14. Alteration of drinking age/underage restrictions (Political/Legal) 15. Growing popularity of hard cider among women (Demographic) 16. Higher number of consumers reaching legal drinking age (Demographic) 17. Growing Hispanic population (Demographic) 18. All American trend (Sociocultural) 19. Do-It-Yourself trend (Sociocultural) STRENGTHS AND OPPORTUNITIES 1. Creation of a “light” cider line for angry orchard 2. Creation of line that emphasizes historical traditions 3. American presidents specially released beer released around July fourth 4. Create new spirits line that focuses on traditional American distilling processes SWOT MATRIX Weaknesses: 1. Much smaller compared to other brewers with broad differentiation (BLS) 2. Large percentage of sales rely on young price conscious customers (BLS) 3. Different laws across states may restrict or hinder contracts with distributors (BLS) 4. Too bureaucratic (OCA) 5. Competitiveness can create divisiveness amongst employees (OCA) 6. Not focused on production as much as culture (OCA) 7. No low cost segment (SOG) 8. Hard to predict demand for seasonal beers (SOG) 9. Work-life balance (OSA) 10. Few options for career advancement (OSA) 11. Highly political work environment (OSA) 12. Strategy doesn’t fit well with organizational fit (DOF) 13. High marketing costs (VRIO) Threats: 1. Misperception as a “Monster Brewery” (Strategic History) 2. Oversaturated markets may lower profits (5-Forces) 3. Better farming techniques improve input quality of product giving suppliers leverage (5 Forces) 4. Major Brewers ability to create similar products and steal market share (5 Forces) 5. Inability to do business without Distributors and Wholesalers (5 Forces) 6. Low switching costs, highly available and high price performance tradeoff (5 Forces) 7. Increased competition (5 Forces) 8. Increased frequency of natural disasters (Macro Environmental) 9. Limited Natural Resources, price of inputs dependent on climate (Hops, Barley, Etc.) 10. High excise tax on alcohol, legally cumbersome product to sell (Macro Environmental) 11. Increased law enforcement of alcohol regulations (Macro environmental) 12. Increased consumer preference for wine up 2.5% since 2011 (Macro Environmental) 13. Aggressive and attacking marketing by wine and spirits industry (Macro Environmental) 14. High unemployment among beer market’s core consumers (MEA) 15. Health conscious trends (MEA) 16. Changing consumer preferences (MEA) WEAKNESSES AND OPPORTUNITIES 1. Create cheaper beer line under different name, produced in cans 2. Create mantra that unifies and motivates employees 3. Franchise Sam Adams Name to start up craft breweries SWOT MATRIX Weaknesses: 1. Much smaller compared to other brewers with broad differentiation (BLS) 2. Large percentage of sales rely on young price conscious customers (BLS) 3. Different laws across states may restrict or hinder contracts with distributors (BLS) 4. Too bureaucratic (OCA) 5. Competitiveness can create divisiveness amongst employees (OCA) 6. Not focused on production as much as culture (OCA) 7. No low cost segment (SOG) 8. Hard to predict demand for seasonal beers (SOG) 9. Work-life balance (OSA) 10. Few options for career advancement (OSA) 11. Highly political work environment (OSA) 12. Strategy doesn’t fit well with organizational fit (DOF) 13. High marketing costs (VRIO) Opportunities: 1. Further expansion of “light” products (SH) 2. Reach more consumers with a broader range of appeal from new products (SH) 3. With-in their strategic group they have the largest market share with 20% (SGA) 4. Craft brewing industry is experiencing rapid growth amidst a declining overall beer industry (SGA) 5. Craft brewers working together against major brewers (TNE) 6. Increased transportation ability allows geographic freedom (PoS) 7. High unemployment allows flexible compensation option for prospective employees (PoS) 8. Rapid sales growth despite overall industry decline (RAEF) 9. Product differentiation and demand for new product lines (PoB) 10. Price flexibility due to low price sensitivity increasing potential profits (PoB) 11. With minor modifications substitute products can easily be imitated (TS) 12. Higher production leads to increased sales (Global) 13. Recycling of Man-made waste products (Natural Environment) 14. Alteration of drinking age/underage restrictions (Political/Legal) 15. Growing popularity of hard cider among women (Demographic) 16. Higher number of consumers reaching legal drinking age (Demographic) 17. Growing Hispanic population (Demographic) 18. All American trend (Sociocultural) 19. Do-it-yourself trend (Sociocultural) WEAKNESSES AND THREATS 1. Focus on increased product placement within bars and restaurants 2. Partner with Maritz to develop employee incentive programs that provide intrinsic motivation and help create a better means of promotion through the company 3. Backward integration into the suppliers of barley, wheat and hops. Pre-Brainstorming Ideas • Andy: • Sponsor Boston sporting events to increase local sales • Tom: • Franchise Sam Adams name out to start up craft breweries to increase production • Nick K: • Create cheaper beer under different name to compete with major brewers • Nick M: • Expand into aluminum canned beer to broaden product offering • Nancy: • Create new flagship product line focused on growing Hispanic Population • Cam: • Expand into festivals and events with “beer tents” and portable selling stations • Alex: • Customizable labels for customers to enjoy Brainstorming 1ST ROUND OF BEERS • Sam Adams lime • Women focused beer • Beer in can • Funny patriotic commercial (like dos Equis) • Sponsor marathon or soccer • Regatta beer positioning • Come up with official mantra Brainstorming 2ND ROUND OF BEERS • • • • • • • • • • Exploit the fact that they're the largest/only TRUE American beer co Sponsor Boston marathon Boston icon themed beers Capitalize on local brand "buy local buy Boston" Return bottles to be green Invest in small startup s /acquire Sponsor small breweries to feature Start a second flagship brand John Adams Have a line of spirits that is distilled in a traditional fashion matching their beer brewing style Start their own bar Brainstorming 3RD ROUND OF BEERS • Invent a new type of beer that gets you drunk faster • McDonald's esque peel off labels/American facts • Brew it yourself kits • Custom label bottles • Negative ad campaign • Pepsi challenge • Beer cruise • Vintage themed • Build biggest beer bottle in world national landmark and throw largest beer party • Boston beer fest -spring break • Boat race around beer buoys • Regatta, horse race/polo, golf classy sports- group Brainstorming FOURTH ROUND OF BEERS • Add Sam Adams face to Mt. Rushmore • Sam Adams country/colony/elementary/Sam Adamsville • Partner with Walmart to have bars in Walmart • Partner with Macy's and Netflix • Nike sponsors Sam Adams apparel "I run like Sam Adams" • Ready made beer evaporate beer into sugar and pour into water to be ready made beer • Golf line - partner with Nike golf- sell it in Walgreens and the movie about it will be on Netflix and wear clothes from Macys • Sam Adams golf line by Nike • Netflix original series about documenting craft beer in America • Sam Adams merchandise sold at Macy's • Beer is medicine Walgreens • Golf kit Walgreens • Sam Adams hangover pill Walgreens Brainstorming- Horizontal Integration 5th Round of Beers • • • • • • Peanuts Steaks/brats/BBQ food Restaurants to complement their breweries Teaming up with restaurants Midwest breweries for easier distribution Merchandising/ t-Shirts Post Brainstorming Ideas • Tom: • American presidents specially released beer released around July fourth • Andy: • Focus on being perceived as the “Real American Beer” capitalize on foreign ownership of other breweries • Nick K: • Create cheaper beer line under different name, produced in cans • Nick M: • Sponsor Boston athletic teams, such as the Red Sox, Bruins, and Celtics • Alex: • Create new spirits line that focuses on traditional American distilling processes • Cam: • Backward integration into the suppliers of barley, wheat and hops. • Nancy: • Partner with Maritz to develop employee incentive programs that provide intrinsic motivation and help create a better means of promotion through the company Works Cited • "10K The Boston Beer Company, Inc." Securities and Exchange Commission. Ernst and Young LLC, 22 Feb. 2012. Web. 20 Feb. 2013. • "Beverage Industry." Value Line Investment Survey. N.p.: Value Line, 2013. N. pag. Print. • Boston Beer Co. Inc. (NYS: SAM). Rep. N.p.: Mergent, 2012. Mergent. Web. 29 Jan. 2013. <www.mergentonline.com/companyfinancials.php>. • Boston Beer Co., Inc (NYS: SAM). Rep. N.p.: n.p., n.d. Mergent Online. Web. 29 Jan. 2013. <www.mergentonlince.com/companyownership.php>. • "The Boston Beer Company Inc." Gale Business Insights: Essentials. N.p., n.d. Web. 29 Jan. 2013. • "The Boston Beer Company Inc. International Directory of Company Histories." Gale Business Insights: Essentials. N.p., n.d. Web. 29 Jan. 2013. • Dignan, Larry. "Pabst CIO Ben Haines Brewing Cloud." ZDNet. N.p., 28 Aug. 2012. Web. 24 Feb. 2013. Works Cited Cont. • "Government Beer Regulations." Apex Publishers. N.p., n.d. Web. 24 Feb. 2013. <http://www.beer-brewing.com/beerbrewing/government_beer_regulations/federal_beer_regulations.htm>. • Kesmodel, David. "In Lean Times, a Stout Dream." The Wall Street Journal. N.p., 18 Mar. 2009. Web. 30 Jan. 2013. • Kowitt, Beth. "Big Beer's Response to Craft: If You Can't Beat 'em, Join 'em." Fortune Management Career Blog RSS. N.p., 12 Dec. 2012. Web. 24 Feb. 2013. • Montague-Jones, Guy. "Scientists Sniff out Potential for Electronic Noses in Brewing." FoodProductionDaily.com. N.p., 10 Jan. 2011. Web. 24 Feb. 2013. • Peck, Nathan. "The Mug Overflows: As Breweries Expand, Craft Brewing Industry Sees Opportunity for Growth." The Mug Overflows: As Breweries Expand, Craft Brewing Industry Sees Opportunity for Growth. N.p., 30 Sept. 2012. Web. 24 Feb. 2013. • Rotunno, Tom. "Craft Beer Industry Continues To Surge." CNBC.com. N.p., 27 Mar. 2012. Web. 24 Feb. 2013. • "Top Brewers 2005-2006." Gale Business Insights: Essential. N.p., n.d. Web. 29 Jan. 2013. • Troy, Leo, Ph.D. "Breweries." Almanac of Business and Industrial Financial Ratios. 2013 ed. Chicago: CCH, 2012. 52-56. Print. Works Cited Cont. • "Beverage Industry." Value Line Investment Survey. N.p.: Value Line, 2013. N. pag. Print. • Blassingame, Kelley M. "Employee Benefit News." Beantown Benefits: Boston Beer Company Applies Relaxed, Family Culture to Benefits. Employee Benefit Advisor, 7 Oct. 2002. Web. 14 Apr. 2013. <http://eba.benefitnews.com/news/beantown-benefits-boston-beer-company-applies-237082-1.html>. • Boney, Jason, Jordan Gristy, Preston Madden, and Heath Stanley. "Boston Beer Quality Valuation." Http://mmoore.ba.ttu.edu. Texas Tech University, 1 Apr. 2005. Web. 9 Apr. 2013. <http://mmoore.ba.ttu.edu/ValuationReports/BostonBeer.pdf>. • Boston Beer Co. Inc. (NYS: SAM). Rep. N.p.: Mergent, 2012. Mergent. Web. 29 Jan. 2013. <www.mergentonline.com/companyfinancials.php>. • Boston Beer. Rep. N.p.: n.p., n.d. ADVFN. Web. 9 Apr. 2013. <http://www.advfn.com/p.php?pid=financials&btn=s_ok&mode=&symbol=SAM&s_ok=OK>. • "The Boston Beer Company Inc. (SAM)." Reuters. N.p., 12 Dec. 2012. Web. 8 Apr. 2013. • "The Boston Beer Company Inc. International Directory of Company Histories." Gale Business Insights: Essentials. N.p., n.d. Web. 29 Jan. 2013. • "Boston Beer Salaries." Glassdoor. N.p., n.d. Web. 14 Apr. 2013. • Bride, Tiffany, Laura Findley, Paul Jessup, and Crystal Love. "Boston Beer Company Firm Analysis." Georgia State University. Intercon Business Consultants, n.d. Web. 6 Apr. 2013. <https://www.student.gsu.edu/~rbernard4/MBA7035/boston%20beer.pdf>. • "Case Study: The Boston Beer Company, Inc." Harvard Business School. Harvard University, 2 June 2000. Web. 6 Apr. 2013. • Chen, Joe. "OB Boston Beer Company." Prezi.com. Prezi, 10 Dec. 2012. Web. 14 Apr. 2013. <http://prezi.com/dn0sxwtmhcjv/ob-boston-beer-company/>. • Craft Beer Alliance Inc. Rep. N.p.: n.p., n.d. ADVFN. Web. 9 Apr. 2013. <http://www.advfn.com/p.php?pid=financials&btn=s_ok&mode=&symbol=NASDAQ%3ABREW>. • Cyr, Linda, Joseph Lassiter, and Michael J. Roberts. "Case Study: Boston Beer Company: Light Beer Decision." Harvard Business School. Harvard University, 20 Nov. 2001. Web. 7 Apr. 2013. • Ernst & Young LLC. "10-K The Boston Beer Company, INC." United States Securities and Exchange Commision. N.p., 29 Mar. 2013. Web. 8 Apr. 2013. <http://www.bostonbeer.com/phoenix.zhtml?c=69432&p=irolSECText&TEXT=aHR0cDovL2FwaS50ZW5rd2l6YXJkLmNvbS9maWxpbmcueG1sP2lwYWdlPTg3NDA5MjEmRFNFUT0wJlNFUT0wJlNRREVTQz1TRUNUSU9OX0VOVElSRS ZzdWJzaWQ9NTc=>. Works Cited Cont. • Family, Beer Garden, Eat, Drinks, Background, Waiters, Series, Parents, Children (MB-03793839). Digital image. Family, Beer Garden, Eat, Drinks, Background, Waiters, Series, Parents, Children. MB-03793839 © Hubatka. Hutbatka, n.d. Web. 9 Apr. 2013. <http://www.agefotostock.com/en/Stock-Images/Rights-Managed/MB-03793839>. • Ferry, Daniel, and The Motley Fool. "Is Boston Beer One of the Best Companies in America?" DailyFinance.com. Daily Finance Investor Center, 24 Mar. 2013. Web. 8 Apr. 2013. <http://www.dailyfinance.com/2013/03/24/is-boston-beer-one-of-the-best-companies-inameric/>. • Google Images. Digital image. Beer Street Journal. N.p., n.d. Web. 9 Apr. 2013. <http://www.google.com/imgres?um=1&hl=en&biw=1614&bih=641&tbm=isch&tbnid=MxhEkz2H1PGf_M:&imgrefurl=http://beerstreetjou rnal.com/jim-koch-of-boston-beer-on-being-overrated/jim-koch2/&docid=TPONL1X6GcGM5M&imgurl=http://beerstreetjournal.com/images/Jim-Koch2.jpg&w=800&h=800&ei=EUZjUbiAAcai2gWm6YDgCQ&zoom=1&ved=1t:3588,r:0,s:0,i:82>. • Greenlee, Steve. "Sam Adams Releases Marathon Beer, '26.2'" Boston.com. N.p., 23 Mar. 2012. Web. 8 Apr. 2013. <http://www.boston.com/lifestyle/food/blogs/99bottles/2012/03/post.html>. • Montague-Jones, Guy. "Trade association widens craft brewing definition." . N.p., 2011. Web. Feb 21 2002. <http://www.beveragedaily.com/Markets/Trade-association-widens-craft-brewing-definition>. • Phillips, Seana, and Jessica Paar. "Press Release." The Boston Beer Company. N.p., 20 Feb. 2013. Web. 8 Apr. 2013. <http://www.bostonbeer.com/phoenix.zhtml?c=69432&p=irol-newsArticle&ID=1787122&highlight=>. • "US Craft Brewers grow by 11%by volume in 2010." . N.p., n.d. Web. 21 Feb 2012. <http://beernews.org/2011/03/u-s-craft-breweries-grow11-by-volume-in-2010/>. • Value Line. (2012). Boston Beer Company Stock Report. Value Line Investment Surveys