The Tripura Municipal (Assessment and collection of property tax )

advertisement

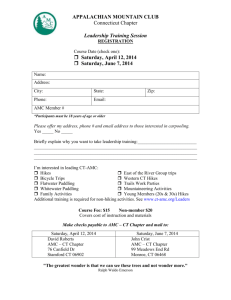

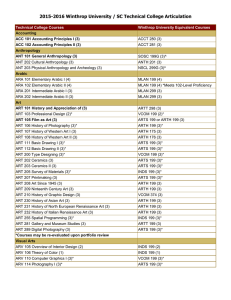

THE TRIPURA MUNICIPAL (ASSESSMENT AND COLLECTION OF PROPERTY TAX ) RULES, 2004 PROPERTY TAX- CONCEPT Property taxation is levied by local governments since ancient times. property tax constitutes the most important autonomous revenue source of local bodies especially urban governments everywhere in the world. As the state gives right to owners of the property for its exclusive use, enjoyment possession and disposal of the property can legitimately tax such properties . In a generic sense, tax on property can take many forms like tax on land, houses, wealth etc. In the context of local finance , property tax is generally used to mean tax on one basic form of property, namely real estate i,e land & buildings. WHY PROPERTY TAX ? • In multi label fiscal systems in order to minimize distortions, according to the principal of fiscal assignment local government can raise revenues mainly from relatively immovable property and non distributing tax bases. • According to MC Cluskey– the property tax is a unique mechanism for local revenue generation. Real estate is a visible immovable property and thus property tax can be well administered and which is proved as a highly efficient fiscal tool to mobilize revenue for local bodies. • Property tax is a reliable revenue source to local governments. • There is a movement to abolish octroi in India levied on entry of goods . Thus property tax is the only tax with local base and can be a revenue productive. COMPONENTS OF PROPERTY TAX • The valuation of land and building is the base for property tax. • The choice of property tax base can be its annual rental value or capital value or standardised area base tends . • Depending on social and political processess or concerns, different countries adopting different base for property tax assessment. • It should also be kept in mind that the purpose of property valuation is only to arrive at the relative value of properties at a given time. • The property tax levied as a small percentage of property value. TAX COLLECTION SYSTEM • Tax collection system consist of enforcement mechanism , stringent recovery provisions, penalty provisions which are found weak in most of the cases. • The property tax system historically has used the concept of Annual rateable value (“ARV”) as the basic taxation derived from the British system of taxing rentals in a free market. • Most of the concerned Acts define ARV as the rent at which the property might reasonably be expected to be let from year to year after allowances of certain deduction. e.g cost of repairs, insurance etc. • Service taxes are often levied with property tax. These services include taxes for water , sewerage, street lighting. FOCUS AREAS OF PT EFFICIENCY UNDER RENTAL VALUE METHOD • A good property tax structure should – • Have a low rate , making it acceptable to the public at large. • Minimize discretion and avoid arbitration in assessment of property tax. • Make the process of assessment and collection transparent and simple. • Ensure equity among classess of tax payer’s /property owners by fixing the assessment in a uniform manner. • Facilitate self assessment of property tax by property owners/ occupiers. • Evolve a specific method of levying property tax. • Delink the provision of rent control Acts from property tax assessment. ASSESSMENT OF PT BY AMC In pursuance of provision of Section 192 & Section 213 of the Tripura Municipal Act,1994, the rule called The Tripura Municipal (Assessment and collection of property tax ) Rules,2004 has been introducted on 7th December,2004. • According to the provision of the above mentioned rule- • AMC has taken following steps - • Fixed the ARV for vacant land –Rs 1400/-(uniform rate) • Rate to fix ARV • M.building: For Residential @ Rs. 0.60 psqf For commercial @ Rs. 1.80 psqf S.P. building: For Residential @ Rs. 0.50 psqf For commercial @ Rs. 1.50 psqf ASSESSMENT OF PT BY AMC Fraim building: For Residential @ Rs. 0.40 psqf For commercial @ Rs. 1.20 psqf Katcha building: For Residential @ Rs. 0.30 psqf For commercial @ Rs. 0.90 psqf Water tax: M.building: For Residential @ Rs. 480/Yr For commercial @ Rs. 3000/Yr. • • • Rate of property tax:-12 % (5%-tax on property, 5% on conservancy,2% on street light) Rate on service Charge-9%. ASSESSMENT PROCEDURE Say one citizen occupies a M.building of 1800 SFT plinth area – Firstly one third of 1800 SFT will be deducted straightway as a standard deduction to find out taxable area> 1800-600= 1200 SFT > Then the amount will be multiplied by 0.60 to fix RV > RV= 1200 x 0.60 = Rs 720.00 >ARV= 720x12 = Rs 8640 > PT = Rs 8640 x 12% = Rs 1036.80 = Say Rs 1037.00 > WT= Rs 40 X 12= Rs 480.00 > Total Tax = Rs 1037 + Rs 480 = Rs 1517.00 Similar procedure will be followed in other type of building. In case of service chargeSay there is a hospital building of 15000 SFT ASSESSMENT PROCEDURE Then ARV of the building will be – > 15000 X 0.60x 12= Rs 1,08,000.00 Service Charge would be = 108000 x 9% = Rs 9720.00 P.A • Service Charge shall be levied on Banks, Postal service & Public offices, Medical Institution, Factories & Industries owned by the Government & PSU. In other cases, PT shall be levied @ 12% or 7% as per decision of the ULB’s . • Rebate may be allowed on ARV under following cases- • 10% for the building below 25 years of age • 20% for the buildding above 25 years of age. • 10% if the building is using by the owner. • AMC is giving PT exemption(10%) to the citizen during April of every year for advance payment. • Penalty @ 10% is being imposed by the AMC in case default cases. COLLECTION OF P.TAX • Collection of AMC during last 2 Financial years are as below:- • 2012-13 - Rs 2.36 Cr.(approX) • 2013-14 - Rs 3.21 Cr.(approx) • Growth - 36 %. • Policy:- Survey of each household shall be done by the surveyor/ enumerator in every year. • All commercial holdings shall be assessed every year keeping in mind the rapid growth of Nagar. • Demand Notice shall be issued showing the figures of taxes in FORM-D. • In case of failure to realize PT, action shall be taken as per provision of Section 215(2)of the TM Act,1994. PROVISION OF SEC. 215 OF THE TM ACT,1994 On failure to pay PT within a period of three months from the date when payment was due, the Municipality may take one or more of the following actions to enforce recovery of such taxes:i) Disconnect the water connection, if there is any such connection provided by Municipality to the holding; ii) Request the power department of the Sate Government to discontinue power supply , if there is power connection to the holding; iii) File application in the court of judicial magistrate having local jurisdiction, ,for realization of tax from the defaulter by issuing distress warrant for sale of moveable properties of the defaulter in such manner as may be prescribed; iv) File application in the court of Certificate Officer under Tripura Public Demand Recovery Act,2000 (No.7 of 2000); v) If the defaulter is an employee under the Central or any state Government for public Section undertaking, intimate the disciplinary or controlling authority of that employee about the default with request to take appropriate step for recovery of the Municipal dues from his salary and allowances for other financial benefits of his service. THANK YOU