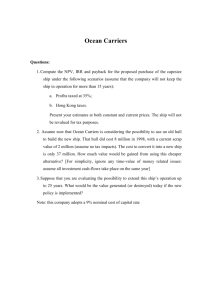

File - Michael Longo

advertisement

Current Dilemma: The decision Ocean Carrier is faced with is whether or not it makes financial sense to build a new ship to accommodate the needs of a new client. The ship would cost $39 million and 2 years to construct. Generally, Ocean Carrier’s ships have a 15 year usable life before they would be decommissioned. The problem exists because the client only needs to charter the new ship for 3 years. After the first three years, Ocean Carrier would need to rely on the spot market charter rates for the remaining 12 years of the ship’s life. Ocean Carrier needs to forecast future market conditions and determine whether those conditions yield adequate cash flows in order to justify a large investment in a new ship. Cash Flow: Sources and Uses Sources of cash include: Revenues - This comes from the number of days of revenue and the contract hire rate. After Tax Salvage Value - This is what Ocean Carriers will receive for the ship at the end of its useful life after it has depreciated. This will be $8,710,000. Uses of cash include: Operating Costs - In order to project this, we use the previous year operating cost, our assumed inflation rate of 3%, and the growth in operating costs/day above inflation. Investment in Working Capital - This is projected by subtracting the previous year’s working capital from the current year’s working capital. Net Capital Investment - This use of cash comes from the cost of the ship multiplied by the percentage of that cost which is due during the current year. Taxes - The tax rate multiplied by our EBIT results in a loss of cash equaling EBIT(1-T) If Ocean Carriers could increase revenues, while decreasing the operating costs, investment in working capital, and net capital investments, then the projected cash flows rise. Recommended Decision: Ocean Carriers should not agree to the three year lease given the current terms of the deal. This undertaking does not provide a rate of return higher than OC’s cost of capital nor does it yield a positive NPV with the given stipulations of the lease. In order for the deal to be more attractive, the charterer should agree to pay a higher premium for a brand new ship or pay a higher daily charter rate. We calculated that OC would need to charge a premium of 4.59% to the charterer while the ship is under 5 years old (Exhibit D). Past year 5, Exhibit B.1 indicates that in order to yield a positive NPV for a ship life of 15 years, the average daily charter rate needs to be at least 8.15%. Alternatively, increasing the daily charter rate from $20,000 to at least $35,758 would allow OC to break even (Exhibit D). Our calculations show that these conditions would be financially unrealistic for the charterer to agree to. Therefore, the deal should be rejected regardless of the lease terms.