467KB - Australian Government Actuary

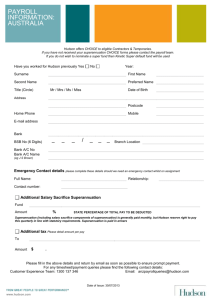

advertisement