Powerpoint slides used for Concerts Lecture

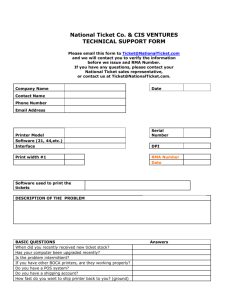

advertisement

Rockonomics: Economics & Public Policy in the Rock & Roll Industry Alan B. Krueger • Economics of Ticket Pricing • Industry Trends • Long-Run Explanations Superstar Model Baumol & Bowen’s Disease Wealth Effects • Short-Run Explanations Concentration Complimentary Goods Under Priced Asset “Somebody said to me, ‘But the Beatles were antimaterialistic.’ That’s a huge myth. John and I literally used to sit down and say, ‘Now, let’s write a swimming pool.” -- Paul McCartney “[I]n some fashion, I help people hold on to their own humanity, if I'm doing my job right.” -- Bruce Springsteen “I don’t see how carving out the best seats and charging a lot more for them has anything to do with rock & roll.” -- Tom Petty • To maximize short run profit “Price Discriminate” • Charge more to those who are less “price sensitive” • Extreme example is variation in prices for airline seats • Don’t go overboard because of tie-in sales & fan loyalty Seven Lessons from Super Bowl Sunday New York Times • List price was $325 in 2000; market price was around $2,500 • Secondary market develops if price too low, but its size can be exaggerated (20%) • Endowment effect • NFL could raise short-run profit by raising prices • But NFL wants to reward loyal fans to build enterprise • Besides, 60% of $4 billion of football revenue from TV • “Gift Exchange” Fi gur e 1: A v e r a ge P r i c e pe r Ti c k e t a nd Ov e r a l l I nf l a t i on R a t e , 19 8 1- 2 0 0 3 60 50 Avg. Price 40 30 CPI 20 10 1981 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 Fi gur e 1: A v e r a ge P r i c e pe r Ti c k e t , H i gh a nd Low P r i c e Ti c k e t s, a nd Ov e r a l l I nf l a t i on R a t e , 19 8 1- 2 0 0 3 60 50 Avg. Price 40 30 CPI 20 10 1981 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 Ticket Prices Soared Relative to Overall Price Inflation the Last 5 Years Proportionate Price Growth 0.700 0.620 0.600 Proportionate Growth 0.500 0.400 Avg. T i cket 0.301 CPI 0.300 0.255 0.243 0.207 0.206 0.200 0.1 52 0.1 28 0.1 00 0.000 1 981 -86 1 986-91 1 991 -96 P e r i od 1 996-01 © Alan B. Krueger, 2002. Prices are Growing Faster at the Top Price of the 90th, 50th, and 10th Percentile - All Artists 80 60 40 20 0 1981 1986 1991 year 1996 2001 2003 Further Analysis • October 2001 edition of Rolling Stone’s Encyclopedia of Rock and Roll • Consistent universe of artists • 1,786 artists, from Abba to ZZ Top; 1,274 in Pollstar database • Responsible for 75% of ticket sales, 1981-2003. • Merged on additional data: year formed; gender; genre; prominence (mm) Average Price Increase Understates Rise for a Consistent Set of Artists Average Price for Artists Listed in Rolling Stone Encyclopedia Source: Alan Krueger’s computations based on Pollstar and BLS data. Year 20 20 19 19 19 19 19 19 19 19 19 19 19 19 19 19 19 19 19 19 19 01 00 99 98 97 96 95 94 93 92 91 90 89 88 87 86 85 84 83 82 81 Ticket Price Average Concert Ticket Price, Selected Artists 140 120 100 80 60 40 20 0 Year 20 20 19 19 19 19 19 19 19 19 19 19 19 19 19 19 19 19 19 19 19 01 00 99 98 97 96 95 94 93 92 91 90 89 88 87 86 85 84 83 82 81 Ticket Price Average Concert Ticket Price, Selected Artists 140 120 100 80 60 40 20 0 Year 20 20 19 19 19 19 19 19 19 19 19 19 19 19 19 19 19 19 19 19 19 01 00 99 98 97 96 95 94 93 92 91 90 89 88 87 86 85 84 83 82 81 Ticket Price Average Concert Ticket Price, Selected Artists 140 120 100 80 60 40 20 0 Year 20 20 19 19 19 19 19 19 19 19 19 19 19 19 19 19 19 19 19 19 19 01 00 99 98 97 96 95 94 93 92 91 90 89 88 87 86 85 84 83 82 81 Ticket Price Average Concert Ticket Price, Selected Artists 140 120 100 80 60 40 20 0 Year 20 20 19 19 19 19 19 19 19 19 19 19 19 19 19 19 19 19 19 19 19 01 00 99 98 97 96 95 94 93 92 91 90 89 88 87 86 85 84 83 82 81 Ticket Price Average Concert Ticket Price, Selected Artists 140 120 100 80 60 40 20 0 Year 20 20 19 19 19 19 19 19 19 19 19 19 19 19 19 19 19 19 19 19 19 01 00 99 98 97 96 95 94 93 92 91 90 89 88 87 86 85 84 83 82 81 Ticket Price Average Concert Ticket Price, Selected Artists 140 120 100 80 60 40 20 0 Year 20 20 19 19 19 19 19 19 19 19 19 19 19 19 19 19 19 19 19 19 19 01 00 99 98 97 96 95 94 93 92 91 90 89 88 87 86 85 84 83 82 81 Ticket Price Average Concert Ticket Price, Selected Artists 140 120 100 80 60 40 20 0 Year 20 20 19 19 19 19 19 19 19 19 19 19 19 19 19 19 19 19 19 19 19 01 00 99 98 97 96 95 94 93 92 91 90 89 88 87 86 85 84 83 82 81 Ticket Price Average Concert Ticket Price, Selected Artists 140 120 100 80 60 40 20 0 Year 20 20 19 19 19 19 19 19 19 19 19 19 19 19 19 19 19 19 19 19 19 01 00 99 98 97 96 95 94 93 92 91 90 89 88 87 86 85 84 83 82 81 Ticket Price Average Concert Ticket Price, Selected Artists 140 120 100 80 60 40 20 0 Year 20 20 19 19 19 19 19 19 19 19 19 19 19 19 19 19 19 19 19 19 19 01 00 99 98 97 96 95 94 93 92 91 90 89 88 87 86 85 84 83 82 81 Ticket Price Average Concert Ticket Price, Selected Artists 140 120 100 80 60 40 20 0 New York Atlanta Salt Lake City Anahei m Hartford Cincinnati Pittsburgh Raleigh Charlotte Houston Austin Louisvi lle Nashville Kansas City St. Louis Tacoma Portland Ticket Price The Boss Hardly Varies His Price Across Cities Low, High and Average Ticket Price Bruce Springsteen & E Street Band, April-June 2000 80 70 60 50 40 30 20 10 0 Figure 4a: Number of Shows Each Year Rolling Stone Encyclopedia Artists 8000 Number of Shows 7000 6000 5000 4000 3000 2000 1000 0 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 Number of Tkts. Sold (Millions) Figure 4b: Number of Tickets Sold Each Year Rolling Stone Encyclopedia Artists 40 35 30 25 20 15 10 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 Figure 4c: Total Ticket Revenue in 2003 Dollars Rolling Stone Encyclopedia Bands Ticket Revenue (Millions of $) $ 1,400 $ 1,200 $ 1,000 $ 800 $ 600 $ 400 $ 200 $0 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 Scalping and List Prices • Survey at Springsteen “The Rising” Concert, Oct. 6, 2003 in Philadelphia, PA. Every ticket sold for $75. • Stratified random cluster sample of seats. Interviewed 858 people in the 15 minutes before the start of the show. • Short questionnaire on index card. Very high response rate. • 20-25 percent of tickets scalped. Worst seats more likely to be resold. Average resale price was $300. • Springsteen gave away $3 million in consumer surplus Explanations For Two Key Facts Need To Be Found: • Long run faster growth in concert prices than inflation • Short-run acceleration in prices the last 5 years The Economics of Superstars • Sherwin Rosen (AER 1981) • If undergoing heart surgery, willing to pay a lot more for the best surgeon over the second best surgeon • Imperfect substitutes Convex reward function • Plus, size of market Best can reach more customers • Human capital would not have a linear effect – twice as good paid more than twice as much Apply to Rock & Roll • Superstars are known to a broader audience because of technology • Improved technology differentiates the best from the rest and permits bigger audience (unlike Ms. Billington) • Demand to hear the very best is higher • Rewards for the best should rise 110.0 100.0 90.0 Price of Consumer Audio Equipment After Adjusting for Inflation (1978=100) Price Index 80.0 70.0 60.0 50.0 40.0 30.0 20.0 1978 1979 1980 1981 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 Source: Bureau of Labor Statistics. The Top A r t i st s a r e Ge t t i ng a La r ge r S ha r e of Tot a l Ti c k e t R e v e nue 100% E ver ybody E l se 84% 80% 60% T op 2-5 P er cent 62% 56% 40% 26% Top 1% 14.6% 20% T op 1 P er cent 0% 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 Y ear Source: Calculated by Alan Krueger based on Pollstar data. 1995 1996 1997 1998 1999 2000 2001 2002 2003 Novel measure of “Star Quality”: Amount written about artist in Rolling Stone’s Encyclopedia of Rock & Roll Measured in millimeters to be scientific 399 mm The Return to “Star Quality” on Log Price Log Difference in Price for 1 Standard Deviation Change in Star Quality for Encyclopedia Bands 0.140 0.123 Log Difference 0.120 0.100 0.091 0.080 0.060 0.047 0.052 1981-86 1987-91 0.040 0.020 0.000 1992-96 1997-03 Note: Based on multiple regressions of log annual revenue on millimeters of print, year dummies and covariates. Sample consists of 10,043 artist/year observations. See Table 3, col. 4. The Return to “Star Quality” on Revenue per Show Log Difference Effect of 1 SD Change in Star Quality on Log Revenue per Show for All Artists 0.8 0.75 0.7 0.65 0.6 0.55 0.5 0.45 0.4 0.35 0.3 0.698 0.714 1992-96 1997-03 0.618 0.482 1981-86 1987-91 Note: Based on multiple regressions of log annual revenue on millimeters of print, year dummies and no. of support acts. Sample consists of 35,835 artist/year observations. See Table 1, col. 3. The Return to “Star Quality” on Revenue per Show Effect of 1 SD Change in Star Quality on Log Revenue per Show for Encyclopedia Bands 0.6 Log Difference 0.55 0.5 0.532 0.528 0.492 0.440 0.45 0.4 0.35 0.3 1981-86 1987-91 1992-96 1997-03 Note: Based on multiple regressions of log annual revenue on millimeters of print, year dummies and covariates. Sample consists of 10,043 artist/year observations. \ See Table 3, col. 6. $55.00 Average Price for Selected Characteristics, All Else Equal $55.00 Age of Band Gender $50.00 $50.00 $47.69 $45.56 $44.03 $45.00 $41.85 $45.00 $42.79 $42.56 $40.00 $40.00 $35.00 $38.50 $35.00 $30.00 $30.00 5 10 20 30 Male Female Mixed $55.00 Genre $50.01 $50.00 $47.86 $44.09 $45.00 $41.60 $41.48 $40.62 $40.00 $37.98 $38.02 $36.10 $35.13 $35.00 $30.00 Blues Country & Western Folk Jazz Other Pop Rock Rhythm & Blues Reggae Rap Note: Based on a multiple regression of log price on millimeters of print, age of band, gender of band, genre of music, foreign vs. U.S. group, and year dummies. Sample consists of 79,375 concerts performed by 1,253 artists. Weighted average price indexed to 2001 average price. Tina Turner: What’s Age Got to Do With It? As Artists Age, the High-Low Ticket Price Ratio Rises Ratio of High to Low Price 2.5 2 1.5 1 1982 1986 1991 1996 2000 Baumol and Bowen’s Disease • Takes same amount of time and input to play Free Bird • Concerts are a low productivity growth sector (modular technological change) • Would expect prices in low productivity growth sectors to grow relatively quickly The Demand for Leisure has Risen with Wealth • As society becomes wealthier people demand more leisure and higher quality leisure activities • Demand for leisure is a “super normal good” – the share of income devoted to leisure rises with income • Price of most leisure activities is growing relatively fast • The demand for leisure is likely to continue to grow Leisure Hours Per Day 8 6 4 2 1850 1900 1950 Source: Robert Fogel (1999). 2000 2050 C o ncert T icket s versus M o vie, T heat er, and Sp o rt s T icket s C o ncert V enue Price Ind ex versus C PI f o r M o vie, T heat er and Sp o rt s Event s 0.600 Proportionate Growth in Price 0.546 0.500 0.427 0.400 0.358 0.332 Concerts 0.278 0.300 0.252 0.241 0.207 Movies, Sports & Theater 0.200 0.1 00 0.000 1 981 -86 1 986-91 1 991 -96 P e r i od 1 996-01 © Alan B. Krueger, 2002. What Explains Recent Price Growth? • Production Costs Increased • Consolidation • Decline in Complementary Revenue Source: Record Sales • Undervalued Asset Industry Consolidation • Vertical Concentration - Venues - Radio - Marketing, etc. • Horizontal Concentration - SFX, Clear Channel Clear Channel Telecommunications Act of 1996 • Signed Feb. 8, 1996 • Prior to 1996 Act, radio stations could own just 40 stations nationally, and 2 in a market • Cap eliminated nationwide, and raised to 8 in a market • Since 1996, 10,000 radio station transactions worth $100 billion • Further legislation could lead to consolidation with TV and newspapers The Industry Has Become More Concentrated Recently Percent of Total Revenue Handled by Biggest Four Promoters – All Artists Percent of Ticket Sales 80 60 40 20 1981 1986 1991 1996 year 2001 2003 Nationally, the Industry Has Become More Concentrated Recently Percent of Total Revenue Handled by Biggest Four Promoters - Top Artists Percent of Ticket Sales 80 60 41% CC 40 20 1981 1986 1991 1996 2001 2003 Source: Calculated by Alan Krueger based on Pollstar data. Only concerts performed in the U.S. are included in the analysis. Sample consists of artists listed in Rolling Stone Encyclopedia. Figure 4a: Number of Shows Each Year Rolling Stone Encyclopedia Artists 8000 Number of Shows 7000 6000 5000 4000 3000 2000 1000 0 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 Figure 5: Proportion of Seats That Are Filled for Concerts held by Artists Listed in Rolling Stone Encyclopedia of Rock & Roll 0.95 Proportion of Seats Filled 0.90 0.85 0.80 0.75 0.70 0.65 0.60 0.55 0.50 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 Average Within-Market Percent of Revenue Handled by Biggest Four Promoters Average of Percent in Each of the Top 24 Markets Percent of Ticket Sales 90.5% 80 60 40 © Alan B. Krueger, 2002. 20 1981 1986 1991 1996 2001 Source: Calculated by Alan Krueger based on Pollstar data. Only concerts performed in the U.S. are included in the analysis. Sample consists of artists listed in Rolling Stone Encyclopedia. Change in Prices vs. Change in Big-Four Concentration Ratio, 1993-94 to 2000-2001; 98 Largest Cities Proportionate Change in Price 2 r = 0.04 1.5 1 .5 0 -.5 -50 0 50 Change in Big-Four Concentration Ratio 100 Clear Channel’s Share of Concert Revenue versus their Share of Radio Listeners across 98 Largest Radio Markets Share of Concert Revenue, 2000-01 1 r = 0.01 .75 .5 .25 0 0 .1 .2 .3 Share of FM Radio Market, 2002 .4 .5 Herfindahl-Hirschman Index for Venues, 1986-2001 Average Across 24 Largest Cities 6000 5000 4000 3000 2000 1000 1986 1991 1996 2001 Note: Venues that are exclusively used by one promoter in a year in a particular city are pooled together into one conglomerate. An industry with an HHI above 1,8000 is considered highly concentrated according to the Justice Department Merger Guidelines. Surge in Average Price Per Concert Ticket in Canada is Similar to that in the United States – 67% Nominal Growth from 1996 to 2001 Price (US Dollars) $50 $40 Avg. Price $30 $20 Grow at U.S. CPI $10 $0 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 Alternative Model - Complementary Goods • Dependent Demands with Shift in Record Market • Records and Concerts are complementary goods • Because of new technology, the complementarity is weaker 1.2 Total Albums and Singles Shipped Billions of Units 1 0.8 0.6 0.4 0.2 0 1990 1992 1994 1996 1998 2000 Source: New York Times, Feb. 25, 2002, p. C1. Music shipments were down an estimated 9.6 percent last year, after declining 7 percent in 2000. Sales were flat 1994 to 2000. Bands Produce 2 Complementary Goods with Market Power Good 1: Concert Tickets Good 2: Record Sales max p1D1 (p )+ p2 D2 (p )- C1 (D1 (p ))- C2 (D2 (p )) p1 - C1' 1 (p2 - C2' )D2e12 = e11 p1 p1D1e11 “Music itself is going to become like running water or electricity. So it’s like, just take advantage of these last few years because none of this is ever going to happen again. You’d better be prepared for doing a lot of touring because that’s really the only unique situation that’s going to be left. It’s terribly exciting. But on the other hand it doesn’t matter if you think it’s exciting or not; it’s what’s going to happen.” David Bowie The New York Times June 9, 2002 p1 - C1' 1 (p2 - C2' )D2e12 = e11 p1 p1D1e11 Monopolistic Price Setting Concerts Only Marginal Cost P Concert Price Demand for concerts Marginal Revenue Q Concerts Monopolistic Price Setting with Complementary Product: Records Concert Price Marginal Cost P P’ Demand for concerts Marginal Revenue Q Q’ Concerts Revenue from Complementary Product Falls Because of MP3, etc. Concert Price Marginal Cost P P Demand for concerts Marginal Revenue Q Q’ Concerts Price Growth by Genre,1996-2001 74.1% 80% 70% 55.6% 60% 50% 45.0% 47.7% Reggae & Other Folk & Country 40% 30% 23.4% 20% 10% 0% Jazz & Blues Rap & R&B Pop & Rock There’s A Long Way to Go to Catch the Super Bowl! 450 400 350 Price 300 250 200 150 Superbowl 100 Concerts 50 0 1981 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 Conclusions • Rising superstar effects, but not accelerating • To understand the market must understand industrial organization and technology • Legal changes that allowed Clear Channel to dominate industry may be overrated • Antitrust action in future? Revised Telecom Act? • Complementarities between concerts and album sales key to market for Rock Stars?