Financial Statements and Transactions

advertisement

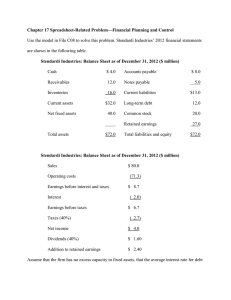

Module 2: Introducing Financial Statements and Transaction Analysis Balance Sheet Reflects the Accounting Equation Assets = Liabilities + Equity Uses of funds = Sources of funds Assets are listed in order of liquidity Liabilities are listed in order of maturity Equity consists of Contributed Capital and Retained Earnings Assets To be reported on a balance sheet, an asset must 1. Be owned (or controlled) by the company 2. Must possess expected future economic benefits Examples of Current Assets Cash—currency, bank deposits, and investments with an original maturity of 90 days or less (called cash equivalents); Marketable securities—short-term investments that can be quickly sold to raise cash; Accounts receivable, net—amounts due to the company from customers arising from the sale of products and services on credit (“net” refers to uncollectible accounts explained in Module 6); Inventory—goods purchased or produced for sale to customers; Prepaid expenses—costs paid in advance for rent, insurance, advertising or other services. Examples of Long-term Assets Property, plant and equipment (PPE), net—land, factory buildings, warehouses, office buildings, machinery, motor vehicles, office equipment and other items used in operating activities (“net” refers to subtraction of accumulated depreciation, the portion of the assets’ cost that has been transferred from the balance sheet to the income statement, which is explained in Module 6); Long-term investments—investments that the company does not intend to sell in the near future; Intangible and other assets—assets without physical substance, including patents, trademarks, franchise rights, goodwill and other costs the company incurred that provide future benefits. Examples of Current Liabilities Accounts payable—amounts owed to suppliers for goods and services purchased on credit. Accrued liabilities—obligations for expenses that have been incurred but not yet paid; examples are accrued wages payable (wages earned by employees but not yet paid), accrued interest payable (interest that is owing but has not been paid), and accrued income taxes (taxes due). Unearned revenues—obligations created when the company accepts payment in advance for goods or services it will deliver in the future; also called advances from customers, customer deposits, or deferred revenues. Short-term notes payable—short-term debt payable to banks or other creditors. Current maturities of long-term debt—principal portion of long-term debt that is due to be paid within one year. Net Working Capital Examples of Noncurrent Liabilities Long-term debt—amounts borrowed from creditors that are scheduled to be repaid more than one year in the future; any portion of long-term debt that is due within one year is reclassified as a current liability called current maturities of long-term debt. Long-term debt includes bonds, mortgages, and other long-term loans. Other long-term liabilities—various obligations, such as pension liabilities and long-term tax liabilities, that will be settled a year or more into the future. We discuss these items in later modules. Equity Equity consists of: Contributed Capital (cash raised from the issuance of shares) Earned Capital (retained earnings). Retained Earnings is updated each period as follows: Examples of Equity Accounts Common stock—par value received from the original sale of common stock to investors. Preferred stock—value received from the original sale of preferred stock to investors; preferred stock has fewer ownership rights compared to common stock. Additional paid-in capital—amounts received from the original sale of stock to investors in addition to the par value of common stock. Treasury stock—amount the company paid to reacquire its common stock from shareholders. Retained earnings—accumulated net income (profit) that has not been distributed to stockholders as dividends. Accumulated other comprehensive income or loss—accumulated changes in equity that are not reported in the income statement (explained in Module 9). Income Statement When are Revenues and Expenses Recognized? Accrual Accounting: Revenue Recognition Principle—recognize revenues when earned Matching Principle—recognize expenses when incurred Operating vs. Nonoperating Operating expenses are the usual and customary costs that a company incurs to support its main business activities Nonoperating expenses relate to the company’s financing and investing activities Statement of Cash Flows Statement of cash flows (SCF) reports cash inflows and outflows Cash flows are reported based on the three business activities of a company: Cash flows from operating activities - Cash flows from the company’s transactions and events that relate to its operations. Cash flows from investing activities - Cash flows from acquisitions and divestitures of investments and long-term assets. Cash flows from financing activities - Cash flows from issuances of and payments toward borrowings and equity. Cash Flow from Operations Articulation of Financial Statements Financial statements are linked within and across time – they articulate. Balance sheet and income statement are linked via retained earnings. Recording transactions • Understand basic recording of transactions. • Pay $100 wages in cash: • Cash assets are reduced by $100, and wage expense of $100 is reflected in the income statement, which reduces income and retained earnings by that amount. Wages Expense $100 Cash $100 • All transactions incurred by the company during the accounting period are recorded similarly. Adjusting Accounts Information at the SEC Form 10-K – Annual Report Form 10-Q – Quarterly Report For 8-K—Significant events, as change in officers, business, auditor, control of company, bankruptcy Form 4—insider transactions Global Accounting Balance Sheet The most visible difference is that the typical IFRS-based balance sheet is presented in reverse order of liquidity. Income Statement The most visible difference is that GAAP requires three years’ data on the income statement whereas IFRS requires only two.