The Global Financial Crisis and Eastern Europe

advertisement

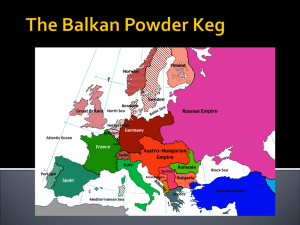

The Global Crisis - Role of Regional Integration and EU Accession Milica Uvalic University of Perugia Western Balkans in 2020 – Overcoming the Economic Crisis and Developing Competitive Economies, Sarajevo, 24-25 February 2010 1 1. Effects of the crisis The WB countries also severely hit by the global economic crisis, though with a delay (only last quarter of 2008), by 2 external shocks: Reduced inflows of foreign capital (FDI, remittances, foreign loans) Reduced demand for exports In 2009, strongly negative growth in all countries except Albania 2 3 Effects of the crisis Recovery on its way (2010), partly as a consequence of improving prospects in EU, but growth sluggish in 2010 (max. 2%), in all cases 50-90% lower than in 2008 Still, WB are not the most severely hit 4 Real GDP growth 2009-10 (IMF, EBRD) European Union Euro area 2009 -4.2 -4.2 2010 0.5 0.3 New EU Member States Estonia Hungary Latvia Lithuania Slovenia Bulgaria Romania -4.3 -14.7 -6.0 -17.9 -15.2 -7.5 -4.8 -7.0 0.7 -1.8 2.0 -2.0 -0.5 1.9 0 1.3 In 7 new EU MS output fall greater than in most WB In 4 new EU MS output growth still not positive (contrary to WB) 4.3 -4.4 -5.9 -1.2 -4.3 -3.1 2.0 0.6 0.6 2.0 0.4 2.4 Western Balkans Albania Bosnia & H. Croatia Macedonia Montenegro Serbia 5 Reasons for milder effects in WB? Not because WB have lower current account deficits and thus are less dependent on inflows of foreign capital Most WB are less integrated with the EU than the new EU member states (1) Trade: WB are still quite closed economies, less open than most new EU member states, and many old EU member states 6 Balkan exports of goods and services 2008 (% of GDP) 60 50 40 30 20 Services Goods 10 0 7 (2)FDI in WB still relatively low 40000 35000 Million US $ 30000 25000 20000 15000 10000 5000 0 2001 2002 CEE & Baltics 2003 2004 2005 CIS Western Balkans 2006 2007 2008 Bulgaria & Romania 8 (3)Financial markets Similarities of WB with new EU MS Foreign banks in WB: 78-98% of banking assets Lending policies of easy credit credit boom, many loans in foreign currency (60% in both Croatia and Serbia) Credit crunchincreasing credit defaults in 2009 Main difference: financial markets in WB are less developed, less sophisticated financial instruments, though higher degree of euroization 9 Credit boom Domestic credit to private sector (% of GDP) 100 80 Albania 60 Serbia Macedonia 40 Bosnia 20 Croatia Montenegro 0 2005 2006 2007 2008 10 (4)Facilitating factors International Loans from the IMF (Serbia, Bosnia...) IMF-sponsored “Vienna initiative”: agreement with foreign banks to prevent capital withdrawals Support of banks by EBRD (Unicredit), or by governments through nationalizations (Hypo-AlpeAdria) Some EU funds (IPA, EIB) Domestic buffers Remittances declined less than expected Savings under mattresses; Serbia €3 billion (9% of GDP) 11 2. Role of regional and EU integration Lower integration of WB with EU has also meant a lower exposure to the effects of the global crisis After 2001, there has been a gradual re-integration of the WB region through increasing trade (CEFTA) and other economic links Increasing regional integration among WB countries has made the effects of the global crisis less severe But the global crisis structural weaknesses and fragility of WB economies, due to the model of credit-driven growth and resulting dependence on capital inflows from abroad 12 Role of regional and EU integration The global crisis has revealed more general flaws of the transition strategy pursued in WB, many problems … Consumption much higher than production, financed by foreign savings & investment Extremely high unemployment Slow growth of new private sector, limited restructuring Inadequate structural changes, favouring primarily fast expansion of services, closely related to Structure of FDI (banking, telecommunications, real estate...) 13 Role of regional and EU integration Key structural deficiency: weak export performance, insufficient tradable goods at competitive terms, not facilitated by overvalued currencies But the main problem in WB insufficiently restructured real sector Extreme de-industrialisation (1990s) FDI has gone into few industrial sectors Insufficient recovery (Serbia: industrial prod. at 50% of 1989 level) Over the next few years, despite remaining privatisation opportunities, WB cannot rely much on FDI (drop by 50%), need to reconsider the growth model 14 Role of regional and EU integration Since most WB countries are not likely to enter the EU very soon, regional integration can and should play an important role in the medium term How can regional cooperation enhance competitiveness and strengthen export performance of WB? WB cannot be competitive in all sectors They need to define longer-term priorities, based on national programmes of regional specialization a regional division of labour Regional integration can strengthen WB economies, preparing them for entry into the EU 15 Role of regional and EU integration Regional industrial policy – not to support national champions, but horizontal measures for all enterprises…Measures to encourage innovation, R&D, protect quality standards, facilitate enterprise restructuring, strengthen and diversify the industrial base In line with the current EU approach to industrial policy, as defined in the Maastricht Treaty and the Lisbon Strategy “policy to enhance enterprise competitiveness” Also in WB: industrial policies to promote structural change, facilitate the transformation of industries and the creation of trans-national networks (S&T, education, specific sectors)Lisbon Strategy for the Balkans … 16