Funding for Retiree Health Care: Comparison of Vehicles

advertisement

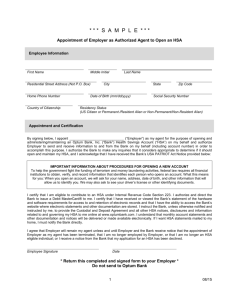

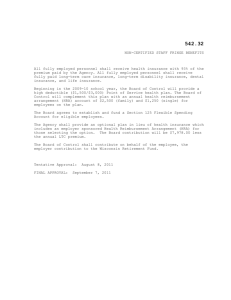

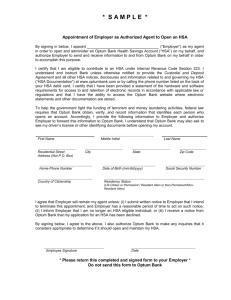

PUBLIC EMPLOYEE FORUM ON GASB STANDARDS 43/45 Funding for Retiree Health Care: Comparison of Vehicles February 7, 2006 Terry A.M. Mumford & Mary Beth Braitman Ice Miller LLP One American Square, Suite 3100 Indianapolis, Indiana 46282-0200 (317) 236-2100 www.icemiller.com Retiree Health Care Vehicles: Goals/Considerations • Tax-Free Contributions – • • • Tax-Free Earnings Tax-Free Benefits/Distributions If Pre-Funding– How to Satisfy GASB Requirements – – – – – • Employer and employee contributions Irrevocable trust Protected from creditors For exclusive benefit of retirees and beneficiaries With assets used for paying benefits in accordance with substantive plan With appropriate fiduciary provisions How to Satisfy Internal Revenue Service Requirements 1 Retiree Health Care Vehicles: Goals/Considerations (cont’d) • Availability – – – – • Post-Retirement Disability Termination While Active Additional Issues To Consider – Integration with pension fund benefits • – – – deductions for $3,000 exclusion Communication and administration issues Medicare Part D subsidy and coordination Cost containment/cost management issues 2 Funding Options • • • • • 401(h) Qualified Medical Account VEBA (voluntary employees’ beneficiary association) Governmental Trust Health Reimbursement Arrangement (“HRA’s”) Heath Savings Account (“HSA’s”) 3 401(h) Qualified Medical Subaccounts $ Employer Contributions $ Qualified Medical Account 401(h) Employee Contributions Individual Accounts for Each Employee (DC) OR Pooled fund for All Participants (DB) Medical Expense Reimbursement Premium Reimbursement Medical Expense Payments Premium Subsidy Process • • • Must be part of “qualified retirement plan” Must have a separate account for funding, actuarial and recordkeeping purposes Secure IRS determination letter 4 Advantages of a 401(h) Account • • • • • • • Satisfies GASB requirements. The only method that permits a qualified pension plan to provide tax-free medical benefits. May be structured to include employee contributions, as well as employer contributions. Employer can fund the 401(h) on pre-retirement basis. Permits carry over of account balances from year to year. Accounts are not maintained on an annual “use it or lose it” basis. Must have separate accounting for contributions, benefits, and earnings, but can be invested with general pension fund assets Payments to and distributions from 401(h) account for medical expenses are not taxable to employee/retiree. 5 Disadvantages of a 401(h) Account • • • • • IRS imposes limits on funding 401(h) accounts. Limited usage – distributions may only be made for qualified medical expenses. Code Section 401(h) benefits are available only for retired employees, their spouses, or their dependents. Must have formal legal structure. May not transfer money between pension reserves and 401(h) reserves (except if qualify for and follow Code Section 420). 6 VEBA $ $ Employer Contributions VEBA 501(c)(9) Trust Employee After-Tax Contributions Individual Accounts for Each Employee (DC Basis) Pooled Fund for all Participants (DB) Medical Expense Reimbursement Premium Reimbursement Medical Expense Payments Premium Subsidy Process • Create employee association trust • Integrate with existing health coverage/structure • Secure IRS ruling 7 VEBA Advantages • • • • . • • Satisfies GASB requirements. Employer may fund pre-retirement, but is not required to pre-fund retiree medical accounts (funding can be bargained). In addition to contributions by an employer, employees may also make after-tax contributions. Formula for funding could be based on cash out value of certain accumulated days at retirement. . Can carry account balance from year to year – need not be on an annual “use it or lose it” basis. Payments to and distributions from VEBA for qualified medical benefits would not be taxable to employee/retiree. – HRA structure must follow IRS guidance. 8 VEBA Disadvantages • • May only be used for certain specified purposes (e.g., medical expenses). The benefits provided through the VEBA must be to safeguard or improve health, or to protect against a contingency that interrupts or impairs earning power. Retirees may not elect to receive cash. 9 Governmental Trust $ Employer Contributions Governmental Trust $ Employee Contributions Reimbursement of Medical Expenses and Premiums Process • • • Establish separate governmental fund trust – 115 trust – Integral part trust Establish administrative process Secure private letter ruling to assure IRS approval of structure and tax treatment 10 Advantages of Governmental Trust • • • • • • May be designed to satisfy GASB requirements. Permits carry over of account balances. Would permit post-tax employee contributions. Employer payments to fund the governmental trust are not taxable to the employee. Distributions from governmental trusts for qualified medical expenses are not taxable to the employee/ retiree. – HRA structure must follow IRS guidance. Can be structured to provide very different benefits. Examples include: – – – Can have fixed contribution and fixed amount available for medical expenses per month for life. Can have fixed contribution and variable amount available for medical expenses per month for life (set annually) Can have actuarially determined contribution and fixed (or non-fixed) amount available for medical expenses for life. 11 Disadvantages of Governmental Trust • Limited usage in order to preserve tax benefits for retirees. 12 Health Reimbursement Arrangement $ Health Reimbursement Arrangement (“HRA”) Employer Contributions Individual Accounts for Each Employee Reimbursement of Medical Expenses and Premiums Process • • Requirements for HRA’s are set out in IRS Revenue Ruling 2002-41; IRS Notice 2002-45 (June 26, 2002); IRS Revenue Ruling 2006-36; IRS Revenue Ruling 2006-45; FSLG Newsletter (July 2006); IRS Notice 2006-69 (July 13, 2006). Requires establishment of an administrative structure. 13 Advantages of HRA • • • • • Can be pre-funded by the employer during an employee’s working career. Payments to HRA are not taxable to employee. Benefits from HRA are not taxable to employee when paid. – Must follow IRS guidance. May carry HRA unused balance over from year-to-year. No “use it or lose it” annual requirement. Can also be maintained after termination or retirement. May set maximum dollar amount that may be used in a “coverage period”. 14 Disadvantages of HRA • • • • • • • No employee contributions permitted. Limited usage - distributions may only be made for qualified medical expenses or premiums for accident or health coverage for current employees, retirees, and COBRA beneficiaries and their tax dependents and spouse. Medical expense must be substantiated by administrator. May not be used to fund general retirement benefits, life insurance, or death benefits, and may not be cashed out. The HRA will itself be subject to COBRA requirements. Code Section 105(h) non-discrimination rules apply. Will generally satisfy GASB provisions for pre-funding defined contribution benefits. 15 Health Savings Account $ Employer Contributions $ Health Savings Account (“HSA”) in conjunction with High Deductible Health Plan Employee Contributions Qualified Medical Expenses (nontaxable) Other Expenses (may be taxable, with potential 10% penalty) unless exception applies Process • Employer adopts High Deductible Health Plan (“HDHP”) • Employer or Employees establish Health Savings Accounts (“HSA”) 16 Health Savings Account Basics • A Health Savings Account (“HSA”) may be established by anyone who: – – – – is covered by a High-Deductible Health Plan (“HDHP”), is not covered by another non-HDHP (this includes medical flexible spending accounts and HRAs), is not enrolled in Medicare, and may not be claimed as a dependent on another person’s tax return. 17 Health Savings Account Basics (cont'd) • An HDHP is a health plan that meets certain conditions and has a minimum deductible, with a maximum out-of-pocket expense limit. – – – For 2007, minimum deductible is $1,100 for individual coverage and $2,200 for family coverage. For 2007, maximum out of pocket amount is $5,500 for individual coverage, and $11,000 for family coverage. New law requires Department of Treasury to publish COLA increases to these amounts by the June 1 prior to the year the increases take effect so employers can plan for the next year. 18 What are contribution limits for HSAs? • Annual HSA contributions may not exceed: – – – $2,850 for single coverage, or $5,650 for family coverage New law requires Department of Treasury to publish COLA increases to these amounts by the June 1 prior to the year the increases take effect 19 What are contribution limits for HSAs? (cont'd) • • Note that beginning in 2007, annual contributions are no longer limited by the individual’s HDHP deductible. “Catch-up” contributions are permitted between 55 and 65 – – Currently $800/year, increasing to $1,000 in 2009 Must be at least 55 by the end of the tax year 20 What are contribution limits for HSAs? (cont'd) • Usually, annual contribution limit is prorated for the months an individual is actually HSA eligible. However, new mid-year enrollee rule allows individuals to contribute full year’s annual maximum if individual is HSA eligible during the last month of the tax year. – However, if the individual ceases to be HSA eligible for any reason (other than death or disability) during the last month of the tax year and the following twelve months, all of the contributions that otherwise could not have been made become subject to normal income taxes plus a 10% penalty tax. 21 How can contributions be made to an HSA? • Employee contributions outside of a cafeteria plan. – – • Employers must make “Comparable Contributions” to comparable participating employees or face a 35% excise tax on all employer contributions made to HSAs. New law allows employers to discriminate in favor of non-highly compensated employees. Employer contributions through a cafeteria plan – Not subject to comparable contribution rules, but are subject to cafeteria plan nondiscrimination rules. 22 How can contributions be made to an HSA? (cont'd) • • • • • Employee contributions. Contributions from other individuals. Archer MSA rollovers. Rollovers from other HSAs or trustee-to-trustee transfers. New – One-time direct rollover from HRAs and FSAs (“qualified HSA distributions”). – Does not count against annual HSA contribution limit. 23 How can contributions be made to an HSA? (cont'd) – – – Rollovers may be made between January 1, 2007 and December 31, 2011. Rollover is limited to the lesser of: (1) the individual’s HRA or FSA balance on September 21, 2006; or (2) the individual’s HRA or FSA balance on day of rollover. Therefore, if individual has $0 balance in HRA or FSA on 9-1-06, that individual cannot use this rollover rule. Entire amount of rollover becomes taxable (and subject to 10% penalty) if individual does not remain HSA eligible (except for disability or death) for the month of the rollover plus next twelve months. 24 How can contributions be made to an HSA? (cont'd) – • If employer allows rollovers, must allow for all comparable employees. New – One-time transfer from IRS (“qualified HSA funding distribution”). – – – Does count against annual HSA contribution limit. One-time transfer, but may get additional transfer if convert from self to family coverage in same taxable year. Tax rules similar to those applicable to HRA/FSA rollovers apply if individual does not remain HSA eligible after the IRA transfer. 25 HSA Distributions • HSA’s can be used to pay for the following “qualified medical expenses” with no taxation: – Medical expenses for account holder, spouse, and tax dependents, – COBRA continuation coverage or health plan coverage while receiving unemployment compensation, – Qualified long-term care insurance, and 26 HSA Distributions (cont'd) – For those 65 or older (and who have previously established an HSA), any health insurance, Medicare premiums and out-of-pocket expenses (Part A, Part B, Medicare HMOs, new prescription drug coverage-Part D), and employee share of premiums for employer based coverage. • But otherwise cannot be used to pay health insurance or Medigap premiums. 27 What rules apply to HSA distributions? • Distributions may be taken any time (even if not currently an “eligible individual”). • Distributions for qualified medical expenses of eligible individual, spouse, and dependents are excludible from income. • Distributions for any other purpose are subject to regular tax plus a 10% penalty tax. • Distributions made after death, disability, or attaining age 65 are not subject to 10% penalty tax. 28 Advantages of HSA’s • • • • • HSA’s are completely portable and owned by the employee. Carry-over of HSA amounts from year to year is permitted. Employees have flexibility to make their own elections about contribution amounts (within limits) and whether to take distributions from HSA. Employee investment direction of HSA is permitted. Employee contributions are deductible. 29 Disadvantages of HSA’s • • • • • Contributions only permitted if employee is participating in an HDHP. Limited employer involvement with the HSA trustee or custodian. Governmental retirement plan or employer may not qualify to be trustee or custodian of HSA’s. Generally, cannot be used to pay for “general” health insurance premiums. Will satisfy GASB provisions for funding defined contribution benefits. 30 Leave Conversion • • “Leave conversion” programs have taken several different forms to convert a retiree’s unused vacation, sick, or personal leave into a credit used to “purchase” a supplemental benefit, including retiree medical benefit. This is not a separate type of structure, but is a way to fund a 401(h) account, 115 Trust, or VEBA. 31 Leave Conversion Design (Example 1) • Example 1 – Public Safety Local Negotiates Accumulated Sick and Vacation Leave at Retirement – – – – – Assumes employer pays accumulated sick leave and vacation leave upon employee reaching retirement. Local negotiates for employer to adopt the Post Employment Health Plan (“PEHP”). Local negotiates that instead of employees being paid for accumulated sick and vacation leave in cash, with fully taxed benefits (Federal, State, and if applicable, 7.65% FICA or 1.45% Medicare tax; the buy-outs would be contributed to PEHP. Note: individual employee elections to have accumulated sick and/or vacation leave are not permitted due to constructive receipt of income issue. The Local’s contract determines the non-elective percentage or dollar value of accumulated sick and vacation leave contributed to the PEHP program upon a member retiring. Member benefits by receiving total value of sick and vacation leave buyout (tax-exempt) and may utilize these contributions from the PEHP program to pay for medical insurance premium expenses. 32 Leave Conversion Design (Example 2) • Example 2 – Public Safety Local Negotiates Accumulated Sick and Vacation Leave at Retirement Plus Annual Ongoing Contribution – – – – As outlined in Example 1, assumes Local negotiates for sick and vacation leave to be contributed into the PEHP program in lieu of having these types of payouts paid to members in cash and being fully taxable. Local negotiates wage and benefits package for the employer to make an annual ongoing contribution into the PEHP program on behalf of each member. These annual ongoing contributions are in the $25 - $50 per pay range which equates to $650 - $1,300 annually for each member. Member benefits by receiving total value of sick and vacation leave buyout (tax-exempt) and may utilize these contributions to the program to pay for health insurance premium expenses in addition to receiving annual ongoing contribution into PEHP program which may be utilized to pay for any qualified health insurance expense. 33