Speaker Presentation

advertisement

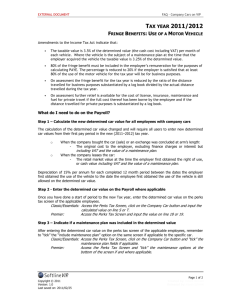

2011 Budget and Tax Update 1 2011 BUDGET 2 Main Tax Proposals • Personal income tax relief of R8.1billion (2010: R6.5 billion) • A third rebate for individuals 75 years and older • Conversion of medical deductions to tax credits • Transfer duty relief • Taxation of gambling winnings • Tax treatment of contributions to retirement funds • Fuel taxes to increase by 18c per litre (2010: 25.5c) • Increased sin taxes 3 Tax Tables - Individuals 2011/2012 Taxable Income (R) 2010/2011 Rate of Tax Taxable Income (R) Rate of Tax 0 - 150,000 18% 0 - 140,000 18% 150,001 - 235,000 R27,000 + 25% 140,001 - 221,000 R25,200 + 25% 235,001 - 325,000 R48,250 + 30% 221,001 - 305,000 R45,450 + 30% 325,001 - 455,000 R75,250 + 35% 305,001 - 431,000 R70,650 + 35% 455,001 - 580,000 R120,750 + 38% 431,001 - 552,000 R114,750 + 38% 580,001 and above R168,250 + 40% 552,001 and above R160,730 + 40% 4 Rebates Primary Rebate Under 65 65 and over 75 and over 2012 R 2011 R 10 755 6 012 2 000 10 260 5 675 - 5 Tax Thresholds Primary Rebate Under 65 65 to 74 75 and over 2012 R 2011 R 59 750 93 150 104 261 57 000 88 528 88 528 6 Interest and Taxable Dividend Exemption 2012 R 2011 R Under 65 22 800 22 300 Over 65 33 000 32 000 Foreign 3 700 3 700 7 Capital Gains Tax Exemptions 2012 2011 R R Annual Exclusion 20 000 17 500 Annual exclusion in year of death – gains and losses 200 000 120 000 Disposal of small business by natural person if over age 55 900 000 750 000 8 Capital Gains Tax Exemptions Primary Residence Exclusion - disregard gains (not losses) if proceeds do not exceed 2012 2011 R R 1,5 m 1,5 m 2m 2m 9 Travel Allowance Deemed Expenditure Table • Changed with effect from 1 March 2011 – Page 10 and 11 of notes – Fewer bands now increase by R60 000 – Limit on cost increased to R480k from R400k • Reimbursive travel allowance where business km’s less than 8 000 p/a increased from R2,92/km to R3,05/km 10 Retirement Fund Lump Sum Withdrawal Benefits 2011/2012 rates are unchanged from 2010/2011 Taxable lump sum R Rate of Tax 0 – 22 500 0% 22,501 - 600,000 R22,500 + 18% 600,001 - 900,000 R103,950 + 27% 900,001 and above R184,050 + 36% Refer page 20 and 21 of notes 11 Retirement Fund Lump Sum Benefits on Retirement or Severance 2011/2012 Taxable lump sum R 2010/2011 Taxable lump sum Rate of Tax R Rate of Tax 0 - 315,000 0% 0 - 300,000 0% 315,001 - 630,000 R0+ 18% 300,001 - 600,000 R0 + 18% 630,001 - 945,000 R56,700 + 27% 600,001 - 900,000 R54,000 + 27% 945,001 and above R141,750 + 36% 900,001 and above R135,000 + 36% 12 Corporate Tax Rates Years of assessment ending between 1/4/11 and 31/3/12 2012 2011 Non-mining companies 28% 28% Close corporations 28% 28% Employment companies 33% 33% Non-resident companies (SA branch) 33% 33% STC: 10% on net amount of dividends declared 13 Small Business Corporations (Years of assessment ending between 1/4/11 and 31/3/12) 2011/2012 Taxable income R 2010/2011 Rate of Tax Taxable income R Rate of Tax 0 - 59,750 0% 0 - 57,000 0% 59,751 - 300,000 R0 + 10% 57,001 - 300,000 R0 + 10% 300,001 and above R24,025 + 28% 300,001 and above R24,300 + 28% 14 Turnover Tax For Micro Businesses (year of assessment ending 28/2/11 and 29/2/12) 2011/2012 Taxable turnover R 2010/2011 Rate of Tax Taxable turnover R Rate of Tax 0 - 150,000 0% 0 - 100,000 0% 150,001 - 300,000 R0 + 1% 100,001 - 300,000 R0 + 1% 300,001 - 500,000 R1,500 + 3% 300,001 - 500,000 R2,000 + 3% 500,001 - 750,000 R7,500 + 5% 500,001 - 750,000 R8,000 + 5% 750,001 and above R20,000 + 7% 750,001 and above R20,500 + 7% From 1 March 2012 can remain registered for VAT and 3 year bar on voluntary deregistration to be lifted SARS will be able to register an unregistered micro businesses that it detects 15 Medical Aid Contributions • Monthly caps to increase 1 March 2011 – from R670 to R720 (7,46%) for each of the first two beneficiaries and – from R410 to R440 (7,31%) for each additional beneficiary • Proposed conversion to a tax credit system will be introduced on 1 March 2012 • Look out for discussion doc in March 2011 16 Subsistence Allowances • Travel in the Republic – meals and incidental costs: R286 (was R276) per day – incidental costs only: R88 (was R85) per day • Travel outside the Republic – daily amount per country also changed from 1 March 2011 (pg 12 to 20 of notes) 17 Transfer Duty Natural and juristic persons agreement on or after 23 Feb 2011 Property value R Rate of Tax Natural persons - agreement pre 23 Feb 2011 Property value R Rate of Tax 0 - 600,000 0% 0 - 500,000 0% 600,001 – 1,000,000 R0 + 3% 500,001 – 1,000,000 R0 + 5% 1,000,001 – 1,500,000 R12,500 + 5% 1,000,001 and above R25,000 + 8% 1,500,001 and above R37,000 + 8% The rate for juristic persons was a flat 8% of the consideration 18 Fuel Levies • To be increased by 18c/l on 6 April 2011 – General fuel levy on petrol and diesel increases by 10c/l – Road Accident Fund levy on petrol and diesel increases by 8c/l cents per litre • Total = 261.5 c/l on petrol; 246.51c/l on diesel 19 Sin Taxes • Excise duties on: – Cigarettes increases from R8.94 per pack of 20 cigarettes to R9.74 – Beer increases from 85c to 91c on a 340ml can – Wine increases from R2.14 to R2.28 a litre 20 National Health Insurance • NHI to be phase in over 14 years • Considerations for funding: – Payroll tax (payable by employers) – Increase in the VAT rate – Surcharge on individual’s taxable income • Look out for announcements in 2012 budget 21 Contributions to Retirement Funds • Current tax treatment on contributions to pension, provident and RAF to be changed from 1 March 2012 • Employer’s contribution will be deemed a taxable benefit. Employee will be allowed to deduct up to 22,5% of taxable income • Two thresholds will apply – Minimum annual deduction of R12 000 – Maximum annual deduction of R200 000 • The taxable income on which the deduction (22,5%) is determined will be streamlined 22 Lump Sum Withdrawals From Provident Funds • Currently 1/3 of the value of a pension or RA fund can be withdrawn on retirement and 2/3 must be used to buy an annuity • 100% of the value of a Provident fund can be withdrawn on retirement • Proposal to apply same 1/3 treatment to provident funds 23 Gambling • Effective 1 April 2012 • Gambling winnings above R25 000 • Subject to 15% final withholding tax • Includes National Lottery • Similar to India, Netherlands and USA 24 Business Taxes • Dividends tax – STC will be replaced 1 April 2012 • Internal company restructuring – Relief for insolvent debtors if debts cancelled or reduced • Venture capital companies – Provisions to be reviewed • Islamic finance – Additional products to be addressed this year – ijara (finance lease) • R&D tax incentive – Approval process to be introduced before claim can be made 25 Skills Development and Job Creation • Learnership tax incentive – Set to expire in September 2011 – Incentive to be extended for further 5 years – Analysis to be undertaken in 2011 • Youth employment subsidy – In form of tax credit through the PAYE system • Industrial development zones – IDZ incentives to be expanded for labour-intensive projects in IDZ’s 26 International Tax • Headquarter company regime – Review of problems with current rules leading to double tax and residence-based tax • CFC’s refinement of rules – Review of overly complex and unintended loopholes 27 Other Proposals • Capital gain foreign currency rules – Individuals and non-trading trusts are taxed on realised currency gains – Must maintain currency pools – Provisions to be removed due to cost benefit considerations • Travelling judges – Home to work is private – Judges presiding over multiple courts or a court that is located far from home – Government vehicles are provided for this purposes – Unusual work travel to be eligible for tax relief as if business 28 Other Proposals • Foreign dividends received – Currently subject to exemptions are taxed at marginal rates – Given changes to taxation of local divs coming in 1 April 2012 – Exemptions and taxation of foreign dividends received will be amended to bring in line with local treatment • SA branches of foreign companies – Tax rate 33% with no STC – On introduction of new div tax the rate might have to be reduced to avoid non-discrimination provisions in DTA’s 29 Other Proposals • CGT treatment on capital distributions and pre 2001 assets – Capital distributions should reduce cost and not trigger a gain or loss – Currently these are subject to gains or losses – Revised and simplified system to determine base cost of pre 2001 assets to be considered – Once in place capital distributions can be aligned with international practice (reduce cost) 30 VAT Proposals • Fixed property – Transfer duty payable by vendor on purchase from non-vendor – Input tax limited to the transfer duty paid – Proposal to delink input claim and will be lower of: • Selling price • Open-market value • Municipal value • VAT inclusive purchase price + improvements, by the nonvendor selling the property 31 VAT Proposals • Exemption for imported services – Threshold on certain imported goods of R100 – No threshold for imported services – Proposal to include exemption for services and increase both exemptions to R500 • Relief for unpaid debt between group companies – Period of 12 months in which to settle debt – Inter-group debt is often not settled – Relief to be considered provided no input can be claimed by the seller until the claw back must be made by the purchaser 32 Estate Duty • Primary abatement – Unchanged at R3,5mill, plus – Unused portion of the primary abatement of a predeceased spouse • The effectiveness of estate duty is being reviewed, with several options under consideration 33 2010 AMENDMENTS 34 SITE (Sections 5(1A) and 6(5) and para 11B(2) of the Fourth Schedule) • SITE introduced in 1988 • Final tax on first R60 000 of net remuneration • Intended to limit number of tax returns • Resources required elsewhere 35 SITE (Sections 5(1A) and 6(5) and para 11B(2) of the Fourth Schedule) • SITE to be eliminated • SITE-minimum and SITE-only – gone for y.o.a ending after 28 Feb 2011 • Phase-out relief for SITE-only taxpayers – 2012: 1/3 of additional tax – 2013: 2/3 of additional tax – 2014: 3/3 of additional tax 36 SITE (Sections 5(1A) and 6(5) and para 11B(2) of the Fourth Schedule) Mr X & Mr Y earn ‘net remuneration’ as follows: Mr X A: R42 000 B: R52 000 C: R54 000 37 SITE (Sections 5(1A) and 6(5) and para 11B(2) of the Fourth Schedule) • Under SITE rules: – Mr X’s tax liability was NIL • Under new rules: – Mr X’s tax liability is R16 940 (subject to phase-out) 38 Official Rate of Interest (Para 1 of the Seventh Schedule) • Used for fringe benefit and STC purposes • Linked to the repurchase or equivalent rate – Rand denominated loans – SA repurchase rate + 1% – Foreign loan – equivalent rate + 1% applicable to foreign currency • Automatically adjusted at beginning of the month following month when the repurchase rate is changed 39 Motor Vehicle Fringe Benefits (Para 7 of the Seventh Schedule and para 1 of the Fourth Schedule) • Travel allowances have become more restrictive • Change to motor vehicle fringe benefits • Both should now reach similar outcomes • Change effective 1 March 2011 • Starting point is presumption that use is deemed private and operating expenses are incurred by employer 40 Motor Vehicle Fringe Benefits (Para 7 of the Seventh Schedule and para 1 of the Fourth Schedule) • Value of benefit = 3.5% of determined value • Determined value = – Now includes VAT – Maintenance plan included in purchase price • At least 3 years or 60 000km • Inclusion of 3.5% is reduced to 3.25% per month • Value is reduced by consideration pd by employee for use but not for ongoing license, insurance, maintenance and fuel • Remuneration = 80% of the 3.5% or 3.25% 41 Motor Vehicle Fringe Benefits (Para 7 of the Seventh Schedule) • On assessment employee can reduce the fringe benefit value for business use and private expenses he/she incurred – Across-the board reduction – ratio of business use over total use x 3.5% (or 3.25%) - logbook – Reduction for private use to the extent employee pays for insurance, licenses, fuel and maintenance costs 42 Motor Vehicle Fringe Benefits (Para 7 of the Seventh Schedule) • Reduction for private usage insurance, licence and maintenance costs – Ratio of private use over total use x actual insurance, licence and maintenance costs • Reduction for private usage fuel costs – Private usage x deemed fuel amount per table • If employer reimburses any part of these costs: – Above reductions cannot be claimed – Correct bottom pg 55 of notes – delete second last sentence The across-the-board reduction for business use is not reduced by the amount reimbursed 43 Motor Vehicle Fringe Benefits (Para 7 of the Seventh Schedule and para 1 of the Fourth Schedule) • Example 1: Employer covers all costs – Cost of vehicle = R300,000 (Incl VAT) – Logbook = total 40,000km, business 10,000km – Employer pays all costs • Gross value of fringe benefit = R300,000 x 3.5% x 12 = R126,000 • Remuneration = R126,000 x 80% = R100,800 • Business reduction on assessment = R126,000 x 10,000/40,000 = R31,500 • Net fringe benefit = R94,500 44 Motor Vehicle Fringe Benefits (Para 7 of the Seventh Schedule and para 1 of the Fourth Schedule) • Example 2: Employee pays private fuel – Same facts as example 1 except employee pays for fuel relating to private use – Remuneration = R100,800 – On assessment, claim reductions for business and private use • Business usage = R31,500 • Fuel cost R0.87 x 30,000km = R26,100 – Net fringe benefit = R126,000 – R31,500 – R26,100 = R68,400 45 Motor Vehicle Fringe Benefits (Para 7 of the Seventh Schedule and para 1 of the Fourth Schedule) • If employee receives both company car and travel allowance – No deduction can be claimed on assessment – Normal reductions relating to the fringe benefit on the company car are still applied 46 Motor Vehicle Fringe Benefits (Para 7 of the Seventh Schedule) • Temporary non-use – If for any reason the vehicle is not used by the employee for private purposes – No reduction in taxable value • Use of more than one vehicle – If all are used primarily for business purposes then taxable value based on vehicle with highest determined value (SARS now has discretion to allow use of another vehicle) 47 Motor Vehicle Fringe Benefits (Para 7 of the Seventh Schedule) • Use of more than one vehicle (cont.) – If all vehicles are not used primarily for business purposes (e.g. a vehicle is used by a spouse) – Taxable benefit of all vehicles is included in remuneration and gross income – 3.5% (or 3.25%) same for all vehicles 48 Motor Vehicle Fringe Benefits (Para 7 of the Seventh Schedule) • Value deemed to be NIL – Pool car • Is available to and used by employees in general • Private use is infrequent or incidental to business use, and • Not normally kept at home overnight – 24 hour service vehicles • Nature of duties requires regular use of vehicle outside of normal working hours • Private use not permitted other than: – Travel between home and work, or – Infrequent or incidental to business use 49 Motor Vehicle Fringe Benefits (Para 1 of the Fourth Schedule) • Remuneration - 80% business use – NB: Applies to both travel allowance and company cars – If employer is satisfied that 80% of the use of the vehicle for the full year will be for business purposes – Only 20% of the allowance or fringe benefit must be included in remuneration (normally 80%) 50 Executive Share Schemes (s 8C) • Aims to tax as salary when restrictions are lifted • Distributions received during period of restriction – Capital distributions and dividends • Both now taxed as income, with exceptions • Only dividends received from restricted non-equity share instruments are taxable (e.g. preference shares) 51 Incorrect Value of Fringe Benefit (para 3(2) of Seventh Schedule) • Vacation Exchanges International v CSARS – Incorrect determination of employees tax by employer caused by incorrect value of fringe benefit – Remedied only on assessment of employee – Amendment allows SARS to raise an assessment on the employer if omission or error in value of fringe benefit 52 Provisional Tax (Para 1 of Fourth Schedule) • Persons exempt from provisional tax could still be provisional taxpayers by definition • Amended definition of provisional taxpayer includes: – Person (other than company) deriving non-remuneration income – Company – Anyone who is notified as such by SARS – Excludes: • Approved PBO • Approved recreational club • Tax exempt body or association • Person exempt from payment of provisional tax (para 18) 53 Provisional Tax (Para 18 of Fourth Schedule) • Who is exempt from payment of prov tax? – Natural person, on last day of y.o.a. is below age 65 • No income from business, and • Taxable income below tax threshold, or • Taxable income from interest, divs and rental is less than R20,000 – Natural person, 65 or older (not director of pvt company) • Taxable income – Below R120,000, and – None from business, and – Only from remuneration, interest, dividends or rental 54 Provisional Tax (s 89quat) • Waiver of section 89quat interest – Interest charged on unpaid prov tax – Waiver was permitted if reasonable grounds for taking the position – Narrowed to circs outside the taxpayer’s control 55 Severance Benefits (s 5(10), s 7A and s 10(1)(x)) • 2009 amendments allow a lump-sum benefit from a retirement fund, following retrenchment, to be treated as if the taxpayer retired – retirement benefit table and R300,000 lifetime exemption • Severance benefits received pre 1 March 2011 – R30,000 tax free – Balance subject to rating formula • Severance benefits received after 1 March 2011 – R300,000 tax free (cumulative lifetime exemption) – Balance taxed per the retirement benefit table 56 Company Law Reform Amendments throughout the IT Act • Companies Act 71 of 2008 – effective 1 April 2011 • Fundamental changes to company law arena – Capital maintenance provisions replace with market value solvency and liquidity tests – Reorganisation rules modernised – Business rescue procedures introduced • Income Tax Act depends on company law principles and definitions – Consequential changes throughout the IT Act 57 Company Law Reform Amendments throughout the IT Act • New dividend definition effective 1 Jan 2011 • Old capital maintenance provisions gone – profits, reserves, par value and nominal value • New definition: – Any amount transferred or applied by a company to a shareholder – Unless results in a reduction of contributed tax capital • CTC is only a tax concept, no basis in company law 58 Company Law Reform Amendments throughout the IT Act • CTC is the amount contributed to the company for the issue of shares • Prior to 1 January 2011 – Stated capital (no par value shares), or – Sum of share capital and share premium (par value shares) • After 1 January 2011 – Increased by consideration received by company for issue of shares • Foreign co becoming SA res after 1 Jan 2011: – Market value of all shares on that date + shares issued thereafter 59 Micro-Business Turnover Tax (Sixth Schedule) • 1 March 2009, optional substitute for IT, CGT and STC • Available to sole props, partnerships, co’s, cc’s and co-ops (subject to conditions) • Changes to: – Entry criteria – Turnover calculation – Transition from normal tax into the turnover tax – Relationship of turnover tax with VAT 60 Micro-Business Turnover Tax (Sixth Schedule) • Professional service total prohibition has been removed • Professional service income cannot exceed 20% of total receipts – natural person • Professional service and investment income cannot exceed 20% of total receipts - company • Example - Construction company also doing drafting activities will now qualify if income from drafting and investment income do not exceed 20% of total receipts • See amended list of professional services – same changes to list of personal services for SBC’s 61 Micro-Business Turnover Tax (Sixth Schedule) • If registered for VAT cannot qualify as a micro- business • Taxable turnover – Reduced by amounts refunded to customers – In it’s first year micro-business no longer needs to include recoupment of allowances – Ignore refunds received from suppliers 62 Small Business Corporations (s 12E) Micro-Business Turnover Tax (Sixth Schedule) • Anti-multiple shareholder provisions relaxed • Dormant – Not carried on a trade in any y.o.a – Total market value of assets < R5,000 • Winding-up – Steps taken i.t.o sec 41(4) to liquidate, wind up or deregister 63 Financial Instruments Held as Trading Stock (S 22(1)(a)) • Natural person share dealer could write down the value of closing stock for tax purposes – lower of cost or market value • Company could not • Now both treated the same • Financial instruments held as trading stock cannot be valued at lower than cost 64 Group Relief Provisions (s 41,42,44,45 and47) • Difficult to trace trading stock regularly transferred under an intra-group transaction • Election mechanism replaced with an agreement mechanism – in writing both parties agree that sec 45 does not apply • Trading stock that is regularly and continuously disposed of, has been excluded from the de-grouping charge (6 year tracing required) and 18 month retention periods 65 STC (s 64B(5)(c)) • Winding-up dividend exemption - Exemption for pre 31 March 1993 profits - Pre 1 October 2001 capital profits - Profits derived before it became SA resident • Removed effective 1 January 2011 66 Dividends Tax (s 64D to H) • Transitional issues – STC triggered on declaration – Div tax triggered on date div accrues – Potential double tax implications have been addressed 67 Value Extraction Tax (s 64O and Q) • VET replaces the STC deemed-dividend rules • Comes into operation on date new dividend tax effective • Official rate of interest has been replaced by arm’s length rate 68 Regional Headquarter Company (s 20C) • South Africa – the gateway to Africa • Obstacles – CFC provisions – Charge on outgoing dividends – Thin-capitalisation provisions • Tax relief for headquarter companies – Foreign subs not regarded as CFC’s – Dividends declared exempt from STC (or div tax) – Back-to-back loans not subject to thin-cap – Foreign creditors exempt from withholding tax on interest 69 Regional Headquarter Company (s 20C) • Definition of a headquarter company – All shareholders must hold at least 20% of its equity shares – Investment in foreign subs • 80% of tax value of HQ must be made up of equity, debt or intellectual property in foreign subs • For sub to qualify the HQ must hold at least 20% of its equity shares – Receipts and accruals from subs • 80% of total receipts must be from foreign subs – Fees, interest, royalties, divs and sale proceeds 70 Regional Headquarter Company (s 20C) • CFC impact on foreign subs – HQ is deemed to be non-resident – Only if more than 50% of HQ shareholders are SA will foreign subs be CFC’s in relation to SA shareholders • Example – 70% of HQ owned by non-resident 30% by resident – HQ owns all shares in foreign-sub 1 which in turn owns all shares in foreign-sub 2 – Neither of the subs is a CFC in relation to the 30% resident shareholder 71 Regional Headquarter Company (s 20C) • Dividend distributions – Deemed non-res when making distributions • Example – HQ is owned 70% by non-res and 30% by resident – HQ’s receipts and accruals are R10 mill • R2mill local interest • R7mill divs and R1mill man fee from wholly-owned foreign sub – HQ declares a div to its shareholders – Div not subject to STC (or div tax) – Both foreign and local shareholder qualify for participation exemption on dividend received 72 Regional Headquarter Company (s 20C) • Transfer pricing rule – HQ is subject to transfer-pricing provisions including thin-cap – No thin-cap rules are applied on foreign loans borrowed if their proceeds are on-lent to a foreign company – No transfer pricing rules are applied to loans made by HQ to a 20% owned foreign company – Price of this exclusion: • Interest incurred on loans introduced by non-residents is ringfenced against interest earned on those funds • Unused losses are carried forward and used in following years 73 Foreign Dividends (s 10(1)(k)(ii)(aa)) • Now includes a div from a HQ • Participation exemption (at least 20%): – No longer applies to a dividend received from a foreign financial instrument holding company – Limits exemption to active businesses 74 Cross-Border Interest Exemption (Part 1A - s 37I to M) • Interest accrued to a non-resident after 31 December 2012 • 10% withholding tax on interest • Exemption: – Government debt instrument – Listed debt instrument or unit trust – Debt owed by a bank or the SARB – Trade debt – Interest paid by a HQ 75 Capital Gains Tax Primary Residence Exclusion (para 45 of Eighth Schedule) • No gain or loss resulted if the total sale proceeds below R2mill • Loss aspect has been removed • Now even if proceeds below R2mill, a capital loss in excess of R1.5mill can be set-off against capital gains 76 Transfer of Residence From Co. or Trust (para 51A of Eighth Schedule) • Opportunity to simplify structures • 2002, 2 year window period granted • 2009, similar relief granted, para 51 • Para 51 relief has been amended and applies to disposals to 30 Sept 2010 • Para 51A introduced, disposals from 1 Oct 2010 to 31 Dec 2012 77 Transfer of Residence From Co. or Trust (para 51A of Eighth Schedule) Company structures • Residence must be used mainly for domestic purposes by individual shareholders or their relatives who ordinarily resided therein from 11 Feb 2009 to date of disposal • Residence must be disposed of in anticipation of winding up • Steps to wind up must be taken within 6 months of disposal • Disposal can be in form of a sale or distribution in specie • Sale to any shareholder, distribution must generally be in shareholding ratio (Beware sale - no STC relief) • No transfer duty or taxable capital gain or loss to company for residence • NB: Other assets disposed of get no tax relief • STC exemption subject to distribution in specie 78 Transfer of Residence From Co. or Trust (para 51A of Eighth Schedule) • Company structures (cont.) – Base cost in hands of recipients: • If disposed of to persons who acquired all shares in co. after it acquired the residence, and • Value of residence makes up 90% or more of market value of co’s assets during window period – Base cost = cost and date shares acquired by shareholder (cannot use M/V @ 1 Oct 2001) + improvements post acquisition of shares • If above does not apply, – Base cost = base cost of residence to company 79 Transfer of Residence From Co. or Trust (para 51A of Eighth Schedule) Example 1 • Couple formed a company in 1995 – 50/50 shareholding • Company then purchased a house in 1995 for R360,000, couple live in the house with their children • Bank loan funded original purchase • In Dec 2010 co. owed bank R200,000 and R420,000 to couple • Market value of house is R920,000 • Improvements to house over 15 years cost R50,000 • In Dec 2010 co. is liquidated and house distributed to couple 80 Transfer of Residence From Co. or Trust (para 51A of Eighth Schedule) Example 1 (cont.) • Liquidation does not give rise to CGT, transfer duty or STC • R360,000 + R50,000 deemed to be spent by couple and at same dates • Base cost rules applied to above as normal 81 Transfer of Residence From Co. or Trust (para 51A of Eighth Schedule) Example 2 • Same facts at 1 but couple sell the company in 2004 for R650,000 to Mr B and he lives in the house • Improvements costing R25,000 incurred before 2004 and R25,000 in 2008 • Dec 2010 market value of house = R920,000 • Dec 2010 company is liquidated and house distributed to shareholder 82 Transfer of Residence From Co. or Trust (para 51A of Eighth Schedule) Example 2 (cont.) • Liquidation does not give rise to CGT, transfer duty or STC • Base cost to Mr B is R650,000 + R25,000 improvement in 2008 • Beware – If Mr B acquired the loan account at a discount, para 12(5)(cc) CGT exemption does not apply to the discount when he waives the loan – Say loan stood at R800,000 when shares and loans were purchased for R650,000. This resulted in a R150,000 discount on purchase of the loan. If the loan is now waived, the discount will not qualify for the 12(5)(cc) CGT relief and the company must include this as a capital gain 83 Transfer of Residence From Co. or Trust (para 51A of Eighth Schedule) Trust structures • Residence must be used mainly for domestic purposes by individual s connected to the trust who ordinarily resided therein from 11 Feb 2009 to date of disposal • Residence must be disposed of in anticipation of termination • Agreement or application to terminate must be made within 6 months of disposal of residence • Disposal can be in form of a sale to anyone or distribution to one or more beneficiaries • Trust will enjoy no transfer duty and no CGT with roll-over relief on disposal of residence • NB: Other assets disposed of get no tax relief • Base cost in recipients hands = Base cost to trust 84 Transfer of Residence From Co. or Trust (para 51A of Eighth Schedule) Example 1 • Couple formed a trust in1995 – both are trustees and beneficiaries • Trust purchased a house in 1995 for R360,000, couple live in the house with their children • Couple lent trust R60,000 and bank loan funded balance of the original purchase • In Dec 2010 bank loan is settled and trust owed the couple R450,000 • Market value of house is R920,000 • Improvements to house over 15 years cost R50,000 • In Dec 2010 the house is distributed to the couple and trust is terminated 85 Transfer of Residence From Co. or Trust (para 51A of Eighth Schedule) Example 1 (cont.) • Termination does not give rise to CGT or transfer duty • R360,000 + R50,000 deemed to be spent by couple and at same dates as incurred by trust • Base cost rules applied to above as normal • Beware – how to deal with loan owing to couple? – Possibly sell house for market value and discharge loan, or – Sell house for value of loan and distribute the balance up to market value? 86 Transfer of Residence From Co. or Trust (para 51A of Eighth Schedule) Example 2 (Multi-tier structure) • Couple formed a trust in1995 – both are trustees and beneficiaries • Trust owns all the shares in a company • In 1998 the company purchased a house that is occupied by the couple • In January 2011 the company is liquidated and the house is distributed to the trust • The trust then distributes the house to the couple in March 2011 • In April 2011 the couple make an application to the court for the revocation of the trust 87 Transfer of Residence From Co. or Trust (para 51A of Eighth Schedule) Example 2 (cont.) • Transfer of house from company to trust qualifies for relief • Transfer of house from trust to the couple qualifies for the relief • Beware – how to deal with loans owing to the couple on revocation of the trust?! Possibly sell the house out of the trust?! 88 Advanced Tax Rulings (s 76E) • ATR in place since 2006 • Now only available to compliant taxpayers 89 Islamic Financing (s 24JA of IT Act, s 3A of Transfer Duty Act, s 8A of the VAT Act and s 8A of the STT Act) • Involves financial transactions and instruments that comply with Islamic law • Principles – Prohibition of interest – Removal of asymmetrical info and encouragement of full disclosure in contracts – Risk-sharing (sharing profit and loss), and – Financial transactions must be linked to a real economic transaction 90 Islamic Financing (s 24JA IT Act, s 3A of Transfer Duty Act, s 8A of the VAT Act and s 8A of the STT Act) • Provisions added to the various tax Acts to place Islamic finance on equal footing with traditional western finance • Three arrangements with banks have been covered: – Mudaraba (Investment or transactional account ) – Murabaha (Asset finance similar to instalment sale) – Diminishing Musharaka (Partnership arrangement for project financing) 91 Estate Duty (s 4A(6) of the Estate Duty Act) • Portable spousal abatement • S 4A(6) added to clarify how to deal with simultaneous death – The person with the smallest net value of the estate is deemed to die first – Any unused portable spousal deduction then shifts to the other deceased spouse 92 VAT (s 10(5A) and s 18(4)) • Micro businesses – Vendor opting into the turnover tax system must first deregister for VAT – Deregistration triggers output VAT on assets – To ease cash-flow R100,000 of the deemed supply can be excluded, clarity now that this is a max amount – R100,000 (VAT portion = R12,280) claw-back of input VAT claimed on re-entry into the VAT system has been deleted 93 VAT (s 8(2) and 22(3)) • Debt-burdened assets on cessation of an enterprise – Deemed supply of all assets- s8(2) – Deemed supply of unpaid debts- s22(3) – Double charge removed for debt-burdened assets – Only s22(3) will apply 94 VAT (s 8(2) and 22(3)) • Example – Vendor purchases an asset for R114,000 on credit on 1 Oct 2011 – Claimed input tax of R14,000 – 1 May 2012 he closes down his business not having paid the debt of R114,000 95 VAT (s 8(2) and 22(3)) • Example (cont.) – The vendor is not liable for s8(2) output VAT for the asset on cessation the business – He is liable for output VAT only in terms of the s22(3) ‘claw-back’ provision on unpaid debts (14/114 x R114,000 = R14,000) 96 VDP • Programme to encourage taxpayers to disclose defaults and regularise their tax affairs • Open 5 Nov 2010 to 31 Oct 2011 • Only penalties and interest will be waived • Full amount of tax will remain payable 97 VDP • Person can apply (s3(1)), unless – He is aware of a pending audit or investigation into his affairs, or – An audit or investigation has commenced but has not yet been concluded • But Commissioner may still allow application (s3(2)) – The default for which voluntary disclosure will be made would not have been detected during the audit or investigation, and – App would be in interest of good management of the tax system and best use of his resources 98 VDP • Requirements for valid voluntary disclosure – Voluntary – Involve a default – Be full and complete in all respects – Involve the potential application of a penalty or additional tax for the default – Must not result in a refund – Application must be made on the prescribed form – Must be made between 5 Nov 2010 and 31 Oct 2011 – Be for a default that occurred prior to 17 February 2010 99 • No-name voluntary disclosure VDP – Commissioner may issue a non-binding private opinion on a person’s eligibility for relief. – Application can be made on a no-name basis • Relief – Commissioner will not pursue criminal prosecution – 100% relief for penalty and additional tax (excluding: s75B admin penalty for late submission and a late payment penalty imposed in terms of any other provision of the Act) – Interest relief • 100% for s3(1) applicant • 50% for s3(2) applicant 100 VDP • Voluntary disclosure agreement – Relief evidence in a written agreement – Details in agreement • Material facts of the default • Tax payable and interest payable • Arrangements and dates of payment • Treatment of the issue in future years • Relevant undertaking by the parties • Withdrawal of relief – Failure to make a material disclosure • Assessment to give effect to agreement – SARS will issue an assessment on conclusion of agreement – This assessment is not subject or objection or appeal 101 Tax Administration Bill (TAB) • First announced in 2005 • Duplication of generic administrative provisions contained in all the Acts administered by SARS • Project to incorporate into one piece of legislation these administrative provisions • TAB prelim step to re-writing the entire IT Act 102 Tax Administration Bill (TAB) A few highlights • New framework of decision making – serious powers only dealt with at a senior level and limit discretion at lower levels of administration • Tax Ombud’s office created to remedy failure by SARS to respect taxpayer rights • Single taxpayer registration for all taxes • Single taxpayer account with a rolling-balance • Extended 3rd party info gathering powers for pre-population • Penalty provisions standardised across the Acts, additional tax of up to 200% now clearly prescribed • Permanent VDP with relief from penalties 103 Thank-you Fasset Call Centre 086 101 0001 www.fasset.org.za 104