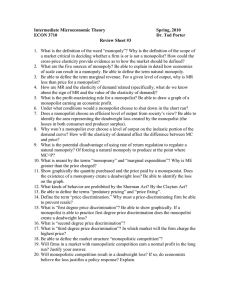

Mid-term 2013

ECO 2145 – MICROECONOMIC THEORY II

MID-TERM EXAMINATION

OCTOBER 24, 2013

Professor Vicky Barham

NOTE: You have the right to use a calculator (as long as it is not a part of your cell phone or other electronic device). No reference to textbooks or other reference materials is permitted.

TRUE/FALSE (10 points). Indicate whether the statement is true, false or uncertain, and provide a one (or two) sentence explanation. Your grade is based on the quality of your explanation. Remember that you should spend no more than 2 minutes on each of these questions.

1.

The difference between a perfectly competitive firm and a (uniform price) monopolist is that whereas a perfectly competitive firm chooses its output level so that price equals marginal cost, a monopolist chooses its output level so that marginal revenue equals marginal cost.

2.

Monopolists earn more profits than do perfectly competitive firms because they are more efficient producers, and consequently social welfare is higher.

3.

Firms with a high advertising elasticity of demand have no need to spend money on advertising.

4.

At the Stackelberg equilibrium in a homogeneous goods market (where both firms choose quantities), both firms earn more than in the Cournot-Nash equilibrium because they can observe what the rival’s choice of strategy is.

5.

A non-cooperative game that has a dominant strategy equilibrium may have more than one equilibrium.

PROBLEMS (30 points). Please solve the following problems. Show all of your work. You should spend no more than 20 minutes answering each question.

6.

Suppose a monopolist producing Q units of output faces the demand curve P = 20 −Q.

Its total cost when producing Q units of output is TC = F + Q 2 , where F is a fixed cost. For what values of F can a profit-maximizing firm charging a uniform price earn at least zero economic profit? For what values of F can a profit-maximizing firm engaging in perfect first-degree price discrimination earn at least zero economic profit? Calculate the deadweight loss associated with uniform price monopoly. What is the deadweight loss associated with first-degree price discrimination?

[1]

7.

(This question is easier than it looks, and I am going to take you by the hand so that you can solve it.) Suppose that a monopolist who can prevent resale faces not two but N distinct types of consumers. For each type of consumer, the inverse demand curve depends on the price charged, i.e., for each type i, i = 1,…N, Q i

= Qi (Pi). The monopolist’s cost of production depends, however, on the total quantity sold: C(Q) =

C(Q

1

+ Q

2

+ … + Q

N

).

(i) Write down the monopolist’s profit function

(ii) Derive the first-order conditions for profit maximization, assuming that the monopolist is practicing third-degree price discrimination.

(iii) Show that when the monopolist chooses the price optimally for each market, the inverse elasticity pricing rule must be satisfies on each market.

(iv) If the elasticity of demand is higher on for type j consumers than for type k consumers, which consumers pay the higher price? (You can answer this even if you could not solve the previous parts of the problem.)

(v) If the monopolist were not able to price discriminate, and N was equal to 3, with the price elasticity of demand highest for type 1 consumers, and lowest for type

2 consumers, would you expect the market price to be higher or lower than the price charged to type 1 consumers? To type 2 consumers? To type 3 consumers?

Why? (No calculations are required.)

8.

The market demand curve in the market for gasoline is given by Q = A − bP, where Q is the quantity demanded per month and P is the market price in dollars. Suppose there are two identical firms in this industry, Firm 1 and Firm 2. Suppose that each has the cost function C(Q i

) = c i

Q, where i = 1,2. Note that c

1 may be different from c

2 .

a.

Calculate the Cournot-Nash equilibrium prices, quantities. b.

Calculate the Stackelberg prices, quantities if firm 1 is the Leader. c.

Would these firms be more profitable if they competed in prices? Explain.

(Calculations are not required.)

[2]