Mod 49 - Consumer and Producer Surplus

advertisement

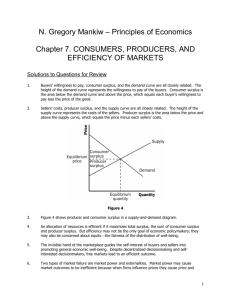

Consumer and Producer Surplus SECT. 9: CONSUMER CHOICE Consumer and Producer Surplus Consumer Surplus Willingness to pay Maximum price at which you would for a good, based on its utility, is the willingness to pay. Knowing consumer surplus allows us to know how changes in price affect the welfare of consumers Three types of Consumer Surplus: Individual Consumer Surplus Total Consumer Surplus The net gain EACH buyer achieves for themselves, from the purchase of a good. The sum of individual consumer surpluses by all buyers of a good Price Changes and Consumer Surplus Consumer and Producer Surplus Two types of Consumer Surplus: Individual Consumer Surplus The net gain EACH buyer achieves for themselves, from the purchase of a good. Total Consumer Surplus The sum of individual consumer surpluses by all buyers of a good Consumer and Producer Surplus Why a cost? OPPORTUNITY COST… the person selling a used book, for example, will lose the book from their collection. Krugman reminder: The true measure of “cost” is opportunity cost, or choice. Two types of Producer Surplus: Individual Producer Surplus- The net gain each seller receives from the sale of a good Total Producer Surplus- Total net gain to all sellers in the market. Consumer and Producer Surplus c. The term “consumer surplus” usually applies to both, and is often used interchangeably. The total consumer surplus at a given price is the area BELOW the demand curve, but above the price *The demand curve is stepped, as there are only a FEW potential buyers!!!! Figure 49.7 Producer Surplus in the Used-Textbook Market Ray and Anderson: Krugman’s Economics for AP, First Edition Copyright © 2011 by Worth Publishers Consumer and Producer Surplus Consumer and Producer Surplus Price Changes and Consumer Surplus Each price change (up or down), can lead to an increase, or decrease in consumer surplus. The quantity demanded of a product changes with price? Correct? This will affect consumer surplus (individual and total) Consumer and Producer Surplus Consumer and Producer Surplus Producer Surplus Cost and Producer Surplus Cost- the LOWEST price at which a potential seller is willing to sell. Consumer and Producer Surplus Why pay taxes? Consumer and Producer Surplus Efficiency and Deadweight Loss In a market, there are gains to be made from trade. Producers AND consumers benefit, and the efficiency of a market, the point where no one can be made better off without making others worse, is the reason why. Efficiency Can you improve on a market? Many have tried. Consumer and Producer Surplus Reallocate consumption? Reduces consumer surplus, takes items away from someone how values them more, and gives them to consumers who value these items less. Reallocate sales among sellers? Increases total cost and reduces producer surplus Changes in Quantity traded? Shortages and Surpluses! Consumer and Producer Surplus If market is at equilibrium, there is no way to increase gains from trade! HOWEVER… Any other outcome reduces total surplus Just because a market is efficient does not mean it is fair. Equity Also, markets sometimes fail, and fail to deliver efficiency. (no longer maximizing total surplus) Consumer and Producer Surplus Equity and Efficiency Society does care about what is fair, and markets can not always fill this need. MUST sacrifice efficiency for fairness in some cases. Taxes Progressive Regressive Proportional (flat) Excise (sales) Consumer and Producer Surplus Excise Tax on Quantities and Prices Tax imposed on hotel owners Consumer and Producer Surplus Tax imposed on consumers. Tax incidence- WHO really pays the tax? And how much? Consumer and Producer Surplus Elasticity and effect on tax incidence When consumers pay most of the tax! Consumer and Producer Surplus When producers pay most of the tax! Consumer and Producer Surplus Benefits of Taxation Revenue (Tax per unit) X Qd= Tax Revenue Consumer and Producer Surplus Costs of Taxation Deadweight Loss Prevents mutually beneficial transactions… Like a quota, creates deadweight loss. Consumer and Producer Surplus Other Specific Costs: Administrative- not shown in deadweight loss, but how much does it cost to collect the tax, and pay for it? Alternatives? Lump-sum tax example- Fair? (same for all) British poll taxes NO… unfair. BUT, incredibly efficient Value Added Taxes (VAT)? Some claim fair and efficient EX: Carbon Taxes