swfa2013_submission_120

advertisement

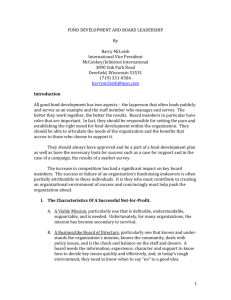

Abstract Are powerful CEOs better at responding to industry-wide downturns? Concentrating decisionmaking power in the CEO may facilitate a rapid response. However, a powerful CEO is less likely to receive independent advice or to have decisions scrutinized, potentially diminishing the quality of decisions made. We investigate the relation between CEO power and decision-making under pressure by examining firm performance when industry conditions deteriorate. We focus on industry downturns since these represent an exogenous ‘shock’ to the firm’s environment. We identify three settings where the net effect of CEO power is likely magnified: when the firm is innovative, when the industry is characterized by high managerial discretion and when the industry is competitive. In these settings powerful CEOs perform significantly worse than other CEOs during industry downturns. 1 INTRODUCTION There is considerable heterogeneity in the decision-making authority of CEOs across firms. Attributes such as tenure, status as founder or as a significant owner and formal positions such as board chairman help determine the level of CEO power. The power a CEO wields can have significant consequences for firms, which raises the question of how much decision-making power should be vested in a CEO. The answer to this is likely to be contextual: the level of CEO power that is appropriate may depend on factors such as the nature of the firm’s industry, investment opportunities and competition. A potential advantage of concentrating decisionmaking power is that the CEO may be able to make quicker decisions. On the other hand a powerful CEO may act more unilaterally with less input from the board or other managers, resulting in lower quality decisions. We explore the impact of CEO power on firm performance by focusing on settings in which CEO power is likely more consequential and relatively rapid decisions may be required. Overall, our finding is that in such settings the benefits of a dispersed power base outweigh the costs. No single definition exists for CEO power but a common thread in the literature is the CEO’s ability to overcome resistance and consistently influence key decisions within a firm (Haleblian and Finkelstein, 1993; Pfeffer, 1997; Adams, Almeida, and Ferreira, 2005). The determination and evolution of a CEO’s power is recognized to be an endogenous process. For instance, the CEO’s ability relative to alternative managers that the firm could hire likely impacts the bargaining process between the CEO and the board (Hermalin and Weisbach, 1998). It is also possible that prior firm performance impacts the level of a CEO’s power such that if a firm performs well under the CEO, the firm grants the CEO greater power (Daily and Johnson, 1997). Endogeneity thus makes it difficult to distinguish the impact of CEO power from the 2 characteristics of CEOs that may enable them to acquire power in the first place. To circumvent this, we focus on ‘shocks’ to an industry (i.e. significant industry downturns). The notion is that such downturns are outside the control of any one firm or CEO. This allows us to draw conclusions relating to the impact of CEO power on firm value, at least under conditions of economic stress. How well powerful CEOs fare is an empirical question: while the need for urgent decisions could play to the strength of powerful CEOs, the lack of independent advice may diminish the quality of those decisions. We focus on three separate settings in which the actions of CEOs are especially likely to affect firm outcomes. The first setting is innovative firms. CEOs have unparalleled firm-specific knowledge and this may be particularly important to innovative firms.1 The second setting we focus on is industries with greater managerial discretion. The characteristics of a firm’s environment affect the level of managerial discretion and thus the influence managers have on firm outcomes (Finkelstein and Hambrick, 1996). The third setting we investigate is competitive industries. The consequences of CEO decisions are likely more severe in such a setting as competition ensures any missteps by CEOs are penalized. The impact of CEO power on firm value has seen much empirical study and the findings have been mixed, possibly reflecting the endogeneity of CEO power and firm value. Using board independence as a measure of power, some studies find a negative relation between board independence and firm value or no relation at all.2,3 While other studies find that independent 1 Brickley, Coles, and Linck (1999) make a similar argument for information-sensitive firms. Fama and Jensen (1983) argue that specific information is detailed information that is costly to transfer and the literature has argued that innovative firms and R&D-intensive firms have more specific information unknown to outsiders (see Harris and Raviv, 1991; Graham and Harvey, 2001). 2 In general, independent directors have two functions, monitoring and advising. Monitoring guards against harmful behavior, and advising provides input on strategy. Maug (1997) finds it is not optimal for firms with high information asymmetry to invite monitoring from independent directors because it is costly for the firms to transfer firm-specific information to outsiders. 3 boards add value in certain circumstances.4 For example, Coles, Daniel, and Naveen (2008) find a positive relation for larger, more diversified firms, the idea being that outside directors provide valuable advice to the CEO and management team. For entrepreneurial firms, Daily and Dalton (1992, 1993) find a positive relation between board independence and financial performance. We focus on shocks to an industry to deal with endogeneity and focus on settings where the consequences of CEO power are greater in order to better understand the impact of CEO power on firm value. The literature has measured CEO power in other ways. Bebchuk, Cremers, and Peyer (2011) argue that the CEO’s pay relative to other top executives within the firm reflects the relative importance of the CEO as well as the extent to which the CEO is able to extract rents. They find this measure of power is associated with lower firm value. Using the CEO’s concentration of titles and founder status as measures of power, Adams, Almeida, and Ferreira (2005) document stock returns are more volatile for firms run by powerful CEOs. However, the empirical evidence of founder impact on firm value is mixed. For example, Fahlenbrach (2009), Amit and Villalonga (2006) and Adams, Almeida, and Ferreira (2005) find that foundermanaged firms have higher values whilst Yermack (1996) finds that such firms have lower values. Using the framework of Finkelstein (1992), we construct a composite measure of CEO power that incorporates each of the above variables along with ownership, tenure and board independence. 3 Agrawal and Knoeber (1996), Yermack (1996), Rosenstein and Wyatt (1997), Klein (1998), Bhagat and Black (2002), Adams (2009), amongst others, find a negative relation between board independence and firm value. Baysinger and Butler (1985), Hermalin and Weisbach (1991) and Mehran (1995) find no relation at all. See Dalton, Daily, Ellstrand and Johnson (1998) for a meta-analytic review. 4 See, amongst others, Weisbach (1988), Borokhovich, Parrino, and Trapani (1996), Brickley, Coles, and Terry (1994), Byrd and Hickman (1992) and Cotter, Shivdasani, and Zenner (1997). 4 Several studies of CEO power focus on computer-related industries and the results are mixed. Haleblian and Finkelstein (1993) find firms with dominant CEOs performed worse in the computer industry than in the natural gas distribution industry compared with firms that have a more balanced power distribution. Their finding is consistent with Eisenhardt and Bourgeois (1988), who find firms with dominant CEOs contributed to poor performance in the microcomputer industry (Eisenhardt and Bourgeois’ sample comprised eight firms). In contrast, a recent study by Dowell, Shackell, and Stuart (2011) argues CEO power is beneficial for firms facing a crisis. They focus on the survival rate of internet firms during the upheaval period spanning 2000-2002 and find that more independent and smaller boards increase a firm’s probability of survival when the firm’s level of financial distress is high. However, when using a broader measure of CEO power they find weaker (insignificant) results. A drawback of such studies is that the results may not generalize since the studies mainly focus on a relatively small number of firms from one or two industries. We employ a more general setting and explore how CEO power impacts firms during an industry-wide downturn. We find, in each of the settings we explore, that CEO power has a negative effect on firm value and performance when the industry it operates in experiences a negative shock. As a prelude, Figure 1 focuses on two particular industries where one might expect the impact of CEO power to differ substantially, Computer and Petroleum and Natural Gas (Haleblian and Finkelstein, 1993). We plot the impact on firm value and performance indicated by the average change in the Market-to-Book ratio (ΔM/B) and the average change in the Return-on-Assets ratio (ΔROA) during shock years for firms in these industries. Before computing the average change, we demean the variables for comparison purposes. Figure 1 plots the average change for 5 powerful versus non-powerful CEOs for each industry.5 As is evident, firms with powerful CEOs appear to perform much worse in the Computer industry during shock years relative to less powerful CEOs. On the other hand, for the Petroleum and Natural Gas industry where managerial discretion is less, the performance of powerful CEOs is similar to that of other CEOs. As we shall see shortly, this finding extends to a much more general setting. ‘Insert Figure 1 here’ THEORY AND HYPOTHESES Whether CEO power matters for firm performance is an open question given there exist both costs and benefits. From an agency cost perspective, if power allows CEOs to become entrenched then power can have a negative effect on performance. Even without agency costs, a potential downside of CEO power is that the decision-making process can be sub-optimal. Experimental evidence suggests that groups can outperform individuals in decision-making (see Bainbridge, 2002, for a review). Having input from outside directors can also be beneficial. For example, Coles, Daniel, and Naveen (2008) find that the advisory role of outside directors is relatively more important for diversified firms. On the other hand, to the extent that firms with powerful CEOs can act relatively quickly, CEO power can have a positive impact on performance (Finkelstein and D’Aveni, 1994; Boyd, 1995; Harris and Helfat, 1998; Coles, Daniel, and Naveen, 2008). Thus, the net effect of CEO power on firm performance is not clear. The impact of CEO power may be most prevalent during times of industry turmoil. In normal times, it is possible the net effect is insignificant but in turbulent times the benefit (or 5 The definitions of shock years, M/B, ROA and powerful CEOs will be discussed in the RESEARCH METHOD section. 6 cost) of a dispersed power base may become important.6 As Haleblian and Finkelstein (1993) point out, firms in turbulent environments can benefit more from increases in top managerial inputs than firms in stable environments due to a balanced power distribution facilitating information sharing and idea exchange (see also Eisenhardt and Bourgeois, 1988). We focus on industry downturns as these are exogenous in the sense of being outside the control of any one firm or CEO. Within these downturns we investigate three settings where the net effect of CEO power is likely magnified. The first is innovative firms, the second is industries characterized by managerial discretion and the third is competitive industries. In each case the decisions of the CEO are pivotal as the impact on firm value and performance is presumably greater in such settings. CEO power, innovativeness and shocks The actions of CEOs are especially likely to affect firm outcomes in innovative firms (see Daily, McDougall, Covin, and Dalton, 2002, who make a similar argument for entrepreneurial firms). Ranft and O’Neill (2001) cite examples where CEOs of innovative firms fail to see reasonable threats in their competitive environments until too late, isolating themselves from the advice of others and becoming myopic in their views. This is potentially compounded when the CEO has greater power. For innovative firms facing a market downturn, the benefits of a dispersed power base may become vital. For example, outside directors may be able to provide expertise and experience that complements the CEO’s knowledge of the firm, which can be especially important during industry-wide downturns. This leads to the following prediction: 6 As Coles et al. (2008) point out, changing CEO power involves significant costs resulting in CEO power being somewhat persistent. 7 Hypothesis 1: CEO power will have a negative effect on firm value and performance for innovative firms when the industry it operates in experiences a negative shock. The impact of managerial discretion Managerial discretion, or latitude of action, varies from industry to industry as the characteristics of a firm’s environment affect the level of managerial discretion and thus how much influence managers have on firm outcomes (Finkelstein and Hambrick, 1996).7 To the degree that power grants CEOs the ability to act unchallenged (i.e. without necessarily consulting with or taking advice from others), the consequences of CEO power is magnified in environments where the impact of any decision is greater. Thus, as with innovative firms, we expect the effect of CEO power on firm value during shock years to be more pronounced in industries where managerial decision-making faces fewer constraints. To the extent that decision-making is sub-optimal in such situations, we have the following prediction: Hypothesis 2: CEO power will have a negative effect on firm value and performance for firms in industries characterized by greater managerial discretion, when the industry it operates in experiences a negative shock. The impact of competition Aldrich (1979) proposes that strategic decisions are made more frequently in high complexity (competitive) environments relative to low complexity (concentrated) environments. While CEO power enables quicker decisions, it does not necessarily follow that CEO power enables better 7 Hambrick and Finkelstein (1987) specify seven environmental forces that determine the degree of managerial discretion within an industry and Hambrick and Abrahamson (1995) construct an industry discretion rating from these factors. 8 quality decisions. In a competitive market, the consequences of managerial decisions are more severe than in a concentrated market as there is less room for error. For example, product differentiation or barriers to entry insulate a firm in a concentrated industry relative to a competitive industry thus enabling firms to be somewhat shielded from poor decisions. To the extent that decision-making is sub-optimal in such situations, we have the following prediction: Hypothesis 3: CEO power will have a negative effect on firm value and performance for firms in competitive industries when the industry it operates in experiences a negative shock. RESEARCH METHOD Sample We begin with the universe of firms contained in the S&P Execucomp database spanning the years 1992 to 2009. As is standard in the literature, we exclude regulated industries such as utilities and financials (SIC codes 4900-4949 and 6000-6999). We identify CEOs using the ‘CEOANN’ variable in Execucomp. For firm financial information, we intersect the Execucomp dataset with Compustat and for firm share price information, we intersect the dataset with CRSP. To obtain information on the board of directors we intersect our sample with the Investor Responsibility Research Center (IRRC) and RiskMetrics databases. Our sample consists of 3,724 CEOs in 2,097 unique firms during the period 1992 to 2009, covering a total of approximately 17,600 firm-years. Model and dependent variable 9 We have a panel dataset and since unobservable firm characteristics are likely to affect firm value and performance, we estimate firm fixed-effect models using each firm’s change in market value or performance as the dependent variable. Fixed-effect models are an unbiased method of controlling for omitted variables in panel datasets (Hausman and Taylor, 1981). We also include year dummies in our models and importantly, we use industry shocks as our setting for investigating the impact of CEO power on value, thus reducing concerns regarding endogeneity. Moreover, the change in performance can be more directly related to the shock as absolute measures of post shock performance more likely reflect enduring performance effects carried over from the pre-shock period (Datta and Rajagopalan, 1998). As we discuss later, our results are robust to using industry-adjusted measures and to various econometric techniques. Change in market-to-book ratio (∆M/B) Our primary measure of valuation impact is the change in Market-to-Book ratio, ∆M/B, where the Market-to-Book ratio (M/B) is defined as the market value of common equity plus the book value of assets minus the book value of common equity, all divided by the book value of assets. 8 The Market-to-Book ratio is a common valuation metric used in the literature (see, for example, Bebchuk, Cremers, and Peyer, 2011; Crossland and Hambrick, 2011). Change in return on assets (∆ROA) As a secondary valuation impact measure, we use the change in Return on Assets, ∆ROA, where Return on Assets (ROA) is computed as earnings before interest, taxes, depreciation and amortization (EBITDA) divided by the book value of assets. Although this is a common We compute the change in the Market-to-Book ratio, ∆M/B, yearly as M/Bt – M/Bt-1 where the ‘t’ subscript represents the year the ratio is computed. 8 10 performance metric used in the management literature, we note that it is also one more prone to manipulation by a firm’s executives.9 In contrast, it is much more difficult for a CEO to manipulate the firm’s market price. Thus, we treat the ∆ROA measure as a secondary measure to the ∆M/B measure. Main independent variables CEO power We utilize the framework of Finkelstein (1992) to measure CEO Power.10 We construct a summary index of CEO power based on seven variables: CEO Pay Slice (CPS), Duality, Triality, Tenure, Ownership, Dependent Directors and Founder. Each variable is described more fully below. We use CEO Pay Slice (CPS), Duality, Triality and Dependent Directors to measure structural power, Ownership and Founder to measure ownership power and Tenure to measure expert power. For each continuous variable we construct an indicator variable that takes the value one if it is above the sample median and zero otherwise. For each discrete variable (Duality, Triality, Founder), an indicator variable takes the value one if the associated characteristic is met and zero otherwise. The power index, CEO Power Index, is the sum of each of the indicator variables and thus ranges from 0 to 7. A higher index value indicates greater CEO power. CEO Pay Slice (CPS): Bebchuk et al. (2011) construct a variable they term the CEO Pay Slice (or CPS for short) defined as the CEO’s total compensation as a fraction of the total 9 There is a large accounting literature documenting earnings management. See Dechow, Ge, and Schrand (2010) for a recent review. 10 Finkelstein (1992) argues that CEO power has four dimensions: structural, ownership, expert and prestige. The last of these dimensions is often measured using the CEO’s educational background. This information is not easily accessible given our sample size so we deviate from Finkelstein by excluding this dimension. Tang, Crossan, and Rowe (2011) also drop this dimension arguing it is not a proximal measure of executive power when compared with the other dimensions. 11 compensation for the firm’s top five executives.11 Bebchuk et al. argue that the CPS could reflect the relative importance of the CEO as well as the extent to which the CEO is able to extract rents. We construct CPS in a similar manner; greater values of CPS indicate greater CEO power. We create an indicator variable that takes the value one if CPS is above the sample median. Duality and Triality: There is a large literature that uses the concentration of titles vested in the CEO as a measure of CEO power (Adams et al., 2005; Pathan, 2009; Morse, Nanda, and Seru, 2011, amongst others). We create two indicator variables to reflect the concentration of titles. Duality is an indicator variable that takes the value one if the CEO is also the Chair of the company’s board of directors. Triality is an indicator variable that takes the value one if in addition to the CEO serving as Chair of the company’s board of directors the CEO also has the title of President of the firm. Both Duality and Triality indicate that the CEO has greater power. Tenure: CEO tenure increases the CEO’s influence over the board and thus increases CEO power (Linck, Netter, and Yang, 2008). We determine CEO tenure by utilizing the ‘BECAMECEO’ variable in Execucomp. We create an indicator variable that takes the value one if CEO tenure is above the sample median. Ownership: Greater CEO stock ownership reduces the influence of the board and enables the CEO to exercise more discretion in making decisions, thus increasing CEO power (Finkelstein, 1992; Fischer and Pollock, 2004). Using Execucomp, we determine the CEO’s stock ownership and construct an indicator variable that takes the value one if the CEO’s ownership is above the sample median 11 Total compensation comprises the following: Salary, Bonus, Other Annual, Total Value of Restricted Stock Granted, Total Value of Stock Options Granted (using Black-Scholes), Long-Term Incentive Payouts, and All Other Total in Execucomp’s 1992 reporting format and Salary, Bonus, Non-Equity Incentive Plan Compensation, GrantDate Fair Value of Option Awards, Grant-Date Fair Value of Stock Awards, Deferred Compensation Earnings Reported as Compensation, and Other Compensation in Execucomp’s 2006 new reporting format. 12 Founder: CEOs that are also founders are likely to be more powerful (Adams et al., 2005; Morse et al., 2011, amongst others). We consider a CEO as a founder of the company if the CEO is a founder, a descendant of the founder, or served as CEO from inception. 12 We construct an indicator variable, Founder, that takes the value one if the CEO is also the founder. Dependent Directors: The higher the proportion of dependent directors on the board, the more likely the CEO can exert influence over the board (Morse et al., 2011). To identify board members, we use the IRRC database from 1996 to 2006 and the RiskMetrics database from 2007 to 2009. As is common when using these databases, in years not covered by either database we backfill the data using the closest year following the missing observation (Gompers, Ishii, and Metrick, 2003; Bebchuk, Cohen, and Ferrell, 2009). We construct an indicator variable that takes the value one if the proportion of dependent directors for the firm is above the sample median CEO Power: The CEO Power Index is the sum of each of the indicator variables listed above. We construct an indicator variable, CEO Power, that takes the value one if the CEO Power Index is above the sample median and zero otherwise. Industry shock identification Using each firm’s primary four digit SIC code, we assign firms to one of 49 Fama and French (1997) industry classifications.13 We define an industry shock as a five percent or greater 12 We thank Murali Jagannathan for providing this data. The Fama and French (1997) industry classifications were developed to address some of the problems with SIC codes caused by changes in the variety and growth of products and services, shifts in technology and the makeup of businesses (Clarke, 1989). The Fama and French industry classifications sort four-digit SIC codes into industry groups that are more likely to share common risk characteristics (Bhojraj, Lee, and Oler, 2003). The original classification scheme sorted SIC codes into 48 industry groups but was later extended to 49 industry groups. The Fama and French industry classifications are widely used in the financial economics literature (see Chan, Lakonishok, and Swaminathan, 2007, for a partial list). 13 13 decrease in aggregate industry sales.14 Our definition of an industry shock is similar to that of Mitchell and Mulherin (1996) in that industry shocks are based on industry sales activities. We also try measures based upon industry market returns and industry market excess returns and find similar results. With a five percent cut-off, we identify a total of 60 industry shock years distributed across 30 industries over our sample period (see Table I – Panel D). Not surprisingly, there are a number of industry shocks during the years 2001, 2002 and 2009 when the overall economy was doing poorly. Importantly, our results are robust to excluding these years. Three Settings: Innovative Firms, Managerial Discretion and Industry Competition Innovative firms Our first measure of innovation is the Research and Development (R&D) ratio, RD, defined as the ratio of R&D expenses to the lagged value of total assets. As is common in the literature, if R&D expense is missing we set RD to zero and set a RD Missing dummy to one. Our second measure is the number of patents a firm registers in a given year.15 Managerial discretion We use Hambrick and Abrahamson’s (1995) industry discretion ratings to classify industries into high- and low-discretion categories. In order to increase the matches with our data we follow Adams, Almeida, and Ferreira (2005) and average Hambrick and Abrahamson’s measures by two-digit SIC code. As an alternative measure, we also perform our tests on two industries the 14 When determining industry sales, we ensure there are at least five firms within an industry. We also try a 10 percent cut-off and find our results are robust. 15 We obtain data on patents from the NBER data patent project through Bronwyn H. Hall’s website (http://elsa.berkeley.edu/users/bhhall/pub/data/). 14 literature has argued are at polar ends of managerial discretion, Computer and Petroleum and Natural Gas (Haleblian and Finkelstein, 1993). Industry competition For our measure of competition we use the Herfindahl Index, defined as the sum of the squared market shares for all firms in an industry group. The Herfindahl Index ranges from 0 to 1 where a score approaching zero reflects pure competition and a score approaching 1 reflects only a few competitors in an industry (a concentrated industry). We also use the market share captured by the largest four firms in an industry as a measure of competition, the smaller the share the more intense the competition. Control variables We control for the following firm-specific variables the prior literature finds important for determining valuation and performance: Firm Size is the log of the firm’s market capitalization (share price times shares outstanding); Capital Expenditure (CapEx) is the ratio of capital expenditures to total assets; Leverage is the ratio of long-term debt to total assets and Volatility is the standard deviation of a firm’s daily stock returns over the previous year. We also include year dummies as well as time-invariant firm heterogeneity using firm fixed-effects. RESULTS Table 1 presents descriptive statistics for our variables. In Panel A we report our sample firm characteristics. The average firm size is almost $6 billion (median $1.4 billion) since Execucomp generally tracks the largest 1,500 listed firms. Our sample period covers two major market-wide 15 downturns (sub-periods 2000-2002 and 2008-2009) and this is reflected in the average change in ROA being slightly negative (median is zero). In more than half our firm years there is some level of R&D reported. With our shock definition of a five percent or greater decrease in aggregate industry sales, seven percent or our firm years are identified as shock years. In Panel B we report our sample CEO characteristics. The CEO is also the chairman 63 percent of the time, the founder 24 percent of the time, has an average tenure of 8 years and owns a little more than two percent of the firm (median ownership is 0.4%). The 38 percent average CEO Pay Slice we report is similar to that reported in Bebchuk et al. (2011). In Panel C we report the descriptive statistics for our CEO Power Index. The index ranges from 0 to 7 with a mean slightly above 3 (median is 3). Finally, in Panel D we report the industries that experienced shocks along with the frequency of shocks for each industry. As is evident, a broad cross-section of industries experience shocks during our sample period. ‘Insert Table 1 here’ In Table 2 we report the correlations between each of our variables. From Panel A we see that among the independent variables, most of the correlations are less than 20 percent in absolute terms with the largest correlation of -42.5 percent occurring between RD and RD Missing. Thus, multicollinearity does not appear to present a significant problem for our analysis. In Panel B we report the correlations among the individual components that comprise our CEO Power Index. While almost all the components are significantly correlated with one another, 16 most correlations are relatively small.16 Overall, it appears our individual components are detecting different aspects of CEO Power. ‘Insert Table 2 here’ Table 3 presents the first set of regression results. Panel A reports regression results using the ∆M/B as the dependent variable. Model (1) contains the results incorporating the control variables and the direct effects of Shock and CEO Power. Not surprisingly, a Shock has a negative effect on valuation. It appears that our aggregate measure of power, CEO Power, does not impact changes in valuation on average. Hypothesis 1 predicts that CEO power will have a negative effect on firm value for innovative firms when the industry it operates in experiences a negative shock. To test this hypothesis we split the sample into two sub-samples based on whether the firm’s RD is above (Model 2) or below (Model 3) the sample median of firms with non-missing RD and add the interaction between Shock and CEO Power. The coefficient on this interaction term is negative and significant at the 10 percent level for Model 2 (p-value=5.8%), the sub-sample where RD is above the sample median. The coefficient on this interaction term is not significant in Model 3 where RD is below the sample median. These results are consistent with Hypothesis 1. In Model (4) we combine the two sub-samples and test Hypothesis 1 by including the triple interaction of Shock, CEO Power and RD. The coefficient on this triple interaction term is negative and significant at the one percent level (p-value<0.1%), again consistent with Hypothesis 1. In Model 5 we re-run Model (4) but replace ∆M/B with ∆ROA as the dependent variable. The coefficient on the triple interaction term is negative and significant 16 The majority of correlations are less than 20 percent in absolute terms. Not surprisingly, the largest significant correlation is between Founder and Ownership (r = 50.7%). 17 at the one percent level (p-value=0.8%), again consistent with Hypothesis 1. Thus, the results from Models 2, 3, 4 and 5 are all supportive of Hypothesis 1. In Panel B we repeat the regressions from Panel A but now use the number of Patents as our measure of firm innovativeness.17 Model (1) contains the results incorporating the control variables and the direct effects of Shock and CEO Power and again it appears CEO Power does not impact valuation on average. We split the sample into two sub-samples based on whether the firm’s Patents is above (Model 2) or below (Model 3) the sample median of firms with nonmissing Patents and add the interaction between Shock and CEO Power. The coefficient on this interaction term is negative and significant at the one percent level for Model 2 (p-value<0.1%) but not significant in Model 3, again consistent with Hypothesis 1. In Model (4) we combine the two sub-samples and test Hypothesis 1 by including the triple interaction of Shock, CEO Power and Patents. The coefficient on this interaction term is negative and significant at the one percent level (p-value<0.1%), consistent with Hypothesis 1. In Model 5, we re-run Model (4) but replace ∆M/B with ∆ROA as the dependent variable. Here the coefficient on the triple interaction term is not significant. Overall, the results from Panel B are supportive of Hypothesis 1. ‘Insert Table 3 here’ Table 4 reports the next set of regression results. Hypothesis 2 predicts the effect of CEO power on firm value during shock years to be more pronounced in industries where managerial decision-making faces fewer constraints. As mentioned earlier, to classify industries into highand low-discretion categories we use Hambrick and Abrahamson’s (1995) industry discretion 17 Consistent with the literature, whenever a firm is not reported in the patents dataset, we set the number of patents to zero and a Patents Missing dummy to one. As the patents dataset ends in 2006, the sample size decreases by over 3,000 observations. 18 ratings. We average Hambrick and Abrahamson’s measures by two-digit SIC code to classify the industries associated with our sample firms into high (above median) and low (below median) discretion categories.18 In Model (1) of Panel A we repeat the corresponding model from Table 3 but add the dummy variable Industry Discretion which takes the value one when the industry discretion rating is above the sample median. Neither CEO Power nor Industry Discretion load significantly. To test the effect of CEO power on firm value during shock years for high-discretion industries, we split the sample into two sub-samples based on whether the firm’s industry discretion rating is above (Model 2 of Panel A) or below (Model 3 of Panel A) the sample median and add the interaction between Shock and CEO Power. The coefficient on this interaction term is significantly negative at the five percent level for Model 2 (p-value=2.6%), the sub-sample where the industry discretion is above the sample median. This interaction term is not significant in Model 3 where the industry discretion is below the sample median. These results are consistent with Hypothesis 2. In Model (4) we combine the two sub-samples and include the triple interaction of Shock, CEO Power and Industry Discretion. The coefficient on this triple interaction term is significantly negative (p-value=5.4%), again consistent with a more negative effect of CEO power on firm value during shock years in industries in which managers have greater discretion. Model (5) repeats Model (4) but replaces ∆M/B with ∆ROA as the dependent variable. The negative sign of the coefficient on the triple interaction term is consistent with Hypothesis 2 but is not significant. In Panel B of Table 4 we focus on two industries at opposite ends of Hambrick and Abrahamson’s (1995) industry discretion ratings, Computer and Petroleum and Natural Gas. We 18 Hambrick and Abrahamson (1995) report their measure for 71 industries based on four digit SIC codes. Even though we average Hambrick and Abrahamson’s measures by two-digit SIC code in order to increase the matches with our sample, the sample size reduces by almost 3,000 observations when compared with Panel A from Table 3. 19 do so in order to investigate whether the results hold in a much narrower setting. The Computer industry, which is often used in the literature as a setting for an industry in flux (for instance, Haleblian and Finkelstein, 1993; Eisenhardt and Bourgeois, 1988), is an example of a high managerial discretion industry whereas Petroleum and Natural Gas is an example of a low managerial discretion industry. Model (1) contains the results of incorporating the levels of each variable for the Computer industry. CEO Power does not load significantly. To test the impact of CEO power on firm value during shock years, in Model (2) of Panel B we add the interaction between Shock and CEO Power. The coefficient on this interaction term is significantly negative at the 10 percent level (p-value=7.5%). Models (3) and (4) repeat Models (1) and (2) but use the ∆ROA as the dependent variable for our measure of firm performance. The sign on the coefficient of the interaction term in Model (4) is negative as in Model (2) but not significant at conventional levels (p-value=12.7%). Models (5) through (8) repeat the analysis of Models (1) through (4) but focus on the Petroleum and Natural Gas industry. The coefficient on the interaction term is not significant in Models (6) and (8). Overall, the results from Panel B indicate the effect of CEO power on firm value during shock years is more negative for the Computer industry (a high managerial discretion industry) relative to the Petroleum and Natural Gas industry (a low managerial discretion industry). Thus, despite the significantly reduced degrees of freedom, the results are consistent with the results from Panel A. ‘Insert Table 4 here’ 20 Hypothesis 3 predicts the effect of CEO power on firm value during shock years is more pronounced in competitive industries. In Panel A of Table 5, we use the Herfindahl Index as our measure of competition. In Model (1) of Panel A we repeat the corresponding model from Table 3 but add the dummy variable Competitive which takes the value one when the Herfindahl Index is below the sample median. Neither CEO Power nor Competitive load significantly. To test the effect of CEO power on firm value during shock years for competitive industries, we split the sample into two sub-samples, Competitive industry (Model 2) or Concentrated industry (Model 3) based on the sample median of the Herfindahl Index and add the interaction between Shock and CEO Power. The coefficient on this interaction term is significantly negative at the five percent level for Model 2 (p-value=3.3%), the Competitive industry sub-sample. This interaction term is not significant in Model 3, the Concentrated industry sub-sample. These results are consistent with Hypothesis 3. In Model (4) we combine the two sub-samples and include the triple interaction of Shock, CEO Power and Competitive. The coefficient on this interaction term is negative, but not significant. Exploring this further, we find this triple interaction term is highly correlated with the interaction of Shock and Competitive. When we re-run the regression without this double interaction, the triple interaction becomes significant at the one percent level. Model (5) repeats Models (4) but replaces ∆M/B with ∆ROA as the dependent variable. The coefficient on the triple interaction term is negative and significant at the one percent level (pvalue=0.3%), consistent with Hypothesis 3. In Panel B of Table 5 we repeat the analysis of Panel A but use the market share captured by the largest four firms in an industry (Top 4) as our measure of competition. We define an industry as Competitive when the proportion of the industry sales captured by the largest four firms (Top 4) is below the sample median. Again, splitting the sample into two sub-samples we 21 find the coefficient on the interaction between Shock and CEO Power is significantly negative at the one percent level for Model 2 (p-value=2.5%), the Competitive industry sub-sample but not significant in Model 3, the Concentrated industry sub-sample. These results are consistent with Hypothesis 3. In Model (4) we combine the two sub-samples and include the triple interaction of Shock, CEO Power and Competitive. The coefficient on this interaction term is negative, but not significant. The triple interaction becomes significant at the one percent level when we re-run the regression without the interaction between Shock and Competitive (the triple interaction term is highly correlated with the interaction of Shock and Competitive). Model (5) repeats Models (4) but replaces ∆M/B with ∆ROA as the dependent variable. As in Panel A, the coefficient on the triple interaction term is negative and significant at the one percent level (p-value=0.3%), again consistent with Hypothesis 3. ‘Insert Table 5 here’ DISCUSSION AND CONCLUSIONS We investigate the relation between CEO power and firm value by examining changes in valuation caused by shocks to an industry. We identify three settings where the net effect of CEO power is likely magnified: when the firm is innovative, when the industry is characterized by high managerial discretion and when the industry is more competitive. We find CEO power has a negative effect on firm value in these settings when the industry it operates in experiences a negative shock. Overall, our results are both statistically and economically significant. For innovative firms with powerful CEOs, a shock to the industry results in, on average, a 0.3 decrease in the firm’s Market-to-Book ratio relative to a less powerful CEO (see Model 2 22 from Panel A of Table 3). Given the mean M/B of 2.85 for firms in this sub-sample, this corresponds to an 11 percent decrease in firm value (16% of the standard deviation of M/B). Using patents as a measure of innovation (Model 2 from Panel B of Table 3), the corresponding impact is a 25 percent decrease in firm value (38% of the standard deviation of M/B). For firms with powerful CEOs in high-discretion industries, a shock to the industry results in an 11 percent decrease in firm value (17% of the standard deviation of M/B). Finally, for firms with powerful CEOs in competitive industries, a shock to the industry results in, on average, a six percent decrease in firm value (10% of the standard deviation of M/B). The economic significance is slightly larger when we use the Top 4 Sales Ratio as a measure of competition (Panel B of Table 5). A potential explanation for our results is greater risk-taking behavior by more powerful CEOs. Adams, Almeida, and Ferreira (2005) find that more powerful CEOs experience greater variability in performance. Potentially then, our results could reflect powerful CEOs taking on greater risks. However, it does not necessarily follow that those risks produce worse performance on average or worse performance during shock years in particular. Indeed, Adams, Almeida, and Ferreira (2005) find no evidence that firms with powerful CEOs have on average worse performance compared with other firms. Moreover, in the regressions we have controlled for firm fixed-effects and Volatility, the standard deviation of a firm’s daily stock returns over the previous year. To the extent that firm fixed-effects and Volatility control for a CEO’s risk-taking behavior, our results are robust to this explanation. Nonetheless, to test this alternative hypothesis we investigate the impact of CEO power on firm value during positive shock years. We find powerful CEOs have no effect on firm value or performance in such years suggesting our results are not the outcome of CEO power mirroring greater CEO risk-taking behavior. 23 To investigate whether our results are robust to various measures of ‘shock’ we use a 10 percent or greater (rather than a five percent or greater) decrease in aggregate industry sales. We also try returns-based measures and designate a year as a shock year whenever the industry’s stock-market return decreases by more than five percent (or 10%). In other tests we designate a year as a shock year whenever the industry’s excess market return is negative. In all cases our conclusions are unaffected as we obtain similar results to those reported in the paper. We also test if our results are robust to various measures of innovation. Rather than using R&D or patents, we use citations as a measure of innovation. Again, we obtain similar results and our conclusions are unaffected. Econometrically, we use industry fixed-effects rather than firm fixed-effects and the results are similar to those we report in the paper. We repeat our analysis with industry-adjusted measures for all variables and find similar results. Excluding the years 2001, 2002 and 2009 (years representing market-wide downturns) does not affect our results. Finally, we try different measures of CEO power. We use various combinations of the seven individual components that make-up our CEO Power Index along with each component separately. Again, the results from doing so are largely unaffected. Thus, our results are robust to various measures of shocks, innovation, econometric techniques and CEO Power. An important takeaway from our results is that firms can benefit from having a more dispersed decision-making structure, especially when the industry is suffering a severe downturn. However, our results do not necessarily reflect the existence of an agency problem. Even if CEOs believe they are acting in shareholders’ (and stakeholders’) best interests, their decisions may be suboptimal due to, for example, a lack of independent advice from the board (or from a chairman or president). Given the difficulty in changing a CEO’s power once it is obtained, our results are instructive for regulators that are pushing for firms to have a more dispersed power 24 base. We believe that our findings are generally supportive of efforts over the last several years to, for instance, encourage board independence and discourage CEOs from also assuming chairmanship of the board. Another takeaway is that it is in innovative and high discretion industries, those that may have the greatest implications for future economic growth, the negative impact of CEO power during downturns is most evident. Hence, these types of firms may have the most to gain from organizational structures that enhance decentralized decision-making and improve the channels of information flow to top management. Finally, CEO power has worse outcomes in competitive industries: indicating the greater consequences of poor decisions in competitive industries. 25 REFERENCES Adams RB. 2012. Governance and the financial crisis. International Review of Finance 12(1): 738. Adams RB, Almeida H, Ferreira D. 2005. Powerful CEOs and their impact on corporate performance. Review of Financial Studies 18(4): 1403-1432. Agrawal A, Knoeber CR. 1996. Firm performance and mechanisms to control agency problems between managers and shareholders. Journal of Financial and Quantitative Analysis 31(3): 377-397. Aldrich HE. 1979. Organizations and environments, Stanford Business Books. Bainbridge SM. 2002. Why a board? group decisionmaking in corporate governance. Vanderbilt Law Review 55(1): 1-55. Baysinger BD, Butler HN.1985. Corporate governance and the board of directors: performance effects of changes in board composition. Journal of Law, Economics, & Organization 1(1): 101-124. Bebchuk L, Cohen A, Ferrell A. 2009. What matters in corporate governance? Review of Financial Studies 22(2): 783-827. Bebchuk L, Cremers KJM, Peyers UC. 2011. The CEO pay slice. Journal of Financial Economics 102(1): 199-221. Bhagat S, Black BS. 2002. The non-correlation between board independence and long-term firm performance. Journal of Corporation Law 27: 231-273. Bhojraj S, Lee CMC, Oler DK. 2003. What's my line? a comparison of industry classification schemes for capital market research. Journal of Accounting Research 41(5): 745-774. Borokhovich KA, Parrino R, Trapani R. 1996. Outside directors and CEO selection. Journal of Financial and Quantitative Analysis 31(3): 337-355. Boyd BK. 1995. CEO duality and firm performance: A contingency model. Strategic Management Journal 16(4): 301-312. Brickley JA, Coles JL, Terry RL. 1994. Outside directors and the adoption of poison pills. Journal of Financial Economics 35(3): 371-390. Brickley JA, Linck JS, Coles JL. 1999. What happens to CEOs after they retire? New evidence on career concerns, horizon problems, and CEO incentives. Journal of Financial Economics 52(3): 341-377. Byrd JW, Hickman KA. 1992. Do outside directors monitor managers?: evidence from tender offer bids. Journal of Financial Economics 32(2): 195-221. Chan LKC, Lakonishok J, Swaminathan B. 2007. Industry classifications and return comovement. Financial Analysts Journal 63(6): 56-70. Clarke RN. 1989. SICs as delineators of economic markets. Journal of Business 62(1): 17-31. Coles JL, Daniel ND, Naveen L. 2008. Boards: does one size fit all? Journal of Financial Economics 87(2): 329-356. Cotter JF, Shivdasani A, Zenner M. 1997. Do independent directors enhance target shareholder wealth during tender offers? Journal of Financial Economics 43(2): 195-218. Crossland C, Hambrick DC. 2011. Differences in managerial discretion across countries: how nation-level institutions affect the degree to which CEOs matter. Strategic Management Journal 32(8): 797-819. Daily CM, Dalton DR. 1992. The relationship between governance structure and corporate performance in entrepreneurial firms. Journal of Business Venturing 7(5): 375-386. 26 Daily CM, Dalton DR. 1993. Board of directors leadership and structure: control and performance implications. Entrepreneurship: Theory and Practice. 17: 65-81. Daily CM, Johnson JL. 1997. Sources of CEO power and firm financial performance: A longitudinal assessment. Journal of Management 23(2): 97-117. Daily CM, Johnson JL, Ellstrand AE, Dalton DR. 1998. Compensation committee composition as a determinant of CEO compensation. Academy of Management Journal 41(2): 209220. Daily CM, McDougall PP, Covin JG, Dalton DR. 2002. Governance and strategic leadership in entrepreneurial firms. Journal of Management 28(3): 387-412. Dalton DR, Daily CM, Ellstrand AE, Johnson JL. 1998. Meta-analytic reviews of board composition, leadership structure, and financial performance. Strategic Management Journal 19(3): 269-290. Datta DK, Rajagopalan N. 1998. Industry structure and CEO characteristics: an empirical study of succession events. Strategic Management Journal 19(9): 833-852. Dechow P, Ge W, Schrand C. 2010. Understanding earnings quality: A review of the proxies, their determinants and their consequences. Journal of Accounting and Economics 50(2– 3): 344-401. Dowell GWS, Shackell MB, Stuart NV. 2011. Boards, CEOs, and surviving a financial crisis: Evidence from the internet shakeout. Strategic Management Journal 32(10): 1025-1045. Eisenhardt KM, Bourgeois LJ III. 1988. Politics of strategic decision making in high-velocity environments: toward a midrange theory. Academy of Management Journal 31(4): 737770. Fahlenbrach R. 2009. Founder-CEOs, investment decisions, and stock market performance. Journal of Financial and Quantitative Analysis 44(2): 439-466. Fama EF, French KR. 1997. Industry costs of equity. Journal of Financial Economics 43(2): 153-193. Fama EF, Jensen MC. 1983. Separation of ownership and control. Journal of Law and Economics 26(2): 301-325. Finkelstein S. 1992. Power in top management teams: dimensions, measurement, and validation. Academy of Management Journal 35(3): 505-538. Finkelstein S, D'Aveni RA. 1994. CEO duality as a double-edged sword: how boards of directors balance entrenchment avoidance and unity of command. Academy of Management Journal 37(5): 1079-1108. Finkelstein S, Hambrick D. 1996. Strategic leadership : top executives and their effects on organizations, South-Western College Publication. Fischer HM, Pollock TG. 2004. Effects of social capital and power on surviving transformational change: the case of initial public offerings. Academy of Management Journal 47(4): 463481. Gompers P, Ishii J, Metrick A. 2003. Corporate governance and equity prices. Quarterly Journal of Economics 118(1): 107-156. Graham JR, Harvey CR. 2001. The theory and practice of corporate finance: evidence from the field. Journal of Financial Economics 60(2–3): 187-243. Haleblian J, Finkelstein S. 1993. Top management team size, CEO dominance, and firm performance: the moderating roles of environmental turbulence and discretion. Academy of Management Journal 36(4): 844-863. 27 Hambrick DC, Finkelstein S. 1987. Managerial discretion: a bridge between polar views of organizational outcomes. Research in Organizational Behavior 9: 369-406. Hambrick DC, Abrahamson E. 1995. Assessing managerial discretion across industries: a multimethod approach. Academy of Management Journal 38(5): 1427-1441. Harris D, Helfat CE. 1998. CEO duality, succession, capabilities and agency theory: commentary and research agenda. Strategic Management Journal 19(9): 901-904. Harris M, Raviv A. 1991. The theory of capital structure. Journal of Finance 46(1): 297-355. Hausman JA, Taylor WE. 1981. Panel data and unobservable individual effects. Econometrica 49(6): 1377-1398. Hermalin BE, Weisbach MS. 1991. The effects of board composition and direct incentives on firm performance. Financial Management 20(4): 101-112. Hermalin BE, Weisbach MS. 1998. Endogenously chosen boards of directors and their monitoring of the CEO. American Economic Review 88(1): 96-118. Klein A. 1998. Firm performance and board committee structure. Journal of Law and Economics 41(1): 275-304. Linck JS, Netter JM, Yang T. 2008. The determinants of board structure. Journal of Financial Economics 87(2): 308-328. Maug E. 1997. Boards of directors and capital structure: alternative forms of corporate restructuring. Journal of Corporate Finance 3(2): 113-139. Mehran H. 1995. Executive compensation structure, ownership, and firm performance. Journal of Financial Economics 38(2): 163-184. Mitchell ML, Mulherin JH. 1996. The impact of industry shocks on takeover and restructuring activity. Journal of Financial Economics 41(2): 193-229. Morse A, Nanda V, Seru A. 2011. Are incentive contracts rigged by powerful CEOs? Journal of Finance 66(5): 1779-1821. Pathan S. 2009. Strong boards, CEO power and bank risk-taking. Journal of Banking & Finance 33(7): 1340-1350. Pfeffer, J. 1997. New directions for organization theory: problems and prospects, Oxford University Press. Ranft AL, O'Neill HM. 2001. Board composition and high-flying founders: hints of trouble to come? Academy of Management Executive (1993-2005) 15(1): 126-138. Rosenstein S, Wyatt JG. 1997. Inside directors, board effectiveness, and shareholder wealth. Journal of Financial Economics 44(2): 229-250. Tang J, Crossan M, Rowe WG. 2011. Dominant CEO, deviant strategy, and extreme performance: the moderating role of a powerful board. Journal of Management Studies 48(7): 1479-1503. Villalonga B, Amit R. 2006. How do family ownership, control and management affect firm value? Journal of Financial Economics 80(2): 385-417. Weisbach MS. 1988. Outside directors and CEO turnover. Journal of Financial Economics 20(0): 431-460. Yermack D. 1996. Higher market valuation of companies with a small board of directors. Journal of Financial Economics 40(2): 185-211. 28 Table 1. Descriptive statistics Panel A: Industries with shocks (total 60 industry shock years) FF Code Industry Name N FF Code Industry Name N 1 Agriculture 3 24 Aircraft 1 5 Tobacco Products 5 25 Shipbuilding, Railroad Equipment 1 6 Recreation 1 28 Non-Metallic and Industrial Metal Mining 4 7 Entertainment 1 29 Coal 4 8 Printing and Publishing 1 30 Petroleum and Natural Gas 2 14 Chemicals 2 33 Personal Service 1 15 Rubber and Plastic Products 1 34 Business Service 1 16 Textiles 3 35 Computers 2 17 Construction Materials 2 37 Electronic Equipment 3 18 Construction 3 38 Measuring and Control Equipment 3 19 Steel Works 2 39 Business Supplies 1 20 Fabricated Products 3 41 Transportation 1 21 Machinery 1 42 Wholesale 2 22 Electrical Equipment 2 44 Restaurants, Hotels, Motels 1 23 Automobiles and Trucks 2 49 Miscellaneous 1 Panel B:. Firm characteristics (total 2,097 firms) Variable N Mean Median Std Dev Minimum Maximum Mkt.cap(millions) 17,604 5,953 1,356 14,394 19.169 97,468 M/B 17,604 2.089 1.643 1.394 0.729 9.344 ΔM/B 17,604 -0.074 -0.012 0.864 -3.977 3.162 Leverage 17,604 0.185 0.167 0.162 0.000 0.769 ROA 17,551 0.145 0.143 0.098 -0.320 0.424 ΔROA 17,536 -0.004 0.000 0.058 -0.252 0.217 RD 17,604 0.037 0.003 0.066 0.000 0.382 RD Missing 17,604 0.360 0.000 0.480 0.000 1.000 Capex 17,604 0.062 0.046 0.055 0.003 0.302 Volatility 17,604 0.028 0.025 0.013 0.010 0.079 Shock 17,604 0.070 0.000 0.255 0.000 1.000 Panel C: CEO characteristics (total 3,724 CEOs) N Variable Mean Median Std Dev Minimum Maximum Chairman 17,604 0.633 1.000 0.482 0.000 1.000 Chairman+President 17,604 0.254 0.000 0.435 0.000 1.000 Founder 17,604 0.237 0.000 0.425 0.000 1.000 Tenure 17,604 8.018 5.751 7.291 0.501 36.02 CPS 17,604 0.382 0.379 0.133 0.000 1.000 Ownership 17,604 0.023 0.004 0.047 0.000 0.205 Internally-Hired 17,604 0.510 1.000 0.500 0.000 1.000 Dependent Directors 17,604 0.336 0.300 0.178 0.000 1.000 N Mean Median Std Dev Minimum Maximum 17,604 3.147 3.000 1.604 0.000 7.000 Panel D: CEO power measure Variable CEO Power Index 29 Table 2. Correlation matrix Panel A: Regression variables 1 2 3 4 5 6 7 8 9 10 11 12 1. M/B 1.000 2. ΔM/B 0.223*** 1.000 3. ROA 0.352*** 0.036*** 1.000 4. ΔROA 0.127*** 0.223*** 0.325*** 1.000 5. RD 0.386*** -0.061*** -0.203*** -0.021*** 6. Shock -0.069*** -0.030*** -0.131*** -0.155*** 0.002 1.000 7. CEO Power 0.027*** -0.003 0.010 -0.005 -0.053*** -0.022*** 1.000 8. RD Missing -0.145*** 0.020*** 0.062*** 0.011 -0.425*** -0.007 0.079*** 1.000 9. Capex 0.065*** -0.041*** 0.250*** -0.018** -0.108*** -0.052*** 0.060*** 0.148*** 1.000 10. Firm size 0.287*** 0.070*** 0.274*** 0.075*** -0.005 -0.016** -0.127*** -0.054*** 0.014* 1.000 11. Leverage -0.264*** 0.003 -0.127*** -0.013* -0.238*** -0.007 0.000 0.200*** 0.050*** 0.013* 1.000 12. Volatility 0.126*** -0.045*** -0.301*** -0.067*** 0.327*** 0.249*** 0.053*** -0.114*** -0.048*** -0.321*** -0.110*** 1.000 1.000 Panel B: Individual measures of CEO power 1 2 3 4 5 6 1. Chairman 1.000 2. Chairman+President 0.444*** 1.000 3. Founder 0.102*** -0.018** 1.000 4. Dependent Directors -0.062*** -0.121*** 0.270*** 1.000 5. Tenure 0.243*** 0.042*** 0.493*** 0.177*** 1.000 6. CPS 0.067*** 0.141*** -0.148*** -0.148*** -0.059*** 1.000 7. Ownership 0.120*** 0.009 0.507*** 0.291*** 0.431*** -0.162*** 7 1.000 *** p<0.01, ** p<0.05, * p <0.10 30 Table 3. Effects of CEO power during ‘shock’ years on valuation and performance for innovative firms Panel A: R&D as a measure of innovation Dependent Variable R&D Intensity Shock CEO Power RD Model (1) Model (2) Entire sample -0.2345*** [0.000] -0.0120 [0.512] -0.8027*** [0.001] High R&D -0.0868 [0.441] -0.0282 [0.635] Shock*CEO Power Model (3) ΔM/B Low R&D -0.0807** [0.012] -0.0071 [0.638] -0.3001* [0.058] -0.0258 [0.576] -3.6743*** [0.000] 0.3586*** [0.000] -0.4556** [0.024] 7.5852*** [0.008] -2.4405*** [0.000] 4,562 0.168 Yes Yes -0.0011 [0.975] -2.4372*** [0.000] 0.1554*** [0.000] -0.0753 [0.228] 7.1709*** [0.000] -0.9883*** [0.000] 13,042 0.111 Yes Yes Shock*CEO Power*RD Shock*RD CEO Power*RD RD Missing Capex Firm Size Leverage Volatility Constant Observations R-squared Firm Fixed Effect Year Dummies 0.0066 [0.894] -2.7233*** [0.000] 0.1966*** [0.000] -0.2260*** [0.002] 4.7102*** [0.000] -1.2077*** [0.000] 17,604 0.096 Yes Yes Model (4) Entire sample -0.1721*** [0.000] -0.0220 [0.295] -1.0036*** [0.000] 0.0534 [0.424] -4.7604*** [0.000] -0.5420 [0.371] 0.4900* [0.067] 0.0046 [0.927] -2.7480*** [0.000] 0.1976*** [0.000] -0.2243*** [0.002] 4.9173*** [0.000] -1.2114*** [0.000] 17,604 0.099 Yes Yes Model (5) ΔROA Entire sample -0.0310*** [0.000] -0.0010 [0.497] -0.0493*** [0.009] 0.0034 [0.461] -0.1913*** [0.008] -0.0223 [0.595] -0.0059 [0.749] 0.0001 [0.982] -0.1223*** [0.000] 0.0093*** [0.000] -0.0257*** [0.000] 0.5319*** [0.000] -0.0561*** [0.000] 17,548 0.058 Yes Yes 31 Panel B: Patents as a measure of innovation Dependent Variable Patents Shock CEO Power RD Patents Model (1) Model (2) Entire sample -0.3780*** [0.000] -0.0162 [0.458] -0.8015*** [0.005] -0.0009** [0.010] High Patents -0.2553** [0.017] 0.0526 [0.314] 0.0163 [0.978] Shock*CEO Power Model (3) ΔM/B Low Patents -0.2901*** [0.000] -0.0250 [0.307] -0.9008*** [0.008] -0.6019*** [0.000] 0.0035 [0.972] -0.0415 [0.861] -5.2294*** [0.000] 0.2434*** [0.000] -0.0994 [0.658] 4.9372 [0.117] -1.7082*** [0.000] 3,096 0.139 Yes Yes 0.0496 [0.114] 0.0386 [0.532] -2.4489*** [0.000] 0.2423*** [0.000] -0.1512 [0.127] 5.8401*** [0.000] -1.5317*** [0.000] 11,159 0.075 Yes Yes Shock*CEO Power*Patents Shock*Patents CEO Power*Patents Patents Missing RD Missing Capex Firm Size Leverage Volatility Constant Observations R-squared Firm Fixed Effect Year Dummies *** p<0.01, ** p<0.05, * p <0.10 0.0492 [0.118] 0.0247 [0.680] -2.7488*** [0.000] 0.2281*** [0.000] -0.2166** [0.016] 4.8486*** [0.000] -1.4418*** [0.000] 14,255 0.081 Yes Yes Model (4) Entire sample -0.2989*** [0.000] -0.0217 [0.345] -0.8141*** [0.004] -0.0011*** [0.005] -0.0775 [0.383] -0.0046*** [0.000] -0.0003 [0.664] 0.0008** [0.043] 0.0502 [0.110] 0.0248 [0.679] -2.7754*** [0.000] 0.2307*** [0.000] -0.2176** [0.015] 4.9423*** [0.000] -1.4621*** [0.000] 14,255 0.083 Yes Yes Model (5) ΔROA Entire sample -0.0260*** [0.000] -0.0010 [0.515] -0.0509*** [0.007] -0.0000 [0.172] -0.0083 [0.160] 0.0000 [0.917] -0.0001* [0.060] 0.0000 [0.123] 0.0009 [0.658] 0.0039 [0.322] -0.1354*** [0.000] 0.0104*** [0.000] -0.0318*** [0.000] 0.6759*** [0.000] -0.0679*** [0.000] 14,203 0.056 Yes Yes 32 Table 4. Effect of CEO power during ‘shock’ years on valuation and performance for firms in high and low managerial discretion industries Panel A: High versus low managerial discretion industries Model (1) Dependent Variable Discretion Shock CEO Power RD Industry Discretion Entire sample -0.3033*** [0.000] -0.0121 [0.569] -0.8897*** [0.001] -0.0057 [0.941] Shock*CEO Power Model (2) High Disc. -0.1222 [0.119] 0.0357 [0.330] -1.2447*** [0.000] Model (3) ΔM/B Low Disc. -0.4121*** [0.000] -0.0511** [0.038] 0.0373 [0.938] -0.2731** [0.026] -0.0054 [0.935] 0.0988 [0.352] -4.0536*** [0.000] 0.2578*** [0.000] -0.2945** [0.030] 4.6780** [0.012] -1.7342*** [0.000] 7,183 0.109 Yes Yes -0.0740 [0.271] -2.1134*** [0.000] 0.1763*** [0.000] -0.1598 [0.109] 5.9218*** [0.000] -1.0333*** [0.000] 7,548 0.116 Yes Yes Shock*CEO Power*Industry Discretion CEO Power*Industry Discretion Shock*Industry Discretion RD Missing Capex Firm Size Leverage Volatility Constant Observations R-squared Firm Fixed Effect Year Dummies -0.0081 [0.893] -2.7298*** [0.000] 0.2107*** [0.000] -0.2193*** [0.009] 4.6826*** [0.000] -1.3115*** [0.000] 14,731 0.102 Yes Yes Model (4) Entire sample -0.3363*** [0.000] -0.0485 [0.102] -0.8911*** [0.001] -0.0514 [0.516] 0.0061 [0.939] -0.2545* [0.054] 0.0904** [0.034] 0.1631** [0.037] -0.0061 [0.918] -2.7309*** [0.000] 0.2112*** [0.000] -0.2192*** [0.009] 4.7550*** [0.000] -1.2945*** [0.000] 14,731 0.102 Yes Yes Model (5) ΔROA Entire sample -0.0379*** [0.000] -0.0018 [0.387] -0.0525*** [0.004] -0.0035 [0.518] 0.0027 [0.617] -0.0087 [0.333] 0.0016 [0.592] 0.0102* [0.056] 0.0006 [0.891] -0.1244*** [0.000] 0.0090*** [0.000] -0.0284*** [0.000] 0.5043*** [0.000] -0.0530*** [0.000] 14,700 0.061 Yes Yes 33 Panel B: Computer industry versus petroleum and natural gas industry High Discretion Industry: Computers Model (1) Model (2) Model (3) Model (4) Dependent variable ΔM/B ΔROA Shock -1.1938 -1.0384 -0.0857 -0.0768 [0.156] [0.219] [0.161] [0.210] CEO Power 0.1069 0.1760 -0.0084 -0.0044 [0.534] [0.316] [0.500] [0.728] RD -2.3631* -2.4728** -0.2236** -0.2287** [0.056] [0.045] [0.013] [0.011] Shock*CEO Power -0.6858* -0.0433 [0.075] [0.127] Capex -6.0210*** -6.2399*** -0.2862** -0.3019** [0.002] [0.002] [0.046] [0.035] Firm Size 0.1931** 0.2103** 0.0164*** 0.0176*** [0.021] [0.012] [0.007] [0.004] Leverage 0.0400 0.0698 -0.0815* -0.0796* [0.949] [0.911] [0.072] [0.078] Volatility 4.5733 4.1610 1.6689*** 1.6589*** [0.548] [0.583] [0.003] [0.003] RD Missing Constant Observations R-squared Firm Fixed Effect Year Dummies -0.6564 [0.531] 514 0.193 Yes Yes -0.7660 [0.465] 514 0.199 Yes Yes -0.1300* [0.088] 512 0.141 Yes Yes -0.1382* [0.070] 512 0.146 Yes Yes Low Discretion Industry: Petroleum and Natural Gas Model (5) Model (6) Model (7) Model (8) ΔM/B ΔROA -0.6186*** -0.5790*** -0.0395 -0.0472* [0.000] [0.000] [0.119] [0.070] 0.0256 0.0395 0.0110 0.0083 [0.492] [0.312] [0.102] [0.239] -11.8855** -11.8059** -1.3425 -1.3581 [0.023] [0.024] [0.153] [0.148] -0.1040 0.0203 [0.233] [0.195] -0.3301 -0.3134 -0.1465*** -0.1498*** [0.255] [0.281] [0.005] [0.004] 0.1674*** 0.1662*** -0.0014 -0.0012 [0.000] [0.000] [0.812] [0.842] 0.2095 0.2213 -0.1222*** -0.1245*** [0.214] [0.190] [0.000] [0.000] -1.8761 -1.8117 -0.7516 -0.7642 [0.547] [0.560] [0.179] [0.172] 0.0418 0.0440 -0.0077 -0.0081 [0.682] [0.666] [0.674] [0.657] -1.0712*** -1.0779*** 0.0770 0.0784 [0.000] [0.000] [0.148] [0.141] 897 897 897 897 0.403 0.404 0.246 0.247 Yes Yes Yes Yes Yes Yes Yes Yes *** p<0.01, ** p<0.05, * p <0.10 34 Table 5. Effects of CEO power during ‘shock’ years on valuation and performance for firms in competitive industries Panel A: Herfindahl index as a measure of competition Dependent Variable Industry Competitiveness Shock CEO Power RD Competitive Model (1) Model (2) Entire sample -0.2350*** [0.000] -0.0121 [0.510] -0.8027*** [0.001] 0.0058 [0.828] Competitive -0.2592*** [0.000] -0.0315 [0.143] -0.9360*** [0.001] Shock*CEO Power Model (3) ΔM/B Concentrated 0.0044 [0.962] 0.0522 [0.228] -0.9861* [0.080] -0.1327** [0.033] -0.0484 [0.717] 0.0096 [0.869] -2.7529*** [0.000] 0.2061*** [0.000] -0.2800*** [0.001] 4.8191*** [0.000] -1.2639*** [0.000] 13,216 0.101 Yes Yes 0.0137 [0.904] -2.9094*** [0.000] 0.2676*** [0.000] 0.0984 [0.588] 6.3646*** [0.004] -1.8428*** [0.000] 4,388 0.107 Yes Yes Shock*CEO Power*Competitive CEO Power*Competitive Shock*Competitive RD Missing Capex Firm Size Leverage Volatility Constant Observations R-squared Firm Fixed Effect Year Dummies 0.0067 [0.893] -2.7228*** [0.000] 0.1967*** [0.000] -0.2260*** [0.002] 4.7174*** [0.000] -1.2133*** [0.000] 17,604 0.096 Yes Yes Model (4) Entire sample -0.0105 [0.893] 0.0392 [0.271] -0.8301*** [0.001] 0.0435 [0.163] -0.0599 [0.616] -0.0693 [0.607] -0.0582 [0.143] -0.2328*** [0.006] 0.0015 [0.975] -2.7101*** [0.000] 0.1962*** [0.000] -0.2273*** [0.002] 4.7232*** [0.000] -1.2402*** [0.000] 17,604 0.097 Yes Yes Model (5) ΔROA Entire sample -0.0312*** [0.000] -0.0021 [0.399] -0.0530*** [0.002] 0.0016 [0.473] 0.0182** [0.027] -0.0273*** [0.003] 0.0011 [0.695] -0.0010 [0.859] -0.0002 [0.962] -0.1208*** [0.000] 0.0093*** [0.000] -0.0259*** [0.000] 0.5239*** [0.000] -0.0568*** [0.000] 17,548 0.058 Yes Yes 35 Panel B: Top 4 sales ratio as a measure of competition Dependent Variable Industry Competitiveness Shock CEO Power RD Competitive Model (1) Model (2) Entire sample -0.2394*** [0.000] -0.0127 [0.489] -0.7976*** [0.001] 0.0821*** [0.002] Competitive -0.2538*** [0.000] -0.0329 [0.124] -0.7956*** [0.004] Shock*CEO Power Model (3) ΔM/B Concentrated 0.0829 [0.353] 0.0409 [0.344] -1.1336* [0.060] -0.1402** [0.025] -0.0433 [0.728] 0.0245 [0.663] -2.6134*** [0.000] 0.2115*** [0.000] -0.2668*** [0.001] 6.1234*** [0.000] -1.3399*** [0.000] 13,524 0.103 Yes Yes 0.0107 [0.932] -2.6595*** [0.000] 0.2349*** [0.000] 0.0906 [0.617] 5.1737** [0.023] -1.6557*** [0.000] 4,080 0.095 Yes Yes Shock*CEO Power*Competitive CEO Power*Competitive Shock*Competitive RD Missing Capex Firm Size Leverage Volatility Constant Observations R-squared Firm Fixed Effect Year Dummies *** p<0.01, ** p<0.05, * p <0.10 0.0059 [0.906] -2.7119*** [0.000] 0.1974*** [0.000] -0.2297*** [0.002] 4.8698*** [0.000] -1.2869*** [0.000] 17,604 0.097 Yes Yes Model (4) Entire sample 0.0004 [0.996] 0.0229 [0.529] -0.8270*** [0.001] 0.1113*** [0.000] -0.0456 [0.700] -0.0856 [0.523] -0.0370 [0.358] -0.2523*** [0.003] 0.0019 [0.969] -2.6885*** [0.000] 0.1970*** [0.000] -0.2345*** [0.001] 4.8751*** [0.000] -1.3106*** [0.000] 17,604 0.098 Yes Yes Model (5) ΔROA Entire sample -0.0305*** [0.000] -0.0033 [0.197] -0.0532*** [0.002] -0.0002 [0.914] 0.0184** [0.024] -0.0276*** [0.003] 0.0026 [0.352] -0.0017 [0.762] -0.0001 [0.986] -0.1198*** [0.000] 0.0093*** [0.000] -0.0261*** [0.000] 0.5219*** [0.000] -0.0552*** [0.000] 17,548 0.058 Yes Yes 36 Figure 1. Average changes in M/B (demeaned) and average changes in ROA (demeaned) during ‘shock’ years 37