london_workshop2005_maoh_july2nd

advertisement

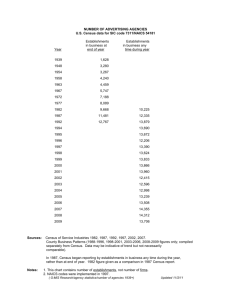

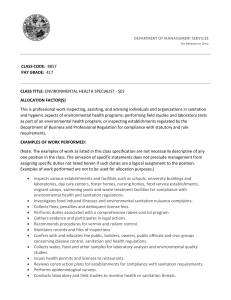

Agent-Based Firmographic Models: A Simulation Framework for the City of Hamilton By Hanna Maoh and Pavlos Kanaroglou Workshop on modelling and microsimulating firm demography University College London (UCL), London, July 2nd, 2005 Research Objectives Objective: Simulate the evolution of establishment population between t and t +1 business Improve upon existing methods used to model firms and jobs in conventional Land use and transportation models Adopt the agent-based approach to develop an agentbased microsimulation model Apply concepts from firm demography to model the evolutionary process The Demography of Firms Firm demography is dedicated to the study of processes that relates to: – – – – Formation of new firms (birth or entry) Failure of existing firms (death or exit) Migration of existing firms (local and regional) Growth and decline of firms It is concerned with identifying and quantifying the causes associated with firmographic processes Evolutionary Process of Business Establishment Population Intra-urban mobile establishments* In-migrated establishments Newly formed establishments + + Establishment population at time t Establishment population at time t + 1 – Out-migrated establishments – Failed establishments Modeling Framework Establishment population t Failure submodul e Establishment population t Survivals Newly formed & in-migrating establishments t+1 Newly formed & in-migrating establishments t+1 Mobility submodul e Migrants Location choice submodul e Growth submodul e Establishment population t+1 Firmographic Processes Assign a business to a site Size of business t+1 Establishment population t+1 Processes Output Real Estate Market A market for industrial and commercial floor space at the parcel level drives the framework This market is influenced by: 1. The firmographic events: Demand for floor-space is generated by the newly formed, relocating and in-migrating establishments Failure, departing current location (out-migration or intraurban migration) free up floor space Growth, decline, merging and splitting also contributes to change in floor space 2. Development and redevelopment practices influence the available floor-space Evolution of the space economy over time, Hamilton 1990 - 1997 Firm Micro-Data: Statistics Canada Business Register (BR) Maintain annual information about business establishments in Canada since 1990 Confidential and can only be used to conduct statistical analysis Attributes: Establishment size, location (postal code and SGC), SIC code and Establishment Number (EN) BR provides the life trajectory of business establishments over space and time BR can be used to measure firmographic events such as: the formation, migration, location choice, failure, growth and decline of business establishments Small and Medium (SME) Size establishments SME with less than 200 employees is the target of our analysis Account for more than 94% of establishments in 1990, 1996 and 2002 Extracted population was constrained to self-owned single establishments Establishments that are part of a chain were not included in the model! However, the extracted sample is deemed appropriate Around 80% of SME are with less than 10 employees, 93% of which are single owned establishments Modeling Methods • Use discrete–time hazard duration models to explain the failure process • Use multinomial logit models to explain the mobility (stay, relocate or out-migrate) of business establishments • Use multinomial logit models to explain the location choice behavior of intra-urban mobile, newly formed and inmigrating establishments (maximum utility and Bid-rent concepts) • Use multivariate regression models to explain the growth/decline process of business establishments Failure Submodule Exploring and modeling survival and failure of establishments Exploring Survival We follow the life trajectory of 1990 and 1996 small and medium size establishments till 2002 We determine the duration of survival and time of failure We explore variation in establishment survival by size, age, industry and geography Non-parametric survival curves suggests that size, age, industry and geography has an influence on the survival rates Survival and Hazard Rates, 1991 and 1996 SME cohorts Survival S(t) Time 1991 1996 t cohort cohort [1-2) 0.84 0.85 [2-3) 0.73 0.74 [3-4) 0.65 0.67 [4-5) 0.59 0.62 [5-6) 0.54 0.58 [6-7) 0.49 0.54 [7-8) 0.45 [8-9) 0.42 [9-10) 0.40 [10-11) 0.38 [11-12) 0.36 Hazard h(t) 1991 1996 cohort cohort 0.17 0.17 0.14 0.14 0.11 0.10 0.09 0.07 0.09 0.07 0.10 0.07 0.09 0.06 0.05 0.06 0.05 Survival rates of the 1991 SME cohort by size class Survival rates of the 1991 SME cohort by industrial class Survival rates of the 1996 SME cohort by age class Failure Model We follow the life trajectory of 1996 SME cohort till 2002 to model the failure process of SME with less than 50 employees via a discrete time hazard duration model: Pit(f) = 1/(1 + exp(-t+ xit)) Firm specific variables Age (+ve) Size (-ve) and Size-squared Growth (-ve) Relocation (-ve) Macro economic variables Unemployment rate (+ve) Average total income (-ve) Geography specific variables Local Competition (+ve) Agglomeration economies (-ve) Location dummies Industry specific variables Average size of industry (+ve) Industry dummies Estimation Results Firm specific variables – Young and small establishments are more susceptible to failure – Growing establishments are more likely to remain in business – Relocation signals a superiority in performance either because it is undertaken to expand or as a reaction to location stress Geography specific variables – Market power (competition) has a positive influence on failure – Market share (agglomeration) has a negative influence on failure – Suburban establishments are less likely to fail compared to those located in the core Estimation Results Macro economic variables – Economic downturn or low demand for services and goods lead to higher rates of failure – High levels of demand for services and goods (purchase power) in the city decrease the propensity of failure Industry specific variables – Small establishments in large industries are more likely to fail – Failure vary by industry (Health and Social Services have the lowest rates of failure; finance insurance services have the highest rates of failure) Conclusions on the failure model Firm, geography, macro-economy and industry specific factors can explain failure with firm and macro-economic being the most influential Pseudo R2 % Explained Right Firm specific model 0.0710 66.5 Industry specific model 0.0186 58.3 Geography Specific model 0.0154 55.3 Macroeconomy specific model 0.0309 53.9 Full model 0.1003 69.9 The BR can be useful in developing agent-based firm demographic models Extension of the modeling framework to study the failure by economic sector may have a value added Mobility Submodule Exploration and modeling of mobility trends Mobility Trends 7% and 2% of 1996 SME establishments relocated and out-migrated by 1997, respectively 12% and 3% of 1996 total establishment population relocated and outmigrated by 2002, respectively Mean employment size of relocating establishments is 15 and mean relocating distance is 5 kilometres (1996 – 2002) 50% of moves happened at short distance within the same municipality 91% of out-migrating establishments moved within a radius of 100 kilometres around Hamilton between 1996 and 2002 57% of out-migrants moved to close by location in the Greater Toronto Area Establishment Mobility Model Objective: Determine if an individual establishment will choose to Stay (S) at its current location, Relocate (R) to a different place within the city or will Leave (L) the city between 1996 and 1997 We use a MNL model to predict probabilities P(S), P(R) and P(L) Mobility is modeled by main economic sector Utility Specification for establishment i Establishment internal factors and location factors are used in the specification of the Stay, Relocate and move utilities Internal factors included: Size, Age, Growth rate and dummies for type of industry industry_d Location factors included: Geography dummies, a measure for agglomeration economies (Agglom), distance between old and new location (Dod) and a measure for location competition (Lcomp) Overview of Results Mobility is more prominent among very small and very large establishments as depicted by the Size and Size2 parameters The Age parameter suggests that young establishments are more likely to relocate or outmigrate The need to grow as suggested by the Growth parameter push manufacturing establishments to relocate Overview of Results The Growth parameter in retail and wholesale models appear as a proxy for performance since growing establishments were less mobile The location dummies suggest decentralization and suburbanization of establishments in Hamilton Mobility is more pronounced among the Central Business District (CBD) establishments Overview of Results Agglomeration increases the propensity of inertia. This effect is more prominent among retail and service industry establishments The increase in local competition (location pressure) will push the establishment to move long distance Mobility vary by the type of industry as discerned from the specified industry dummies Conclusions on the mobility model Mobility is not common place in the urban context Firm internal factors and location factors are important determinants of mobility The research emphasizes the value in using data from Statistics Canada Business Register to study firmography in the urban context More work need to be done to investigate the role of organizational structure on mobility Future research is still needed to thoroughly scrutinize the relation between public policy and establishment mobility behavior in the urban context; Therefore, enhancing the attributes of existing firm micro data is required Location choice submodule A micro-analytical modeling framework Modeling Approach Establishments search the city for the location that will maximize their profit Searching pool: relocating, new born and in-migrating establishments Measuring firmographic events: – Continuer establishments: if for two consecutive years, the establishment has the same EN and the Hamilton SGC – Relocating establishments: if a continuer establishment has a different postal code address or coordinates between two consecutive years – Newborn establishments: if the establishment has an EN number in year t + 1 which did not exist in year t – In-migrating establishments: Those with the same EN in two consecutive years, but with a different SGC, and an SGC in Hamilton for the later year Representing space Bidding process – Establishments in the pool will out-bid each other for a particular location which will be assigned to the highest bidder – The bidding and maximizing profit processes can be modeled using discrete choice models (Martinez, 1992) Space at the micro-level – Use boundaries of developed land parcels; but postal code addresses has a one-to-many relationship with parcel Alternatively – Divide the city into grid cells of 200 x 200 meters; extract grid cells that correspond to developed commercial and industrial land uses to create the set of alternative locations We employ a MNL model to handle the location choice decisions: exp(Vni) Pn(i) = ___________ We model the location choice problem by major economic sectors exp(Vnj) j Creation of Choice set: – Grid cells resulted into a large choice set of 2635 and 2855 alternatives (cells) in the two periods 1996-1997 and 2001 – 2002, respectively Therefore – Random sample of alternatives (McFadden, 1978) : 9 randomly selected cells (locations) in addition to the chosen cell (location) Linear in parameter systematic utility Vni is a function of: Location characteristics and establishment attributes Model Specification Model specification is based on information we gathered from the urban economic literature and the available data Location specific factors included: – Distance to CBD (CBDPRO) – Main road and highway proximity (MRHWYPRO) – Regional Mall proximity (MALLPRO) – Measures of Agglomeration economies (AGGLOn); n is economic sector – Geography classification: Inner suburbs (MOUNTAIN) and outer suburbs (SUBURBS) – Density of new residential development (NEWDEVELOP) – Density of old residential development (OLDDEVELOP) – Population density (POPDENS) and Household density (HHLDDENS) – Household income density (HHLDINCDENS) – Average Housing value density (AVGDWELLVAL) – Percentage of a particular land use at a given location (LANDUSEk); k is type of land use Firm specific factors included: – Dummies to reflect firmographic event (NEWBORN) and type of industry the firm belongs to (INDUSTRYsic); SIC is 2-digit or 3-digit SIC code Estimation Results Most firms in Hamilton prefer locating on land far away from the CBD Central location is important for: – – – – Printing, publishing, and allied manufacturing firms (SIC 28), Communication and utilities firms SIC(48 – 49) Food, beverage drug and tobacco wholesale firms, Finance insurance, business services, accommodation food and beverages and other services – New born manufacturing firms (i.e: incubation plant hypothesis) Main road and highway proximity is important for all firms except for – All construction firms except for Electrical work firms (SIC 426) – Other product wholesale trade firms (SIC59) NEWBORN Health and social services AND accommodation food and beverage firms favor land in close proximity to main roads and highways Land in proximity to Regional Malls attracts retail trade firms specialized in food, beverage and drugs (SIC60), apparel, fabric and yarn (SIC 61) and general retailing stores (SIC 65). Construction, communication and transportation firms avoid land in close proximity to regional malls Agglomeration economies is prominent in the city of Hamilton. All firms seems to appreciate the externalities associated with clustering in the local market All Construction firms except for electrical work firms (SIC 426) favor locating in the inner suburbs above the escarpment. Other services firms show affiliation of location in the inner suburbs area Wholesale trade and retail trade firms show evidence of suburbanization. This is true for all firms except for food stores (SIC 601), gasoline service station firms (SIC 633), motor vehicle repair shops (SIC 635) and general merchandize stores (SIC641) Construction, wholesale trade, retail trade, real estate, businesses, and accommodation food and beverage firms favor locations with new residential development Construction and retail show evidence of avoiding the location with old residential development Manufacturing firms avoid highly populated areas High Income Locations are attracting services and retail trade firms except for firms specialized in selling shoe, apparel fabric and yarn (SIC 61), household furniture, appliances and furnishing retail (SIC 62) and automotive vehicles parts and accessories sales and services (SIC 63) Land use variables suggest that: – Construction, communication and transportation firms locate predominantly on open space land – Manufacturing and communication firms favor locations with resource and industrial land use. – Retail trade and services firms show high affiliation with commercial land use – General merchandize Stores (SIC 64) and SIC(65) show affiliation with residential land use areas (i.e: population oriented) – Service firms also show affiliation with governmental and open space land uses Location behavior over time: An Example from the retail sector Variable HWYMRPRO AGGLOM5 SUBURBS NEWDEVLOP OLDDEVLOP HHLDINCDENS LANDUSE4 LANDUSE5 INDUSTRY10 x MALLPRO INDUSTRY11 x HHLDINCDENS INDUSTRY12 x LANDUSE4 INDUSTRY13 x SUBURBS No. of Observations L(0) L(B) Rho 2 Adj. Rho 2 Parameter 1996 – 1997 0.376421 (3.168) 0.022177 (6.829) 0.426167 (2.294) 0.003345 (3.189) -0.000629 (-2.734) 0.000002 (1.698) -0.559876 (-2.719) 1.152924 (2.946) 0.650485 (2.890) -0.000002 (-1.535) 0.643616 (1.888) -0.425008 (-1.752) 396 -911.824 -812.938 0.10845 0.10544 Parameter 2001 – 2002 0.383930 (2.798) 0.049132 (8.889) 0.389474 (1.845) 0.001438 (1.706) -0.000925 (-3.287) 0.000002 (1.844) -0.567610 (-2.192) 0.870484 (2.149) 0.704633 (2.018) -0.000001 (-0.863) -0.100075 (-0.255) -0.494691 (-1.720) 303 -697.6833 -600.3443 0.13952 0.13571 Estimation results of the 2001 – 2002 models Suggest a consistency in the location choice Behavior over time Conclusion on the location choice model The research was successful in extending the conventional firm location modeling approach to study location choice behavior at the microlevel Results suggest a variation in the location choice behavior among firms from the different sectors The modeling approach was able to account for the heterogeneity in location choice behavior Results are consistent with the urban economic literature Future Research Model implementation: Creating a synthetic list of business establishments (BE) to use as a base year population for any simulation Develop a dynamic Geodatabase data model to store, maintain and update the BE list during simulations. Utilize Unified Modeling Language (UML) as the basis for the development Implement a real estate development model to predict the change in industrial and commercial floor-space Simulate the inter-play between the local economy and urban form in Hamilton Acknowledgments We would like to thank Statistics Canada for supporting this research through their (2003 – 2004) Statistics Canada PhD Research Stipend program. We would like to John Baldwin, Mark Brown and Desmond Beckstead for providing office space and access to the BR data. Also I am thankful to them for their useful discussions, input and assistance. We are grateful to Social Sciences and Humanities Research Council of Canada (SSHRC) for financial support through a Standard Research Grant and a SSHRC doctoral fellowship